In 1666, the Great Fire of London destroyed many homes and businesses, but from the ashes rose the world’s first property insurance policies. Here’s how it happened:

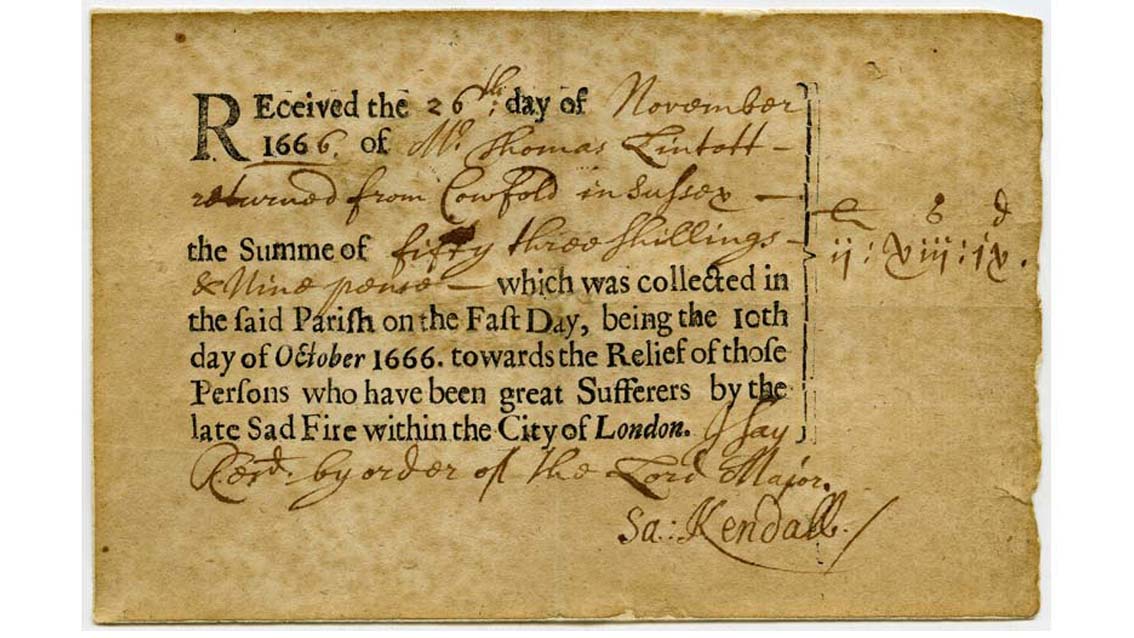

It’s estimated that the fire destroyed property worth around £1.5 bn in modern money. Charitable donations raised covered a whopping 0.13% of that... but where would the rest come from? And what if something like this happened again?

Thanks to streets lined with timber-framed buildings and the widespread use of open fires to heat homes and businesses, destructive blazes remained a constant threat in London even after the Great Fire.

At the time of the fire, tenants were liable for repairs to their homes, rather than the landlords. The Great Fire made it clear that this arrangement was untenable, and an emergency court was set up to decide who should pay to rebuild.

