Happy Saturday. It’s 169 days since the CARES Act passed. As Congress dithers on another relief package, I want to show you what the stimulus has done for people, from the lowest-paid worker to the most profitable Fortune 500 company.

It’s time for a trip to Cleveland. (THREAD)

It’s time for a trip to Cleveland. (THREAD)

While reporting on the stimulus’s effects, one truth has jumped out: An outpouring of cash kept many small businesses afloat temporarily, but the law’s most generous, least conditional support went to large companies & the investors who back them.

It was a big corporate rescue.

It was a big corporate rescue.

This happened because the CARES Act allowed the Fed to purchase virtually unlimited quantities of corporate bonds, fueling a rapid recovery in the ability of corporations to borrow -- especially riskier companies that had already taken on a lot of debt.

One such company, the aerospace-focused holding company TransDigm, caught our eye for a few reasons: A history of aggressive borrowing, high profits enabled by sole-source contracts, generous executive compensation, and a skyrocketing stock price pre-pandemic. (This is their HQ.)

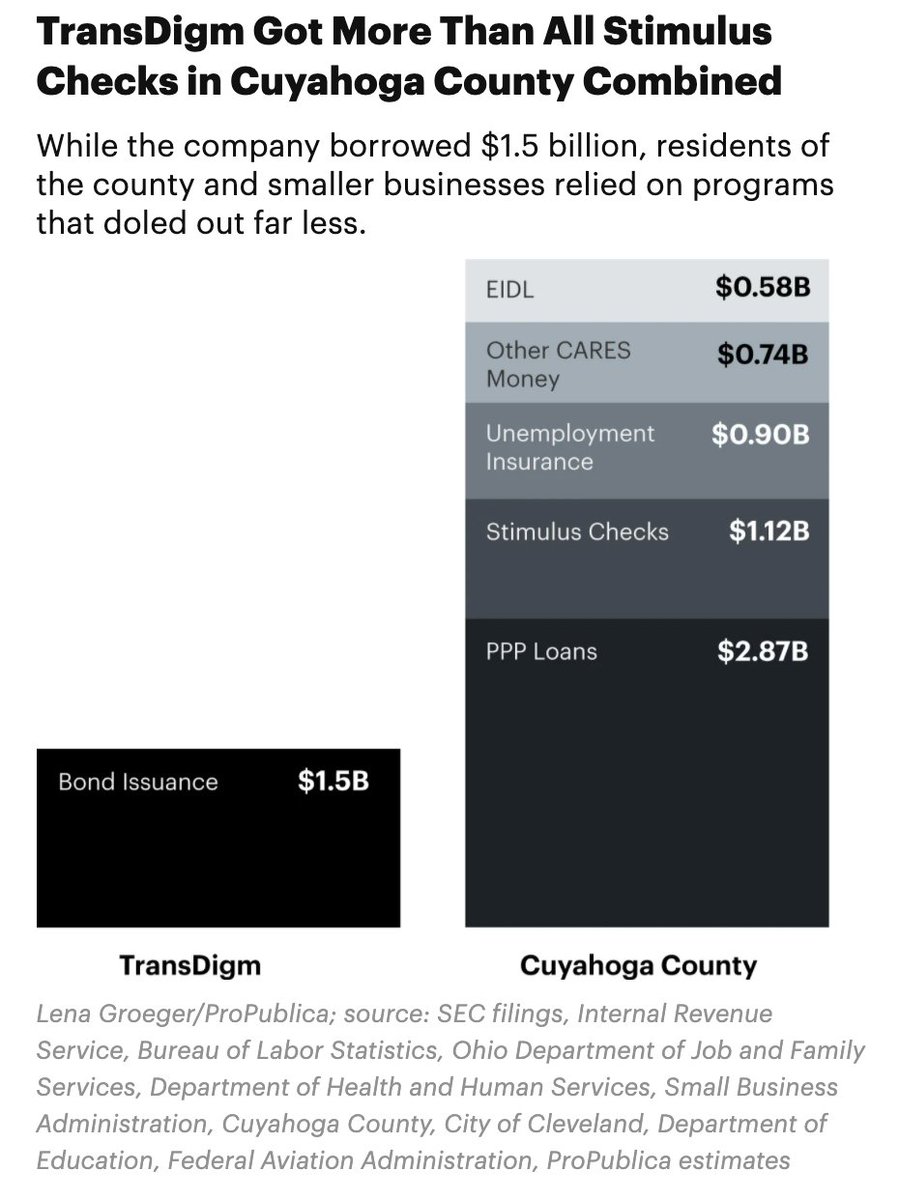

After the Fed announced its plan to backstop the bond market in March, TransDigm issued $1.5 billion worth of bonds at a moderate interest rate. Unlike the CARES Act’s other programs, this favor didn’t come with requirements to retain workers or stop shareholder payouts.

TransDigm, which referred to the extra $1.5b as an “insurance policy,” proceeded to lay off 15% of its 18,300 workers, allowing it to maintain its 40% margins. It could use that extra cash to keep buying up companies, TransDigm told analysts. https://www.fool.com/earnings/call-transcripts/2020/05/05/transdigm-group-inc-tdg-q2-2020-earnings-call-tran.aspx">https://www.fool.com/earnings/...

(A TransDigm spokesperson says that the bond issuance was a “prudent measure to ensure the company maintained liquidity” at a tough time for the aerospace industry and that laid-off employees received $4,000 payouts to help defray costs.)

So what does this all have to do with Cleveland? Well, that’s where TransDigm is based -- and we wanted to figure out how much the CARES Act had helped the city, as opposed to the corporations it hosts. (Because these days, those are two different things.)

