Today in Toronto Rentals

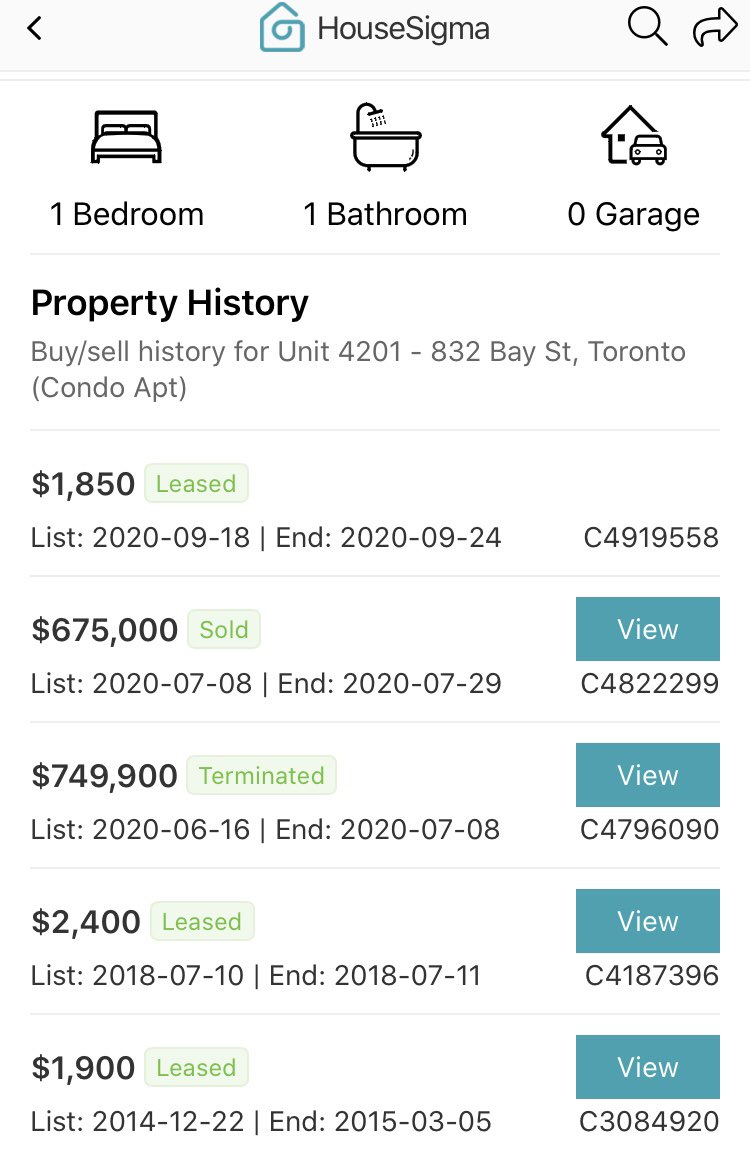

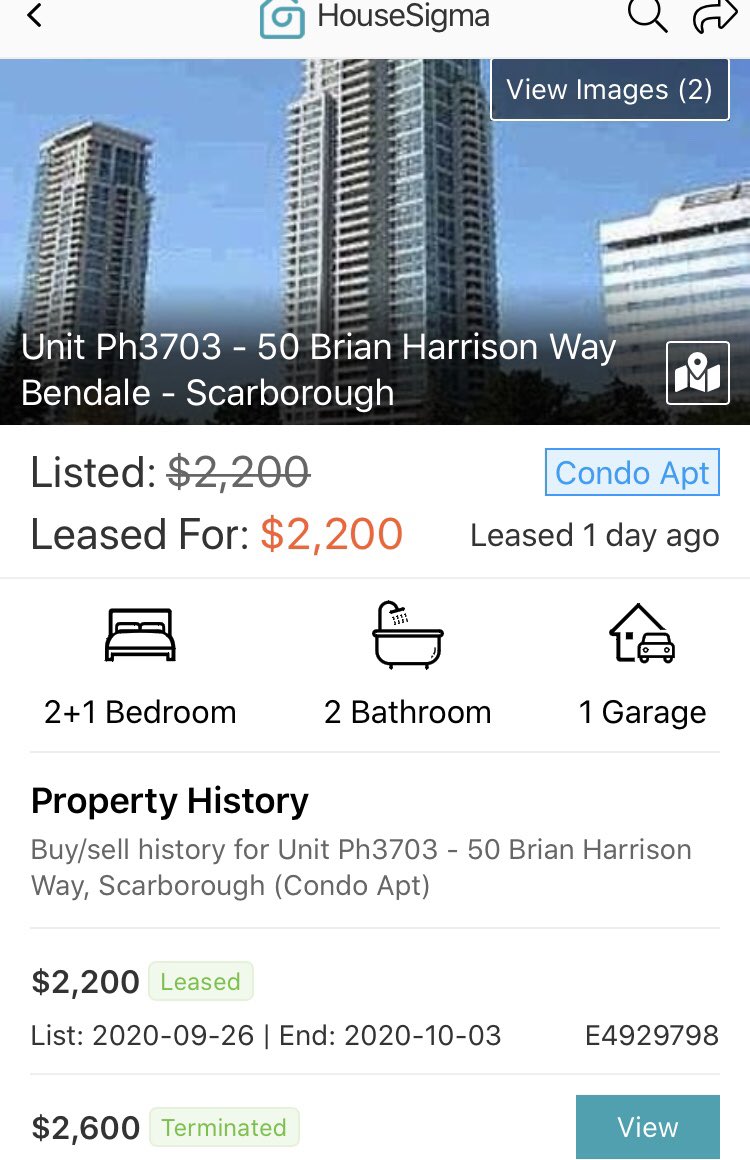

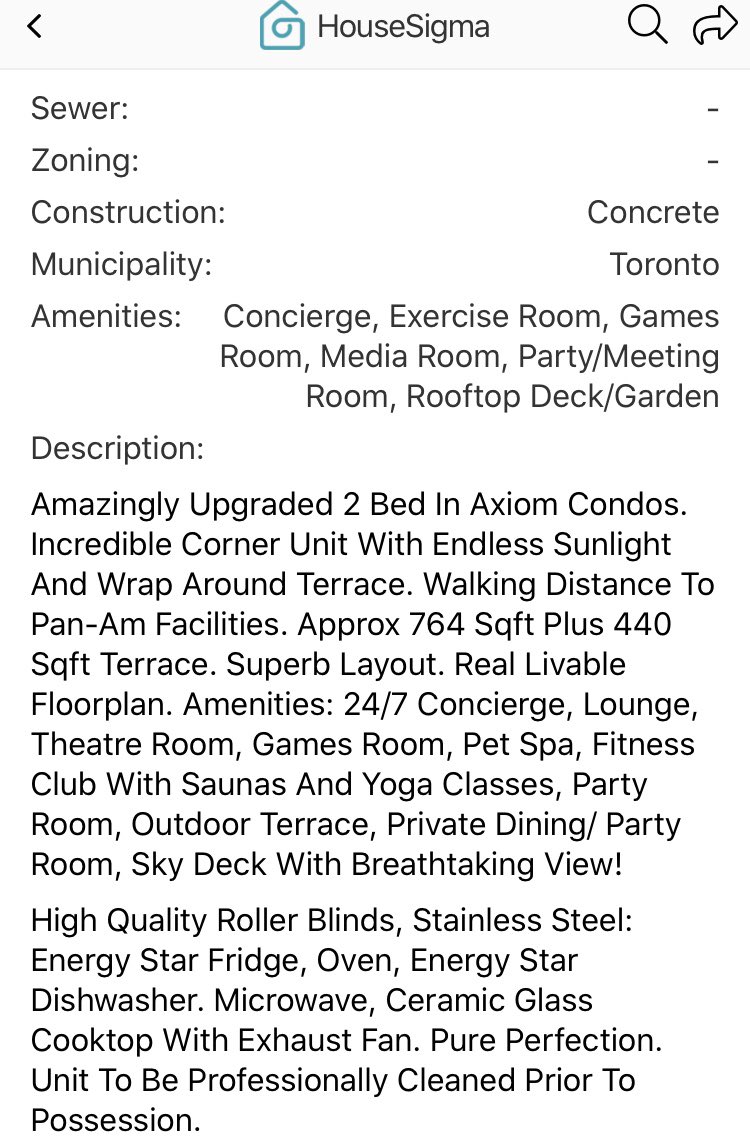

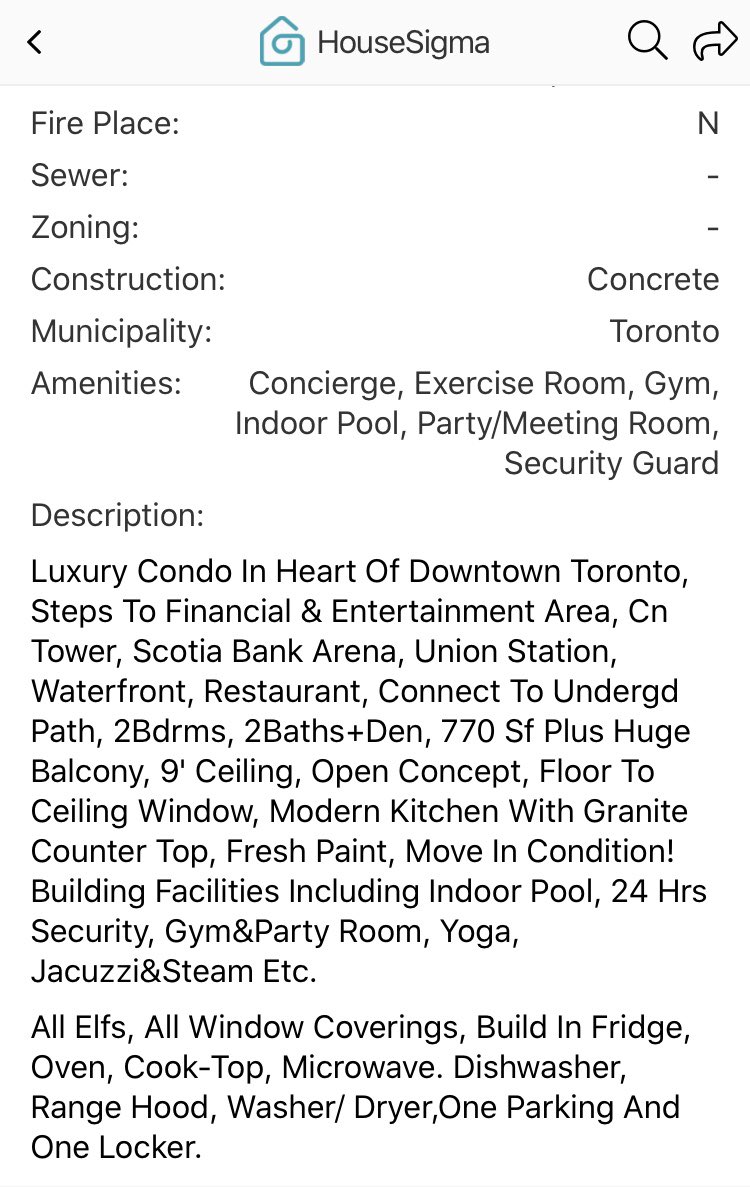

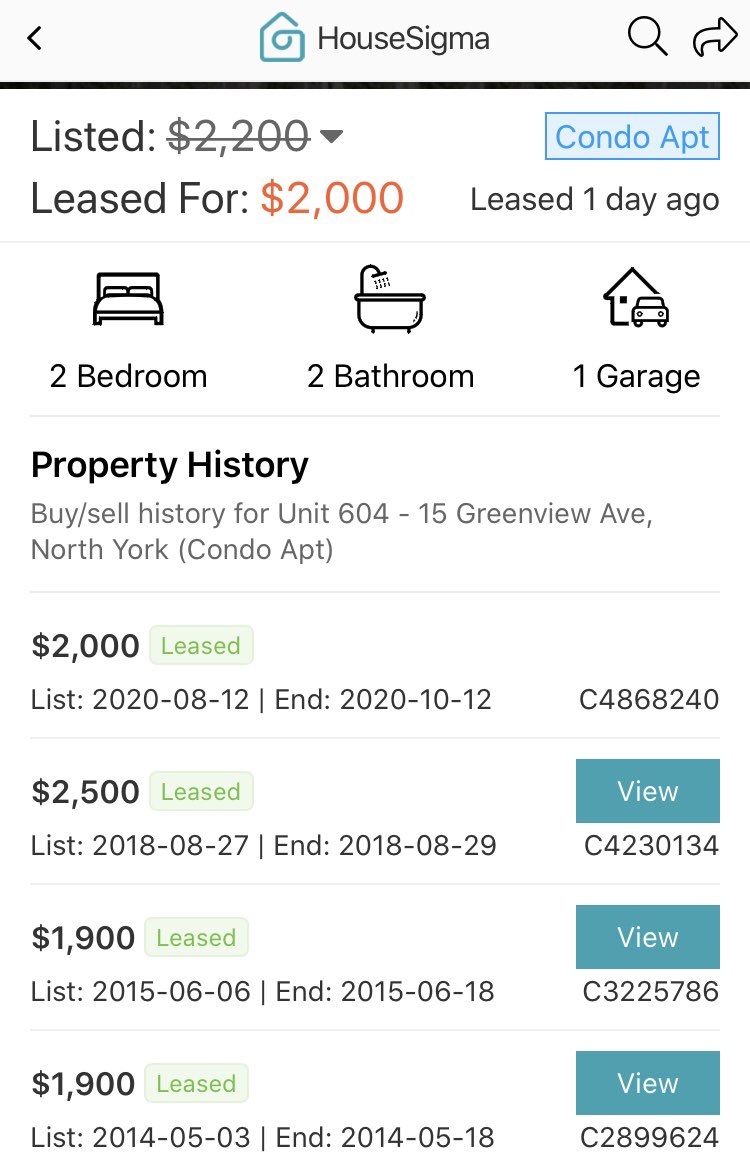

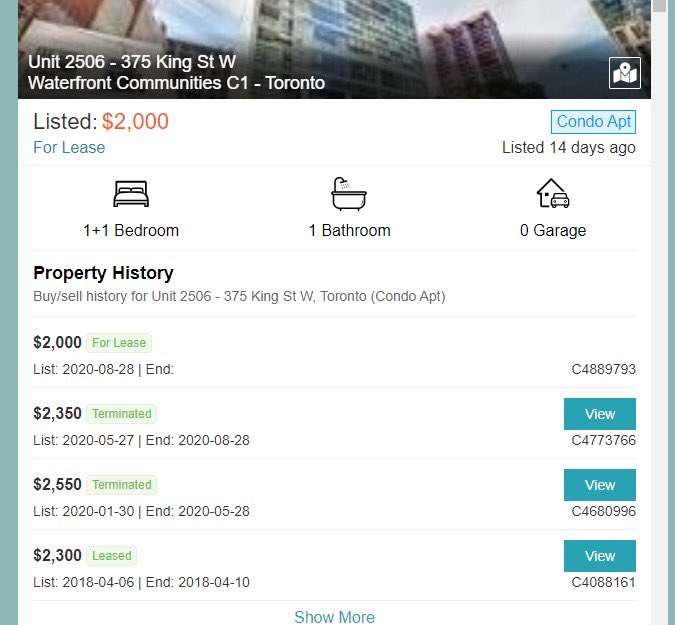

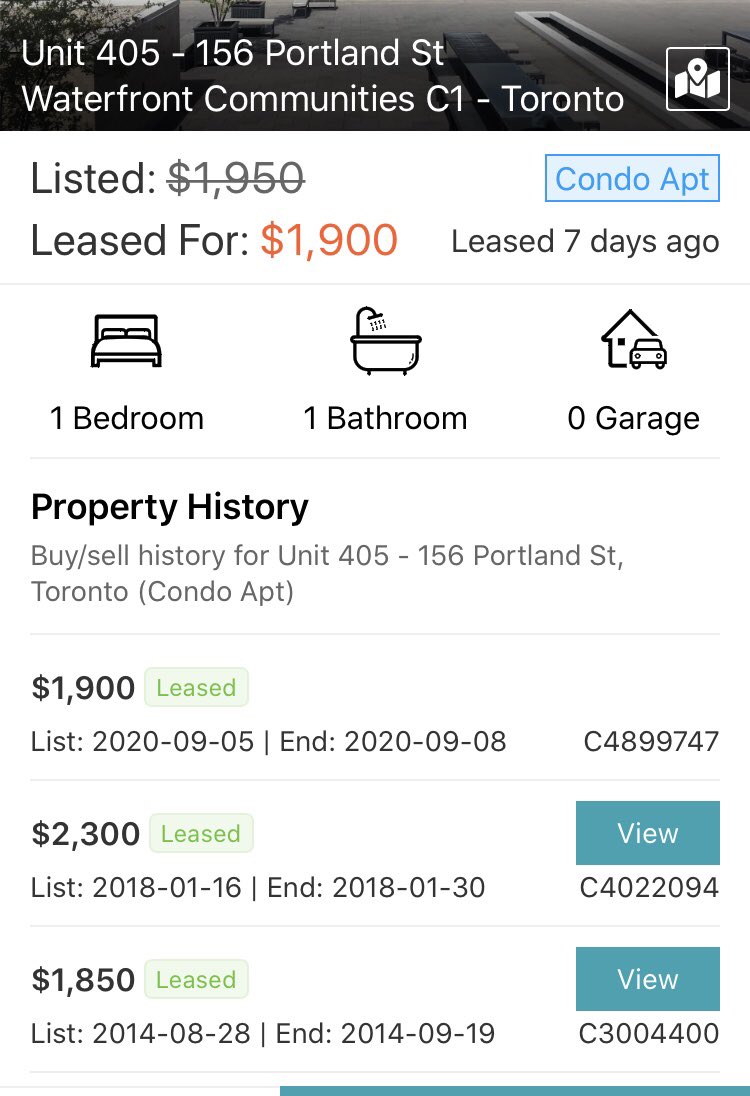

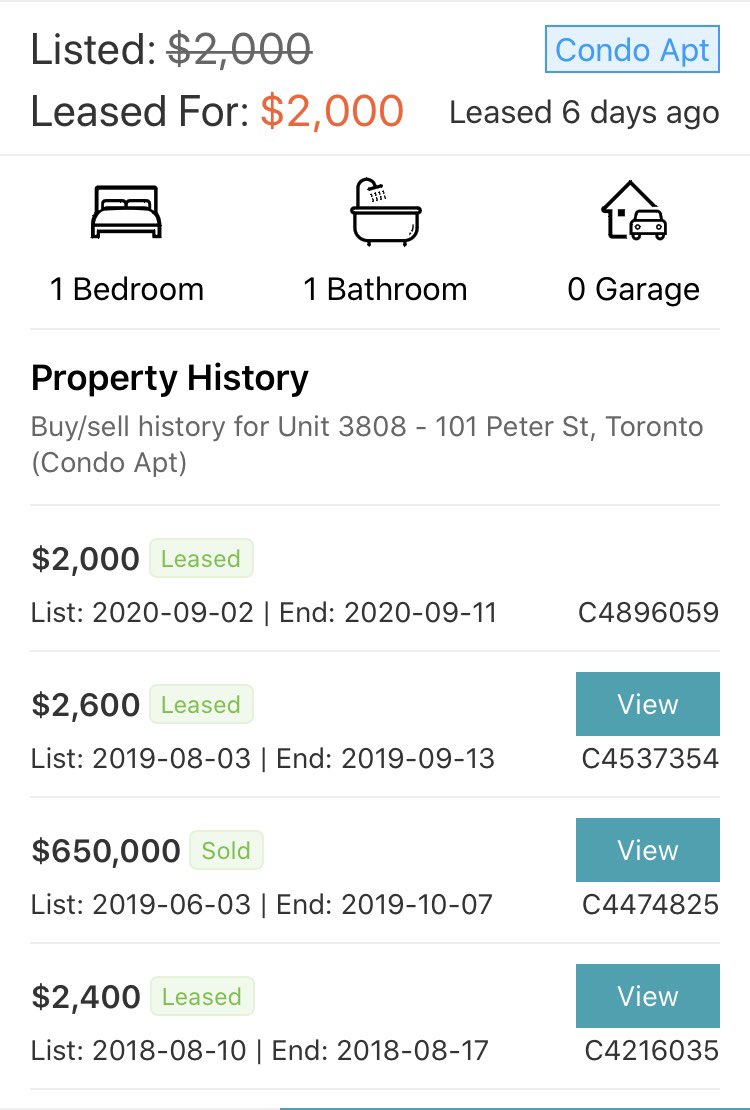

This one has been vacant a while and still no bites after a 13% reduction in the 2018 leased price.

This one has been vacant a while and still no bites after a 13% reduction in the 2018 leased price.

