VALUATION TIME:

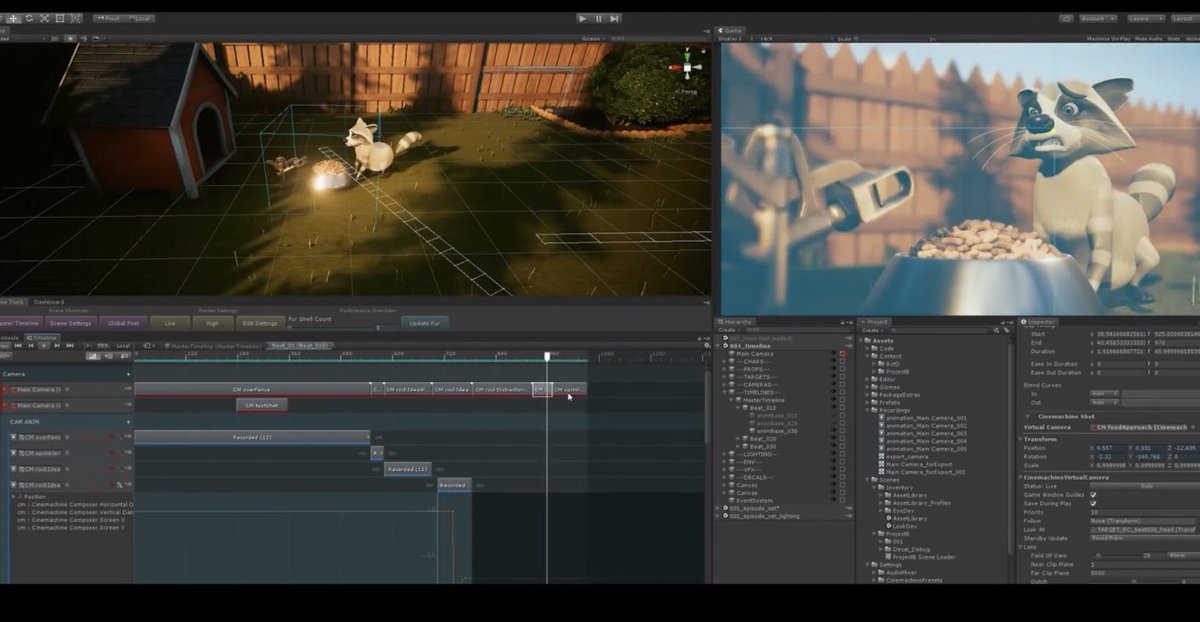

Reverse engineering the game engine software Unity $U

IPO trades Thursday 9/17 at a midpoint of $38. What inputs would be required to justify buying?

Reverse engineering the game engine software Unity $U

IPO trades Thursday 9/17 at a midpoint of $38. What inputs would be required to justify buying?

