1/5

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐸" title="Froschgesicht" aria-label="Emoji: Froschgesicht">JFrog is IPO& #39;ing this week & I wrote a breakdown of $FROG that dives into:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐸" title="Froschgesicht" aria-label="Emoji: Froschgesicht">JFrog is IPO& #39;ing this week & I wrote a breakdown of $FROG that dives into:

- What the product & how it fits into a developers workflow

- Its business model & competition

- The financials and how it comps to its IPO price range

https://blog.publiccomps.com/jfrog-s-1-analysis/

Summary">https://blog.publiccomps.com/jfrog-s-1... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

- What the product & how it fits into a developers workflow

- Its business model & competition

- The financials and how it comps to its IPO price range

https://blog.publiccomps.com/jfrog-s-1-analysis/

Summary">https://blog.publiccomps.com/jfrog-s-1...

2/5

Their core offering is Artifactory, which is the best product for enterprise binary & package management. This is https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> to distribute safe software efficiently.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> to distribute safe software efficiently.

The impressive & diverse customer list of JFrog is a testament to the product& #39;s quality.

Their core offering is Artifactory, which is the best product for enterprise binary & package management. This is

The impressive & diverse customer list of JFrog is a testament to the product& #39;s quality.

3/5

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> It& #39;s pricing structure + auxiliary offerings drive a high net dollar expansion (best-in-class at 139%).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> It& #39;s pricing structure + auxiliary offerings drive a high net dollar expansion (best-in-class at 139%).

It& #39;s free-trial is a powerful bottoms-up channel to acquire customers and get their sticky product integrated with their development stack.

It& #39;s free-trial is a powerful bottoms-up channel to acquire customers and get their sticky product integrated with their development stack.

4/5

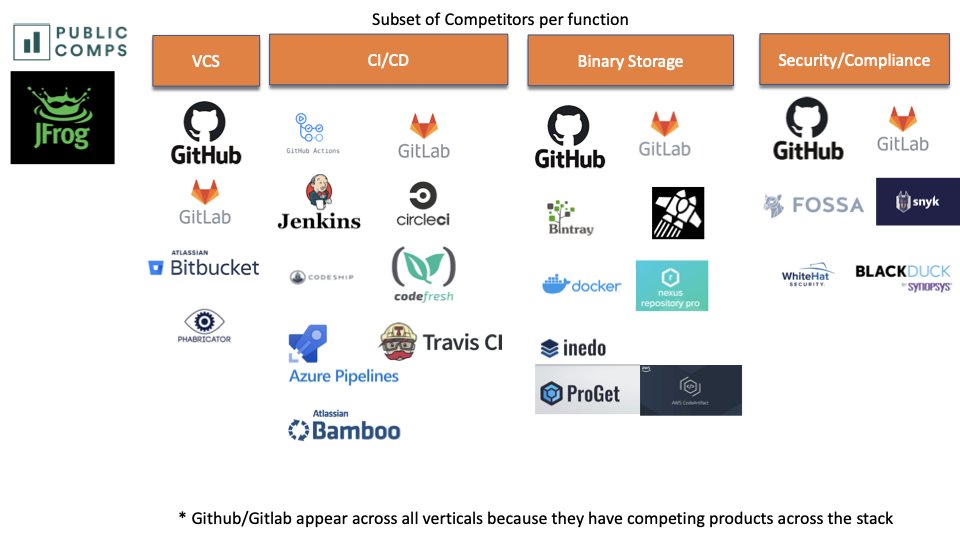

Its core + auxiliary products do have competitors in both the public & private markets BUT its Artifactory product is head and shoulders above its competition in enterprise features.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Customers will keep on choosing JFrog for its core competency (Artifactory)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Customers will keep on choosing JFrog for its core competency (Artifactory)

Its core + auxiliary products do have competitors in both the public & private markets BUT its Artifactory product is head and shoulders above its competition in enterprise features.