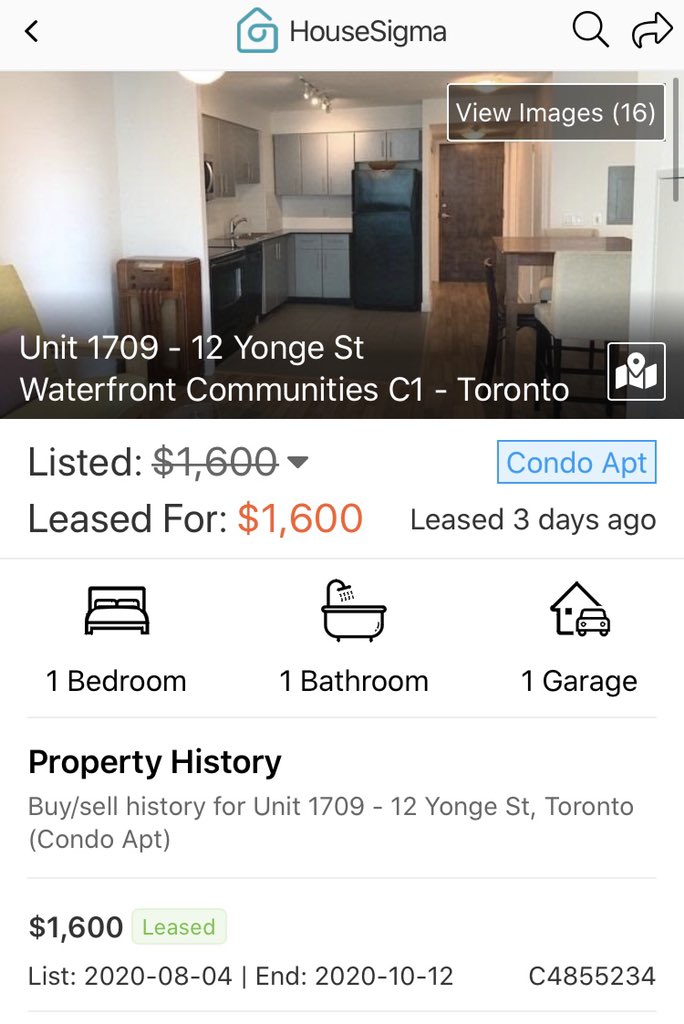

Today in Toronto Rentals

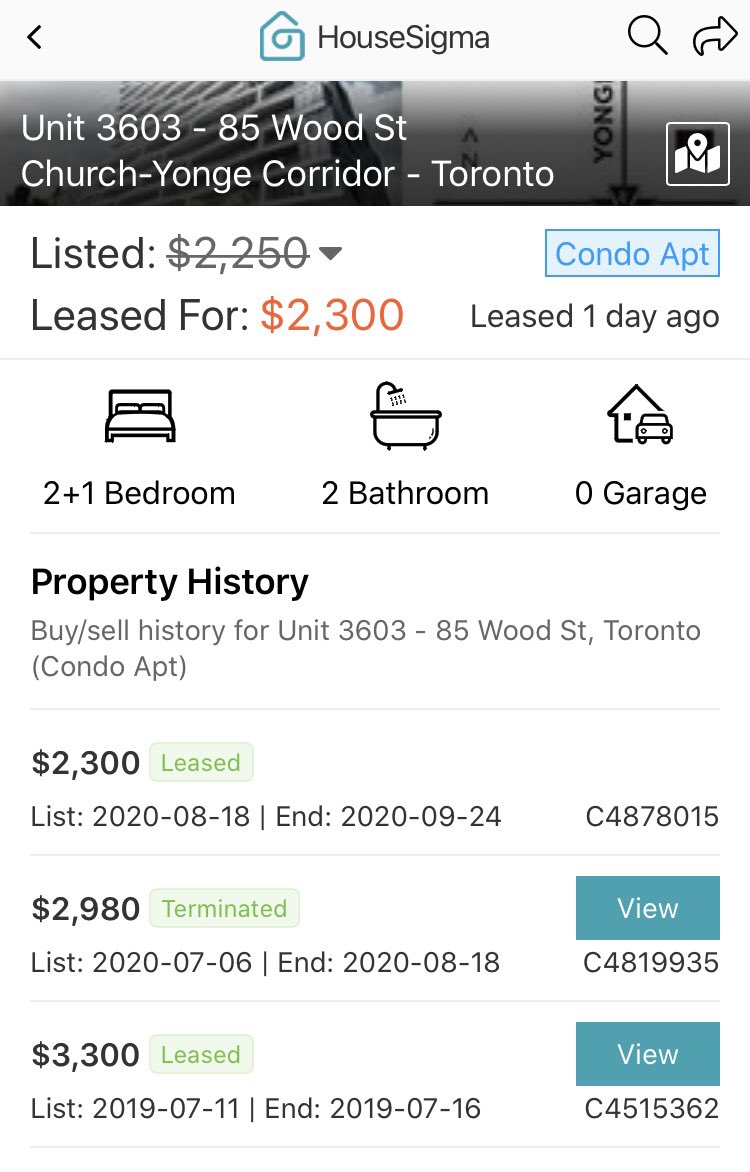

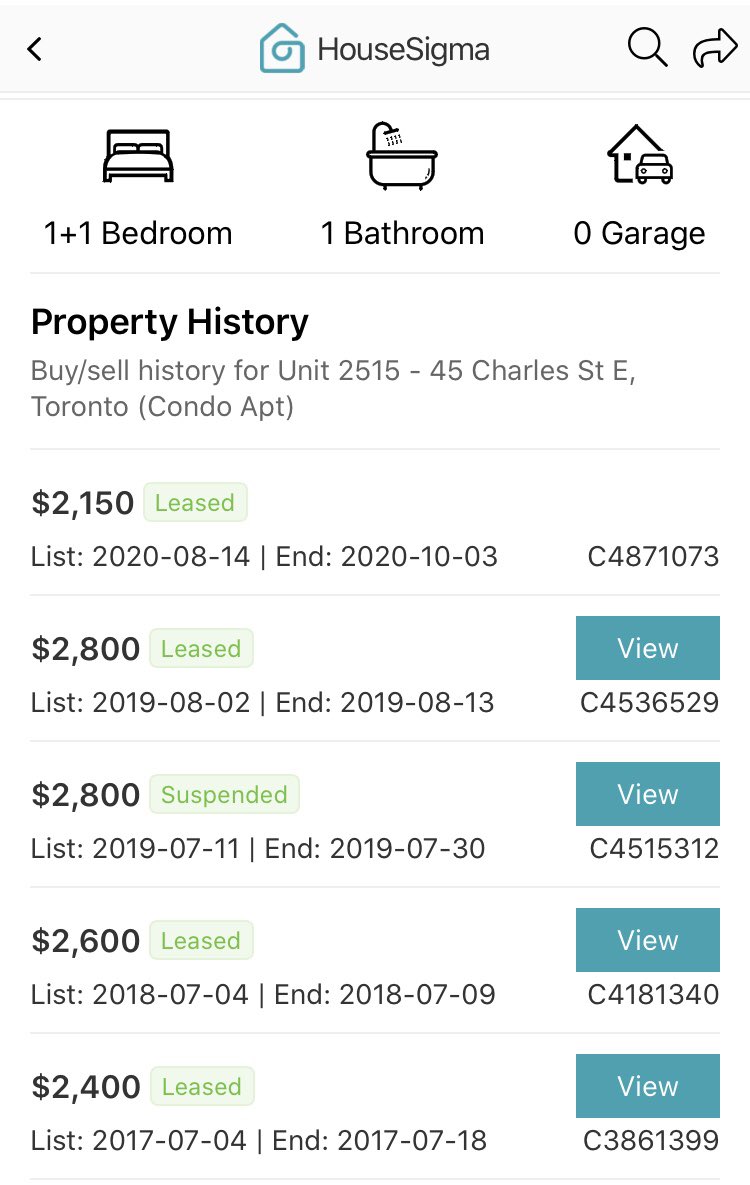

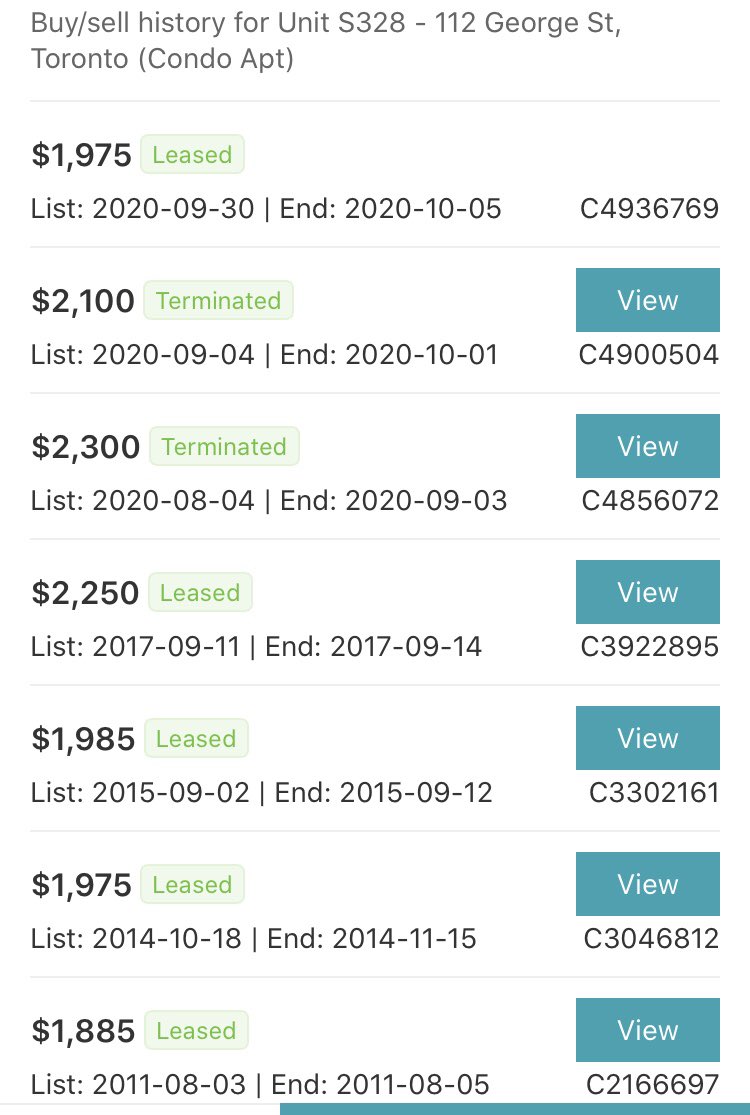

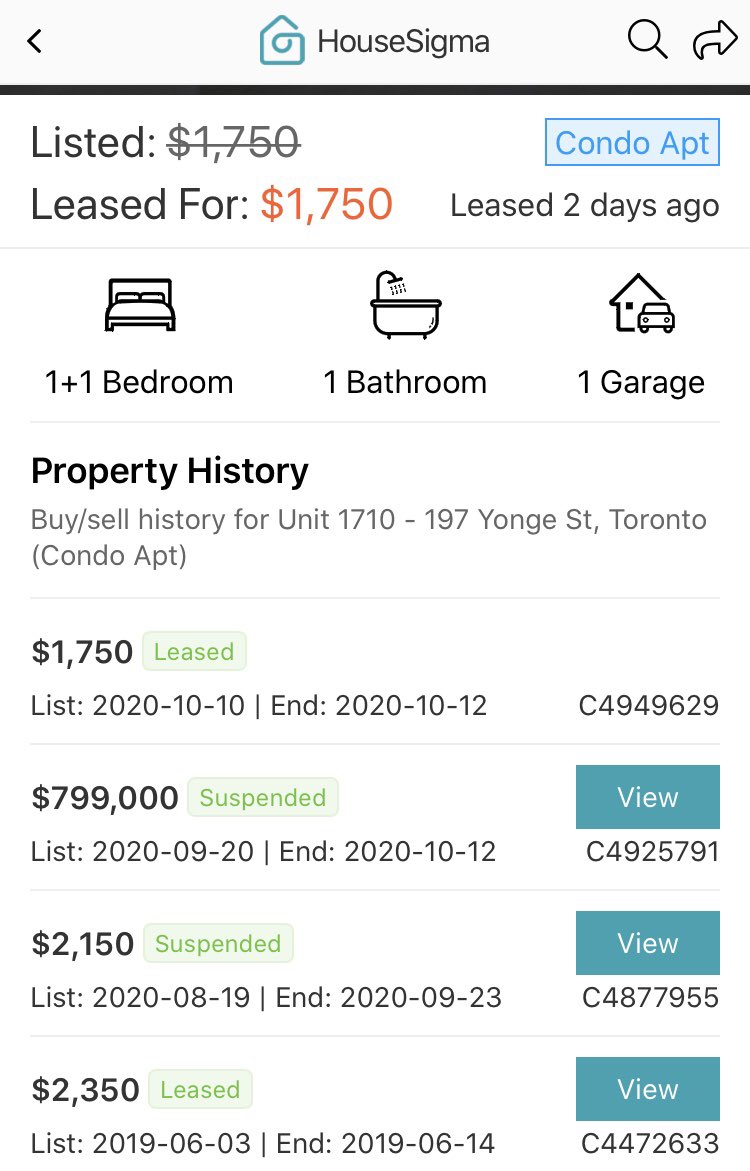

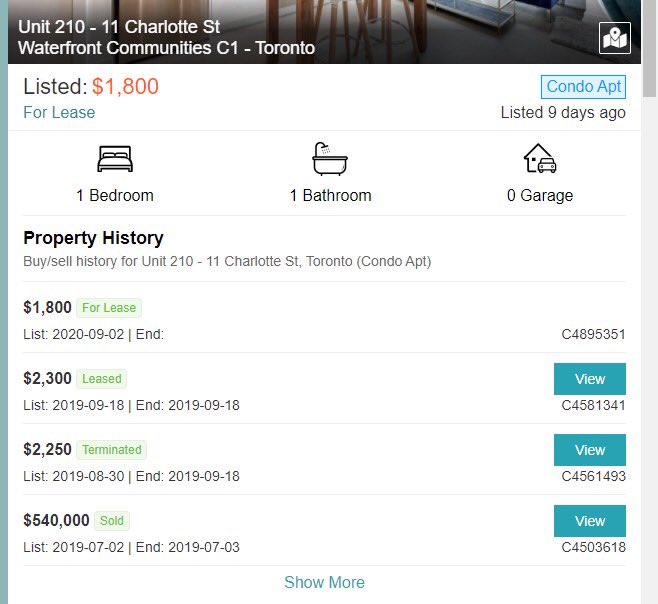

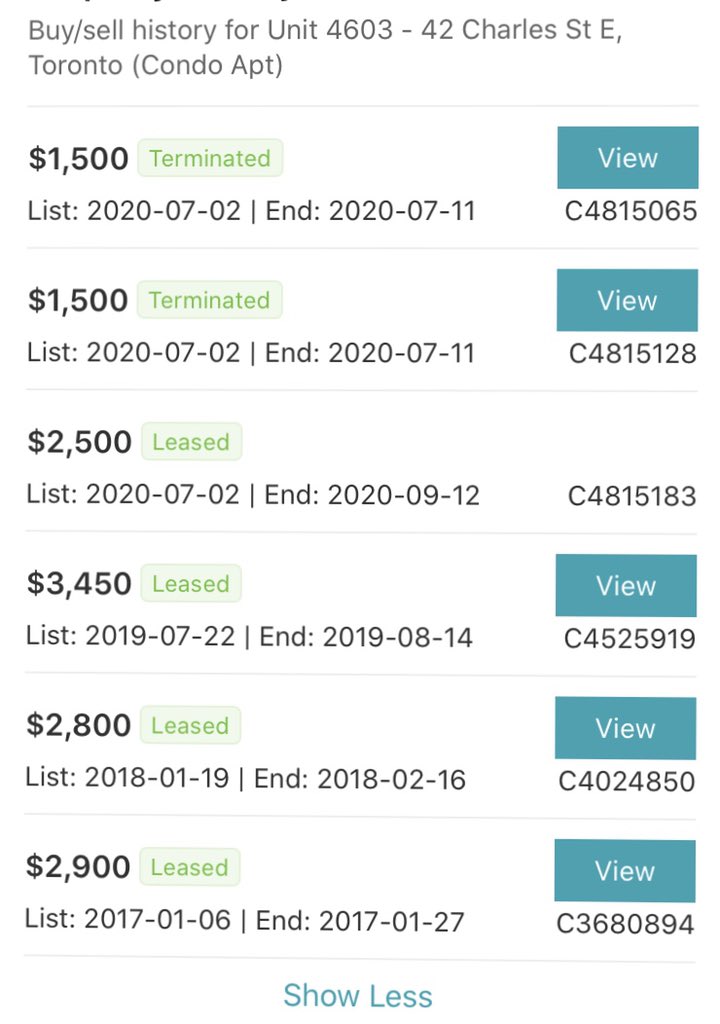

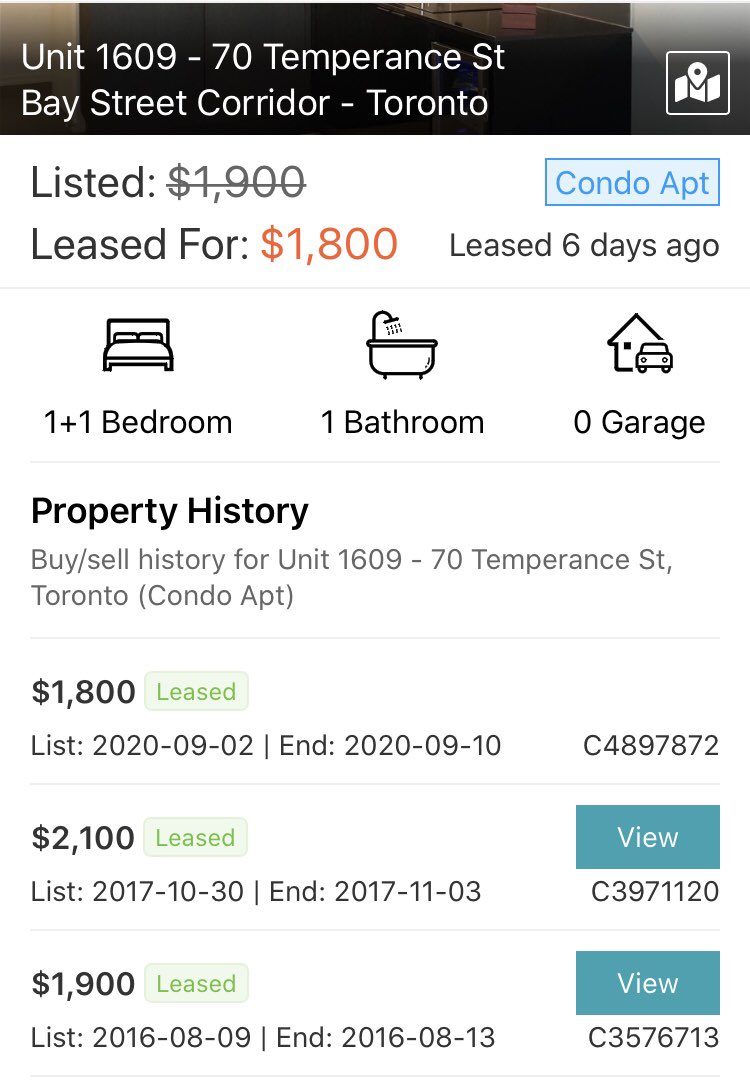

A whopping $500 (21%) drop in the asking lease price for this condo, as compared to the 2019 leased price.

When condo “investments” burn a hole in your pocket from vacancy and negative cash flow.

A whopping $500 (21%) drop in the asking lease price for this condo, as compared to the 2019 leased price.

