Zoom’s stock ($ZM) is expensive.

It’s in the lead now but companies big and small are attacking.

It has an incredible product but no moats to protect itself long-term.

What should Eric Yuan do? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

It’s in the lead now but companies big and small are attacking.

It has an incredible product but no moats to protect itself long-term.

What should Eric Yuan do?

I wrote up a case study on Zoom in @notboringclub yesterday, and asked readers:

What do you, as Zoom’s CEO, do to maximize long-term shareholder value?

This thread is a combination of my ideas and theirs (tagged when theirs). https://notboring.substack.com/p/zooms-blank-check">https://notboring.substack.com/p/zooms-b...

What do you, as Zoom’s CEO, do to maximize long-term shareholder value?

This thread is a combination of my ideas and theirs (tagged when theirs). https://notboring.substack.com/p/zooms-blank-check">https://notboring.substack.com/p/zooms-b...

In 1995, a Chinese engineer saw @BillGates speak in Japan and decided he needed to move to America.

His visa application was denied 8 times before it was approved on the 9th.

When he got here, he went to work @Webex as a founding engineer.

That engineer was Eric Yuan.

His visa application was denied 8 times before it was approved on the 9th.

When he got here, he went to work @Webex as a founding engineer.

That engineer was Eric Yuan.

WebEx IPO’d in 2000, and @Cisco (not @OfficialSisQo) acquired it for $3.2bn.

Yuan was unhappy. He explained to @bdeeter:

“Every time I talked to a WebEx customer, I felt very embarrassed, because I did not speak with a single happy WebEx customer.” https://open.spotify.com/episode/2CGirPFcClelQoikTSftLY?si=H6Z9HMjdSoSjfoOT2veHzQ">https://open.spotify.com/episode/2...

Yuan was unhappy. He explained to @bdeeter:

“Every time I talked to a WebEx customer, I felt very embarrassed, because I did not speak with a single happy WebEx customer.” https://open.spotify.com/episode/2CGirPFcClelQoikTSftLY?si=H6Z9HMjdSoSjfoOT2veHzQ">https://open.spotify.com/episode/2...

He left WebEx to start a new company, and people wanted to back him. As @djrosent explained on @AcquiredFM:

“basically anyone who had ever worked with Eric immediately gives him money, just blank check, to back him to work on whatever he’s going to do.” https://www.acquired.fm/episodes/the-zoom-ipo-with-santi-subotovsky">https://www.acquired.fm/episodes/...

“basically anyone who had ever worked with Eric immediately gives him money, just blank check, to back him to work on whatever he’s going to do.” https://www.acquired.fm/episodes/the-zoom-ipo-with-santi-subotovsky">https://www.acquired.fm/episodes/...

The time was right for a better video solution. @ssubo pointed out on @AcquiredFM that the purchasing decision was moving from IT to end users, which meant the best product would win. And Zoom had the best.

@waltmossberg agreed in his 2012 review: https://youtu.be/S6QadO0L3-I ">https://youtu.be/S6QadO0L3...

@waltmossberg agreed in his 2012 review: https://youtu.be/S6QadO0L3-I ">https://youtu.be/S6QadO0L3...

Over the next 6 years, Zoom focused on customer happiness and product.

It raised 4 times:

- Jan 2013: $6mm @QualcommVenture

- Sep 2013: $6.5mm @HorizonGrowth

- Feb 2015: $30mm @emergencecap

- Jan 2017: $100mm @sequoia @ $1bn https://techcrunch.com/2017/01/17/sequoia-invests-100-million-in-zoom-video-conferencing-service/">https://techcrunch.com/2017/01/1...

It raised 4 times:

- Jan 2013: $6mm @QualcommVenture

- Sep 2013: $6.5mm @HorizonGrowth

- Feb 2015: $30mm @emergencecap

- Jan 2017: $100mm @sequoia @ $1bn https://techcrunch.com/2017/01/17/sequoia-invests-100-million-in-zoom-video-conferencing-service/">https://techcrunch.com/2017/01/1...