Adding up all the CARES $$$, from unemployment insurance to money for hospitals, Cuyahoga County got ~ $6 billion. That’s a lot -- around $5K for every county resident. But just for comparison’s sake, TransDigm’s April borrowing came out to $82K per employee.

And of course, the stimulus wasn’t equally distributed. PPP funds went to firms that barely lost revenue, for example, while the neediest missed out. The county hasn’t even spent $100m because it has to be used for COVID-specific stuff, not to fill its enormous budget hole.

But the biggest problem is that the money was supposed to last only as long as it took to beat the virus, and that hasn’t happened yet -- so with the Cleveland economy still only partially open, businesses and unemployed workers are running out of help.

What that means: The convenience store downstairs from TransDigm’s headquarters surviving on a fraction of its pre-pandemic sales may have to close. This is Gary Patel, who& #39;s run the Erieview Newsstand for 20 years, and likely won& #39;t make it to 2021.

Neighborhoods like Slavic Village, hard hit by the foreclosure crisis 12 years ago, have taken another hit -- its diners are half full, its barbershops serving only a trickle of customers, the industrial factories on its border laying off hundreds. Food pantries are slammed.

Big corporations, however, continue to benefit from the Fed’s policy of keeping interest rates low and propping up the bond market, fueling their ability to buy smaller competitors. That aid doesn’t expire and it doesn’t come with strings.

Stepping back, the Fed may have been wise to keep credit markets from seizing up. But it’s not well equipped to help small businesses. That’s up to Congress, which this past week couldn& #39;t even pass a "skinny" bill, while at least 13.4m people remain officially unemployed.

Anyway, it was an honor to work with @paulkiel and @JustinElliott on this one, with great photos by Theo Stroomer ( https://www.theostroomer.com/ )">https://www.theostroomer.com/">... and help from @jilliankumagai and @eisingerj and so many more. Take a read: https://features.propublica.org/cleveland-bailout/the-big-corporate-rescue-and-the-america-thats-too-small-to-save/">https://features.propublica.org/cleveland...

And sign up for our big story newsletter to get more of my colleagues& #39; best work: https://www.propublica.org/newsletters/the-big-story?source=social">https://www.propublica.org/newslette...

Read on Twitter

Read on Twitter