When condo “investments” burn a hole in your pocket from vacancy and negative cash flow.

Today in Toronto Rentals

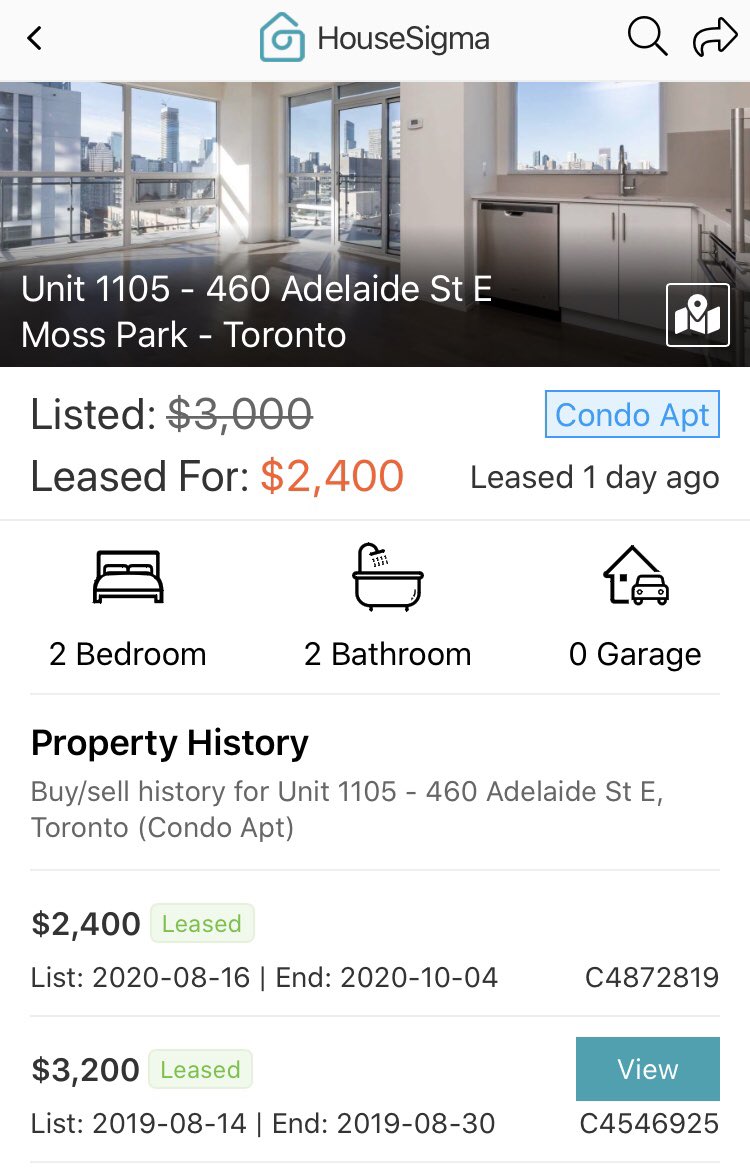

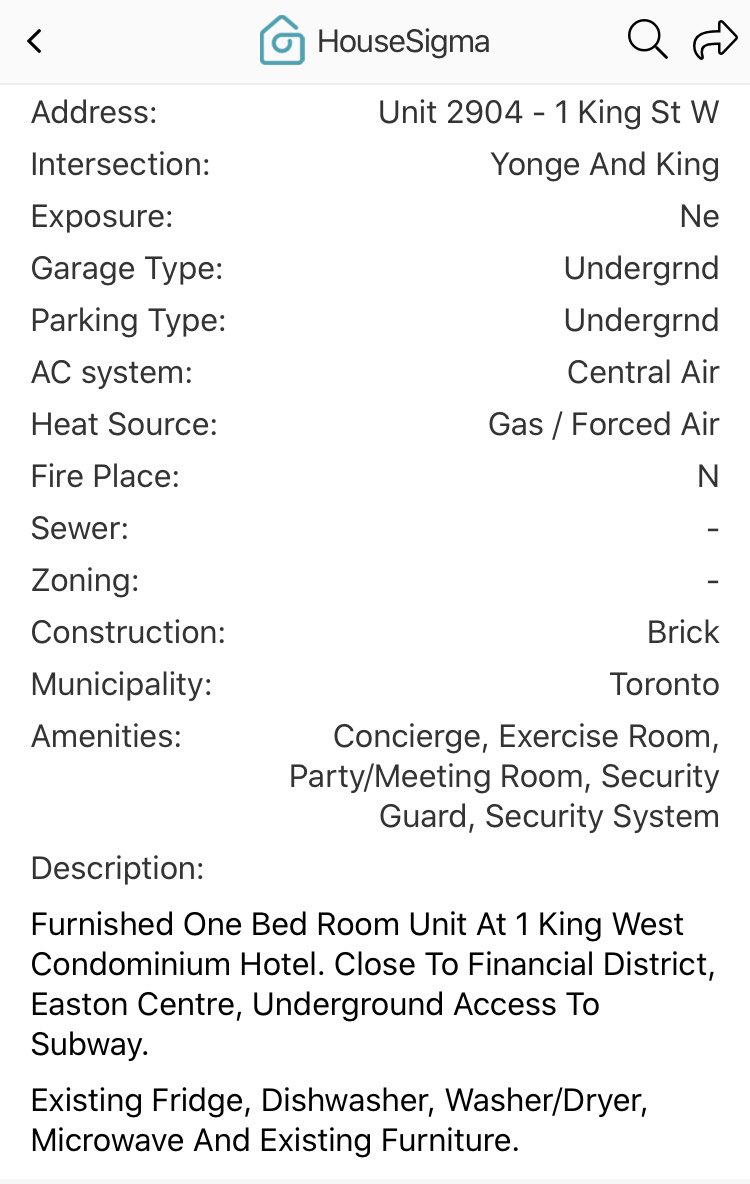

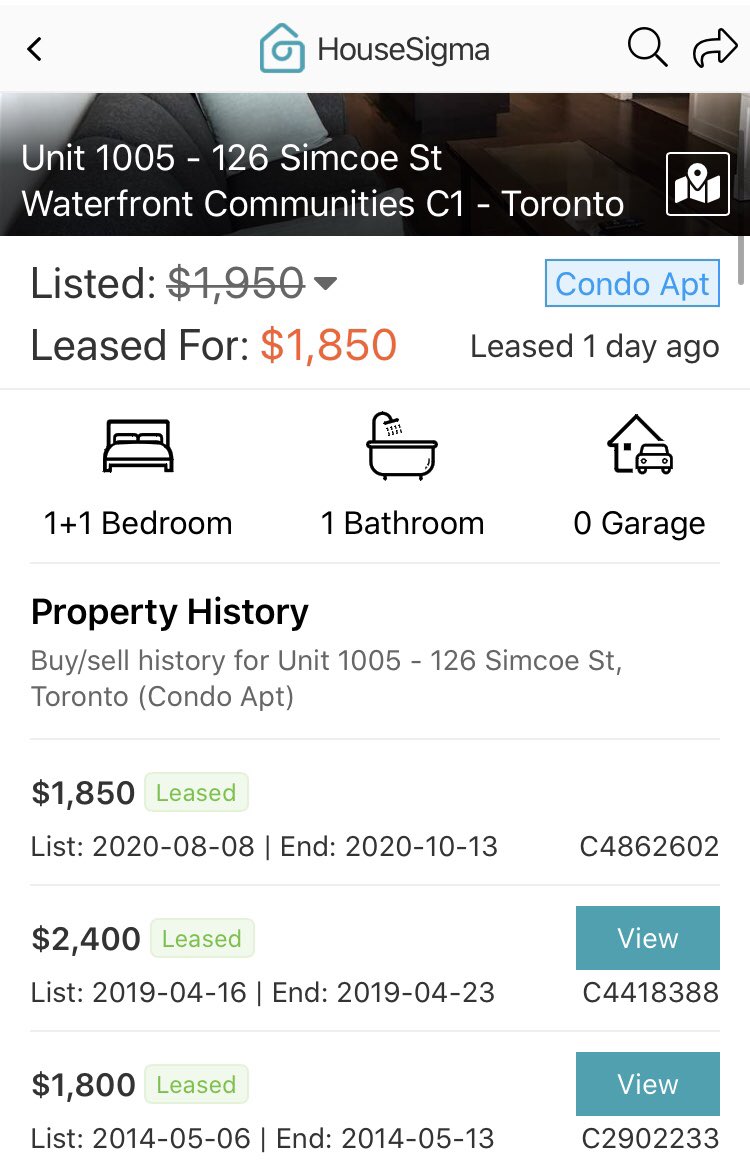

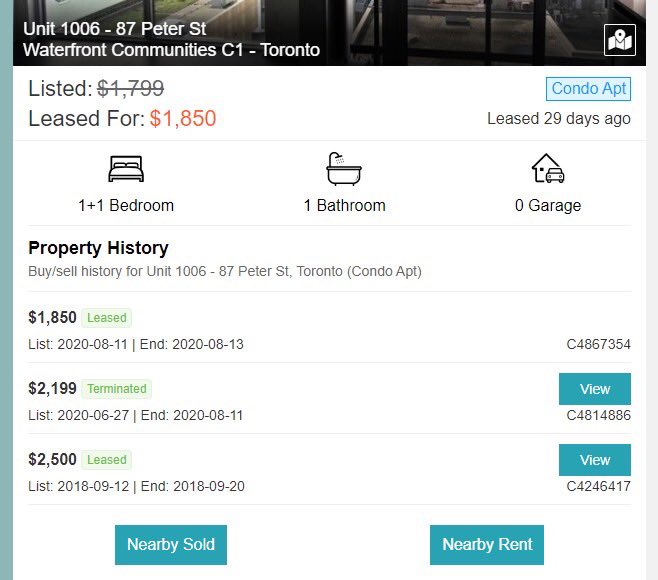

This one is a wow!

It was leased for and incredible 26% ($650) below the 2018 leased priced.

How many years back would that take us!

Definitely burning a hole in the investors pocket

This one is a wow!

It was leased for and incredible 26% ($650) below the 2018 leased priced.

How many years back would that take us!

