Hoo boy.

MEC& #39;s many financial woes are outlined in this 735 (!!) page affidavit: https://www.alvarezandmarsal.com/sites/default/files/canada/first_affidavit_p._arrata_september_14_2020.pdf

I">https://www.alvarezandmarsal.com/sites/def... am not a bankruptcy lawyer, but here& #39;s a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> with some things that jumped out at me:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> with some things that jumped out at me:

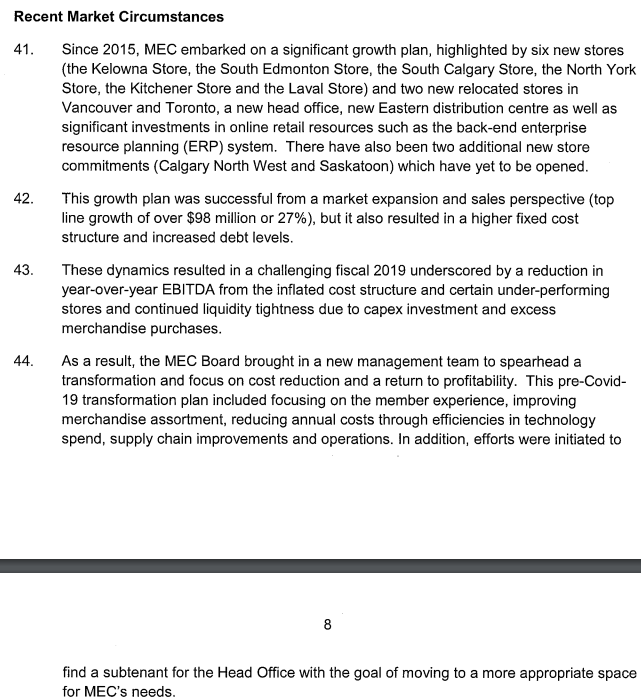

1) The expansion plan started out OK but put MEC in a vulnerable financial position:

MEC& #39;s many financial woes are outlined in this 735 (!!) page affidavit: https://www.alvarezandmarsal.com/sites/default/files/canada/first_affidavit_p._arrata_september_14_2020.pdf

I">https://www.alvarezandmarsal.com/sites/def... am not a bankruptcy lawyer, but here& #39;s a

1) The expansion plan started out OK but put MEC in a vulnerable financial position:

2) Despite online sales nearly doubling during the pandemic, total sales were down $90 million from the same time last year:

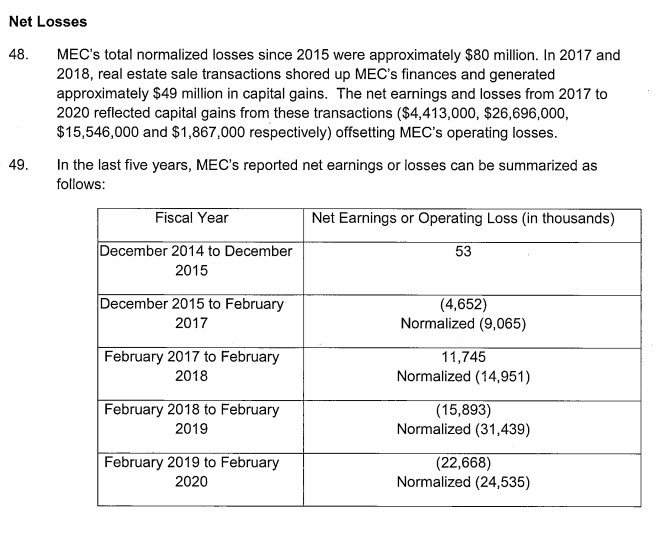

3) MEC had been losing a lot of money on operations for years and was staying afloat largely through real-estate sales:

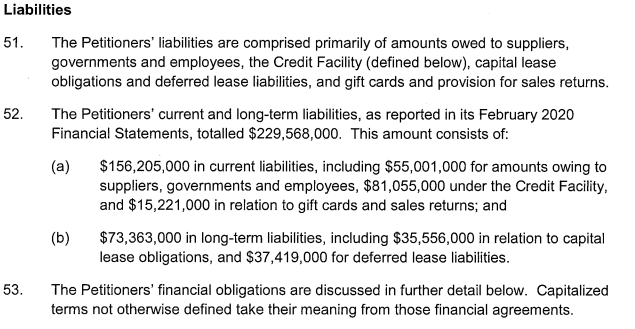

5) Its borrowing limit was reduced and the maturity date on its debt pushed back but it became clear a default was imminent:

6) MEC has about 1,500 employees

&

6a) It sounds like they will get $1.7 million in accrued OT & vacation pay? (Someone correct me if I& #39;m reading the 2nd part wrong)

&

6a) It sounds like they will get $1.7 million in accrued OT & vacation pay? (Someone correct me if I& #39;m reading the 2nd part wrong)

7) And in this additional document -- https://www.alvarezandmarsal.com/sites/default/files/canada/monitors_pre-filing_report_september_13_2020.pdf">https://www.alvarezandmarsal.com/sites/def... -- it& #39;s forecast that MEC would lose another $17 million in the next 11 weeks (despite receiving $6M in Canada Emergency Wage Subsidy).

It& #39;s estimated it will need $89 million in interim financing during that time.

It& #39;s estimated it will need $89 million in interim financing during that time.

Read on Twitter

Read on Twitter with some things that jumped out at me:1) The expansion plan started out OK but put MEC in a vulnerable financial position:" title="Hoo boy.MEC& #39;s many financial woes are outlined in this 735 (!!) page affidavit: https://www.alvarezandmarsal.com/sites/def... am not a bankruptcy lawyer, but here& #39;s a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> with some things that jumped out at me:1) The expansion plan started out OK but put MEC in a vulnerable financial position:" class="img-responsive" style="max-width:100%;"/>

with some things that jumped out at me:1) The expansion plan started out OK but put MEC in a vulnerable financial position:" title="Hoo boy.MEC& #39;s many financial woes are outlined in this 735 (!!) page affidavit: https://www.alvarezandmarsal.com/sites/def... am not a bankruptcy lawyer, but here& #39;s a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> with some things that jumped out at me:1) The expansion plan started out OK but put MEC in a vulnerable financial position:" class="img-responsive" style="max-width:100%;"/>