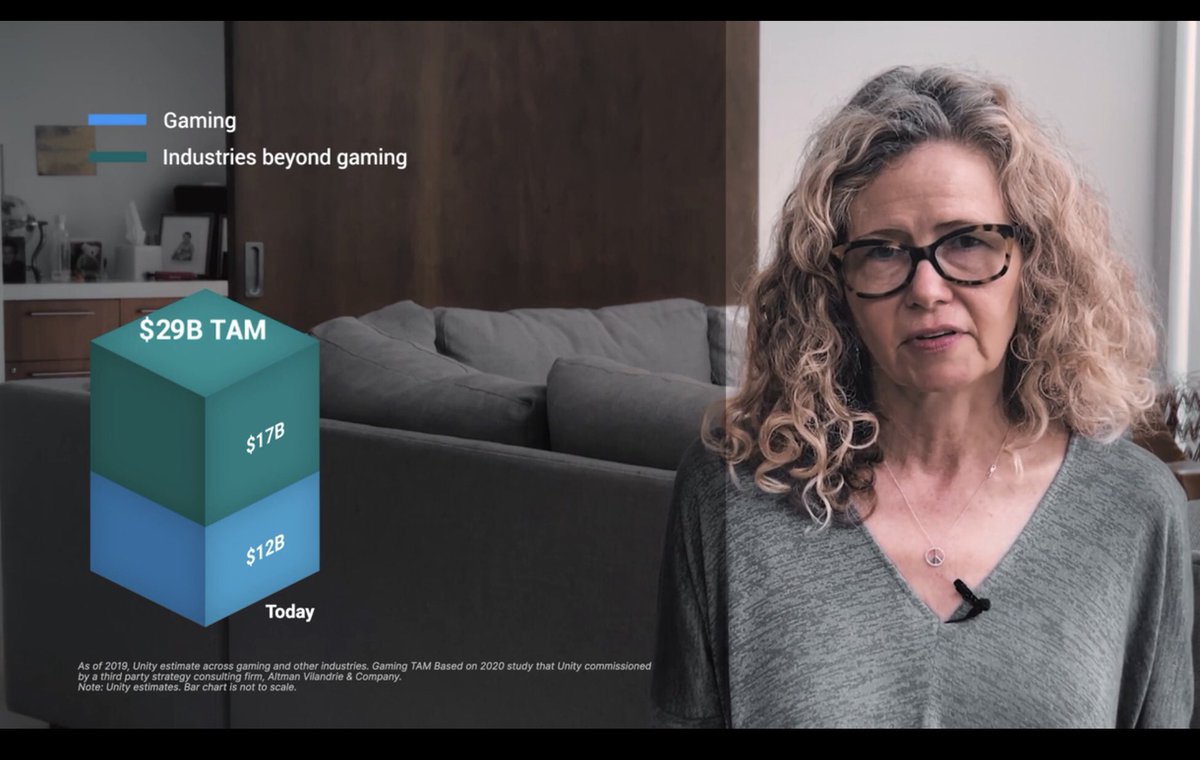

2/ Unity boasts that 50% of all PC, console, and mobile games are made on $U and mgmt claims their TAM is $29billion.

As @daveambrose recently noted, this software is “the rails” of a massive gaming industry. A lot to be excited about.

As @daveambrose recently noted, this software is “the rails” of a massive gaming industry. A lot to be excited about.