Definitely burning a hole in the investors pocket

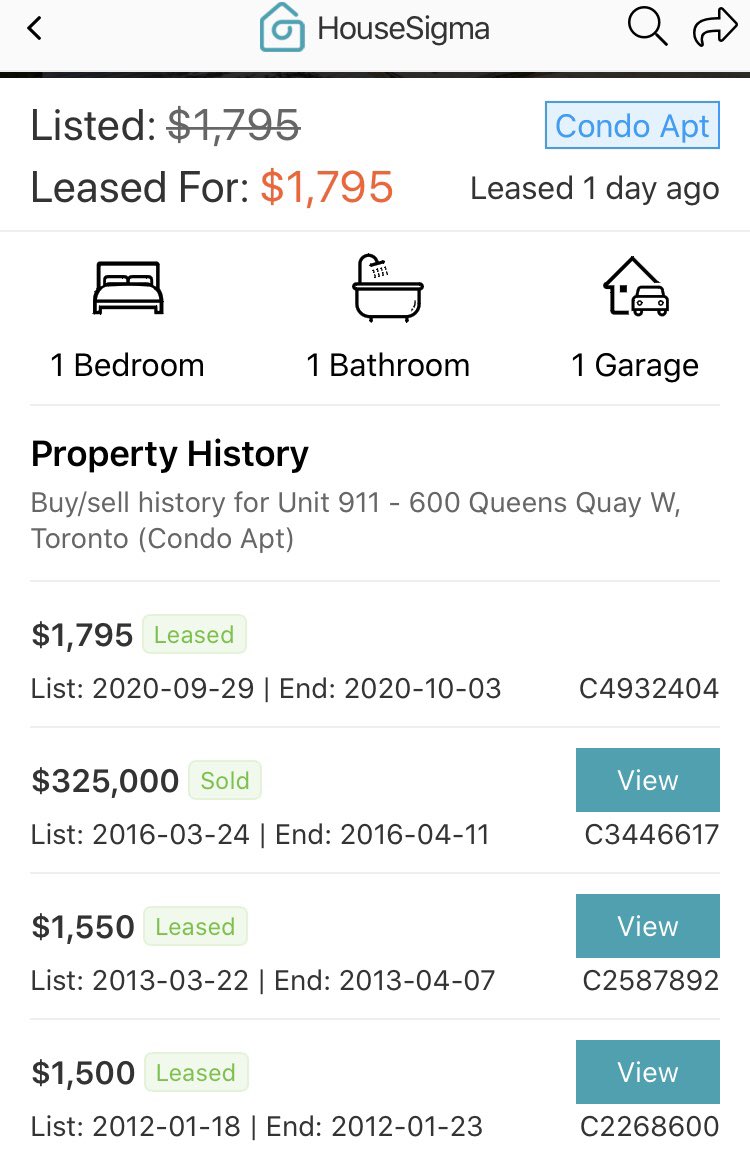

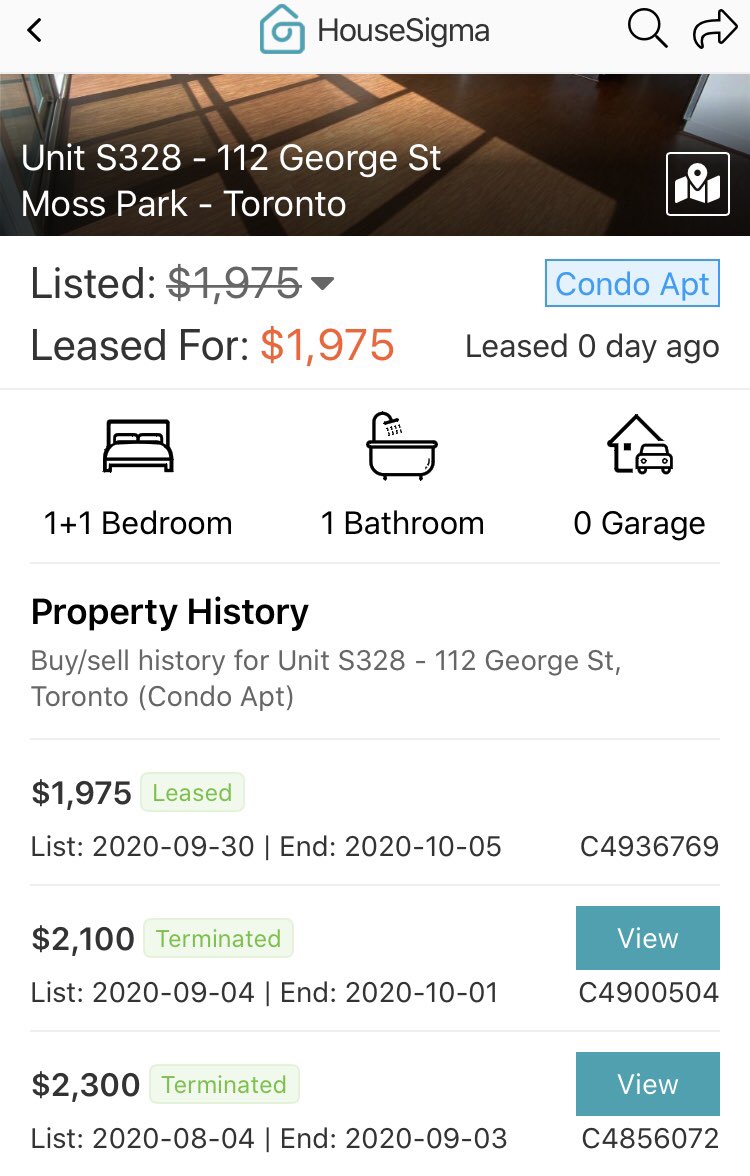

The Latest in Toronto Rents

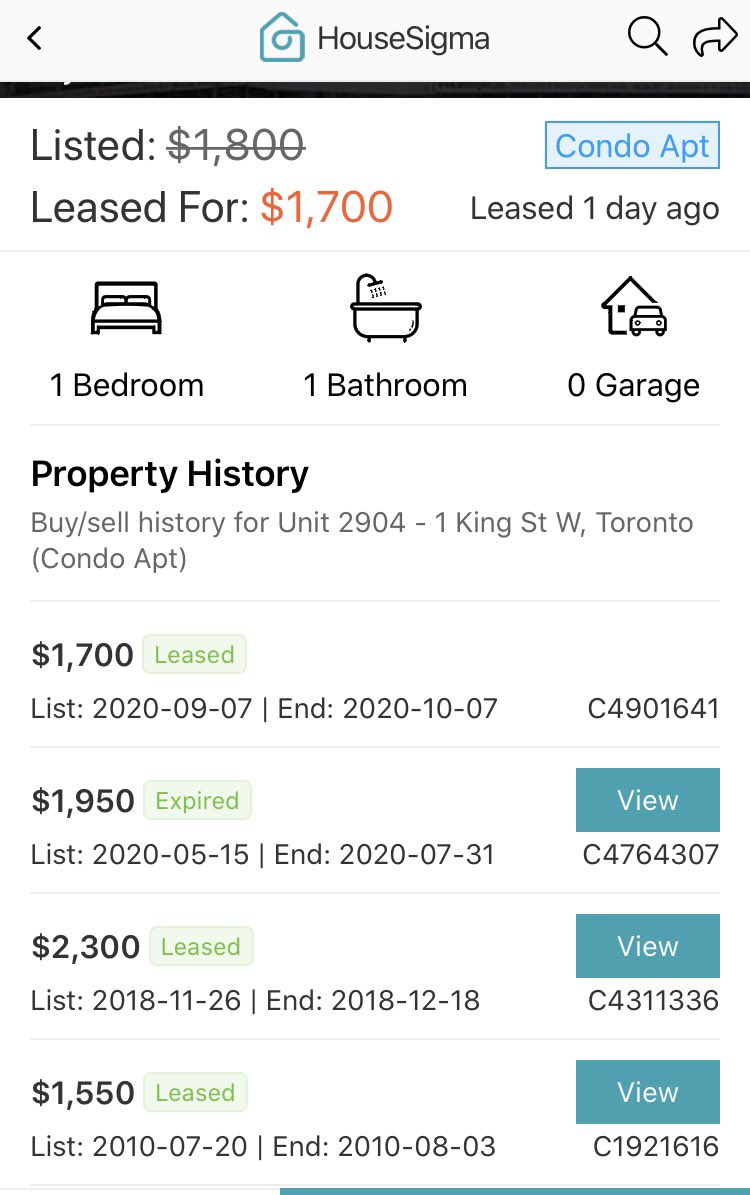

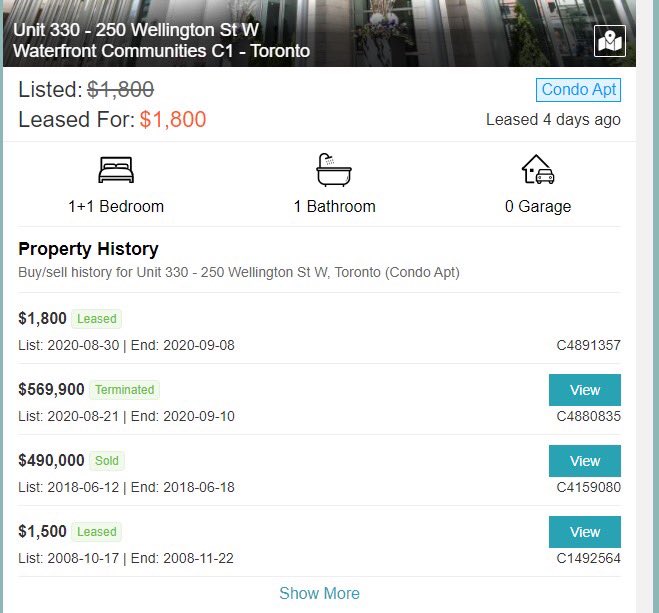

This one was leased for $1500 in 2008.

Fast forward 12 yrs later to 2020, and the rent has only increased by $300 more.

That’s below inflation rent growth over a 12 yr span in downtown Toronto!

This one was leased for $1500 in 2008.

Fast forward 12 yrs later to 2020, and the rent has only increased by $300 more.

That’s below inflation rent growth over a 12 yr span in downtown Toronto!

The Latest in Toronto Rents

This 3 bd condo was rented for $2700 in 2014

And was just recently leased for $2900

A paltry $200 in rent growth over 6 yrs, which is well below inflation while expense rising much > inflation

With downward rent pressure to continue

This 3 bd condo was rented for $2700 in 2014

And was just recently leased for $2900

A paltry $200 in rent growth over 6 yrs, which is well below inflation while expense rising much > inflation

