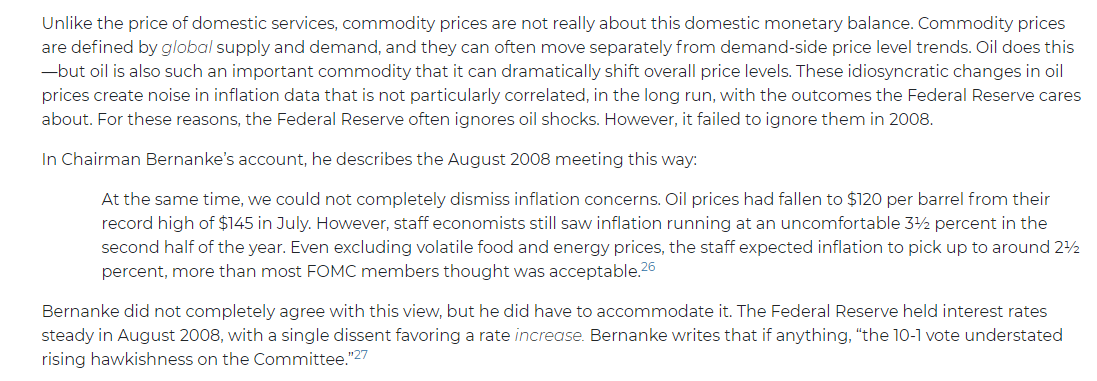

Here& #39;s the problem with the assessment of inflation from the committee, though: they paid a *lot* of attention to oil. Bernanke says so in his book, it says so in the minutes, and so on.

Why is paying attention to oil a problem?

Why is paying attention to oil a problem?

Well, because inflation in oil prices is not really the kind of inflation the Fed is responsible for. It& #39;s a global price responding to real trends in global supply and demand.

High gas prices alone don& #39;t really imply a general problem of too much money in the US economy.

High gas prices alone don& #39;t really imply a general problem of too much money in the US economy.

The reason we have an inflation component of the mandate is more to stop the Fed from growing our currency circulation much faster than the U.S. productive capacity.

It& #39;s not to entirely insulate commodity prices from reflecting real supply and demand.

It& #39;s not to entirely insulate commodity prices from reflecting real supply and demand.

We knew all of this back in the 2000s, we just kind of... forgot it. Here& #39;s an educational primer on this from the Fed that pre-dates the crisis. https://www.frbsf.org/education/publications/doctor-econ/2004/october/core-inflation-headline/">https://www.frbsf.org/education...

There& #39;s good evidence that the 2008 Fed was much more concerned with the components of the green lines, which are volatile and encompass some international supply and demand mechanics that the Fed isn& #39;t really responsible for--not the blue line, which was more stable.