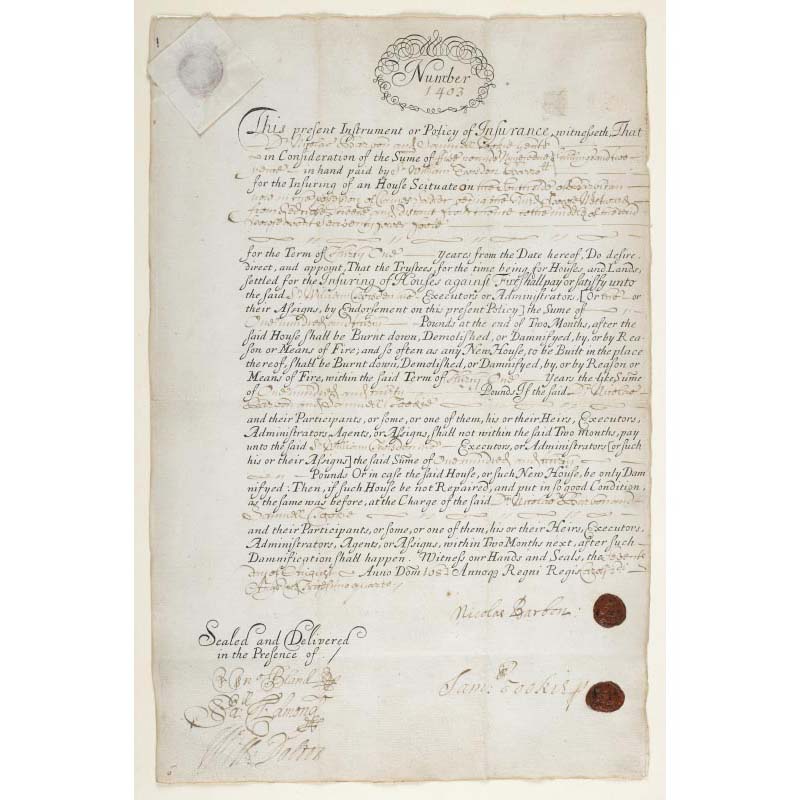

In 1680 the first insurance company, the ‘Fire Office’, was set up by Nicholas Barbon and began issuing policies like this one, signed by Barbon himself. Others like it soon emerged, and by 1690 one in ten houses in London was insured.

By 1700, the insurers realised it was cheaper to put out fires themselves than pay for rebuilds, so they each employed fire brigades. Insurers created ‘fire mark’ plates to mark houses they insured. This one is from the Hand in Hand Fire Office.

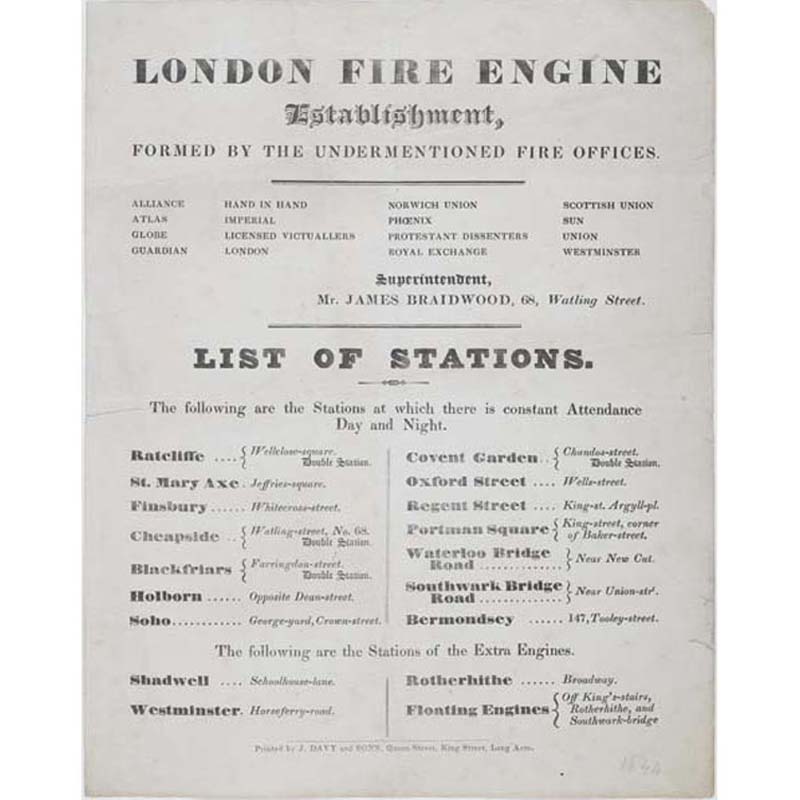

Companies made arrangements with each other to pool their fire-fighting resources for mutual benefit. Eventually, they realised it would be efficient to have a unified force, and in 1833 the London Fire Engine Establishment was created.

The industry continued to grow and by 1720 it had underwritten 17,000 policies, totalling enough to cover the estimated cost of the property that the fire had destroyed. This mark was issued by the Sun Fire Office, which exists today as the @rsagroup .

For more details on this story, read it in full here: http://bit.ly/GFinsurance2 ">https://bit.ly/GFinsuran...

Read on Twitter

Read on Twitter