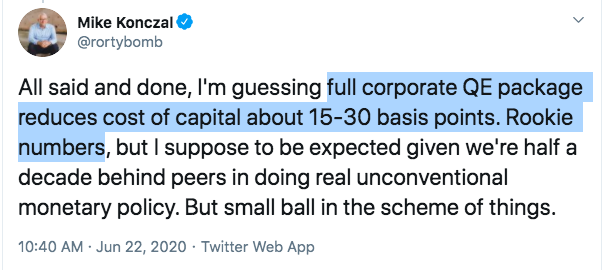

you: corporate QE is a trillion dollar slush fund, free money for corporations

me: it probably just reduced spreads 15-30bp.

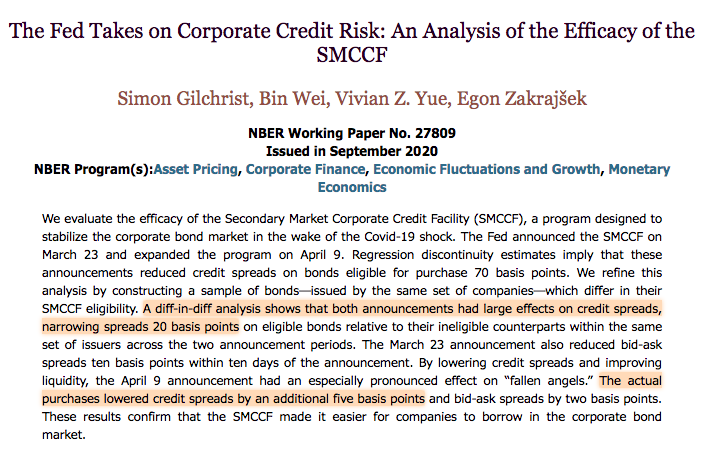

newest big TRACE research: it reduced spreads 25bp.

Prescient, bold market calls: why you follow @rortybomb on twitter dot com.

https://www.nber.org/papers/w27809 ">https://www.nber.org/papers/w2...

me: it probably just reduced spreads 15-30bp.

newest big TRACE research: it reduced spreads 25bp.

Prescient, bold market calls: why you follow @rortybomb on twitter dot com.

https://www.nber.org/papers/w27809 ">https://www.nber.org/papers/w2...

Twitter isn& #39;t ready for this yet, but in March wealth tried executing a "capital strike" against the real economy. They were refusing funding survival unless obscene terms and rates were met.

Jay Powell broke that capital strike by threatening a public option for that financing.

Jay Powell broke that capital strike by threatening a public option for that financing.

Noteworthy how similar numbers are to when the Bank of England did the same program in 2016, post-Brexit. Equivalent techniques found a 13–14bp reduction there.

Same for Japan& #39;s programs. And, of course, this is the ballpark for the effects of QE too. https://twitter.com/rortybomb/status/1258015451319238658">https://twitter.com/rortybomb...

Same for Japan& #39;s programs. And, of course, this is the ballpark for the effects of QE too. https://twitter.com/rortybomb/status/1258015451319238658">https://twitter.com/rortybomb...

Read on Twitter

Read on Twitter