BUT it grew 62% YoY and had a 137% DBNER

Here is an EASY thread

$FSLY, a US  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flagge der Vereinigten Staaten" aria-label="Emoji: Flagge der Vereinigten Staaten"> Cloud Computing Services provider, processes, serves and secures its customer’s apps very close to the end users

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flagge der Vereinigten Staaten" aria-label="Emoji: Flagge der Vereinigten Staaten"> Cloud Computing Services provider, processes, serves and secures its customer’s apps very close to the end users  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

This happens through $FSLY Edge Platform https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen"> it provides a content delivery network, internet security, load balancing and video & streaming services

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen"> it provides a content delivery network, internet security, load balancing and video & streaming services

This happens through $FSLY Edge Platform

This is PURE TECHNICAL JARGON  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> Let’s break down what this means

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> Let’s break down what this means

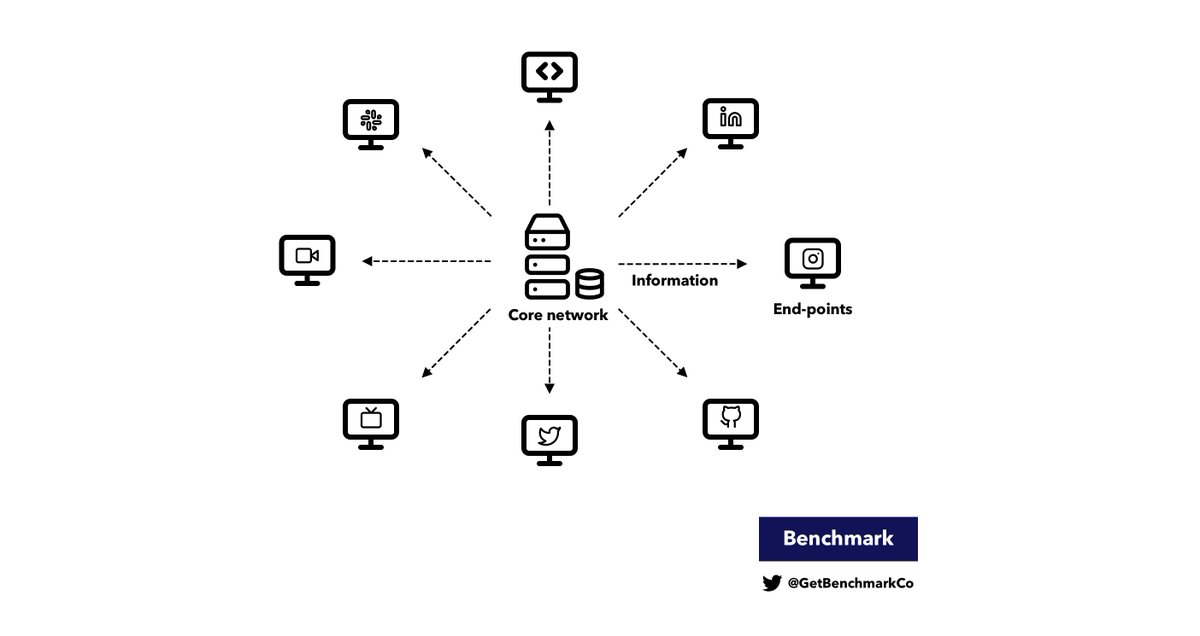

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎛" title="Drehknöpfe" aria-label="Emoji: Drehknöpfe"> The internet was designed according to the End-to-End Principle

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎛" title="Drehknöpfe" aria-label="Emoji: Drehknöpfe"> The internet was designed according to the End-to-End Principle

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> This means that the core network’s KEY PRIORITY is to move the information to the network end-points (hosts and clients) as much as possible

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> This means that the core network’s KEY PRIORITY is to move the information to the network end-points (hosts and clients) as much as possible

Ok, so here we have an network that just forward data packets as much as possible to the end-points of the network  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

How could we improve that without altering the functioning of the whole network and compromising Net Neutrality? https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

Hint https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> CDN

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> CDN  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

How could we improve that without altering the functioning of the whole network and compromising Net Neutrality?