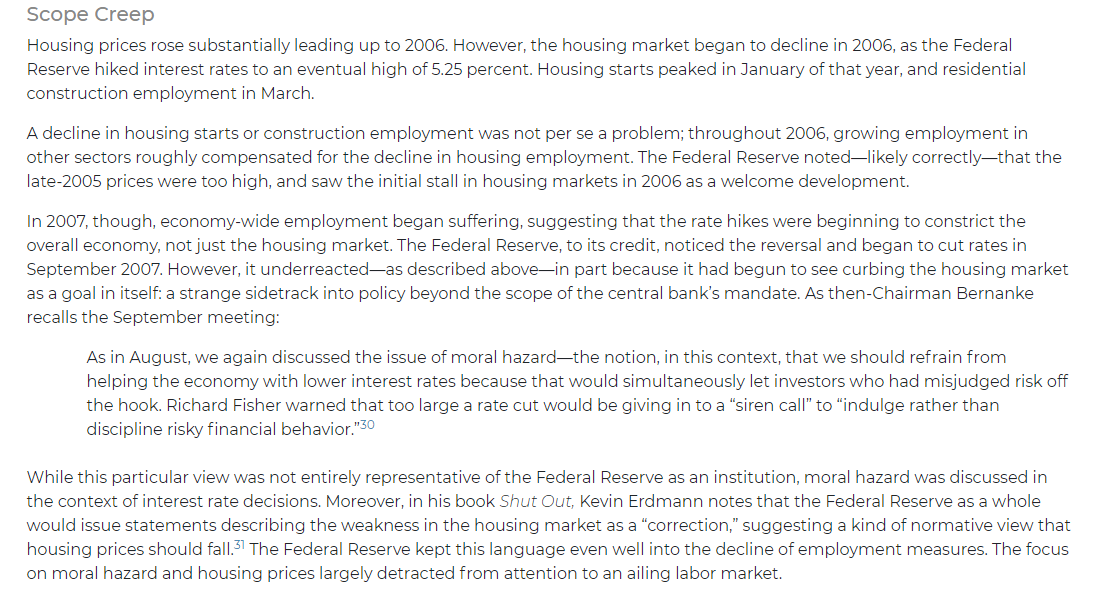

The other thing the Fed was doing in 2008 was managing some things that fall pretty far outside the scope of the dual mandate. They had an idea about what the correct housing prices would be, and they had some ideas about moral hazard.

They were wrong on both counts.

They were wrong on both counts.

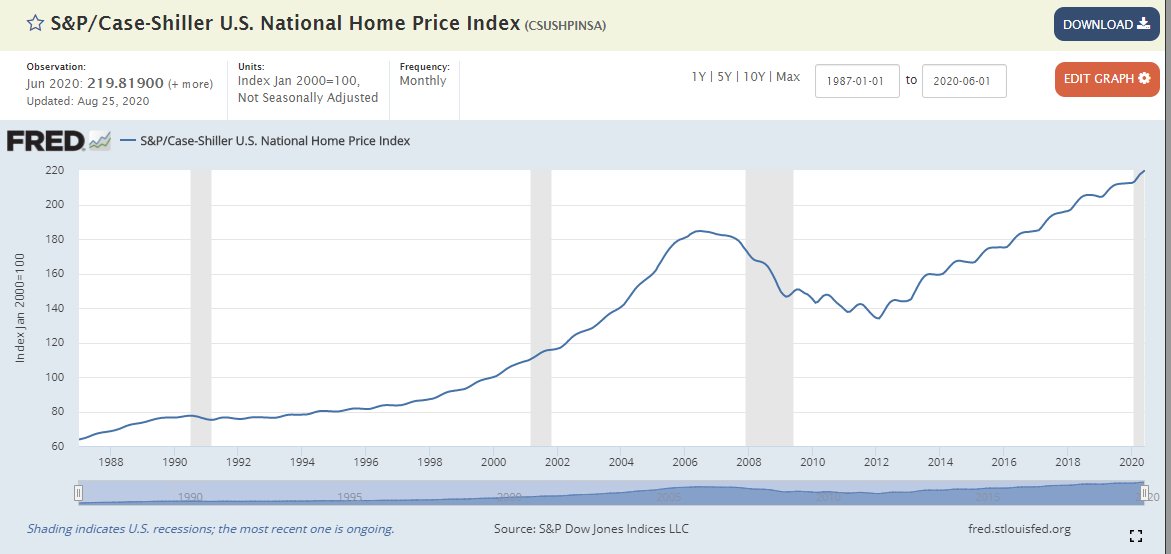

On housing: turns out house prices were rising for a variety of boring, secular reasons: people getting richer, population growing, more saving in the economy pushing the natural rate of interest down, and zoning restrictions making some coastal cities expensive.

There was, to be sure, some irrational exuberance and over-lending, too, but absent a Fed-generated recession, the overall trend for housing prices is to go up.

Was the 2006 price exactly right? Probably not, probably a bit ahead of the trend.

Was the 2006 price exactly right? Probably not, probably a bit ahead of the trend.

But was "correcting" the 2006 price by taking away 9 million jobs so that people would be poor and bid less on houses a helpful solution to a mispricing of assets?

Also no.

Also no.

Finally, the "moral hazard" claim is arguably the worst one. The argument goes like this:

(a) some people made investments that will do poorly under a bad economy

(b) we could fix the economy by loosening monetary policy

(c) but we shouldn& #39;t do that, to teach them a lesson

(a) some people made investments that will do poorly under a bad economy

(b) we could fix the economy by loosening monetary policy

(c) but we shouldn& #39;t do that, to teach them a lesson

This George Bluth Senior-level logic really has no place in government, but even if it did, it should fall under the scope of Congress& #39;s work, not the Fed& #39;s.