Zoom went public in April 2018. Its growth and profits stood out in a year of cash-burning IPOs like $UBER, $LYFT, $BYND, $WORK

@afc highlighted 82% GM & 5% OM in his S-1 breakdown

https://medium.com/@alexfclayton/zoom-ipo-s-1-breakdown-119249acadd3">https://medium.com/@alexfcla...

@afc highlighted 82% GM & 5% OM in his S-1 breakdown

https://medium.com/@alexfclayton/zoom-ipo-s-1-breakdown-119249acadd3">https://medium.com/@alexfcla...

On IPO day, Zoom shares popped from $36 to $66 before closing at $62, giving $ZM a $15.8bn market cap.

Yuan told @emilychangtv of @BloombergTV ”the price is too high” https://twitter.com/bloombergtv/status/1118994671407992832">https://twitter.com/bloomberg...

Yuan told @emilychangtv of @BloombergTV ”the price is too high” https://twitter.com/bloombergtv/status/1118994671407992832">https://twitter.com/bloomberg...

It’s gotten much higher since.

In May, I wrote While Zoom Zooms, Slack Digs Moats.

I thought $ZM had run too much and $WORK was a better buy. I was wrong (for now).

Zoom is up over 400% since the beginning of COVID.

In May, I wrote While Zoom Zooms, Slack Digs Moats.

I thought $ZM had run too much and $WORK was a better buy. I was wrong (for now).

Zoom is up over 400% since the beginning of COVID.

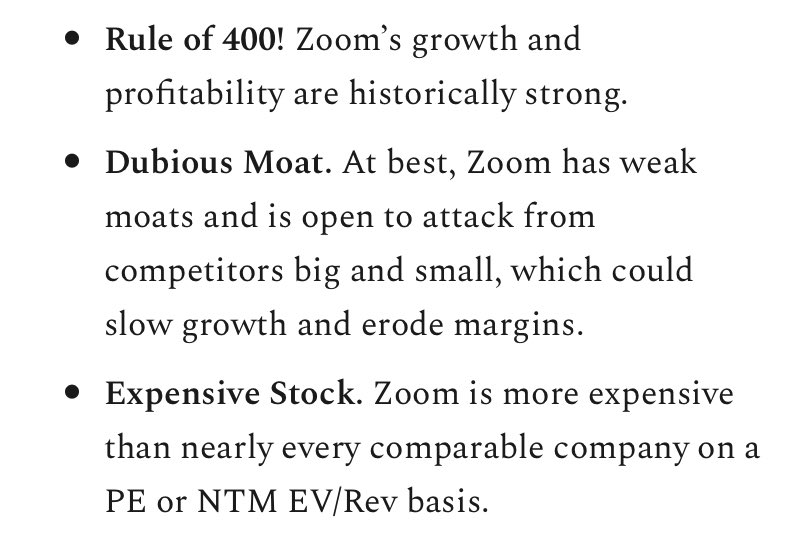

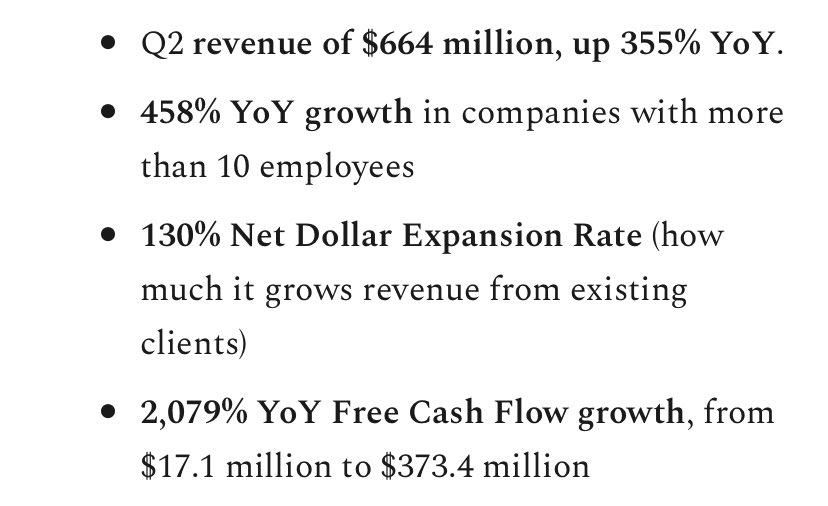

Zoom’s Q2 earnings were absurdly good.