With downward rent pressure to continue

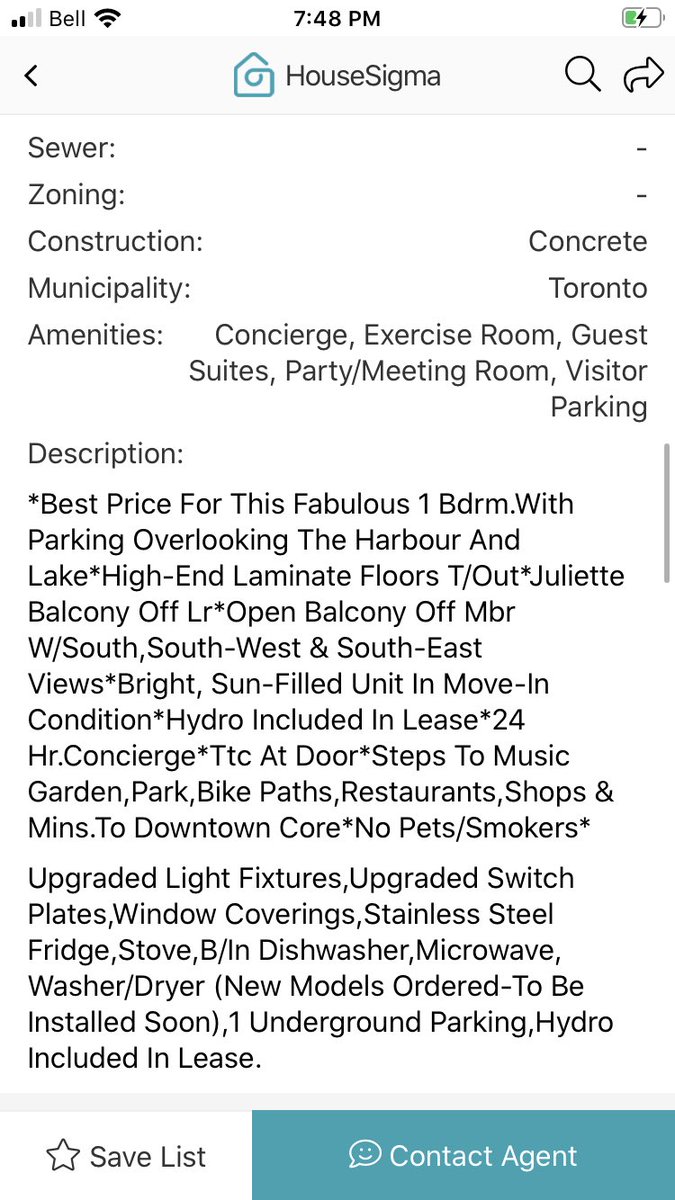

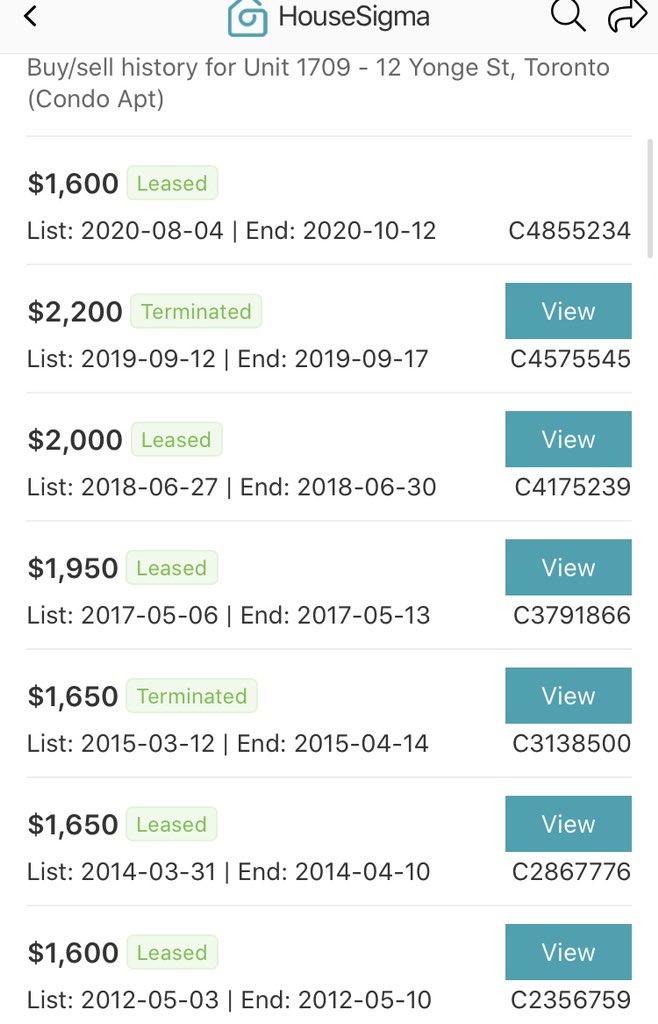

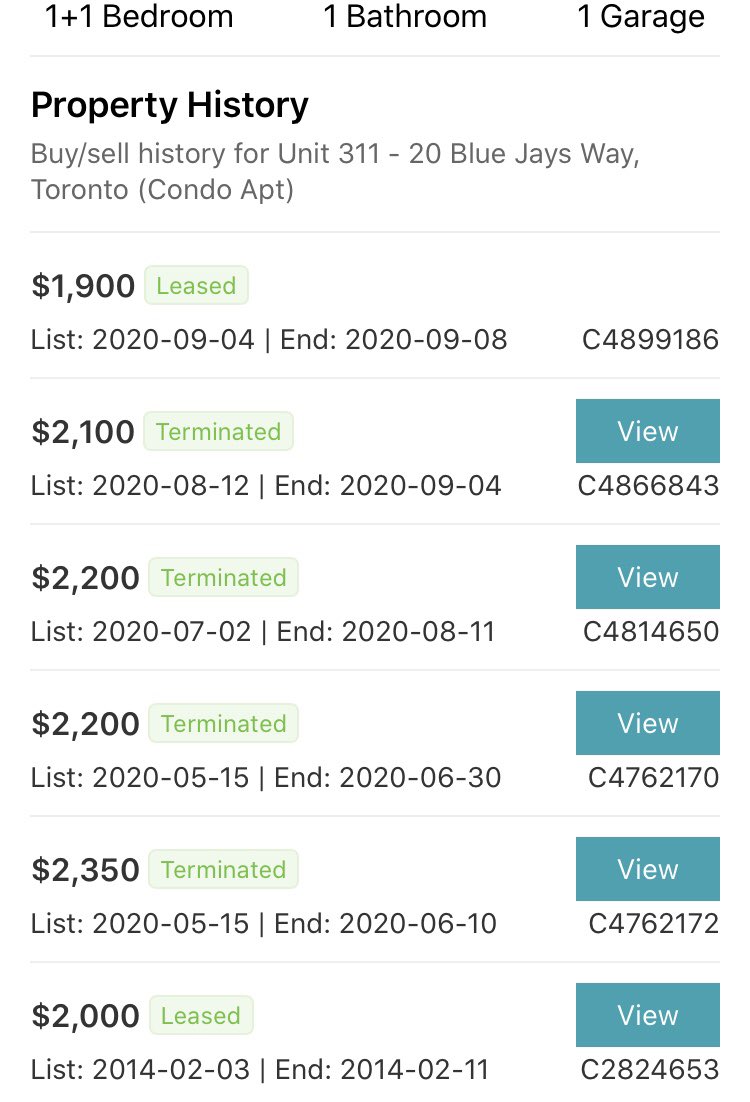

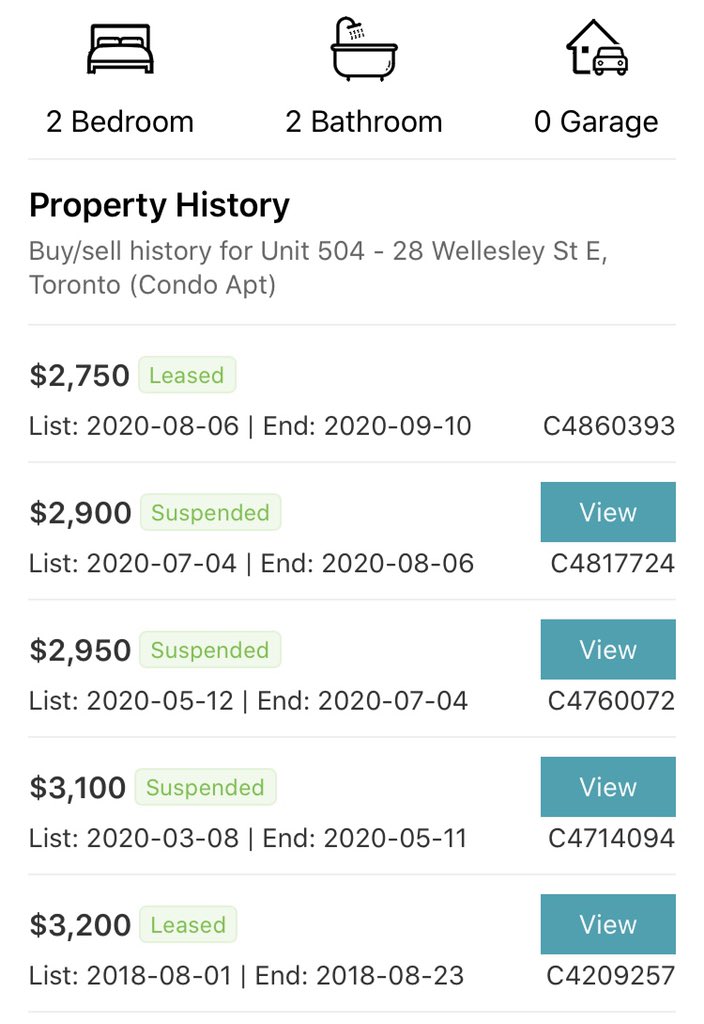

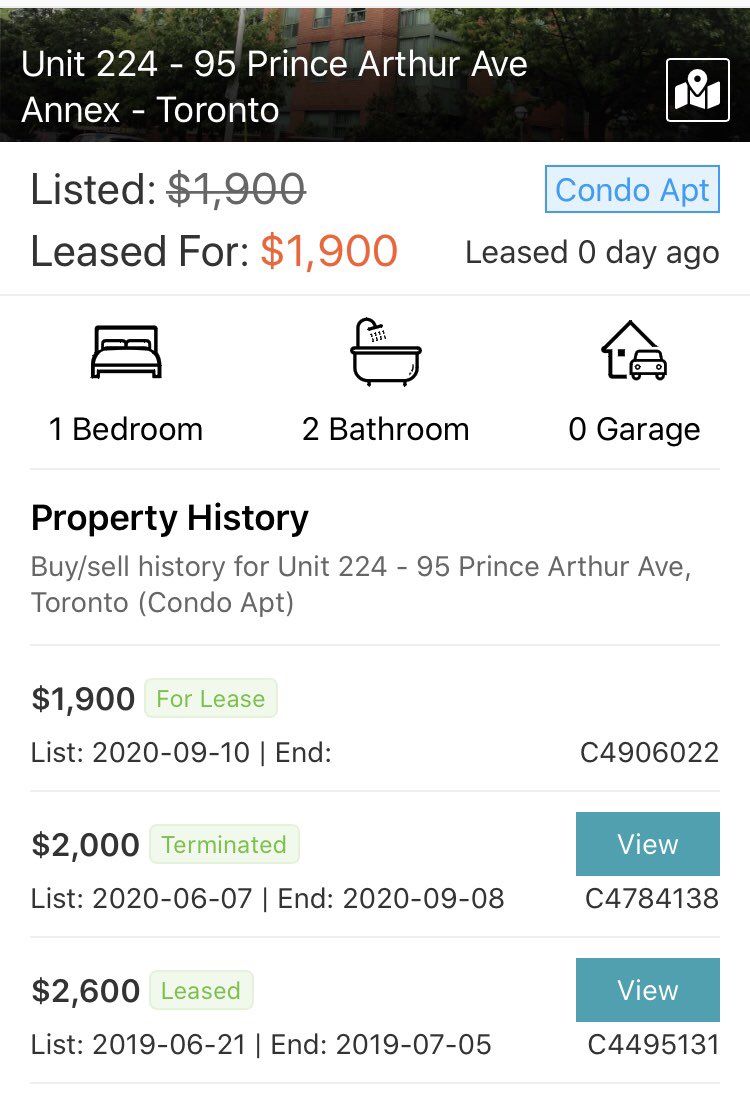

The Latest in Toronto Rents.

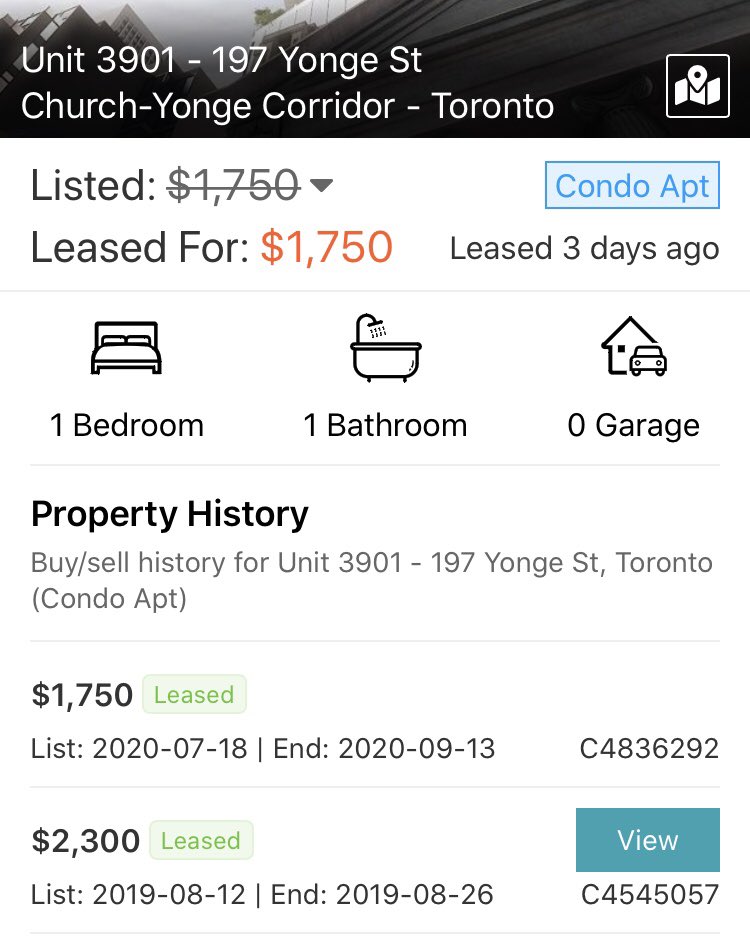

After 5 months on the mkt, this investor accepted the new reality and leased the unit $100 below the 2014 price.

Negative rent growth after 6 years in the world class city of Toronto.

#cdnecon

After 5 months on the mkt, this investor accepted the new reality and leased the unit $100 below the 2014 price.

Negative rent growth after 6 years in the world class city of Toronto.

#cdnecon

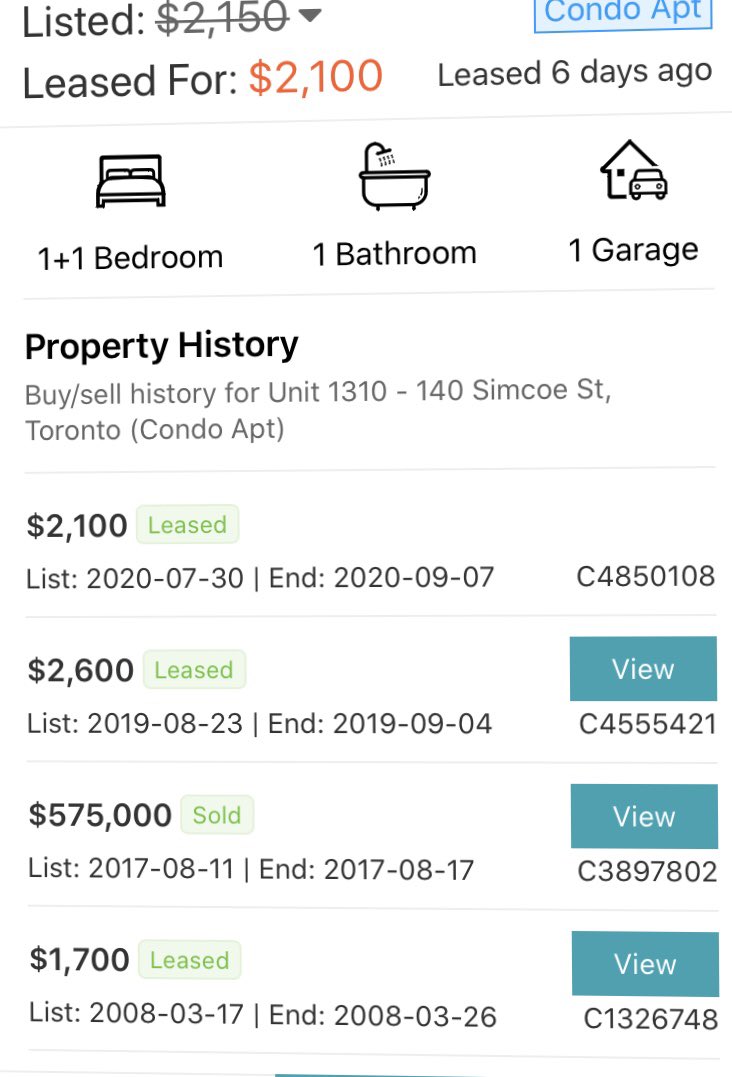

The Latest in Toronto Rents

This one was leased $500/month below the 2019 price and $400/month above the 2008 price.

Below inflation rent growth over a 12 yr span in downtown Toronto

This one was leased $500/month below the 2019 price and $400/month above the 2008 price.

Below inflation rent growth over a 12 yr span in downtown Toronto

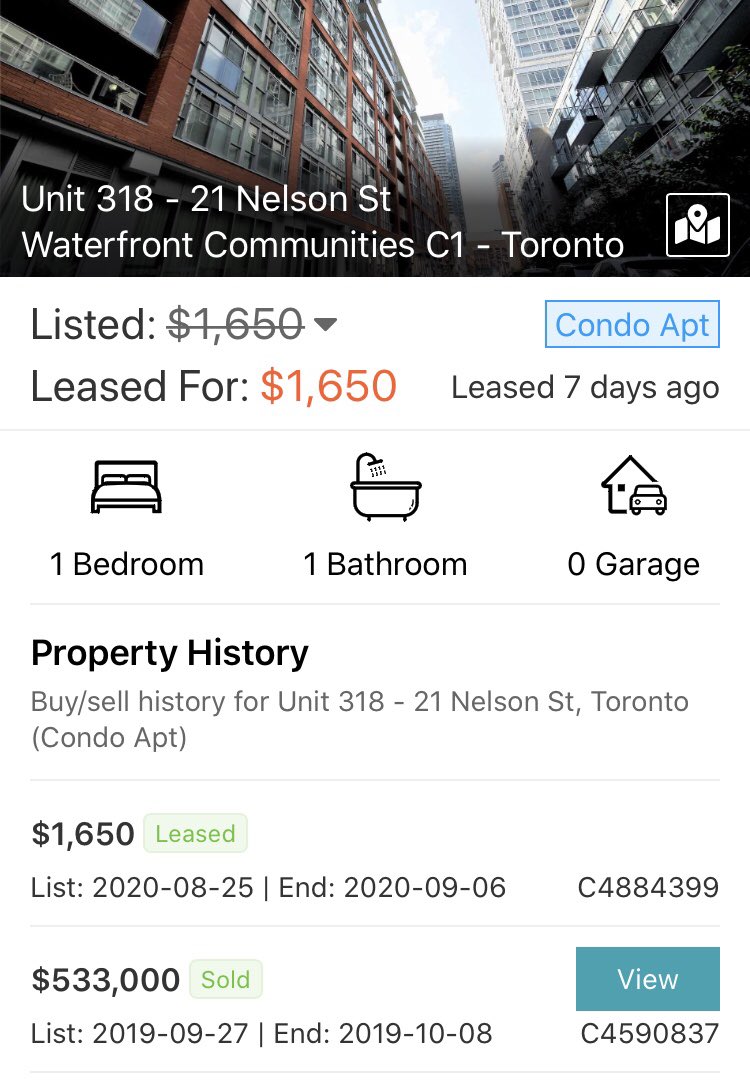

The Latest in Toronto rent

After being bought for $533K in 2019, this “investor” just leased the unit for $1650/month

Minimum $1100/month in negative cash flow, even with a 1.99% rate

Who can sustain $13K/year in negative cash flow in hopes of appreciation? (~1% of condo val)

After being bought for $533K in 2019, this “investor” just leased the unit for $1650/month

Minimum $1100/month in negative cash flow, even with a 1.99% rate

Who can sustain $13K/year in negative cash flow in hopes of appreciation? (~1% of condo val)

