Time to revisit a recurring theme of price and value of electricity production as there’s a recent presentation on US wind power statistics by Berkeley Labs:

https://eta-publications.lbl.gov/sites/default/files/2020_wind_energy_technology_data_update.pdf">https://eta-publications.lbl.gov/sites/def...

https://eta-publications.lbl.gov/sites/default/files/2020_wind_energy_technology_data_update.pdf">https://eta-publications.lbl.gov/sites/def...

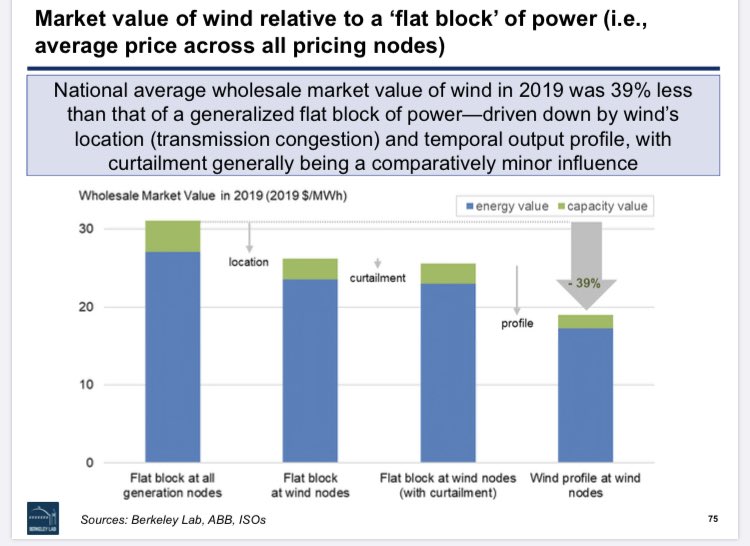

For those not familiar with the concept of self-cannibalization of value, see this thread (and the thread that prompted it) on evolution of value of intermittent generation sources at high % of total energy produced: https://twitter.com/vtulkki/status/1229005827492732930?s=21">https://twitter.com/vtulkki/s...

BUT! The presentation linked has 80+ slides of interesting data, so I’m merely picking a few, and all errors in interpretation are mine.

