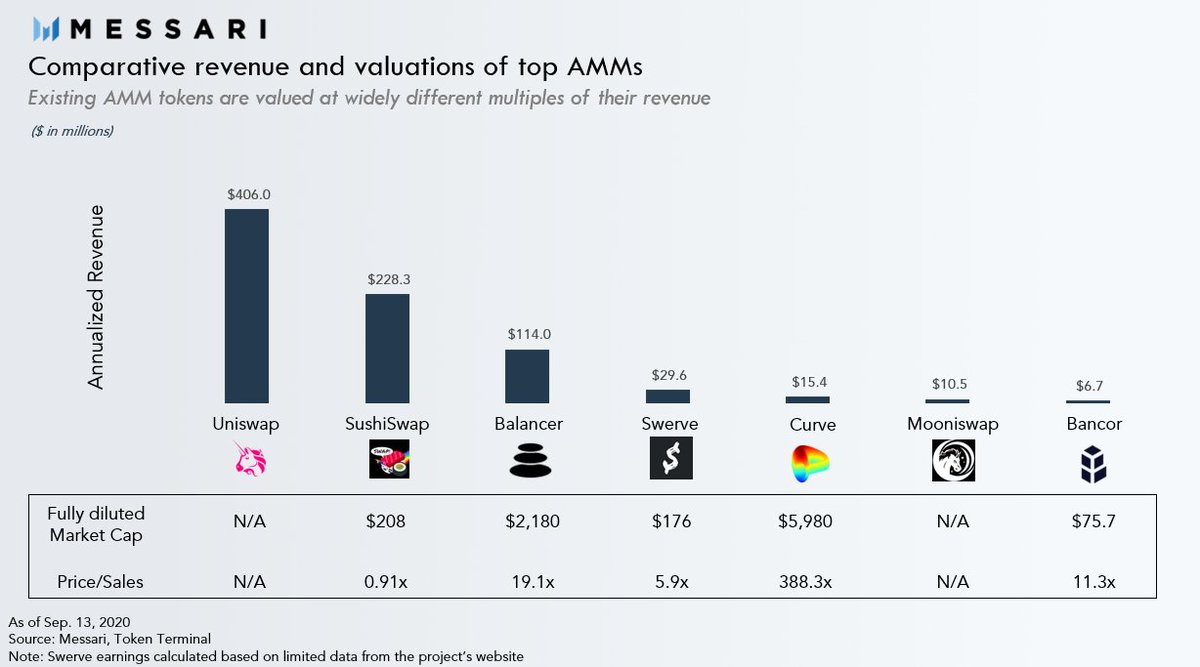

Crypto has massively decreased the time it takes to generate substantial revenue

AMMs that have been live for a few years (some months) are now generating nine figures https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

But how sustainable is this success? And will it translate to value for their governance tokens?

AMMs that have been live for a few years (some months) are now generating nine figures

But how sustainable is this success? And will it translate to value for their governance tokens?

The future success of AMMs is largely predicated on them serving two niches:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Incentivized liquidity provision

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Incentivized liquidity provision