Hint

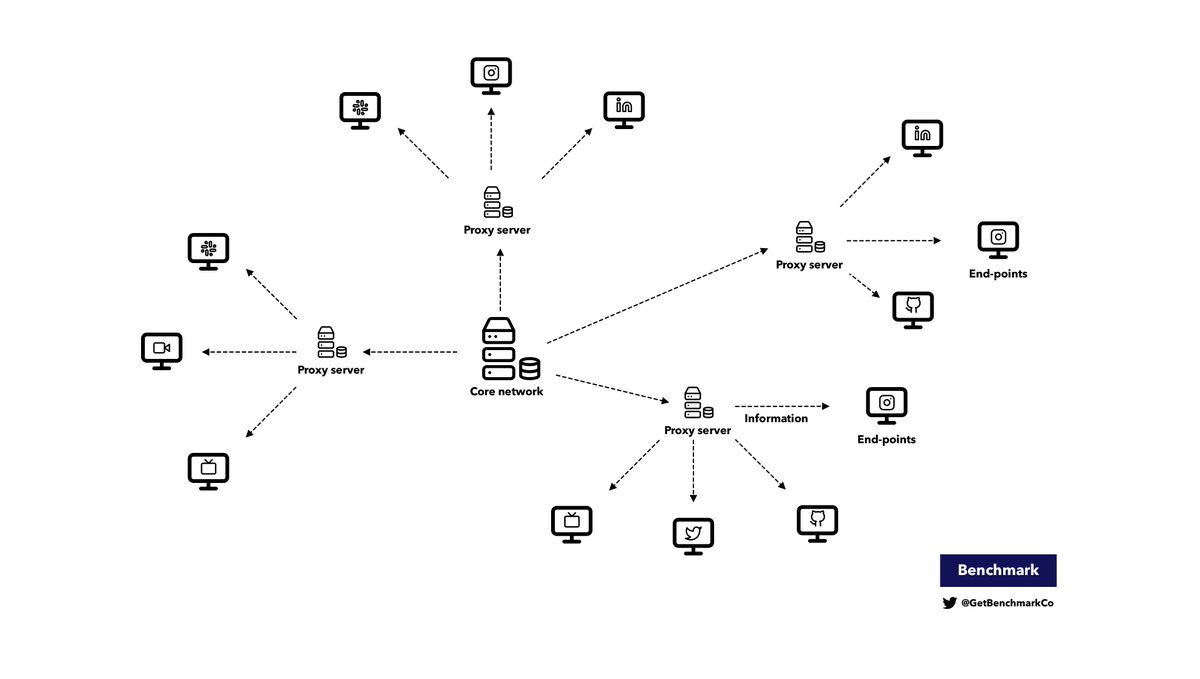

CDNs augment the network by intelligently distributing & storing data

A CDN is a geographically distributed https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus"> network of proxy servers & their data centres

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus"> network of proxy servers & their data centres  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager">

By distributing the information geograph. relative to the end-users, a CDN provides high availability & perf. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📡" title="Satellitenantenne" aria-label="Emoji: Satellitenantenne">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📡" title="Satellitenantenne" aria-label="Emoji: Satellitenantenne">

A CDN is a geographically distributed

By distributing the information geograph. relative to the end-users, a CDN provides high availability & perf.

A CDN is able to increase a networks’ performance (speed, reliability and availability) thanks to web caching, server load balancing, request routing and content services

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💾" title="Diskette" aria-label="Emoji: Diskette"> Web caches store popular content on servers

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💾" title="Diskette" aria-label="Emoji: Diskette"> Web caches store popular content on servers  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💽" title="Minidisc" aria-label="Emoji: Minidisc"> that have the greatest demand for the content requested

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💽" title="Minidisc" aria-label="Emoji: Minidisc"> that have the greatest demand for the content requested

So, Content Delivery Networks store information in a smart and optimised way closer to the end user - Improving performance  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> Is there anything else they could do? Well, one of the main cyber threats are DDoS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> Is there anything else they could do? Well, one of the main cyber threats are DDoS  https://abs.twimg.com/emoji/v2/... draggable="false" alt="☠️" title="Totenkopf" aria-label="Emoji: Totenkopf"> Distributed Denial of Service attack

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☠️" title="Totenkopf" aria-label="Emoji: Totenkopf"> Distributed Denial of Service attack

How is that linked to CDN’s?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> DDoS attacks can be filtered and stopped by the CDN - in the worst case, the proxy server dies off

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> DDoS attacks can be filtered and stopped by the CDN - in the worst case, the proxy server dies off  https://abs.twimg.com/emoji/v2/... draggable="false" alt="☠️" title="Totenkopf" aria-label="Emoji: Totenkopf"> while the origin server stays intact

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☠️" title="Totenkopf" aria-label="Emoji: Totenkopf"> while the origin server stays intact

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Suspected bot activity

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Suspected bot activity  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕵️" title="Detective" aria-label="Emoji: Detective"> can be identified and stopped with CDNs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕵️" title="Detective" aria-label="Emoji: Detective"> can be identified and stopped with CDNs

By know you should see the performance and security benefits of CDNs  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> Some key questions remain

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> Some key questions remain  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> What is $FSLY offering?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> What is $FSLY offering?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> What is the size of the market?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> What is the size of the market?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="3️⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3"> What is $FSLY moat?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="3️⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3"> What is $FSLY moat?