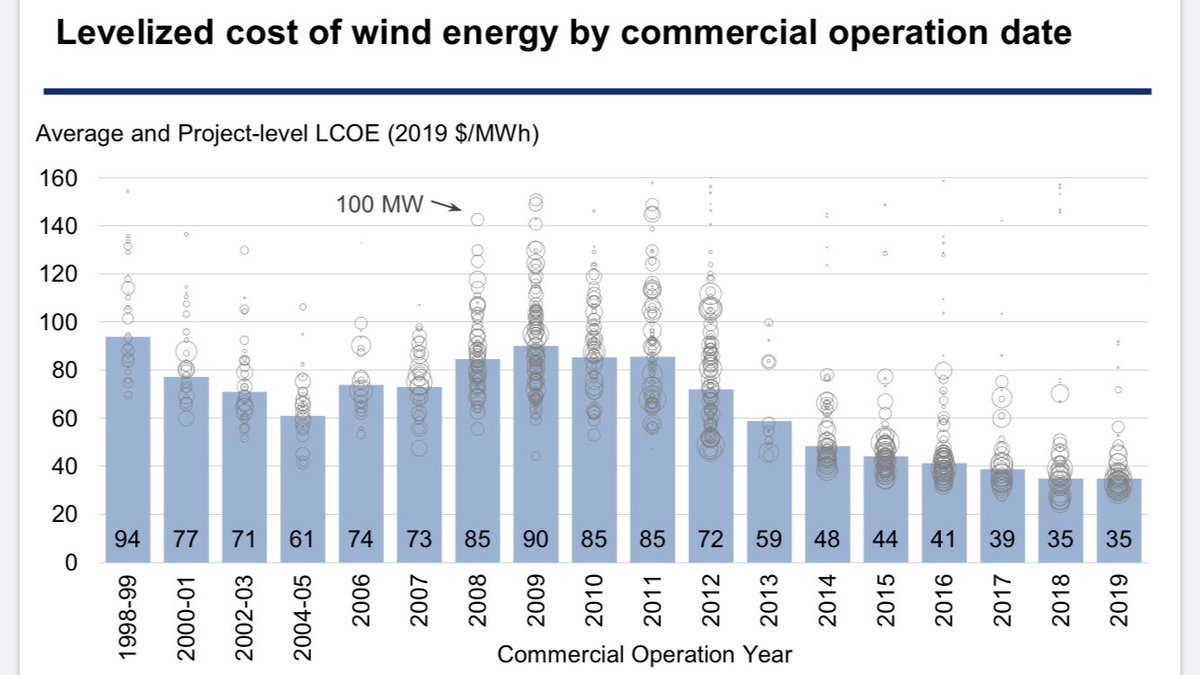

First the good news: cost of building new wind power capacity is low and keeps getting lower (though not that fast anymore).

First the good news: cost of building new wind power capacity is low and keeps getting lower (though not that fast anymore).

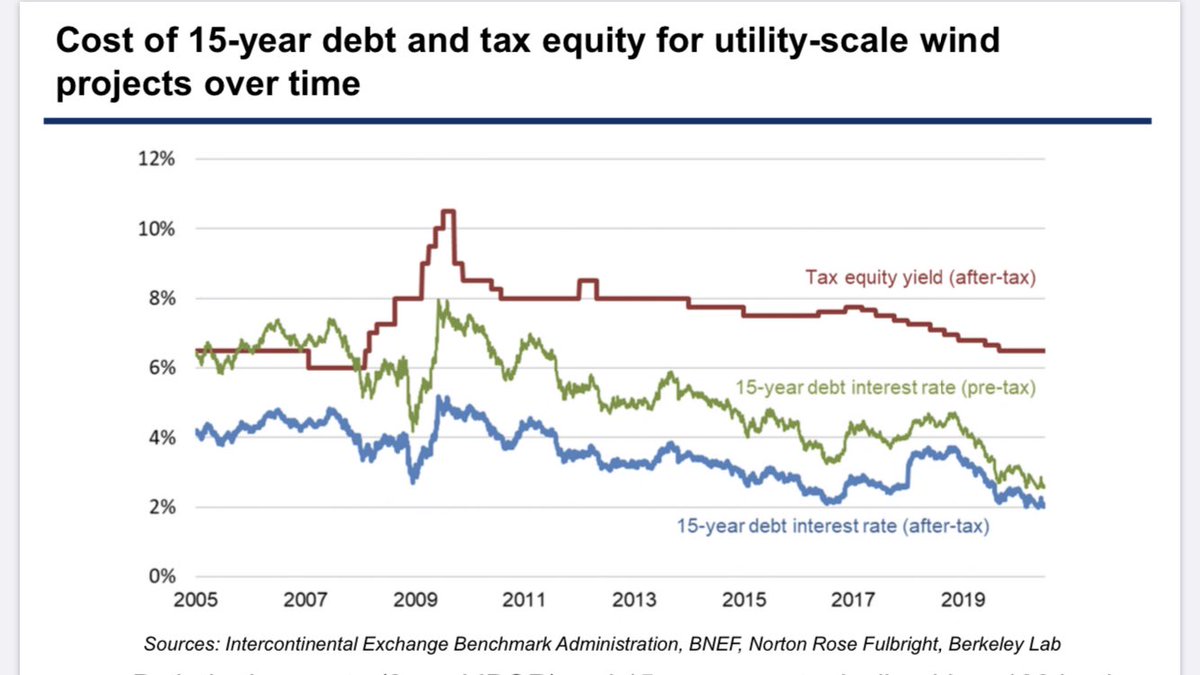

I guess onshore wind just is a mature technology, and now it’s about the site. With capital intensive technology, it of course also helps that the cost of money has come down.

Read on Twitter

Read on Twitter