I like Buffett& #39;s attitude on ignorning the stock market& #39;s prices shouted at him, unless he wants to transact

Instead, focus on the business and fundamentals

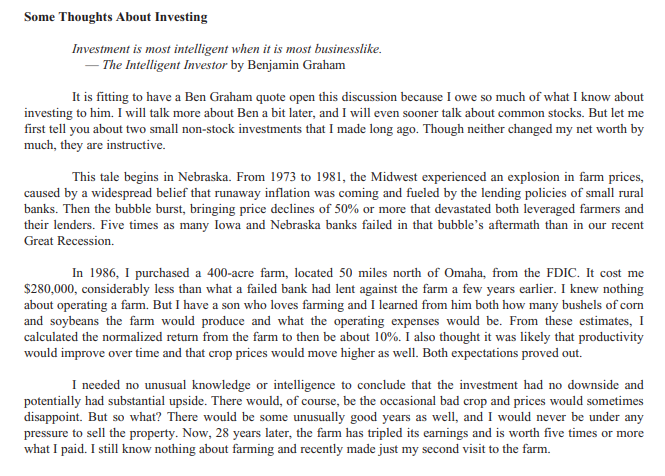

From 2013 letter to shareholders:

He discusses buying a farm in 1986 at a good price. He looks at it as a business 1/

Instead, focus on the business and fundamentals

From 2013 letter to shareholders:

He discusses buying a farm in 1986 at a good price. He looks at it as a business 1/

Tha& #39;ts how a business man thinks:

"I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity

would improve over time and that crop prices would move higher as well. Both expectations proved out."

2/

"I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity

would improve over time and that crop prices would move higher as well. Both expectations proved out."

2/

"There would be some unusually good years as well, and I would never be under any pressure to sell the property. "

"Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. " 3/

"Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. " 3/

His second investment is buying New York real estate in 1993

"As had been the case with the farm, the unleveraged current yield from the property was about 10%. The property had been undermanaged by the RTC & its income would increase when several vacant stores were leased" 4/

"As had been the case with the farm, the unleveraged current yield from the property was about 10%. The property had been undermanaged by the RTC & its income would increase when several vacant stores were leased" 4/

Does Buffett look at yield on cost?

"Annual distributions now exceed 35% of our original equity investment

Our original mortgage was refinanced in 1996 and again in 1999, moves that allowed several special distributions totaling more than 150% of what we had invested" 5/

"Annual distributions now exceed 35% of our original equity investment

Our original mortgage was refinanced in 1996 and again in 1999, moves that allowed several special distributions totaling more than 150% of what we had invested" 5/

Fundamentals of investing:

1) You don’t need to be an expert in order to achieve satisfactory investment returns

2) Focus on the future productivity of the asset you are considering

3) If you focus on the prospective price change of a purchase, you are speculating 6/

1) You don’t need to be an expert in order to achieve satisfactory investment returns

2) Focus on the future productivity of the asset you are considering

3) If you focus on the prospective price change of a purchase, you are speculating 6/

4) Consider only of what the properties would produce and don& #39;t worry not at all about their daily valuations

5/ Forming macro opinions or listening to the macro or market predictions of others is a waste of time

7/

5/ Forming macro opinions or listening to the macro or market predictions of others is a waste of time

7/

These two investments were not quoted, so noone shouted prices at him daily.

Take advantage of the moody fellow, Mr Market, who shouts prices above and below intrinsic value

Sadly, too many investors get taken advantage of that

8/

Take advantage of the moody fellow, Mr Market, who shouts prices above and below intrinsic value

Sadly, too many investors get taken advantage of that

8/

Perhaps people do ok in real estate, because it is not quoted?

That forces them to think long-term, as business owners.

9/

That forces them to think long-term, as business owners.

9/

That& #39;s the attitude to have towards fluctuations:

"If I owned 100% of a solid business with good long-term prospects, it would have been foolish for me to even consider dumping it. So why would I have sold my stocks that were small participations in wonderful businesses?"

10/

"If I owned 100% of a solid business with good long-term prospects, it would have been foolish for me to even consider dumping it. So why would I have sold my stocks that were small participations in wonderful businesses?"

10/

Read on Twitter

Read on Twitter