$FSLY is operating in a market growing at 27%  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> over the next 5 years and is positioning itself as a leader for image and video delivery and streaming

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> over the next 5 years and is positioning itself as a leader for image and video delivery and streaming https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

It offers a solution that is more configurable https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛠" title="Hammer und Schraubenschlüssel" aria-label="Emoji: Hammer und Schraubenschlüssel"> while offering astonishing speed

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛠" title="Hammer und Schraubenschlüssel" aria-label="Emoji: Hammer und Schraubenschlüssel"> while offering astonishing speed  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏎" title="Rennauto" aria-label="Emoji: Rennauto"> and excellent uptime

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏎" title="Rennauto" aria-label="Emoji: Rennauto"> and excellent uptime  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">

Financials https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

It offers a solution that is more configurable

Financials

$FSLY financials do not offer too much cause for concern

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend"> Operating expenses represent 80% of revenues (stable YoY) - Causing short term losses

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend"> Operating expenses represent 80% of revenues (stable YoY) - Causing short term losses

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> 62% growth and outstanding Net Retention Rate - Creating a compelling long term story

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> 62% growth and outstanding Net Retention Rate - Creating a compelling long term story

Let’s look into $FSLY last acquisition https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Let’s look into $FSLY last acquisition

$FSLY bought Signal Sciences for $ 200m in cash and $ 575m in stock on Aug 27

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> This completes $FSLY Secure@Edge offering with improved API Protection, Rate Limiting, Bot Mitigation, ATO Protection

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> This completes $FSLY Secure@Edge offering with improved API Protection, Rate Limiting, Bot Mitigation, ATO Protection

Hope you liked this thread!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> For more content, follow us on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> For more content, follow us on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Want to get UNDER HYPED companies delivered straight to your inbox? Subscribe now! https://getbenchmark.substack.com"> https://getbenchmark.substack.com

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Want to get UNDER HYPED companies delivered straight to your inbox? Subscribe now! https://getbenchmark.substack.com"> https://getbenchmark.substack.com

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ CDNComparison

✑ CDNPlanet

Sources

✑ Investor presentation

✑ Company website

✑ CDNComparison

✑ CDNPlanet

✑ MarketsAndMarkets

✑ MordoIntelligence

✑ GlobalDots

✑ Devopedia

✑ MordoIntelligence

✑ GlobalDots

✑ Devopedia

Read on Twitter

Read on Twitter Let’s break down what this meanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🎛" title="Drehknöpfe" aria-label="Emoji: Drehknöpfe"> The internet was designed according to the End-to-End Principlehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> This means that the core network’s KEY PRIORITY is to move the information to the network end-points (hosts and clients) as much as possible" title="This is PURE TECHNICAL JARGON https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> Let’s break down what this meanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🎛" title="Drehknöpfe" aria-label="Emoji: Drehknöpfe"> The internet was designed according to the End-to-End Principlehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> This means that the core network’s KEY PRIORITY is to move the information to the network end-points (hosts and clients) as much as possible" class="img-responsive" style="max-width:100%;"/>

Let’s break down what this meanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🎛" title="Drehknöpfe" aria-label="Emoji: Drehknöpfe"> The internet was designed according to the End-to-End Principlehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> This means that the core network’s KEY PRIORITY is to move the information to the network end-points (hosts and clients) as much as possible" title="This is PURE TECHNICAL JARGON https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> Let’s break down what this meanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🎛" title="Drehknöpfe" aria-label="Emoji: Drehknöpfe"> The internet was designed according to the End-to-End Principlehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> This means that the core network’s KEY PRIORITY is to move the information to the network end-points (hosts and clients) as much as possible" class="img-responsive" style="max-width:100%;"/>

network of proxy servers & their data centres https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager">By distributing the information geograph. relative to the end-users, a CDN provides high availability & perf. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📡" title="Satellitenantenne" aria-label="Emoji: Satellitenantenne">" title="CDNs augment the network by intelligently distributing & storing dataA CDN is a geographically distributed https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus"> network of proxy servers & their data centres https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager">By distributing the information geograph. relative to the end-users, a CDN provides high availability & perf. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📡" title="Satellitenantenne" aria-label="Emoji: Satellitenantenne">" class="img-responsive" style="max-width:100%;"/>

network of proxy servers & their data centres https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager">By distributing the information geograph. relative to the end-users, a CDN provides high availability & perf. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📡" title="Satellitenantenne" aria-label="Emoji: Satellitenantenne">" title="CDNs augment the network by intelligently distributing & storing dataA CDN is a geographically distributed https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus"> network of proxy servers & their data centres https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager">By distributing the information geograph. relative to the end-users, a CDN provides high availability & perf. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📡" title="Satellitenantenne" aria-label="Emoji: Satellitenantenne">" class="img-responsive" style="max-width:100%;"/>