1- The inflation/deflation debate makes me uneasy. I find the topic is poorly understood.

Much of the discussion centers on either i) inflation as measured by CPI or PCE, or ii) inflation as measured by a paper currency’s purchasing power in relation to other paper currencies.

Much of the discussion centers on either i) inflation as measured by CPI or PCE, or ii) inflation as measured by a paper currency’s purchasing power in relation to other paper currencies.

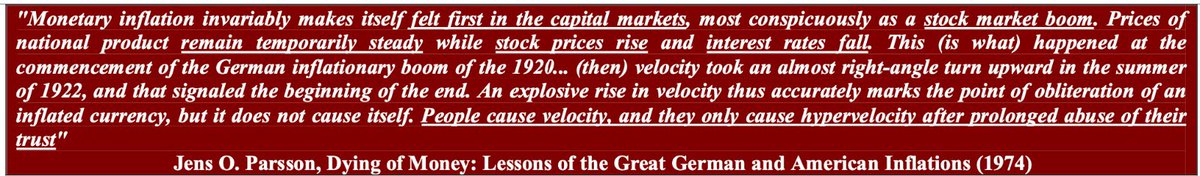

2- Inflation is a monetary phenomenon. Increase in MS = inflation. It always first manifests in capital markets, most noticeably in stocks. General prices of goods remain stable for a time, until something causes velocity to spike (like continued abuse of trust in the currency).

3- Too many ppl point to record-low velocity and rule out the possibility of inflation. These people ignore financial history at their own peril. Low AF velocity has preceded most hyperinflationary episodes (see e.g. Weimar).

4-Velocity is a psychological concept before an economic one. People cause velocity. And when they do, velocity could spike up violently and unexpectedly. I’ve paraphrased most of the above from @vol_christopher’s “Vol at World’s End”, and a quote he attaches in there by Parsson:

5- UBI is one potential tailwind for velocity. For now, ppl are thinking this helicopter money is a one-time thing. So they hoard it (and thus it has little effect on velocity). But they likely won’t hoard it if helicopter money turns into full-blown UBI...

6- Also, as lockdowns are lifted and the world returns to “normal”, much of the helicopter money that has been hoarded will likely be spent. Here’s Russel Napier on that:

7- So when someone says, “We’ve had no inflation despite QE & all” feel free to refer them to this thread. We’ve had tremendous inflation in stocks, bonds & real estate. By the time inflation gets picked up by CPI or PCE, you’ll know the End Game is near...

Read on Twitter

Read on Twitter