Morning thoughts:

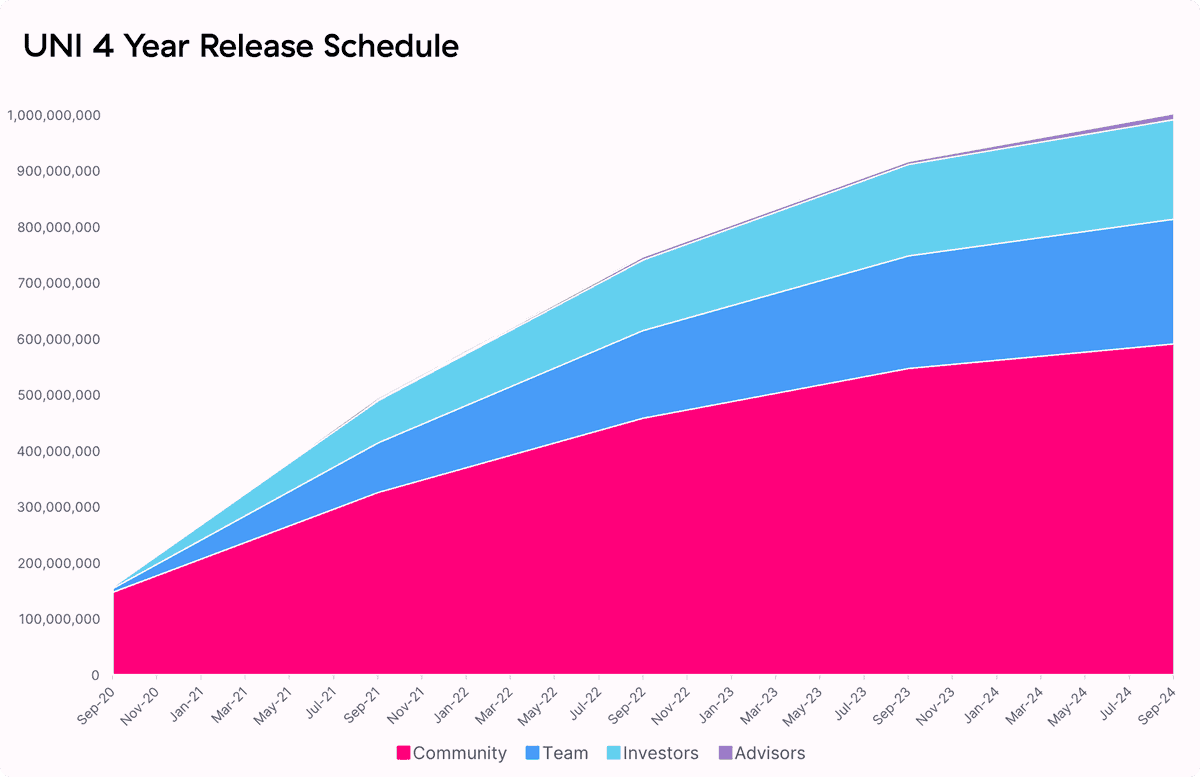

So right now there& #39;s $495m worth of Uniswap (UNI) tokens (implied $3.3bn Y2024) that just flooded the market overnight out of nowhere.

Can you answer the following question: Does this now mean that the cryptocurrency community as a whole is $495m richer?

So right now there& #39;s $495m worth of Uniswap (UNI) tokens (implied $3.3bn Y2024) that just flooded the market overnight out of nowhere.

Can you answer the following question: Does this now mean that the cryptocurrency community as a whole is $495m richer?

"No! Zero new fiat entered the system. Nothing was raised in an ICO. The cryptocurrency economy can only grow if people send in new fiat. Various cryptoassets trading at arbitrary exchange rates with each other doesn& #39;t magically increase the total wealth. There must be inflows."

Example: the automotive industry came from "nowhere" in a sense and has a multi-trillion dollar market cap now. Tesla& #39;s $411bn valuation has nothing to do with whether people sent $411bn to purchase the Nasdaq stock or not. Daily vol = ~$2bn and is sufficient for price discovery.

And now, Tesla could in theory be flat-out purchased for $411bn in an all-cash bid. Its market cap is definitely real, even though it came out of making something where there was previously just air. An asset& #39;s valuation has nothing to do with "inflow of capital to exchanges".

So, when new tokens like Uniswap (UNI) pop up and conjures up a $0.5bn pile of wealth in our ecosystem from nowhere without any new fiat, that& #39;s by no means a "zero sum game". The space *did* get richer. The π grew. There is more wealth in the system now since this happened.

Read on Twitter

Read on Twitter