1/ Is there any way to make sense of growth& #39;s decade-long out-performance against value?

Polen Capital recently released a white paper that suggests this cycle might play out differently than the last time this happened in the late 90s, ending in the tech bubble.

Polen Capital recently released a white paper that suggests this cycle might play out differently than the last time this happened in the late 90s, ending in the tech bubble.

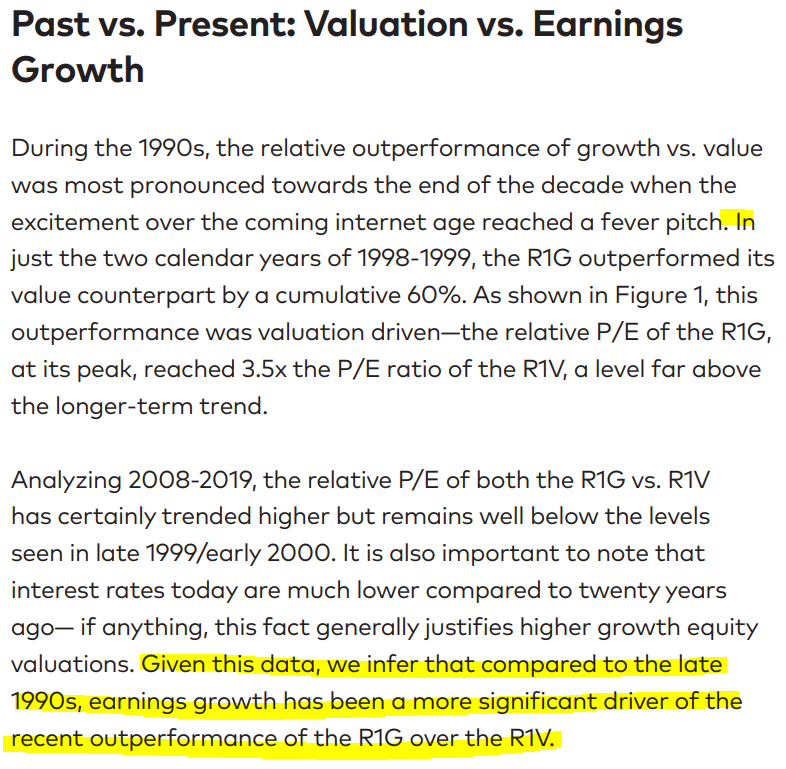

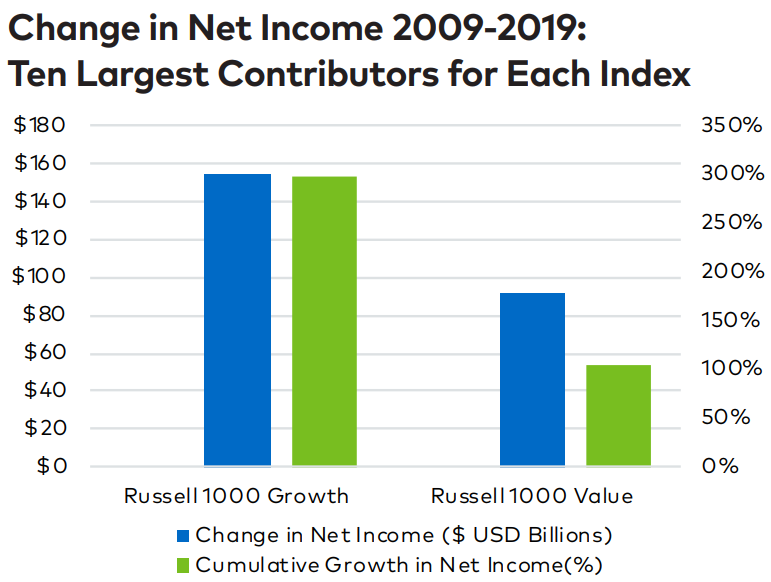

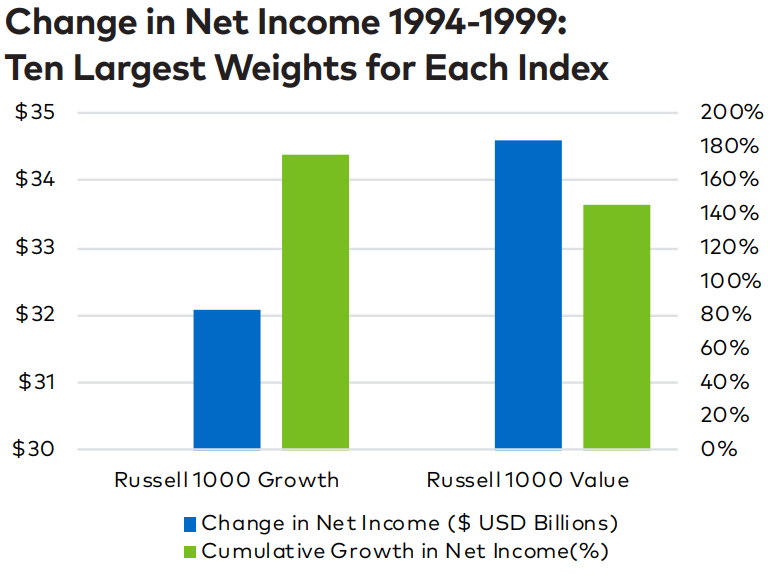

2/ In the paper, Polen notes that this out-performance was more driven by valuation in the 90s, but more driven by earnings growth in the past decade.

