BP& #39;s new Energy Outlook was as rigorous and thought-provoking as ever, and full of fascinating points. It is a must-read for anyone interested in energy and climate. But there was one point that puzzled me... (1/n) https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/introduction/overview.html">https://www.bp.com/en/global...

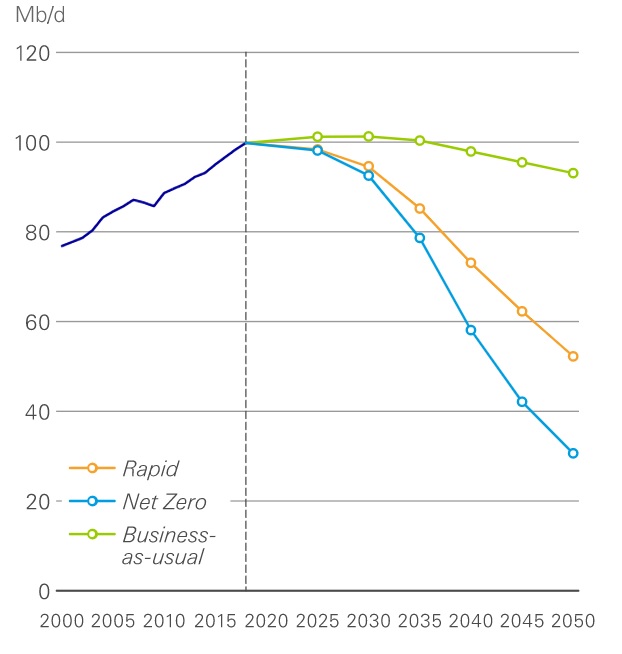

The line that mostly grabbed the headlines was that even in the "business as usual" scenario, world oil demand has essentially hit a plateau. There is very modest growth in the next few years, and a clear decline from 2030. (2/n)

FWIW, @WoodMackenzie expects a higher and later peak. In our base case forecast, oil demand plateaus at about 110 million b/d in the late 2030s. BP makes clear that its number is a scenario, not a forecast. But most people generally treat it like a forecast. (3/n)

BP says: "The scenarios are not predictions of what is likely to happen or what BP would like to happen. Rather, the scenarios help to illustrate the range of outcomes possible over the next thirty years, although the uncertainty is substantial..." (4/n)

In practice, discussion around the scenarios generally treats them as if they were forecasts. And I think that& #39;s fine. You can wade into the deep waters of epistemology in debating what we can know about the future... (5/n)

...but for practical purposes, the distinction doesn& #39;t seem very useful. A forecast / scenario is a way of organising our thinking about the future, not an oracular revelation of days to come, whatever you call it. (6/n)

Basically this. Although BP actually is betting its house on it. (7/n) https://twitter.com/Petrologica/status/1305902197293617152?s=20">https://twitter.com/Petrologi...

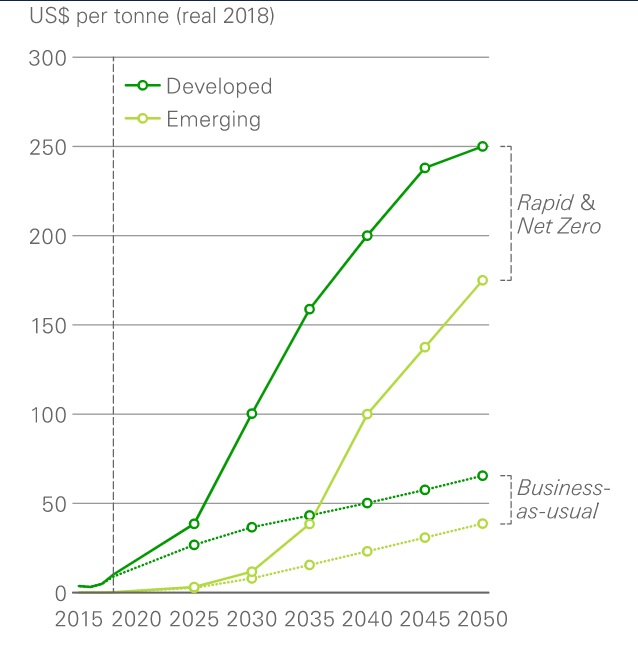

But I digress... The numbers that jumped out at me were BP& #39;s projections of carbon prices in 2050. For the "rapid transition" scenario - a world with 2°C of warming - the average price of carbon in developed countries has to reach $250 per tonne of CO2 equivalent by 2050 (8/n)

That is in 2018 real dollars, by the way, so in nominal terms it would be quite a bit higher. That sounds like a lot! (9/n)

It seems high both in terms of what the public in developed countries might tolerate, and in terms of the expected costs of cutting carbon emissions. (10/n)

It is also quite a bit higher than in the scenarios from the IEA. In its Sustainable Development scenario, its version of a 2 degree world, the IEA last year projected a price of $140 per tonne of CO2 in developed countries in 2040, covering power, industry and aviation. (11/n)

Bearing in mind all the caveats about "it& #39;s a scenario, not a forecast", it still makes sense to ask if BP& #39;s $250 / tonne CO2e number is plausible. WoodMac has calculated that in the markets where carbon is explicitly priced today, the average price is ~$22 / tonne CO2e. (12/n)

Are people in developed countries going to be prepared to accept - and vote for - a 1000% increase in carbon prices over the next 30 years, most of it front-loaded into the next 20? Maybe. But it feels like a big ask. (13/n)

That& #39;s the bad news. The good news is that it also sounds high for the cost of cutting emissions. Certainly, as @AkshatRathi points out, there are some policies such as EV subsidies that cost a lot more than $250 / tCO2e today. (14/n)

...but as the costs of wind and solar power, batteries and EVs continue to fall, those costs of carbon abatement will keep dropping. (15/n)

To get to a 2 degree world, you need to reach the sectors that are hard to decarbonise: energy intensive industries, long-distance road freight, etc. Tackling those will mean a higher cost of carbon abatement. (16/n)

But solutions for those hard-to-decarbonise sectors already exist: hydrogen, carbon capture, etc. Today they are at the early stages of development. If they were rolled out at large scale, costs would fall. (17/n)

At the limit, there is Direct Air Capture of CO2. Today that costs $600-$800 per tonne of CO2... (18/n) https://www.pri.org/stories/2020-07-03/can-direct-air-capture-make-real-impact-climate-change">https://www.pri.org/stories/2...

...but the cost of DAC also has the potential to fall sharply if it is deployed at scale. Some estimates suggest it could be done for $100 / tCO2. If that happens, then a carbon price of $250 / tonne is a licence to print money. (19/n) https://www.cell.com/joule/fulltext/S2542-4351(18)30225-3">https://www.cell.com/joule/ful...

Read on Twitter

Read on Twitter