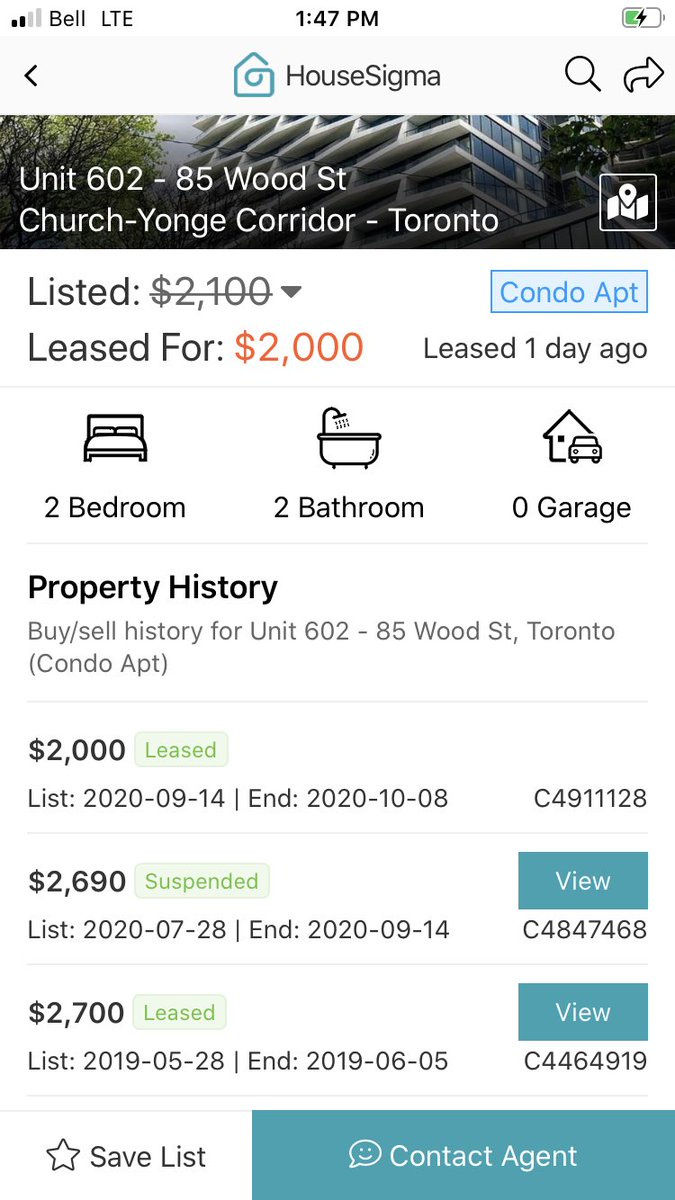

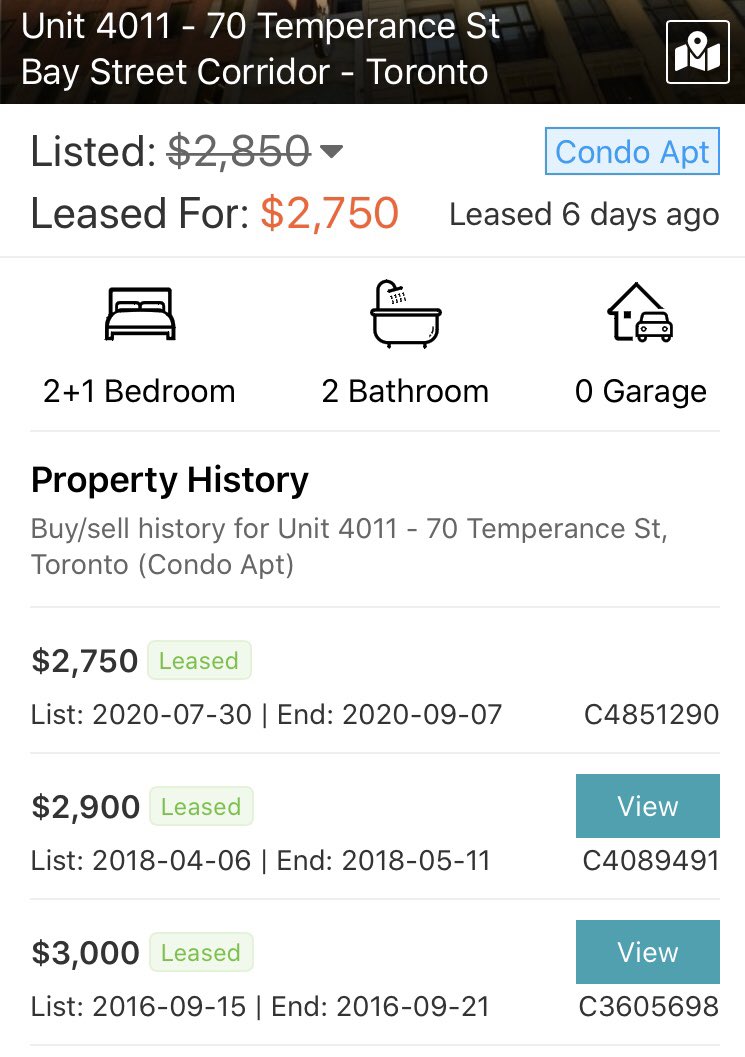

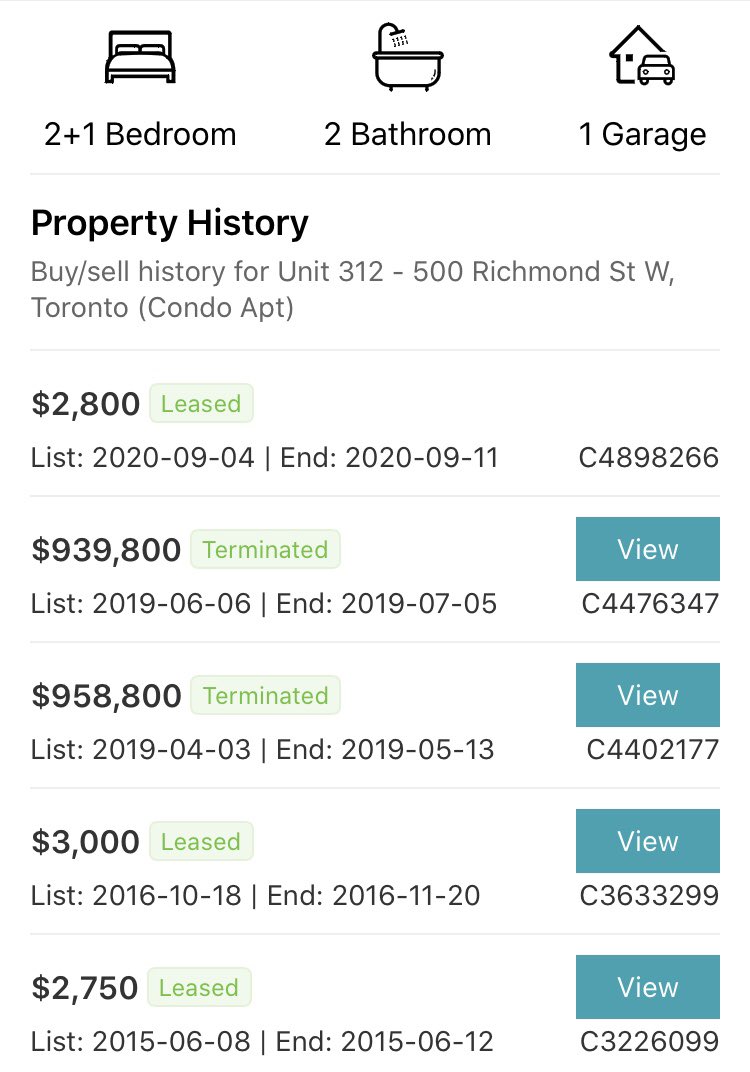

The Latest in Toronto Rents

After leasing this unit for $3000 2019, & attempting to lease this unit for last ~7 months..

This investor accepted the new reality & leased this unit for a paltry $100 above 2016 price & $200 below 2017 price

Below inflation rent growth

#cdnecon

After leasing this unit for $3000 2019, & attempting to lease this unit for last ~7 months..

This investor accepted the new reality & leased this unit for a paltry $100 above 2016 price & $200 below 2017 price

Below inflation rent growth

#cdnecon

The Latest in Toronto Rents

This unit was just recently leased for a paltry 10% above the 2013 leased price!

10% rent growth after 7 yrs is negative real rent growth while expenses to rise significantly > inflation

Welcome to the new Toronto rental landscape!

This unit was just recently leased for a paltry 10% above the 2013 leased price!

10% rent growth after 7 yrs is negative real rent growth while expenses to rise significantly > inflation

Welcome to the new Toronto rental landscape!

The Latest in Toronto Rents

After being vacant for over a month, this investor accepted the new Toronto rental reality and leased their unit for $250/month below the 2016 leased price.

After being vacant for over a month, this investor accepted the new Toronto rental reality and leased their unit for $250/month below the 2016 leased price.

The Latest in Toronto Rents

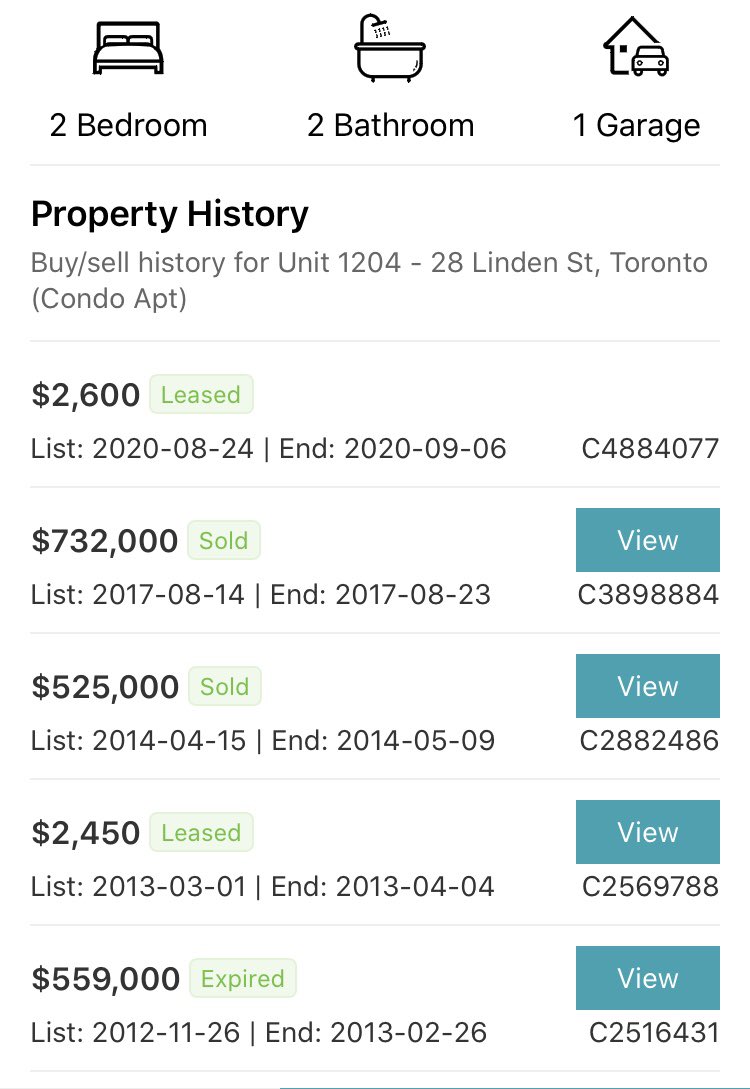

After purchasing this condo for $732K in 2017

This investor rented their unit for a mere $150 > 2013 leased price

Neg real rent growth after 7 yrs

This could be up to ~1500/month negative cash flow w a 1.99% rate & 20% down

Huge headwind #cdnecon

After purchasing this condo for $732K in 2017

This investor rented their unit for a mere $150 > 2013 leased price

Neg real rent growth after 7 yrs

This could be up to ~1500/month negative cash flow w a 1.99% rate & 20% down

Huge headwind #cdnecon

The Latest in Toronto Rents

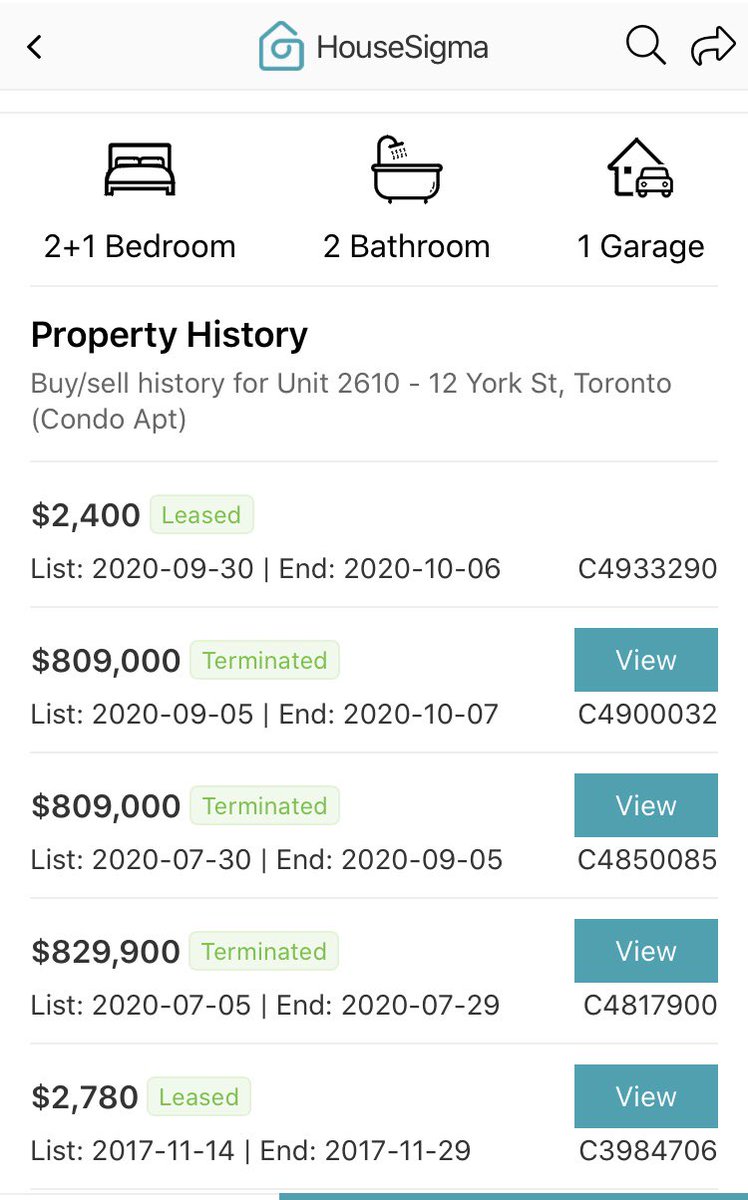

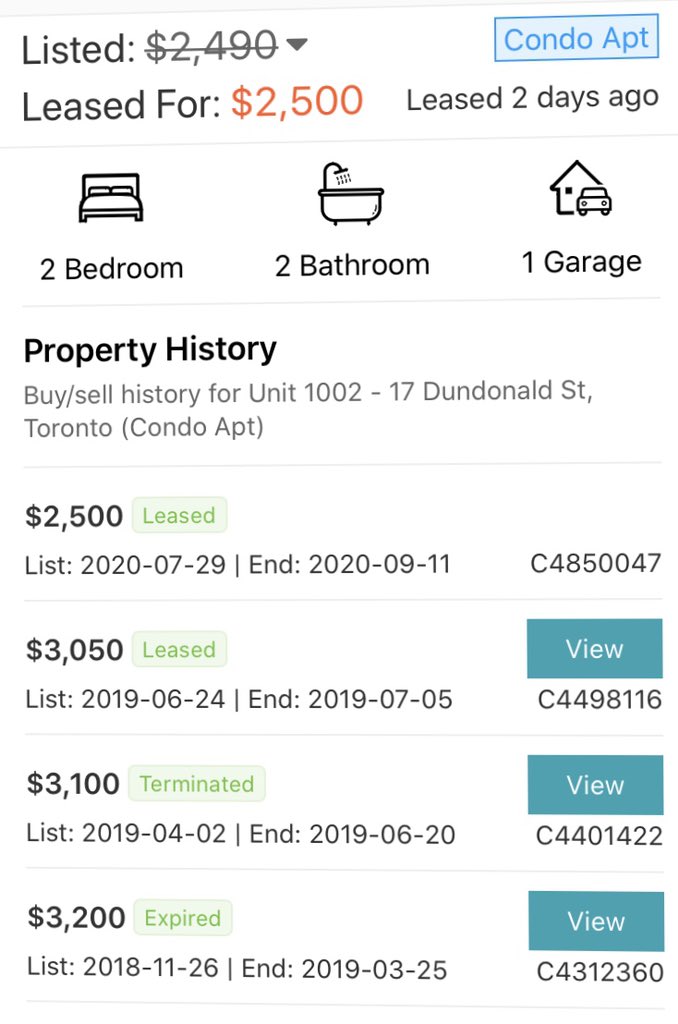

This investor accepted the new Toronto rental landscape & rented their unit for $550 (18%) below 2019 leased price

This is an instant increase of $6500/yr in neg cash flow

The significant fall in rents much more important than lower rates #cdnecon

This investor accepted the new Toronto rental landscape & rented their unit for $550 (18%) below 2019 leased price

This is an instant increase of $6500/yr in neg cash flow

The significant fall in rents much more important than lower rates #cdnecon

The Latest in Toronto Rents

This downtown condo was just leased for 21% ($450) below the 2018 rented price.

Not enough supply they said...

#cdnecon

This downtown condo was just leased for 21% ($450) below the 2018 rented price.

Not enough supply they said...

#cdnecon

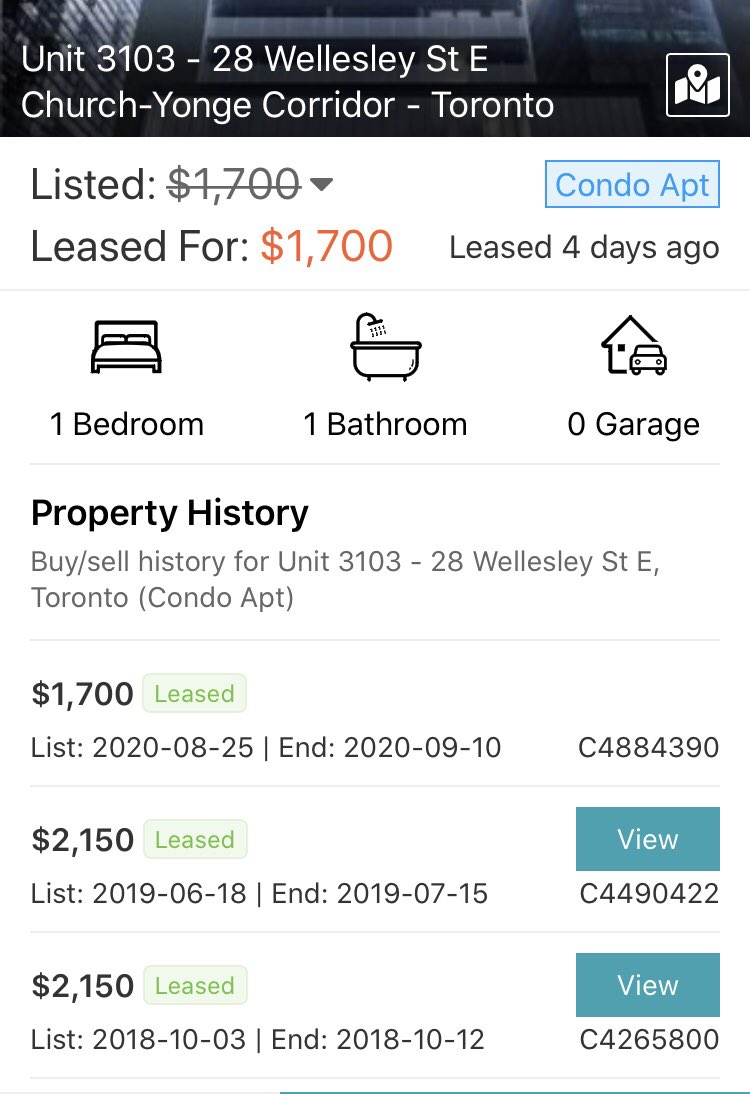

The Latest in Toronto Rents

This 2 bd condo was just rented for the same leased price as 2012 in desirable Yorkville

2012, yo!

