Quick thread on UBS, Credit Suisse merger:

This comes off the back of the rumours that UBS and Credit Suisse are considering a merger, spearheaded by the UBS chairman, in a move nicknamed Project Signal. /1 https://insideparadeplatz.ch/2020/09/14/projekt-signal-axel-weber-plant-ubs-cs-fusion/">https://insideparadeplatz.ch/2020/09/1...

This comes off the back of the rumours that UBS and Credit Suisse are considering a merger, spearheaded by the UBS chairman, in a move nicknamed Project Signal. /1 https://insideparadeplatz.ch/2020/09/14/projekt-signal-axel-weber-plant-ubs-cs-fusion/">https://insideparadeplatz.ch/2020/09/1...

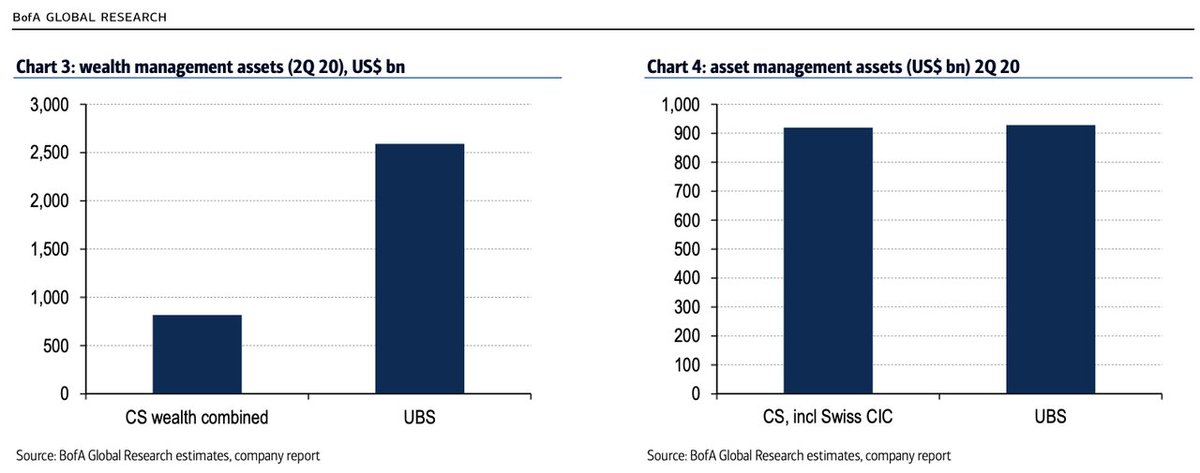

In terms of AUM, UBS& #39;s wealth management assets are much higher than Credit Suisse& #39;s, however in terms of total AUM, they are not too far apart.

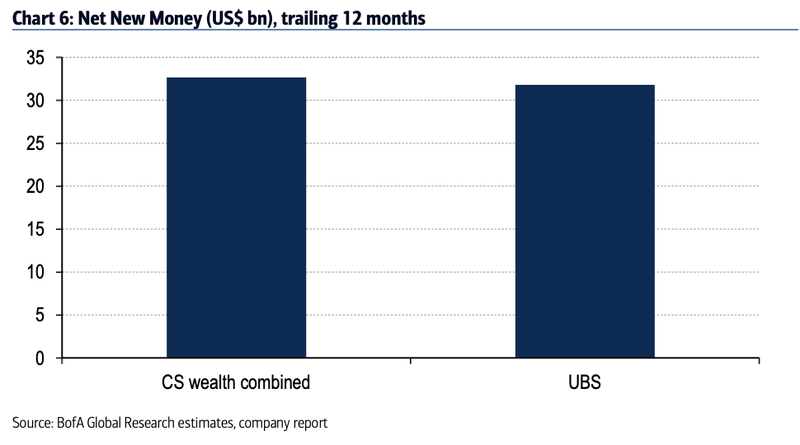

However, Credit Suisse has seen better growth in its asset-management business over the past 12 months, compared to UBS. /2

However, Credit Suisse has seen better growth in its asset-management business over the past 12 months, compared to UBS. /2

According to @SPGlobal, this would create one of the largest banks in Europe, with deposits totaling around 1.6 trillion euros, putting the new super-bank only behind HSBC, BNP Paribas, and Credit Agricole.

The flip side of this is a cut of 15,000 jobs across the two banks. /3

The flip side of this is a cut of 15,000 jobs across the two banks. /3

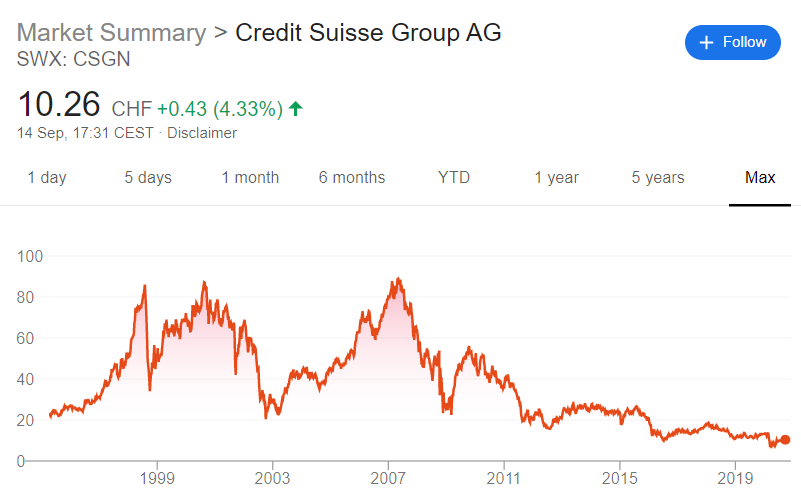

Investors are likely to welcome this proposed merger as neither banks have recovered since the fall in share price following the GFC in 2007. Cost synergies, streamlining and a more efficient bank would hopefully boost the bottom line in the balance sheet, and the share price. /4

In Q2 2020 earnings, UBS announced a net profit of $1.23 billion for the second quarter of 2020, down 11% from the same period last year whilst Credit Suisse reported net income of $1.27 billion in the second quarter of 2020, up 24% for the same period last year. /5

In terms of ECL (expected credit loss), CS had set aside

$625m in Q1 and added another $325m during Q2. UBS had credit loss expenses of $272 million in Q2 - $110 million came in personal and corporate banking and $78 million in the investment bank. /6

$625m in Q1 and added another $325m during Q2. UBS had credit loss expenses of $272 million in Q2 - $110 million came in personal and corporate banking and $78 million in the investment bank. /6

Lastly, at the end of Q2, CS& #39;s CET 1 ratio stood at 12.5, versus 12.1% at the end of the Q1. UBS& #39;s CET 1 capital ratio stood at 13.3%, versus 13.3% a year ago. /7

Finally, the questions remains, what is the motive behind this merger? It seems like neither bank have particular liquidity or solvency issues, and a merger on this scale is likely to face huge scrutiny from FINMA - the Swiss banking regulators. /8

Or is the goal just to create a Swiss Superbank able to compete on the same level as the big European banks such as HSBC and BNP Paribas and the huge American banks?

As always, if I& #39;ve made any mistakes, or if you have any comments, feel free to reply to this thread! /end

As always, if I& #39;ve made any mistakes, or if you have any comments, feel free to reply to this thread! /end

Read on Twitter

Read on Twitter