5/5

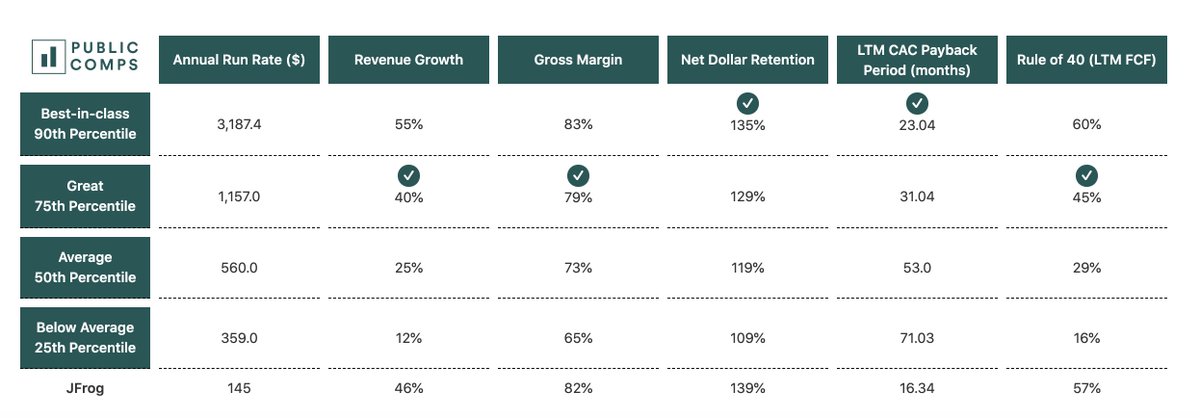

Financials:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">46% Revenue Growth

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">46% Revenue Growth

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">57% FCF Efficiency

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">57% FCF Efficiency

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📏" title="Gerades Lineal" aria-label="Emoji: Gerades Lineal">82% Gross Margins (Best-in-class)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📏" title="Gerades Lineal" aria-label="Emoji: Gerades Lineal">82% Gross Margins (Best-in-class)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">139% Net Dollar Retention (Best-in-class)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">139% Net Dollar Retention (Best-in-class)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗓️" title="Spiralkalenderblatt" aria-label="Emoji: Spiralkalenderblatt">16 month LTM CAC Payback Period (Best-in-class)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗓️" title="Spiralkalenderblatt" aria-label="Emoji: Spiralkalenderblatt">16 month LTM CAC Payback Period (Best-in-class)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts">25x EV / Revenue Run Rate @ $41 (est price today)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts">25x EV / Revenue Run Rate @ $41 (est price today)

Vs Top 10 SaaS & DevOps @publiccomps

Financials:

Vs Top 10 SaaS & DevOps @publiccomps

Read on Twitter

Read on Twitter JFrog is IPO& #39;ing this week & I wrote a breakdown of $FROG that dives into:- What the product & how it fits into a developers workflow- Its business model & competition- The financials and how it comps to its IPO price range https://blog.publiccomps.com/jfrog-s-1... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="1/5https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐸" title="Froschgesicht" aria-label="Emoji: Froschgesicht">JFrog is IPO& #39;ing this week & I wrote a breakdown of $FROG that dives into:- What the product & how it fits into a developers workflow- Its business model & competition- The financials and how it comps to its IPO price range https://blog.publiccomps.com/jfrog-s-1... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

JFrog is IPO& #39;ing this week & I wrote a breakdown of $FROG that dives into:- What the product & how it fits into a developers workflow- Its business model & competition- The financials and how it comps to its IPO price range https://blog.publiccomps.com/jfrog-s-1... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="1/5https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐸" title="Froschgesicht" aria-label="Emoji: Froschgesicht">JFrog is IPO& #39;ing this week & I wrote a breakdown of $FROG that dives into:- What the product & how it fits into a developers workflow- Its business model & competition- The financials and how it comps to its IPO price range https://blog.publiccomps.com/jfrog-s-1... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

to distribute safe software efficiently.The impressive & diverse customer list of JFrog is a testament to the product& #39;s quality." title="2/5Their core offering is Artifactory, which is the best product for enterprise binary & package management. This is https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> to distribute safe software efficiently.The impressive & diverse customer list of JFrog is a testament to the product& #39;s quality." class="img-responsive" style="max-width:100%;"/>

to distribute safe software efficiently.The impressive & diverse customer list of JFrog is a testament to the product& #39;s quality." title="2/5Their core offering is Artifactory, which is the best product for enterprise binary & package management. This is https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> to distribute safe software efficiently.The impressive & diverse customer list of JFrog is a testament to the product& #39;s quality." class="img-responsive" style="max-width:100%;"/>