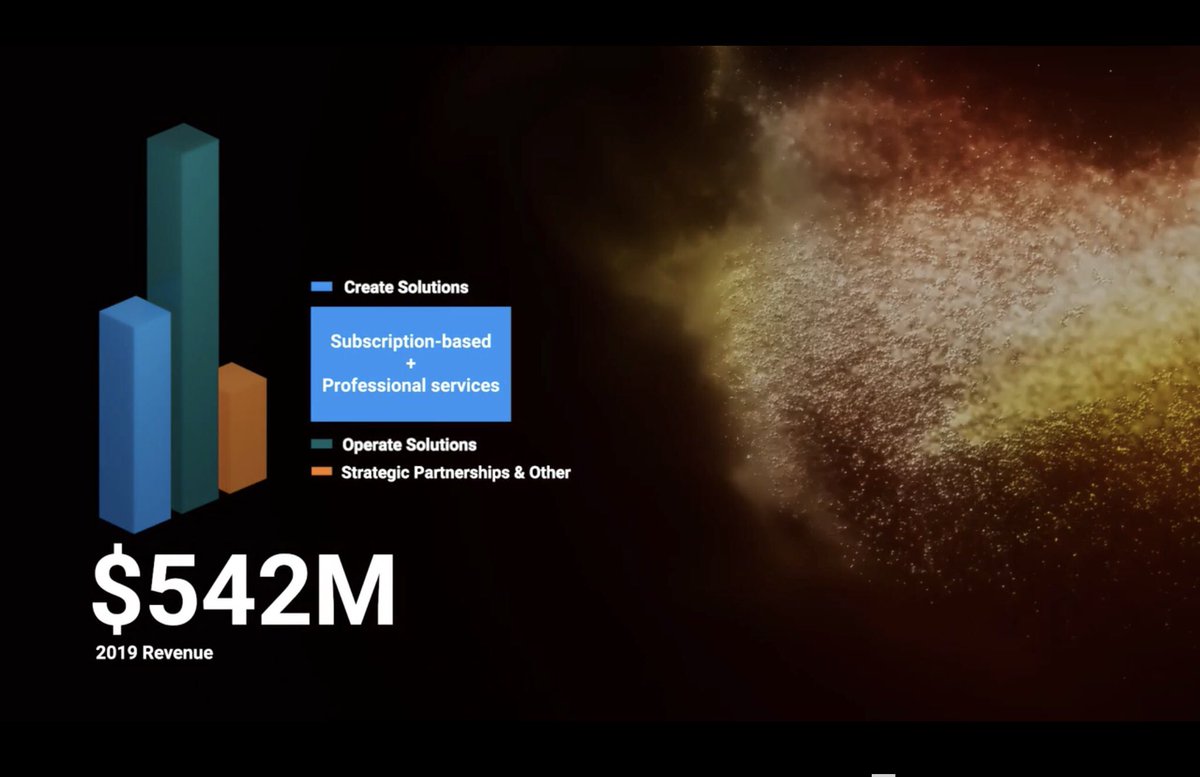

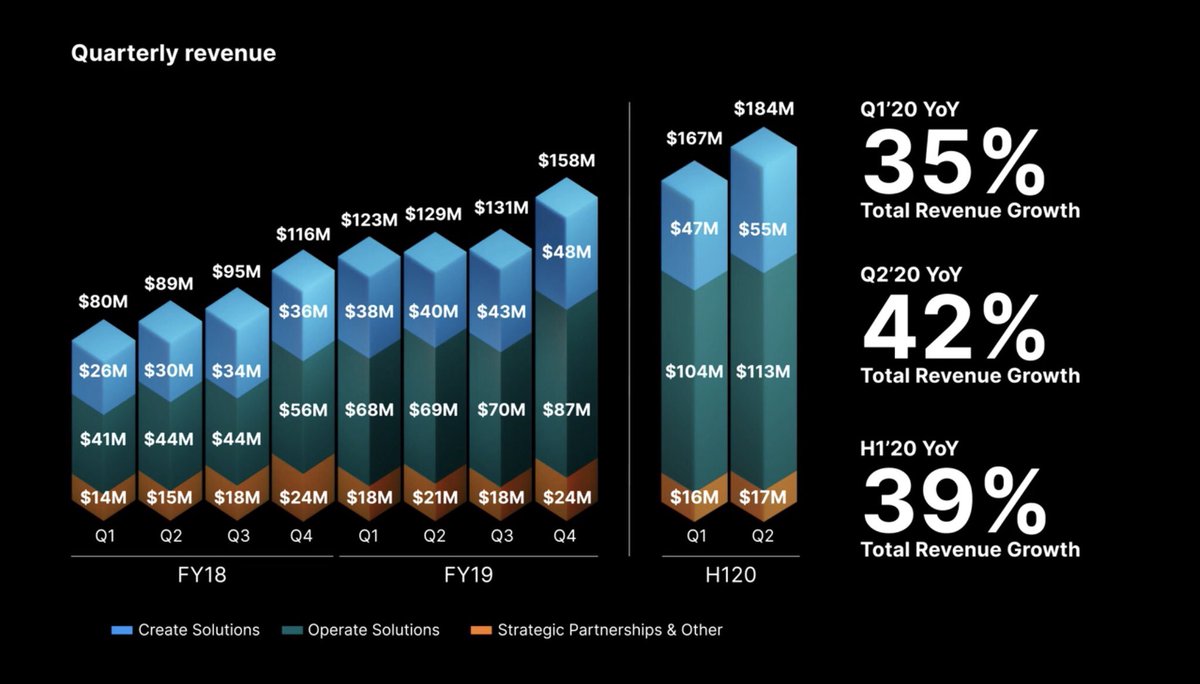

3/ But if 50% of ALL games are currently made on Unity, why is $U 2019 revenue only $542m ($640m TTM) and they still haven’t managed to turn a profit?

