Busted.

Been mining @SwerveFinance the hour it opened, also LPing at the same time on @UniswapProtocol too.

@harvest_finance gotta do what it& #39;s gotta do... I& #39;m gonna do what I& #39;m gonna do.

Exercising free options + charging for volatility both directions.

$ETH #Ethereum $WRV https://twitter.com/Blockchain_C/status/1305738134798372864">https://twitter.com/Blockchai...

Been mining @SwerveFinance the hour it opened, also LPing at the same time on @UniswapProtocol too.

@harvest_finance gotta do what it& #39;s gotta do... I& #39;m gonna do what I& #39;m gonna do.

Exercising free options + charging for volatility both directions.

$ETH #Ethereum $WRV https://twitter.com/Blockchain_C/status/1305738134798372864">https://twitter.com/Blockchai...

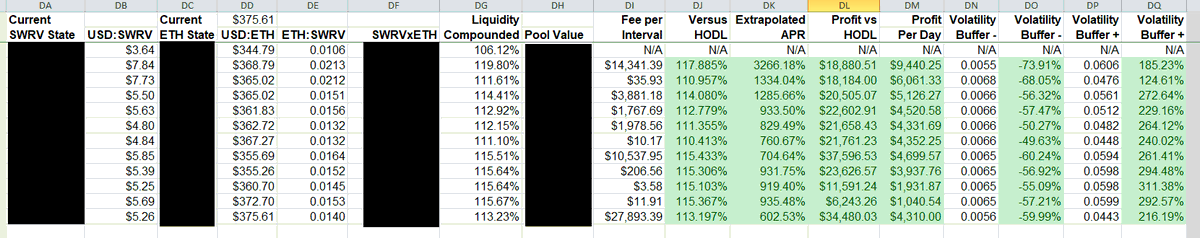

Most farms that yields quad-digit APY requires taking on the risk of the asset.

I mitigated this by mining the asset for zero cost-basis, nevermind risk, then sending it to uniswap, therefore my cost-basis is only the ETH-side of the equation.

600% APR ain& #39;t bad.

I mitigated this by mining the asset for zero cost-basis, nevermind risk, then sending it to uniswap, therefore my cost-basis is only the ETH-side of the equation.

600% APR ain& #39;t bad.

Read on Twitter

Read on Twitter