In SaaS, the Rule of 40 says a company’s growth + profitability should add up to over 40%.

Zoom’s adds up to 411! 10x Rule of 40 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

In SaaS, the Rule of 40 says a company’s growth + profitability should add up to over 40%.

Zoom’s adds up to 411! 10x Rule of 40

But it’s possible to be both excellent and overvalued. Zoom is:

- P/E of 489x, 2nd only to $TSLA (and unprofitable $SHOP) among 75 biggest cos by market cap

- NTM EV/Rev of 37.6x, higher than any large cap software co

It’s growing faster for sure, but bears have one argument...

- P/E of 489x, 2nd only to $TSLA (and unprofitable $SHOP) among 75 biggest cos by market cap

- NTM EV/Rev of 37.6x, higher than any large cap software co

It’s growing faster for sure, but bears have one argument...

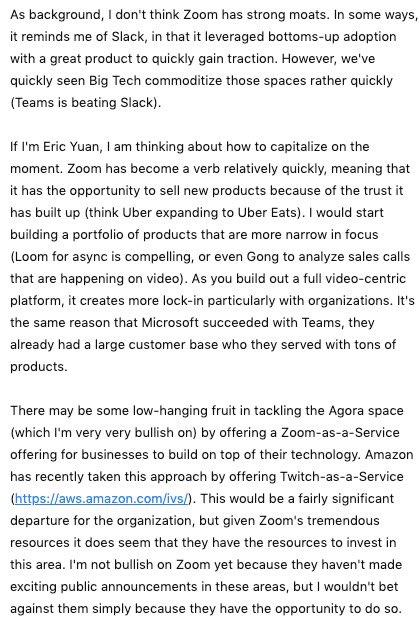

Zoom has no moats.

Why does it matter?

Moats are important for any business, but especially for those that are mostly valued on earnings in the future. A moat makes sure those future earnings happen.

Why does it matter?

Moats are important for any business, but especially for those that are mostly valued on earnings in the future. A moat makes sure those future earnings happen.

Moat does not mean “advantage.” I like the Hamilton Helmer definition:

“Barriers that protect your business’ margins from the erosive forces of competition.” https://www.amazon.com/7-Powers-Foundations-Business-Strategy/dp/0998116319">https://www.amazon.com/7-Powers-...

“Barriers that protect your business’ margins from the erosive forces of competition.” https://www.amazon.com/7-Powers-Foundations-Business-Strategy/dp/0998116319">https://www.amazon.com/7-Powers-...

When @Austin_rief said he didn’t know what Zoom’s moat was, the responses fell into 2 categories:

1. Brand: Zoom is a verb, like Google.

2. Product: “it just works”

I don’t buy either as a moat for Zoom. https://twitter.com/austin_rief/status/1300799223873638402">https://twitter.com/austin_ri...

1. Brand: Zoom is a verb, like Google.

2. Product: “it just works”

I don’t buy either as a moat for Zoom. https://twitter.com/austin_rief/status/1300799223873638402">https://twitter.com/austin_ri...

In What Comes After Zoom?, @benedictevans compares zoom to Dropbox and Skype. Skype lost for 2 reasons:

1. Product drifted.

2. Everything got voice, so voice became a commodity.

He thinks the same is happening in video. https://www.ben-evans.com/benedictevans/2020/6/22/zoom-and-the-next-video">https://www.ben-evans.com/benedicte...

1. Product drifted.

2. Everything got voice, so voice became a commodity.

He thinks the same is happening in video. https://www.ben-evans.com/benedictevans/2020/6/22/zoom-and-the-next-video">https://www.ben-evans.com/benedicte...

@OslundJJ wrote about that phenomenon in The Verticalization of Zoom.

@akarshsanghi of @reachlive365 told me that all these companies are building on the same non-Zoom stack: React, typescript, hasura, Postgres, WebRTC, and Agora. https://medium.com/swlh/the-verticalization-of-zoom-eb61a79d1cad">https://medium.com/swlh/the-...