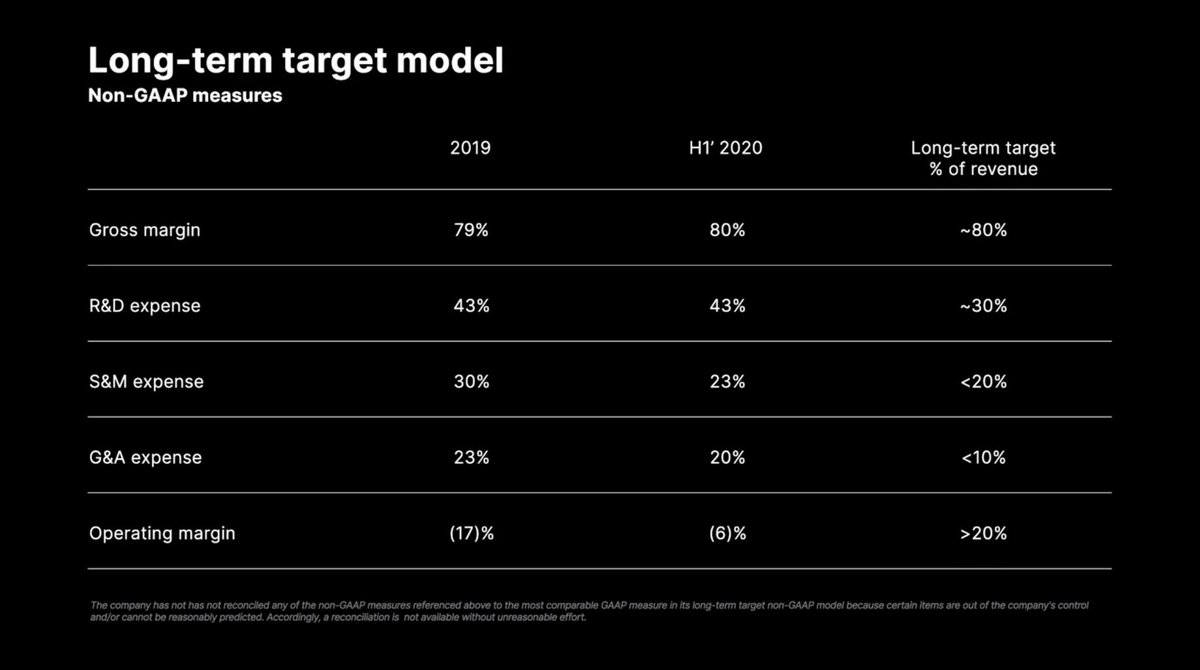

Reinvestment will delay profitability, and in Unity’s case I think it’s the right move. R&D is the key to continued growth.

Reinvestment will delay profitability, and in Unity’s case I think it’s the right move. R&D is the key to continued growth.

4/ To reach $29bn in revenue by 2030, $U would have to grow revenue 75% ANNUALLY with an operating margin of 25%. The $29bn TAM mgmt claims is more than ambitious in my opinion. This would require massive success in auto, architecture, engineering. Possible, but is it plausible?

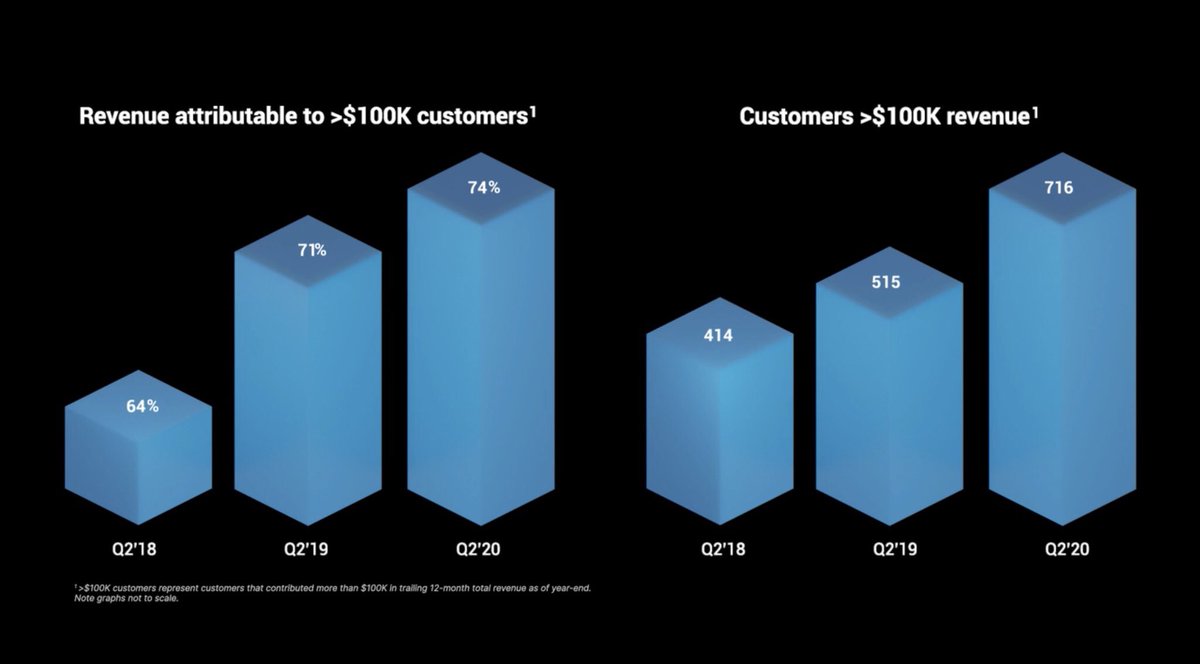

5/ 74% of revenue comes from customers who spend >$100k, (ONLY 716 customers) So if just a few of these big spenders opt for Unreal Engine and cut ties w/ $U it could do major damage to their bottom line.

6/ Riccitello is my biggest concern when considering $U. During his tenure as CEO of $EA he tanked the share price -65% in a period when $QQQ was +70% and w/250k votes, won the title of Worst Company In America, 2012 and 2013, two years in a row!

7/ Riccitello had wins like The Sims, but also spent a lot on acquisitions at $EA. The pattern has already emerged at $U

Some create synergy, he tried to buy $TTWO which I’ll give credit as smart, but read this link to see why they’re usually a bad sign

http://people.stern.nyu.edu/adamodar/pdfiles/country/acqanonlong.pdf">https://people.stern.nyu.edu/adamodar/...