It& #39;s pricing structure + auxiliary offerings drive a high net dollar expansion (best-in-class at 139%).It& #39;s free-trial is a powerful bottoms-up channel to acquire customers and get their sticky product integrated with their development stack." title="3/5https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> It& #39;s pricing structure + auxiliary offerings drive a high net dollar expansion (best-in-class at 139%).It& #39;s free-trial is a powerful bottoms-up channel to acquire customers and get their sticky product integrated with their development stack." class="img-responsive" style="max-width:100%;"/>

It& #39;s pricing structure + auxiliary offerings drive a high net dollar expansion (best-in-class at 139%).It& #39;s free-trial is a powerful bottoms-up channel to acquire customers and get their sticky product integrated with their development stack." title="3/5https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> It& #39;s pricing structure + auxiliary offerings drive a high net dollar expansion (best-in-class at 139%).It& #39;s free-trial is a powerful bottoms-up channel to acquire customers and get their sticky product integrated with their development stack." class="img-responsive" style="max-width:100%;"/>

Customers will keep on choosing JFrog for its core competency (Artifactory)" title="4/5Its core + auxiliary products do have competitors in both the public & private markets BUT its Artifactory product is head and shoulders above its competition in enterprise features.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Customers will keep on choosing JFrog for its core competency (Artifactory)" class="img-responsive" style="max-width:100%;"/>

Customers will keep on choosing JFrog for its core competency (Artifactory)" title="4/5Its core + auxiliary products do have competitors in both the public & private markets BUT its Artifactory product is head and shoulders above its competition in enterprise features.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Customers will keep on choosing JFrog for its core competency (Artifactory)" class="img-responsive" style="max-width:100%;"/>

46% Revenue Growthhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">57% FCF Efficiencyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📏" title="Gerades Lineal" aria-label="Emoji: Gerades Lineal">82% Gross Margins (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">139% Net Dollar Retention (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗓️" title="Spiralkalenderblatt" aria-label="Emoji: Spiralkalenderblatt">16 month LTM CAC Payback Period (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts">25x EV / Revenue Run Rate @ $41 (est price today)Vs Top 10 SaaS & DevOps @publiccomps" title="5/5Financials:https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">46% Revenue Growthhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">57% FCF Efficiencyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📏" title="Gerades Lineal" aria-label="Emoji: Gerades Lineal">82% Gross Margins (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">139% Net Dollar Retention (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗓️" title="Spiralkalenderblatt" aria-label="Emoji: Spiralkalenderblatt">16 month LTM CAC Payback Period (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts">25x EV / Revenue Run Rate @ $41 (est price today)Vs Top 10 SaaS & DevOps @publiccomps" class="img-responsive" style="max-width:100%;"/>

46% Revenue Growthhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">57% FCF Efficiencyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📏" title="Gerades Lineal" aria-label="Emoji: Gerades Lineal">82% Gross Margins (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">139% Net Dollar Retention (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗓️" title="Spiralkalenderblatt" aria-label="Emoji: Spiralkalenderblatt">16 month LTM CAC Payback Period (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts">25x EV / Revenue Run Rate @ $41 (est price today)Vs Top 10 SaaS & DevOps @publiccomps" title="5/5Financials:https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">46% Revenue Growthhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">57% FCF Efficiencyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📏" title="Gerades Lineal" aria-label="Emoji: Gerades Lineal">82% Gross Margins (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">139% Net Dollar Retention (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗓️" title="Spiralkalenderblatt" aria-label="Emoji: Spiralkalenderblatt">16 month LTM CAC Payback Period (Best-in-class)https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts">25x EV / Revenue Run Rate @ $41 (est price today)Vs Top 10 SaaS & DevOps @publiccomps" class="img-responsive" style="max-width:100%;"/>