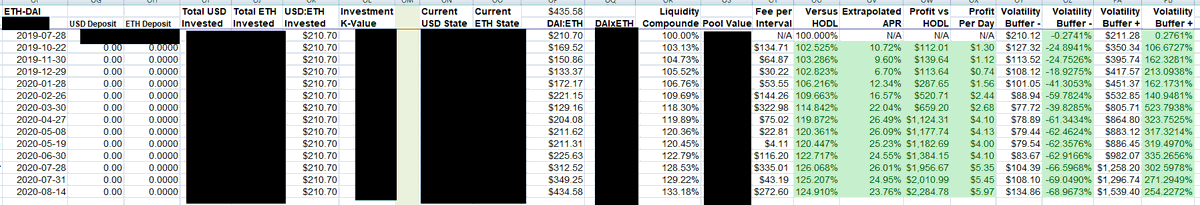

AMM LP Accounting:

Volatility buffer is the amount of leeway the ratio can change before IL exceeds revenue.

Unless it& #39;s a Stablecoin-ETH pairing, I usually pull liquidity and bail if I see either of the volatility buffers approaching zero.

#uniswap #Ethereum $ETH https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">

Volatility buffer is the amount of leeway the ratio can change before IL exceeds revenue.

Unless it& #39;s a Stablecoin-ETH pairing, I usually pull liquidity and bail if I see either of the volatility buffers approaching zero.

#uniswap #Ethereum $ETH

In a bull market, I& #39;m actually more worried as an LP about IL than I am in bear markets!

In bear markets, I just sit and collect fees waiting for it to go back up again... bull markets I still get $$$, but IL is devastating!

In bear markets, I just sit and collect fees waiting for it to go back up again... bull markets I still get $$$, but IL is devastating!

Stablecoin-ETH from my XP: don& #39;t worry about IL, the fees are consistent, volatility favors me, and fees will always catch up or exceed IL on a bigger timeframe.

Here& #39;s one of my practice runs with test money: DAI-ETH

Ran for exactly a year to the day: 26% profit.

That& #39;s 26% more DAI, 26% more ETH, vs HODL.

Ran for exactly a year to the day: 26% profit.

That& #39;s 26% more DAI, 26% more ETH, vs HODL.

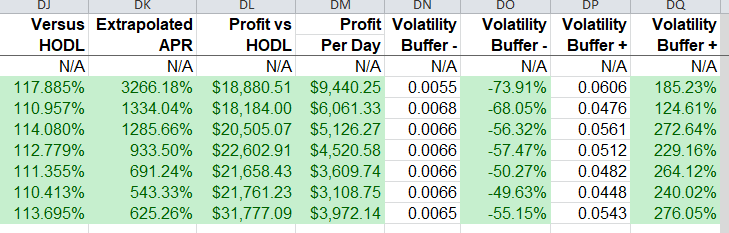

LPing for YFI-ETH is a PITA.

Just when I thought I had built a big enough volatility buffer to last forever, YFI goes from moon to JFC territory... I had to pull liquidity 4 times.

I still leave a trace amount in there for purpose of data collection.

Just when I thought I had built a big enough volatility buffer to last forever, YFI goes from moon to JFC territory... I had to pull liquidity 4 times.

I still leave a trace amount in there for purpose of data collection.

Read on Twitter

Read on Twitter " title="AMM LP Accounting:Volatility buffer is the amount of leeway the ratio can change before IL exceeds revenue.Unless it& #39;s a Stablecoin-ETH pairing, I usually pull liquidity and bail if I see either of the volatility buffers approaching zero. #uniswap #Ethereum $ETH https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">" class="img-responsive" style="max-width:100%;"/>

" title="AMM LP Accounting:Volatility buffer is the amount of leeway the ratio can change before IL exceeds revenue.Unless it& #39;s a Stablecoin-ETH pairing, I usually pull liquidity and bail if I see either of the volatility buffers approaching zero. #uniswap #Ethereum $ETH https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">" class="img-responsive" style="max-width:100%;"/>