@akarshsanghi of @reachlive365 told me that all these companies are building on the same non-Zoom stack: React, typescript, hasura, Postgres, WebRTC, and Agora. https://medium.com/swlh/the-verticalization-of-zoom-eb61a79d1cad">https://medium.com/swlh/the-...

So if you’re Eric Yuan in this situation, what do you do to maximize long-term shareholder value? You can submit your own answers here:

https://airtable.com/shr9DN3hIjz6VUCOG">https://airtable.com/shr9DN3hI...

https://airtable.com/shr9DN3hIjz6VUCOG">https://airtable.com/shr9DN3hI...

Here’s what I would do:

Zoom’s stock is essentially a blank check, like the classic 1994 movie:

https://youtu.be/D1rbgxR_9uA

It">https://youtu.be/D1rbgxR_9... should spend it to acquire moats.

Zoom’s stock is essentially a blank check, like the classic 1994 movie:

https://youtu.be/D1rbgxR_9uA

It">https://youtu.be/D1rbgxR_9... should spend it to acquire moats.

Zoom’s #1 target has to be Agora ($API). Its founder, Tony Zhao, was also a founding engineer at WebEx, and it’s arming the rebels against Zoom.

The acquisition would:

- neutralize the threat

- allow Zoom to participate in growth

- METAVERSE

- dig moats (NE & SC)

The acquisition would:

- neutralize the threat

- allow Zoom to participate in growth

- METAVERSE

- dig moats (NE & SC)

37 readers submitted excellent ideas. Most popular were:

1. Buy Slack $WORK

2. Buy Agora $API

3. Focus on meetings through partnership and M&A

4. New workplace productivity vertical ( @airtable @figmadesign @NotionHQ etc)

5. Just keep investing in core product

1. Buy Slack $WORK

2. Buy Agora $API

3. Focus on meetings through partnership and M&A

4. New workplace productivity vertical ( @airtable @figmadesign @NotionHQ etc)

5. Just keep investing in core product

@phemartin called out that Agora would allow Zoom to do the Tencent / WeChat thing and invest in up and coming video startups based on proprietary performance data.

Love that idea.

Love that idea.

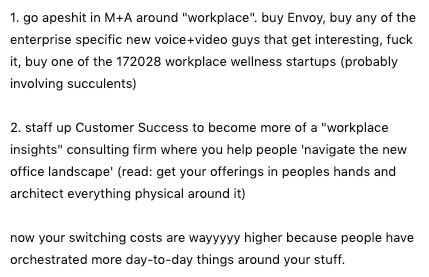

@LoudSharp thinks Zoom should “go apeshit in M + A around workplace”

Get involved in all this fun by subscribing to Not Boring  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤓" title="Nerd-Gesicht" aria-label="Emoji: Nerd-Gesicht"> https://notboring.substack.com/subscribe ">https://notboring.substack.com/subscribe...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤓" title="Nerd-Gesicht" aria-label="Emoji: Nerd-Gesicht"> https://notboring.substack.com/subscribe ">https://notboring.substack.com/subscribe...

Read on Twitter

Read on Twitter " title="Zoom’s stock ($ZM) is expensive.It’s in the lead now but companies big and small are attacking.It has an incredible product but no moats to protect itself long-term.What should Eric Yuan do? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="Zoom’s stock ($ZM) is expensive.It’s in the lead now but companies big and small are attacking.It has an incredible product but no moats to protect itself long-term.What should Eric Yuan do? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="Zoom’s Q2 earnings were absurdly good.In SaaS, the Rule of 40 says a company’s growth + profitability should add up to over 40%.Zoom’s adds up to 411! 10x Rule of 40 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" class="img-responsive" style="max-width:100%;"/>

" title="Zoom’s Q2 earnings were absurdly good.In SaaS, the Rule of 40 says a company’s growth + profitability should add up to over 40%.Zoom’s adds up to 411! 10x Rule of 40 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" class="img-responsive" style="max-width:100%;"/>