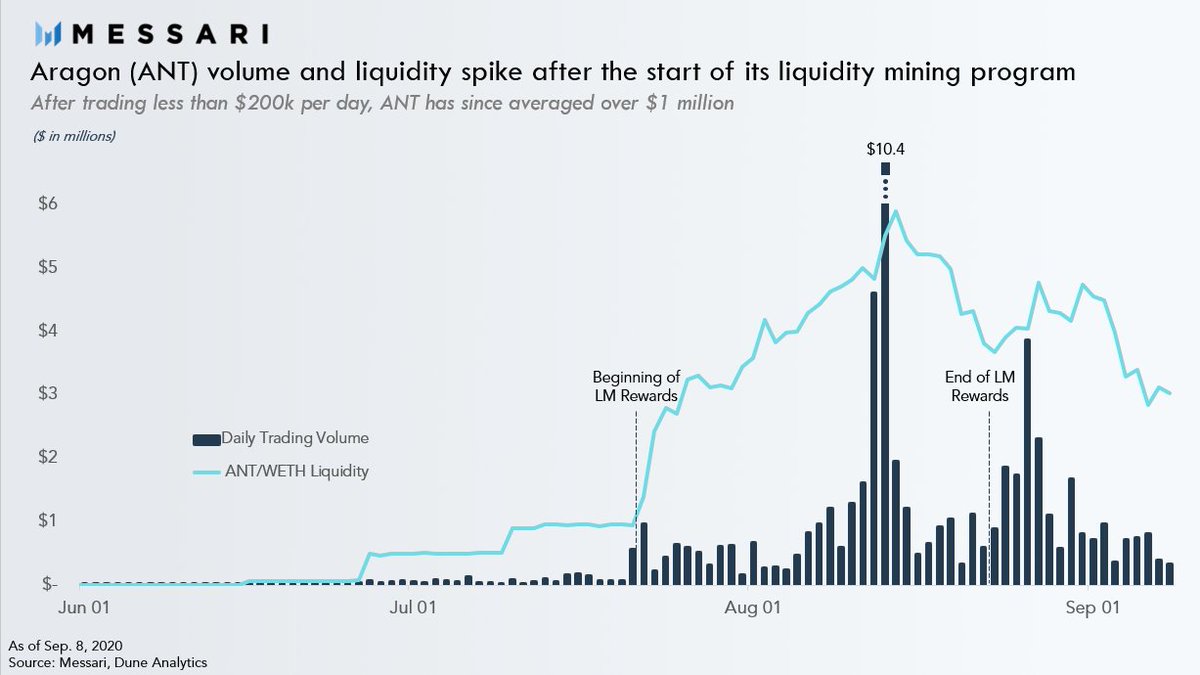

Tokens can easily bootstrap a market by allocating tokens to LPs which we’ve seen succeed in increasing liquidity and trading volumes

Tokens can easily bootstrap a market by allocating tokens to LPs which we’ve seen succeed in increasing liquidity and trading volumes

Compressed pricing curves such as @CurveFinance can actually provide a superior product compared to CLOBs

Provided AMMs continue to serve these markets then there will likely be billions in revenue generated

The bull case for AMM tokens then comes down to the ability for governance to justify a material gross margin (such as SushiSwap& #39;s ~15%)

The bull case for AMM tokens then comes down to the ability for governance to justify a material gross margin (such as SushiSwap& #39;s ~15%)

Which if AMM tokens can successfully extract...

Translates to substantial value accrual https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://messari.io/article/the-bull-case-for-automated-market-makers-tokens?utm_source=jpurd17&utm_medium=thread&utm_campaign=ammbull">https://messari.io/article/t...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://messari.io/article/the-bull-case-for-automated-market-makers-tokens?utm_source=jpurd17&utm_medium=thread&utm_campaign=ammbull">https://messari.io/article/t...

Translates to substantial value accrual

Read on Twitter

Read on Twitter But how sustainable is this success? And will it translate to value for their governance tokens?" title="Crypto has massively decreased the time it takes to generate substantial revenue AMMs that have been live for a few years (some months) are now generating nine figures https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> But how sustainable is this success? And will it translate to value for their governance tokens?" class="img-responsive" style="max-width:100%;"/>

But how sustainable is this success? And will it translate to value for their governance tokens?" title="Crypto has massively decreased the time it takes to generate substantial revenue AMMs that have been live for a few years (some months) are now generating nine figures https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> But how sustainable is this success? And will it translate to value for their governance tokens?" class="img-responsive" style="max-width:100%;"/>

Incentivized liquidity provisionTokens can easily bootstrap a market by allocating tokens to LPs which we’ve seen succeed in increasing liquidity and trading volumes" title="The future success of AMMs is largely predicated on them serving two niches: https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Incentivized liquidity provisionTokens can easily bootstrap a market by allocating tokens to LPs which we’ve seen succeed in increasing liquidity and trading volumes" class="img-responsive" style="max-width:100%;"/>

Incentivized liquidity provisionTokens can easily bootstrap a market by allocating tokens to LPs which we’ve seen succeed in increasing liquidity and trading volumes" title="The future success of AMMs is largely predicated on them serving two niches: https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Incentivized liquidity provisionTokens can easily bootstrap a market by allocating tokens to LPs which we’ve seen succeed in increasing liquidity and trading volumes" class="img-responsive" style="max-width:100%;"/>