COVID19 has massively impacted India’s already stressed electricity sector. With little change in costs, but massive reductions in revenues, discoms’ finances are in for a shock. But exactly how bad is it? *New Findings!* (1/7)

We study the impact of COVID19 on Karnataka’s discoms, and examine possible mitigation strategies. We develop demand scenarios across a range of uncertainties – including COVID-driven demand shocks and exogenous factors such as agricultural demand and hydro inflows. (2/7)

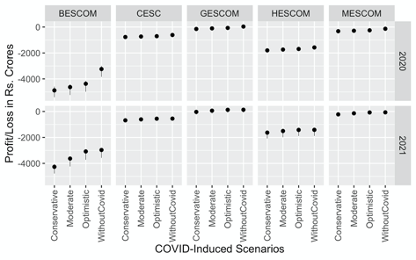

We find that discoms’ revenue collection could decrease by up to 8% in the year 2020, but the losses (cost minus revenue) could increase by 50%! BESCOM fares the worst due to its heavy reliance on its large industrial and commercial consumer base for cross-subsidies. (3/7)

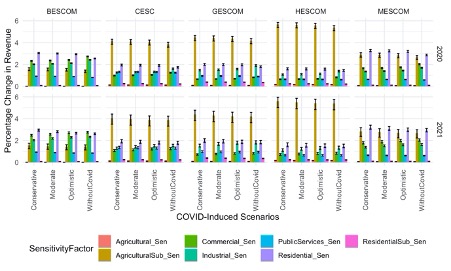

Furthermore, to what extent is each discom sensitive to cost recovery from its various consumer categories? This figure shows the overall change in revenue for a discom caused by a 10% rise in tariffs per consumer segment. (4/7)

For BESCOM, residential revenue improvements are most lucrative. Although cost recovery from agricultural consumers could also increase as it is so low to begin with. Other discoms, in contrast, would benefit the most from agricultural revenue increases. (5/7)

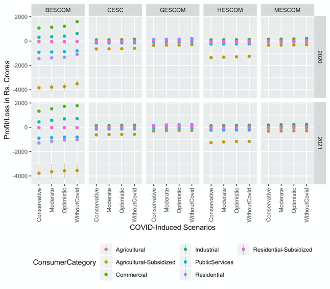

Along the way, we found other interesting results! How do different consumer categories contribute to cost recovery? Interestingly, agricultural-subsidized consumers in the BESCOM area account for far less cost recovery when compared to their counterparts elsewhere. (6/7)

Finally many thanks to my fantastic co-authors @jurpelai @east_winds and Xiaoxue Hou . It was a refreshing change to work on this report for its practical significance at a difficult time! You can find this report at https://bit.ly/3ktsAro .">https://bit.ly/3ktsAro&q... We welcome your comments!

@DrTongia @KarthikGanesan6 @ShaluAgrawal12 @AshwiniKSwain @PrayasEnergy @175GW_IndiaRenw @rohitreads @absmalhotra We& #39;d love to hear from you!

Read on Twitter

Read on Twitter