Zero rent growth after 8 yrs, which equates to neg real rent growth with expenses rising > inflation

Not enough supply they said...

#cdnecon

This 2 bd condo was just rented for the same leased price as 2012 in desirable Yorkville

2012, yo!

Zero rent growth after 8 yrs, which equates to neg real rent growth with expenses rising > inflation

Not enough supply they said...

#cdnecon

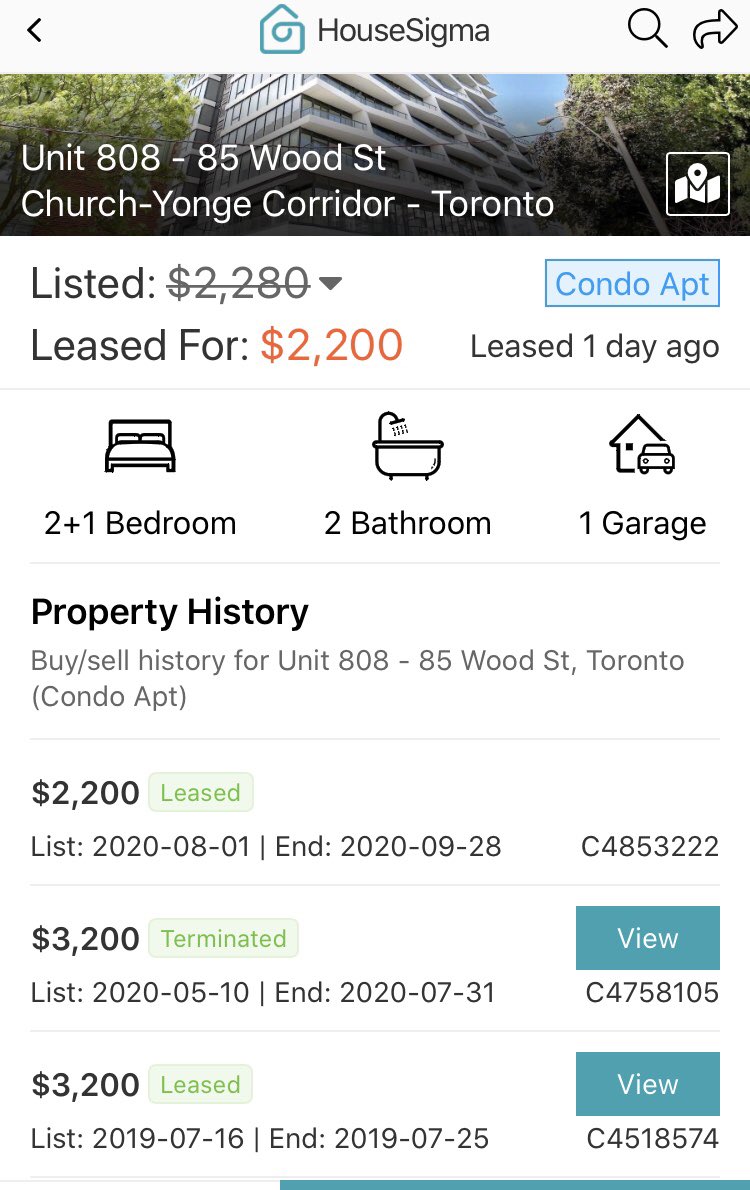

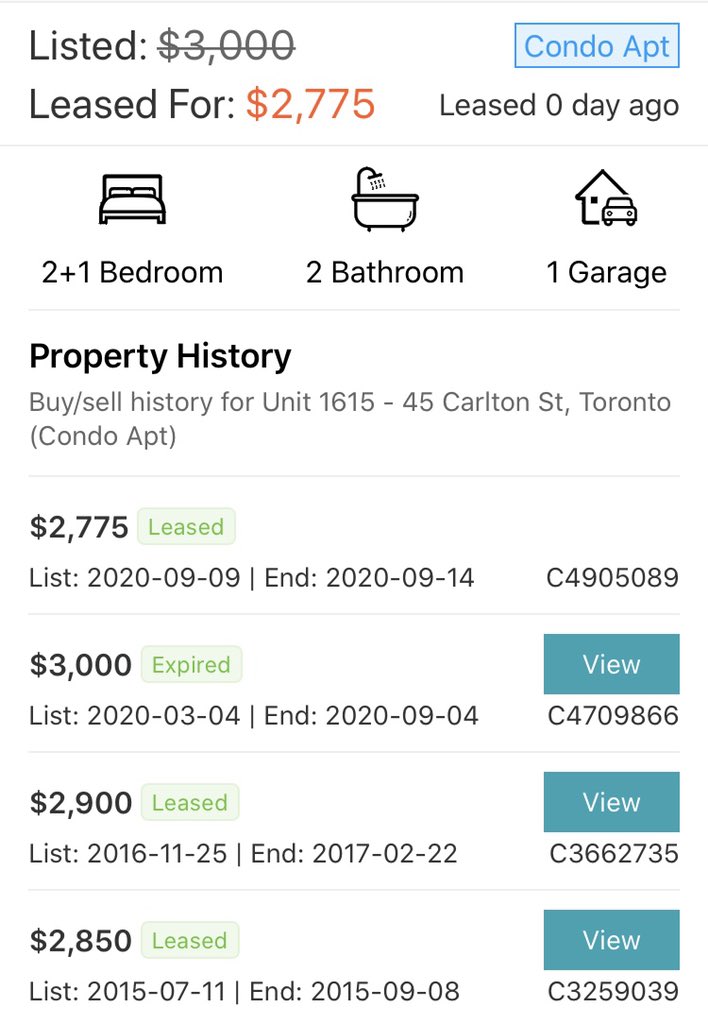

The Latest in Toronto Rents

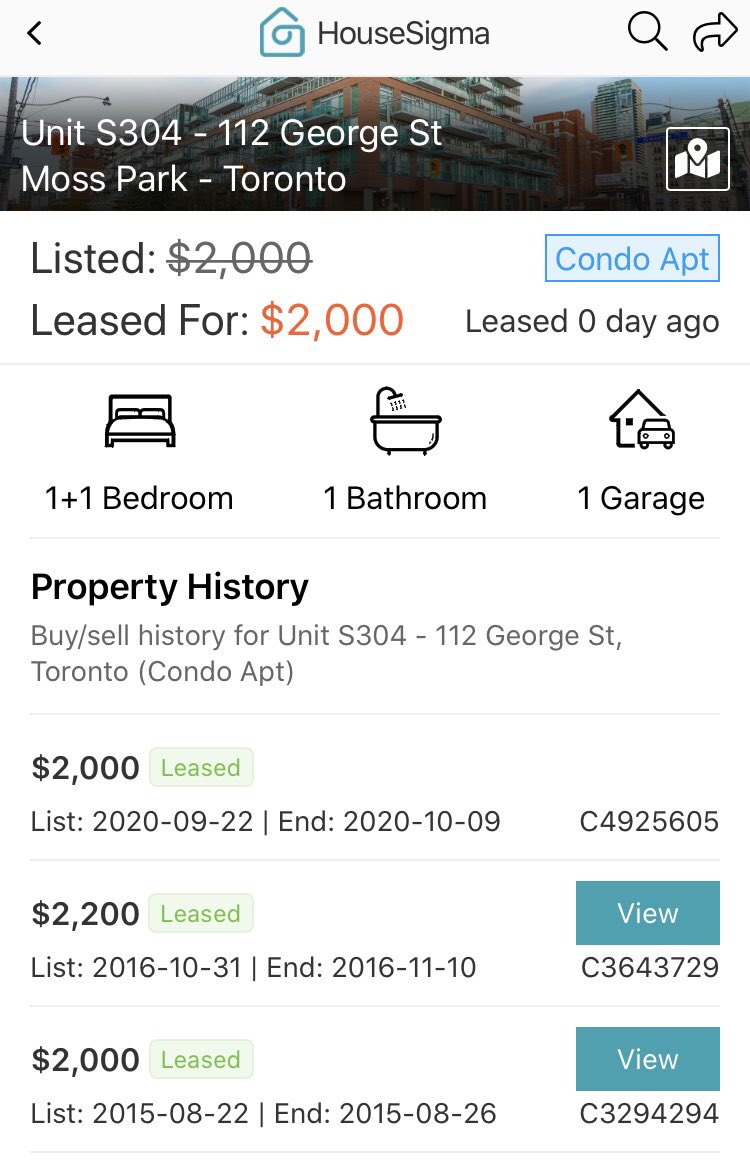

This 2+1 bd condo was just rented for slightly below 2015 leased price

The significant drop in rents is quite the blow to any condo investor of last few yrs as many were counting on rents to continue to rise to compensate for neg cash flow

#cdnecon

This 2+1 bd condo was just rented for slightly below 2015 leased price

The significant drop in rents is quite the blow to any condo investor of last few yrs as many were counting on rents to continue to rise to compensate for neg cash flow

#cdnecon

The Latest in Toronto Rents

After being on the market for 6 months, this investor begrudgingly accepted the new reality for Toronto rents & leased their unit for $450/month (15%) below the 2018 price.

#cdnecon

After being on the market for 6 months, this investor begrudgingly accepted the new reality for Toronto rents & leased their unit for $450/month (15%) below the 2018 price.

#cdnecon

The Latest in Toronto Rents

This 2 bd condo was just leased for $200/month below the 2016 rented price & slightly above the 2015 rented price

Consistently seeing about 4-5 yrs worth of rent growth being rolled back for Toronto condos

#cdnecon

This 2 bd condo was just leased for $200/month below the 2016 rented price & slightly above the 2015 rented price

Consistently seeing about 4-5 yrs worth of rent growth being rolled back for Toronto condos

#cdnecon

Zero rent growth after 4 years & neg real rent growth after 7 yrs

This isn’t a case of “when rates go up”

The gap between current rents & prices, caused by the rollback in rents, will be simply too much negative cash flow for investors to swallow

Low rates won’t help

#cdnecon

This isn’t a case of “when rates go up”

The gap between current rents & prices, caused by the rollback in rents, will be simply too much negative cash flow for investors to swallow

Low rates won’t help

#cdnecon

The Latest in Toronto Rents

This one is a wow!

It was just leased for a whopping $950 (27.5%) below the 2019 rented price, & was vacant for over 2 months before it was rented to boot!

This is also ~14% below the 2017 leased price, rolling rents all the way back

#cdnecon

This one is a wow!

It was just leased for a whopping $950 (27.5%) below the 2019 rented price, & was vacant for over 2 months before it was rented to boot!

This is also ~14% below the 2017 leased price, rolling rents all the way back

#cdnecon

The Latest in Toronto Rents

The condo was just leased for $50 above 2014 price & $400 below the 2018 price.

With the rollback in rents, it may be that overall real rental growth over last 5-6 yrs for Toronto condos is basically flat - just keeping up with inflation

#cdnecon

The condo was just leased for $50 above 2014 price & $400 below the 2018 price.

With the rollback in rents, it may be that overall real rental growth over last 5-6 yrs for Toronto condos is basically flat - just keeping up with inflation

#cdnecon

The Latest in Toronto Rents

This condo was just leased at a $530/month - 22% drop compared to 2019 - rolled back to ~2015

Neg real rent growth after 5 yrs while expenses rise > inflation

This is quite the blow for investors, especially when expectations were so high

#cdnecon

This condo was just leased at a $530/month - 22% drop compared to 2019 - rolled back to ~2015

Neg real rent growth after 5 yrs while expenses rise > inflation

This is quite the blow for investors, especially when expectations were so high

#cdnecon

The Latest in Toronto Rents

This condo was rented for $100 below the 2016 price.

Rents being rolled back to 2015 nominal prices here, which means this condo has had negative real rent growth over the last 6-8 yrs.

Not enough supply they said.

#cdnecon

This condo was rented for $100 below the 2016 price.

Rents being rolled back to 2015 nominal prices here, which means this condo has had negative real rent growth over the last 6-8 yrs.

Not enough supply they said.

#cdnecon

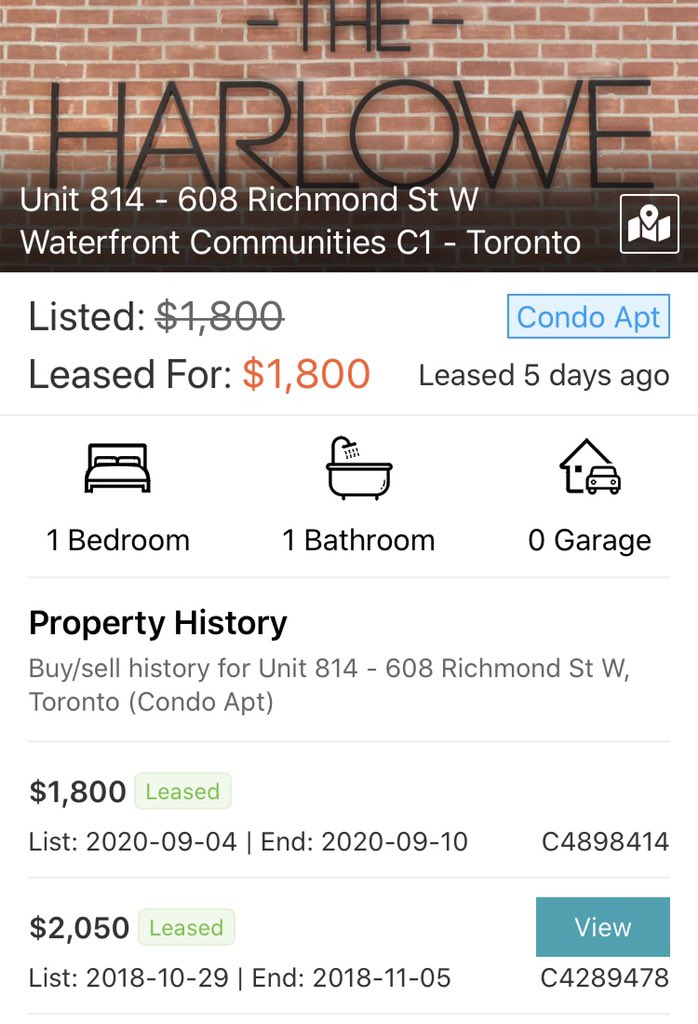

The Latest in Toronto Rents

It’s “The Harlowe”

Being leased for $350 (17%) below the 2018 leased price.

You can’t lose if you don’t sell he said.

#cdnecon

It’s “The Harlowe”

Being leased for $350 (17%) below the 2018 leased price.

You can’t lose if you don’t sell he said.