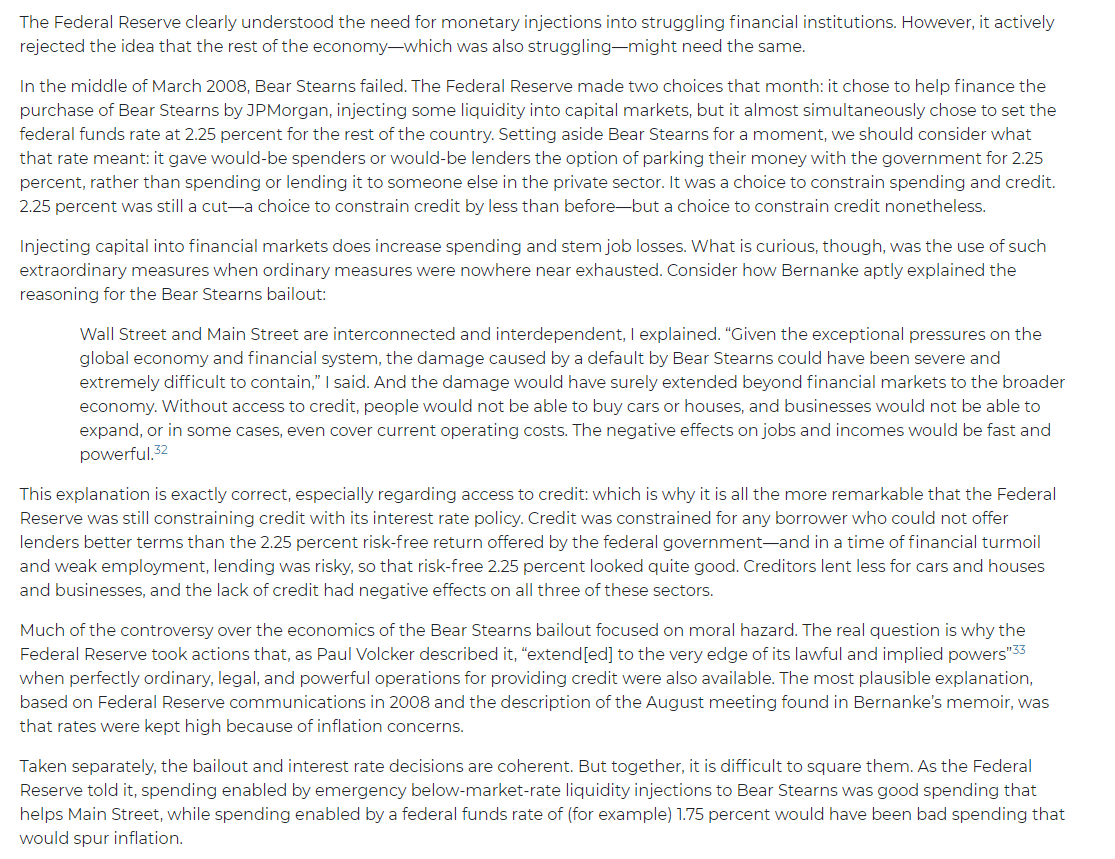

The final area to address about 2007-2008 is that bespoke rescue packages for banks, with looser credit for them, were matched with tighter credit for the public at large, presumably to contain inflation.

I am not a populist, in tone, in policy preferences, really in anything. But the facts are what they are here.

The public should get the benefit of the Fed& #39;s ordinary policy tools long, long before extraordinary measures are employed.

The public should get the benefit of the Fed& #39;s ordinary policy tools long, long before extraordinary measures are employed.

That& #39;s all for now, on the 2007-2008 era. That& #39;s how we got into this mess.

But we can also do a better job of getting out of messes. Later we& #39;ll talk 2009-2019, which also has some implications for how we get out of the COVID economy troubles. https://www.jec.senate.gov/public/index.cfm/republicans/analysis?id=051267FC-0147-4E31-BE80-946E0543AF82">https://www.jec.senate.gov/public/in...

But we can also do a better job of getting out of messes. Later we& #39;ll talk 2009-2019, which also has some implications for how we get out of the COVID economy troubles. https://www.jec.senate.gov/public/index.cfm/republicans/analysis?id=051267FC-0147-4E31-BE80-946E0543AF82">https://www.jec.senate.gov/public/in...

Read on Twitter

Read on Twitter