Some create synergy, he tried to buy $TTWO which I’ll give credit as smart, but read this link to see why they’re usually a bad sign

http://people.stern.nyu.edu/adamodar/pdfiles/country/acqanonlong.pdf">https://people.stern.nyu.edu/adamodar/...

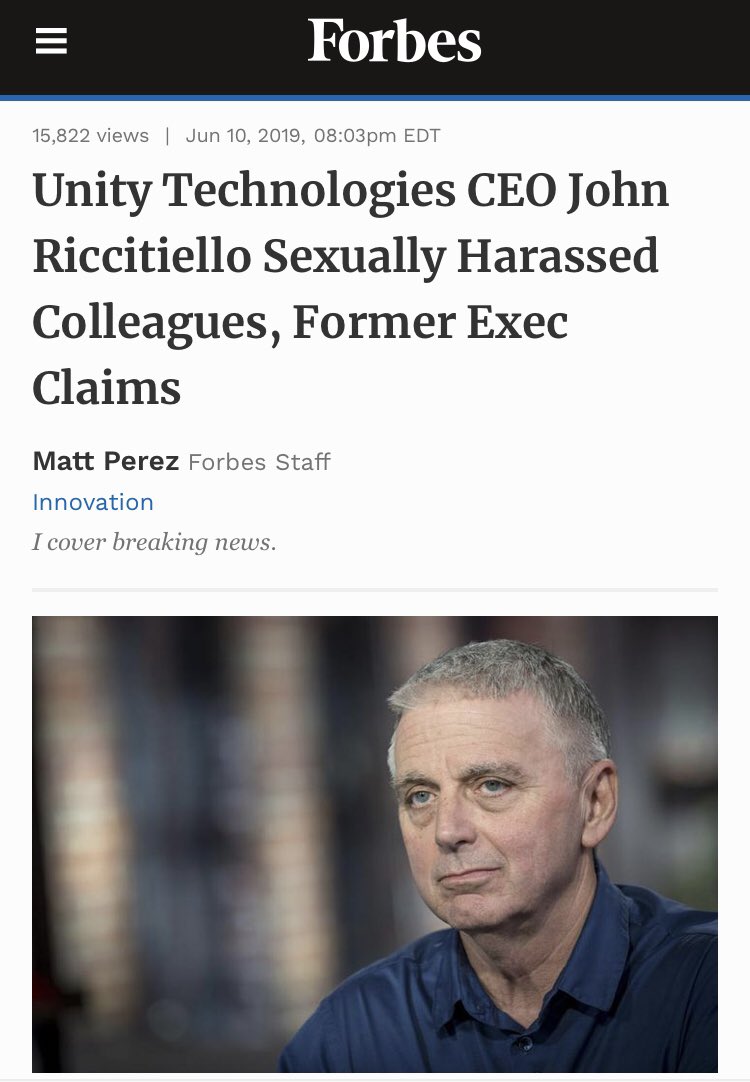

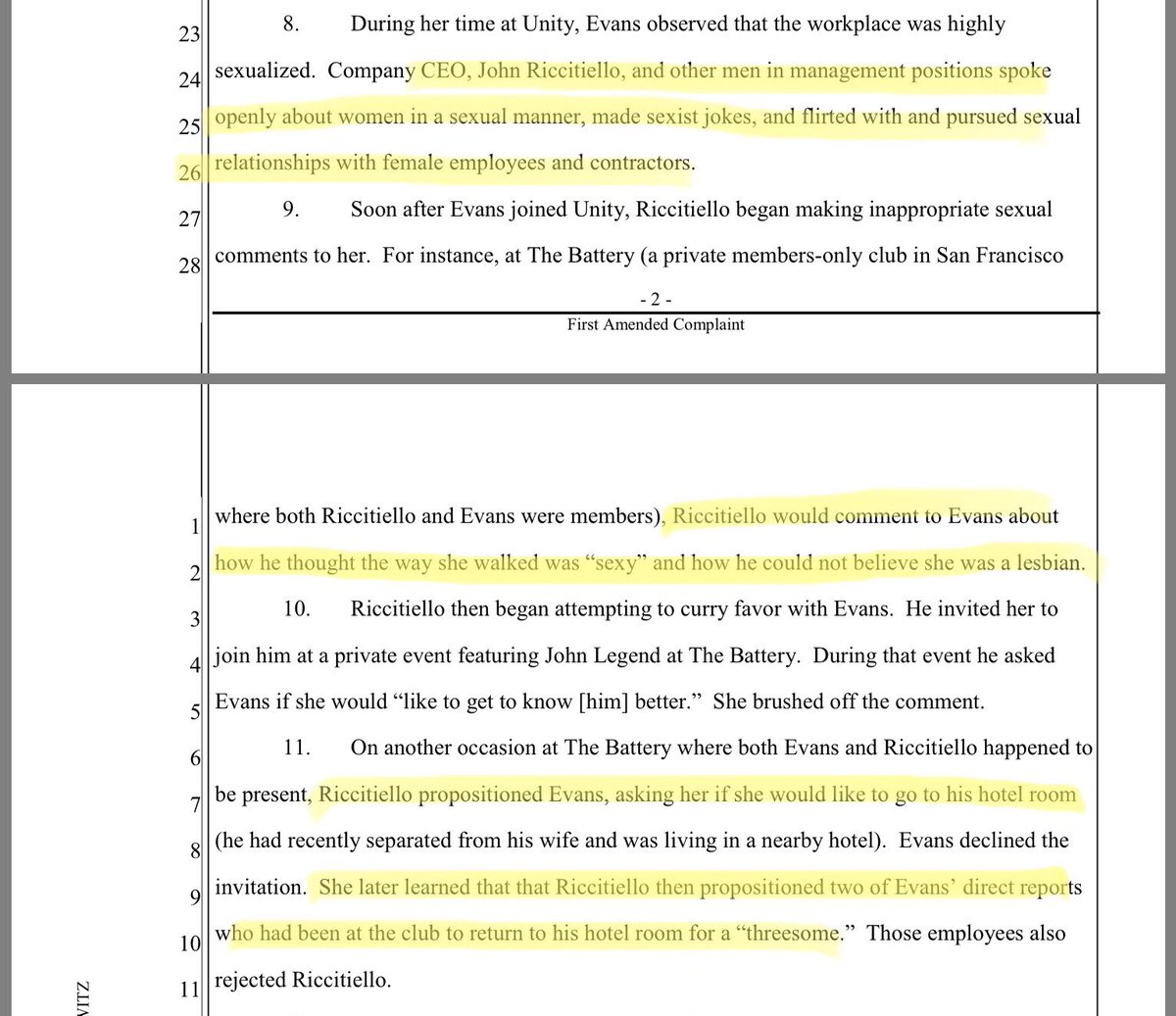

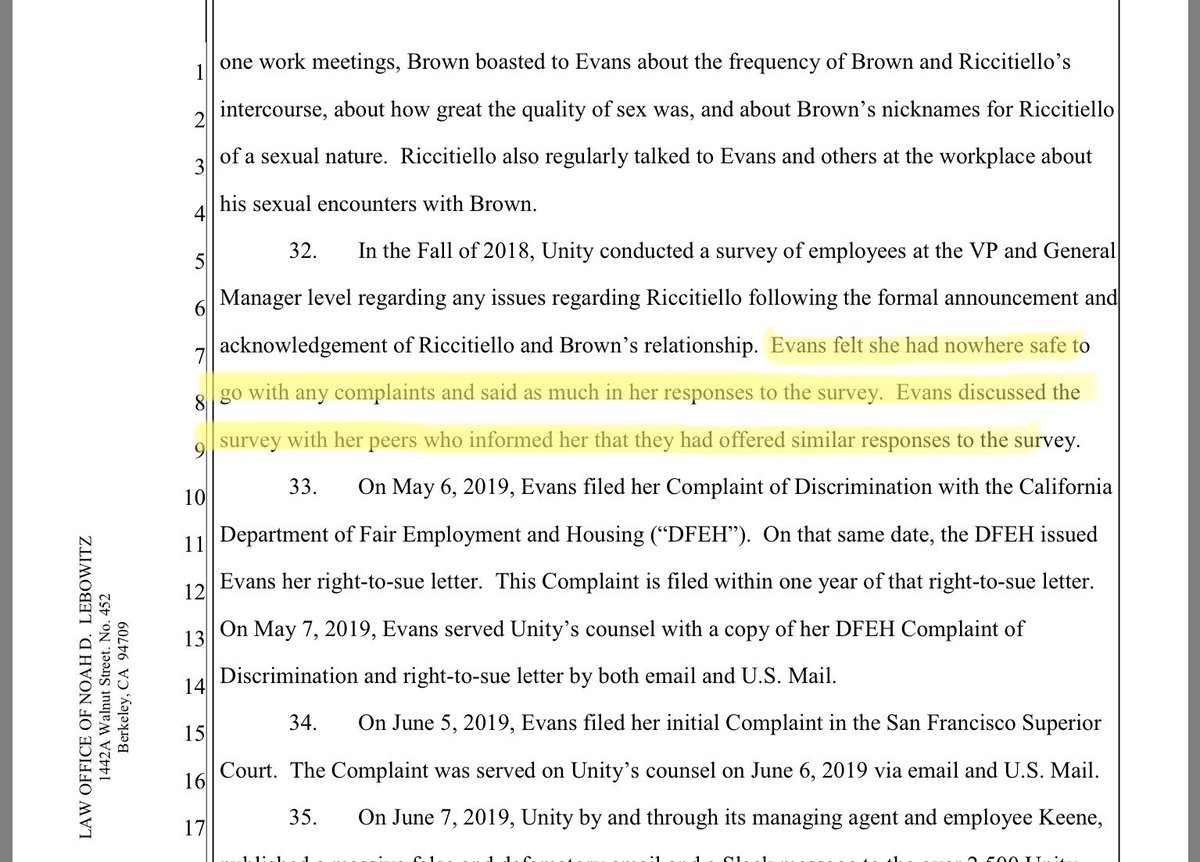

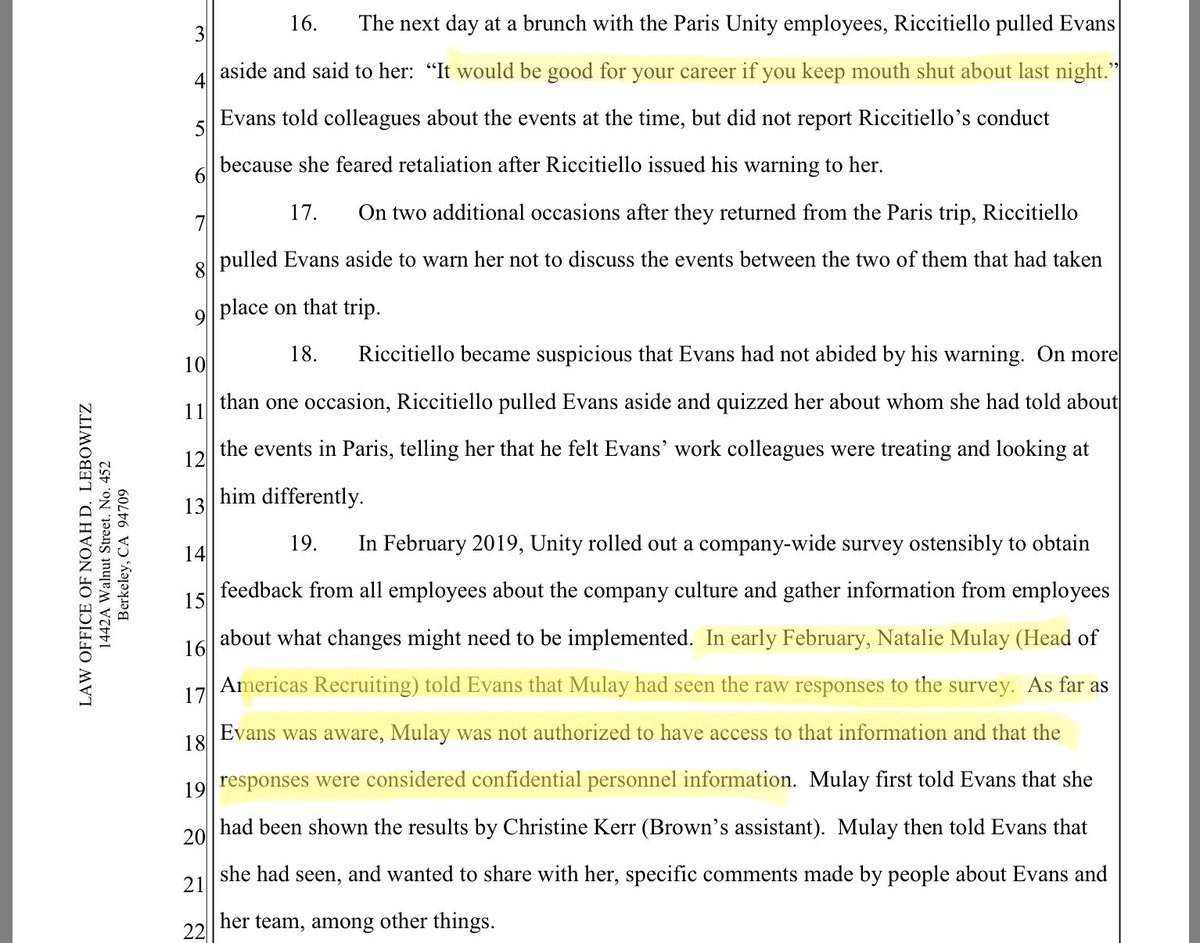

8/ $U is being sued for harassment and wrongful termination by a former VP (now at Roblox). I mentioned to @mariodgabriele if this is who’s in the driver’s seat, I’m hesitant put my money in the car.