Another huge factor has been today& #39;s lower interest rates.

Another huge factor has been today& #39;s lower interest rates.

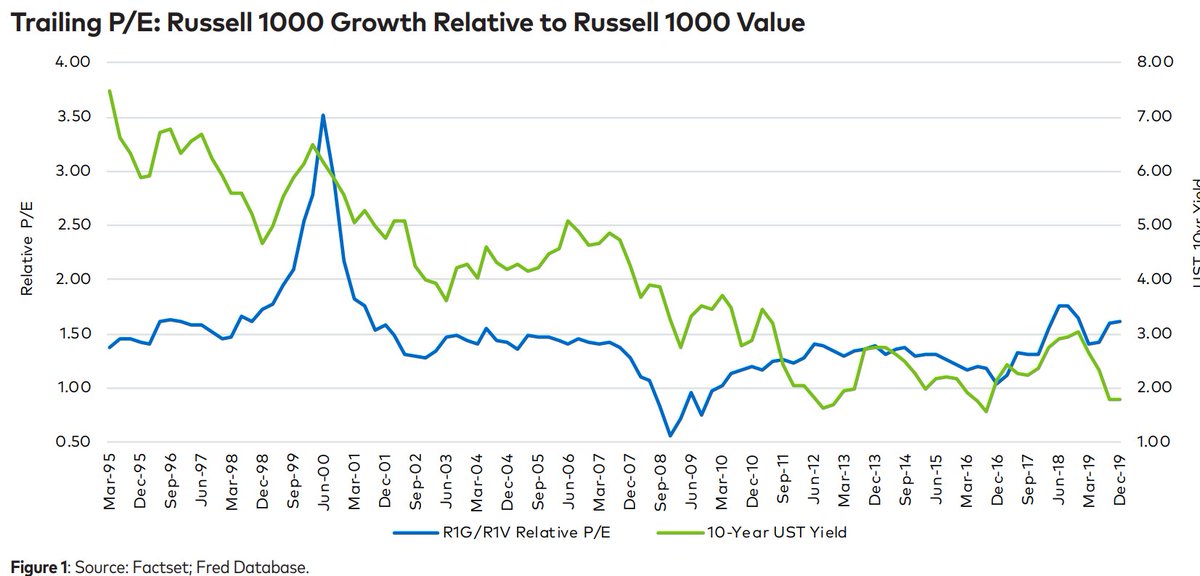

3/ Polen also looks at the fundamentals of the 10 most significant contributors to each the Russell 1000 Growth& #39;s and Value& #39;s performance over the last decade. These charts show the absolute change and growth in rev and net income for the top 10 largest contributors to each.

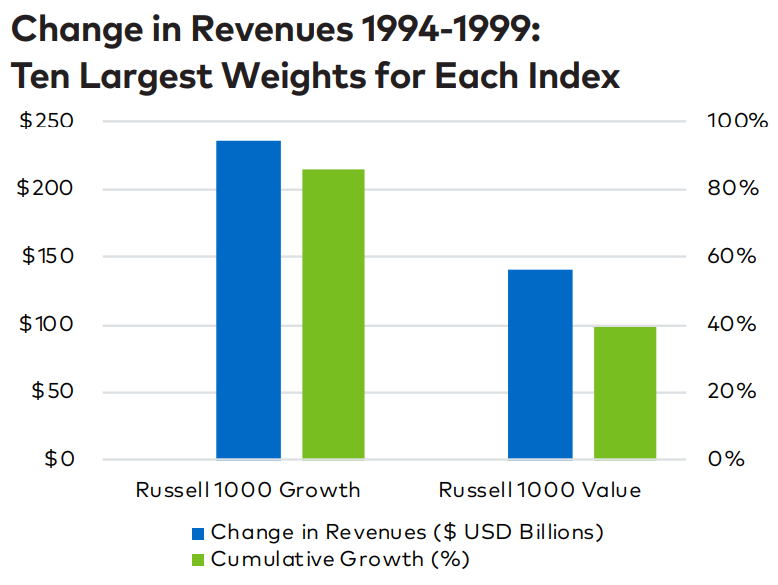

4/ Now compare to each of the indices& #39; largest contributors in the 1990s.

5/ Polen concludes this is the natural result of realizing the full promise of digitization and the creation of successful digital ecosytems.

6/ The entire paper is not long and is worthy of a read. It frames the value vs. growth debate in way that& #39;s clear to understand and makes strong, rational case for why we& #39;ve seen growth out-perform value over this past decade. Would welcome feedback. https://www.polencapital.com/perspectives/making-sense-of-value-vs-growth-dynamic">https://www.polencapital.com/perspecti...

7/ For more on Polen& #39;s current portfolio, investing philosophy, and established track record of out-performance, see this thread: https://twitter.com/Matt_Cochrane7/status/1259105426785873921">https://twitter.com/Matt_Coch...

Read on Twitter

Read on Twitter