700 relationships = 74% of revenues. A toxic personality can have a big impact

700 relationships = 74% of revenues. A toxic personality can have a big impact

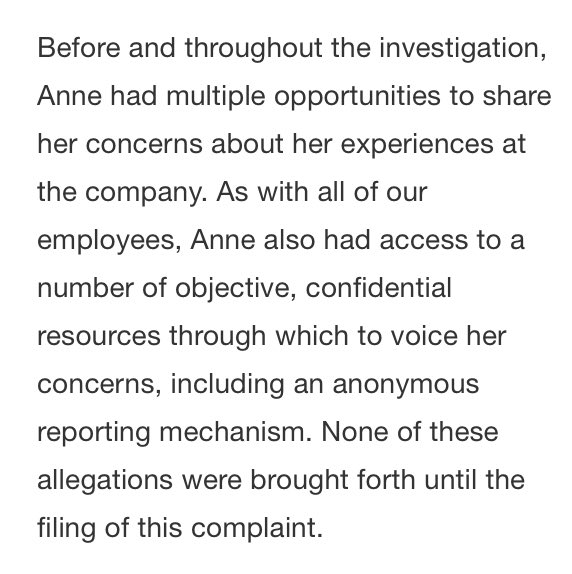

9/ Unity’s response was weak. “Anne had access to a number of objective, confidential resources…none of these allegations were brought forth…”

There’s no way to file a complaint about a specific incident confidentially. The incident would’ve immediately identify Evans.

There’s no way to file a complaint about a specific incident confidentially. The incident would’ve immediately identify Evans.

10/ Mgmt showed poor judgment emailing this out to staff members opening $U up to further liability. If they felt the needed to reassure employees, do it with tact, DO NOT name Evans in the email, and if the claims are unfounded, prove it in court. Not a great sign IMO.

11/ I have to discount heavily for mgmt, so what would it take to make $38 per share a buy on Thursday?

MY DCF ANSWER: Successful expansion outside of gaming, implied 45% annual growth rate (for the next 5 years) at a 25% operating margin puts them at a fair value of $41.78

MY DCF ANSWER: Successful expansion outside of gaming, implied 45% annual growth rate (for the next 5 years) at a 25% operating margin puts them at a fair value of $41.78

12/ Unreal Engine (Epic Games) is $U primary competitor. Because Fortnite/Epic are profitable, Epic can afford to invest in Unreal with plenty of flexibility, whereas $U is a money losing company, so its capital is much more restricted. https://youtu.be/qC5KtatMcUw ">https://youtu.be/qC5KtatMc...

13/ I’m reminded of video editing software Final Cut Pro X vs Adobe Premier. Both great products, Windows users primarily use $ADBE, and Mac users choose Final Cut (owned by $AAPL) Both have been able to thrive. I don’t think the game engine world is zero sum either.

14/ IME of using Final Cut, $U has an early advantage as switching to new software is a pain. But if a better industry standard emerges, designers will switch. As we move closer to a Metaverse, everyone needs to be on the cutting edge. $U lives and dies by R&D.

15/ Buffett likes businesses so great an idiot could run them and still make money.

That may be $U, but I’d argue at a young growth company the CEO matters quite a bit. This is where I keep getting stuck. I think the IPO price of $38 is fair, but is it a good value? IDK

That may be $U, but I’d argue at a young growth company the CEO matters quite a bit. This is where I keep getting stuck. I think the IPO price of $38 is fair, but is it a good value? IDK

16/ TL;DR

Unity $U IPO at $38 would require very impressive growth and margins to justify the price. With massive potential, there may be value here, but due to mgmt concerns, I’m hesitant to invest (not saying I won’t).

Will revisit before Thursday.

Unity $U IPO at $38 would require very impressive growth and margins to justify the price. With massive potential, there may be value here, but due to mgmt concerns, I’m hesitant to invest (not saying I won’t).

Will revisit before Thursday.

“Unity CEO... has decided an internal team should determine the pricing and stock allocation.”

“strategy could create a higher listing price but limit the first-day pop.” $U

CC: @ballmatthew @Post_Market @mariodgabriele @daveambrose @Badpak https://seekingalpha.com/news/3613884-unity-ipos-unusual-pricing-limit-first-day-gains-cnbc">https://seekingalpha.com/news/3613...

“strategy could create a higher listing price but limit the first-day pop.” $U

CC: @ballmatthew @Post_Market @mariodgabriele @daveambrose @Badpak https://seekingalpha.com/news/3613884-unity-ipos-unusual-pricing-limit-first-day-gains-cnbc">https://seekingalpha.com/news/3613...

Read on Twitter

Read on Twitter