#cdnecon

After a 2 month vacancy, this condo was leased for a 23.5% drop($550/month) compared to 2019

New condo investors should be made aware

Unless you’re able to sustain 2-3% of the condos value in annual neg cash flow ($1000/month+), don’t even bother or asking for trouble

#cdnecon

New condo investors should be made aware

Unless you’re able to sustain 2-3% of the condos value in annual neg cash flow ($1000/month+), don’t even bother or asking for trouble

#cdnecon

This condo was just rented for $600 (23%) below 2019 price & ~17% below the 2018 rented price

After purchasing this condo for $650K in 2019, this investors pocket will literally be on https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> from all the neg cash flow ( > $1000/month neg cash flow assume 20% down & 1.99%)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> from all the neg cash flow ( > $1000/month neg cash flow assume 20% down & 1.99%)

#cdnecon

After purchasing this condo for $650K in 2019, this investors pocket will literally be on

#cdnecon

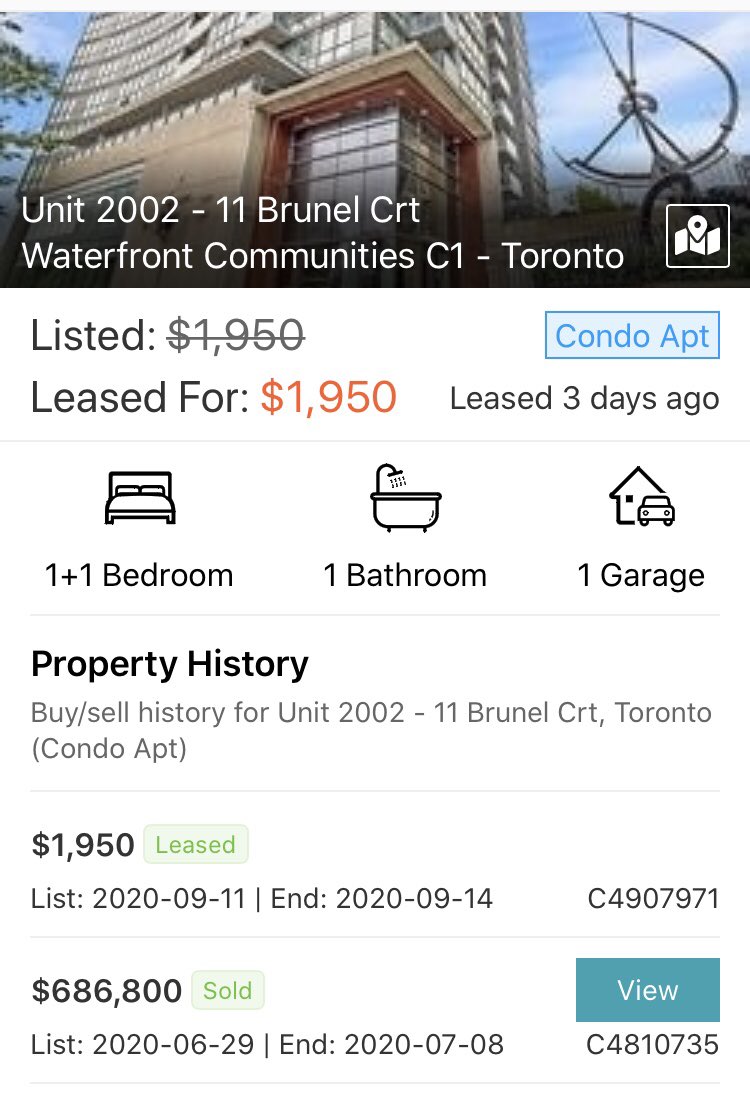

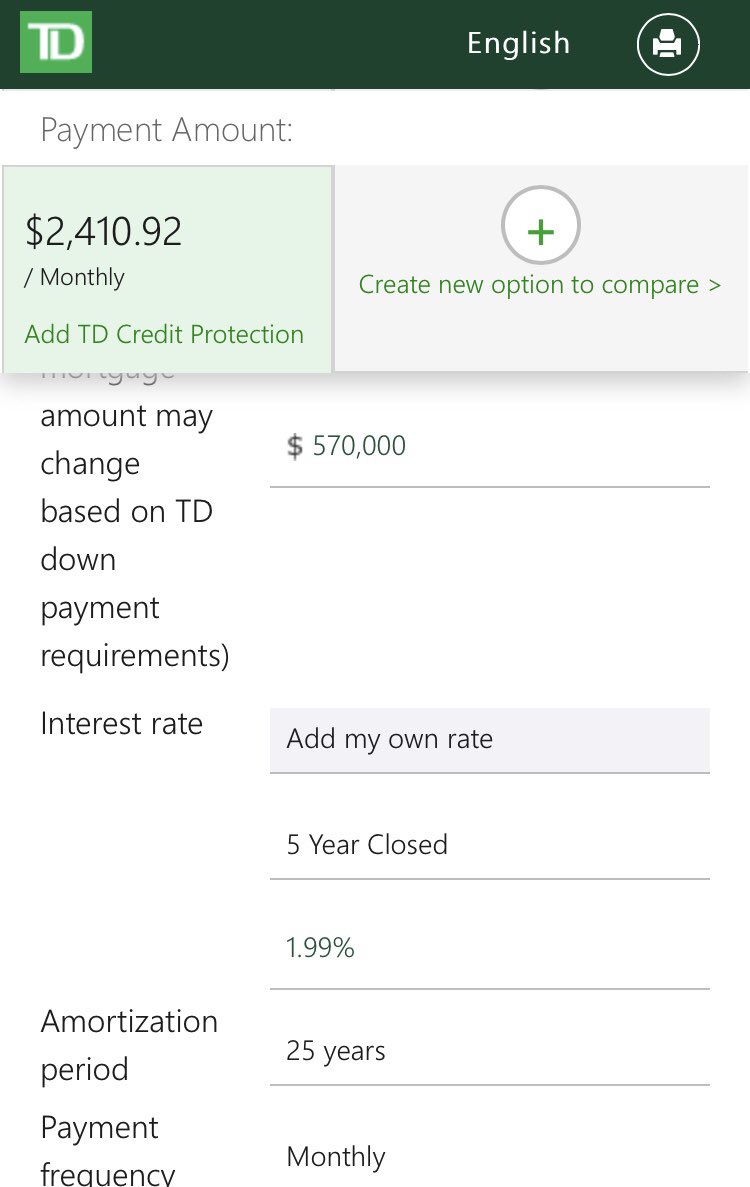

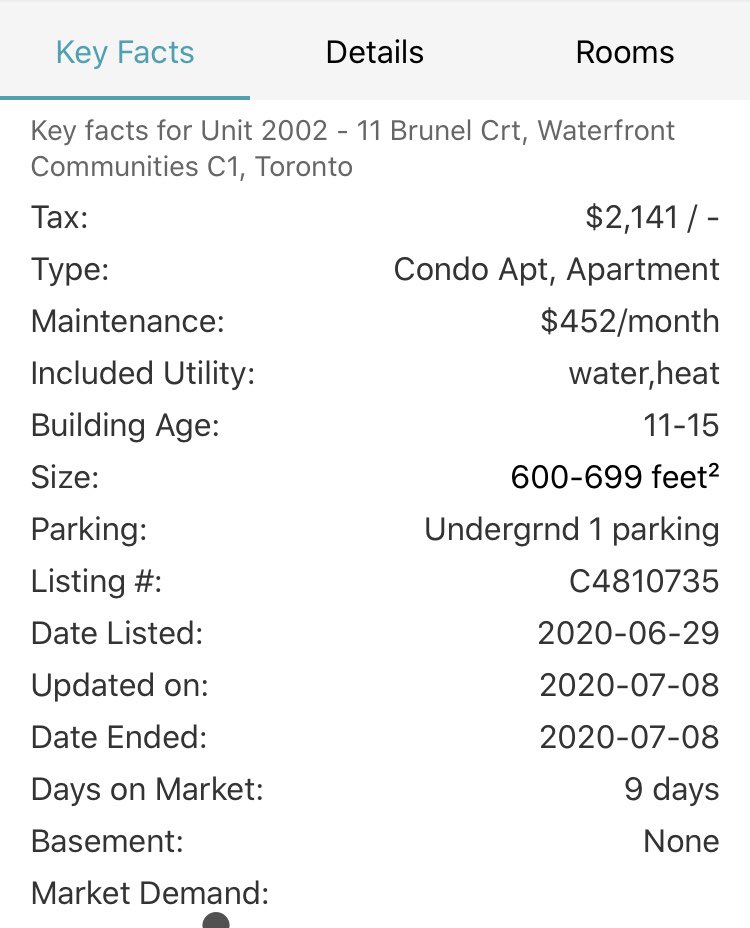

This unit was just recently purchased for ~689K & leased for $1950/month

Assume 20% down & 1.99% rate

The condo will sustain $1350/month in negative cash flow

A whopping $16K/yr or 2.35% of the condos value in annual neg cash flow

Brand new world of condo investing!

#cdnecon

Assume 20% down & 1.99% rate

The condo will sustain $1350/month in negative cash flow

A whopping $16K/yr or 2.35% of the condos value in annual neg cash flow

Brand new world of condo investing!

#cdnecon

This Toronto condo was recently purchased for $695K

The investor is easily ~$1400/month negative cash flow or > 16K/yr - (assume 20% & 1.99% rate)

After 5 yrs this investor will have lost > 12% of condos value to negative cash flow alone

How can this be sustainable?

#cdnecon

The investor is easily ~$1400/month negative cash flow or > 16K/yr - (assume 20% & 1.99% rate)

After 5 yrs this investor will have lost > 12% of condos value to negative cash flow alone

How can this be sustainable?

#cdnecon

The Latest in Toronto Rents

This condo was just leased for a whopping $900 below the 2018 leased price.

Revenue just plummeted 32%

The kicker is that it still took a month to lease out after taking a massive haircut

#cdnecon

This condo was just leased for a whopping $900 below the 2018 leased price.

Revenue just plummeted 32%

The kicker is that it still took a month to lease out after taking a massive haircut

#cdnecon

The Latest in Toronto Rents

This condo was just leased for ~20% below the 2018 rented price & even below 2016 price

Rents being rolled back to 2015 levels here

With a 5 yr roll back in rents, likely means 7-8 yrs of neg real rent in the world class city of Toronto

#cdnecon

This condo was just leased for ~20% below the 2018 rented price & even below 2016 price

Rents being rolled back to 2015 levels here

With a 5 yr roll back in rents, likely means 7-8 yrs of neg real rent in the world class city of Toronto

#cdnecon

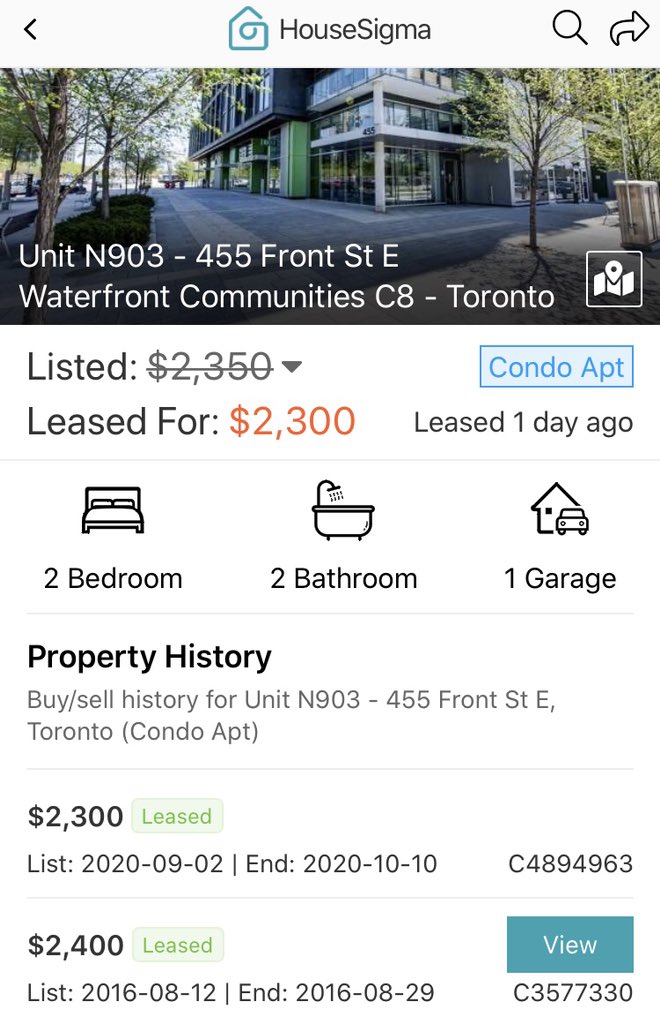

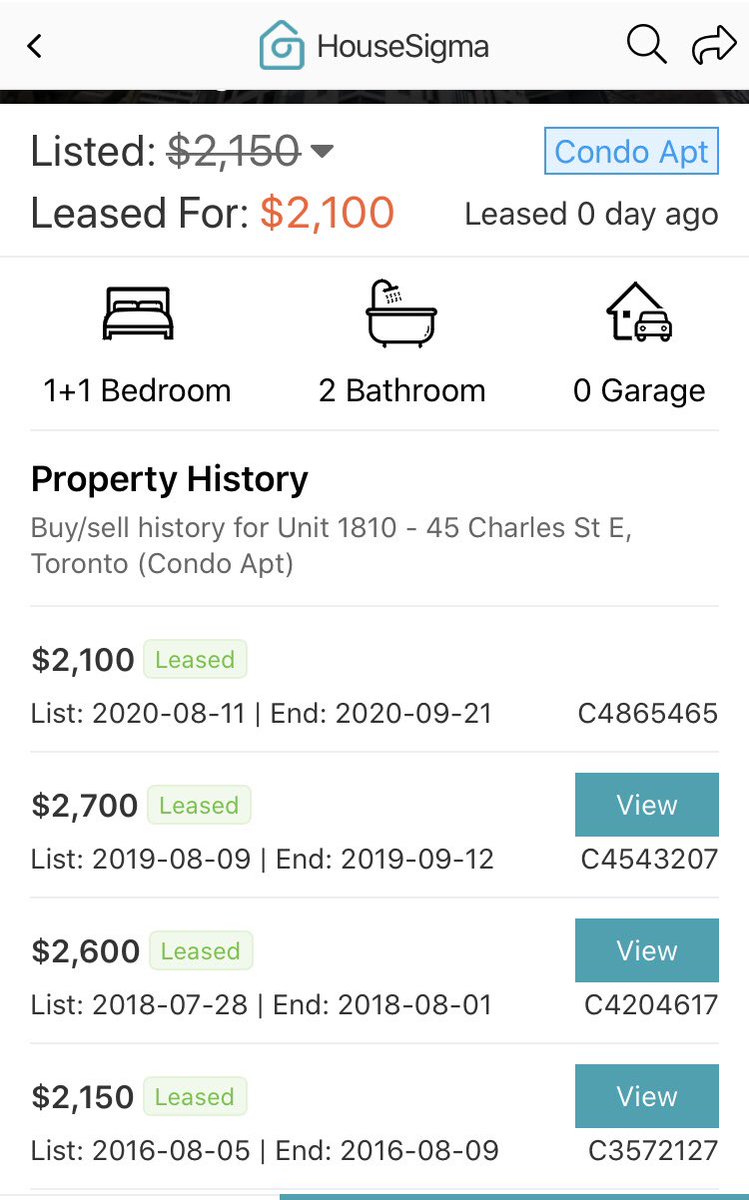

The Latest in Toronto Rents

Leased for $2700 in 2019

Leased for $2600 in 2018

Leased for $2150 in 2016

Drumroll pls..

After > month vacancy was just leased for $2100 or 22% below 2019 peak

About a ~5 yr roll back in rent here

Neg real rent growth over a 7-8 span

#cdnecon

Leased for $2700 in 2019

Leased for $2600 in 2018

Leased for $2150 in 2016

Drumroll pls..

After > month vacancy was just leased for $2100 or 22% below 2019 peak

About a ~5 yr roll back in rent here

Neg real rent growth over a 7-8 span

#cdnecon

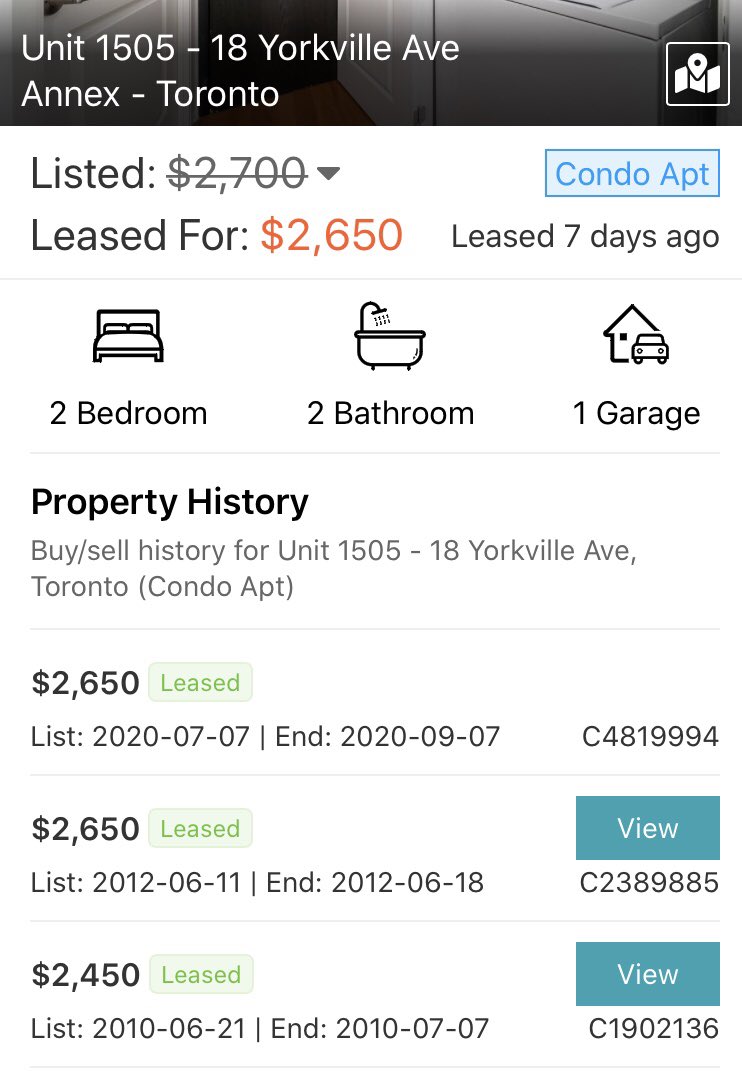

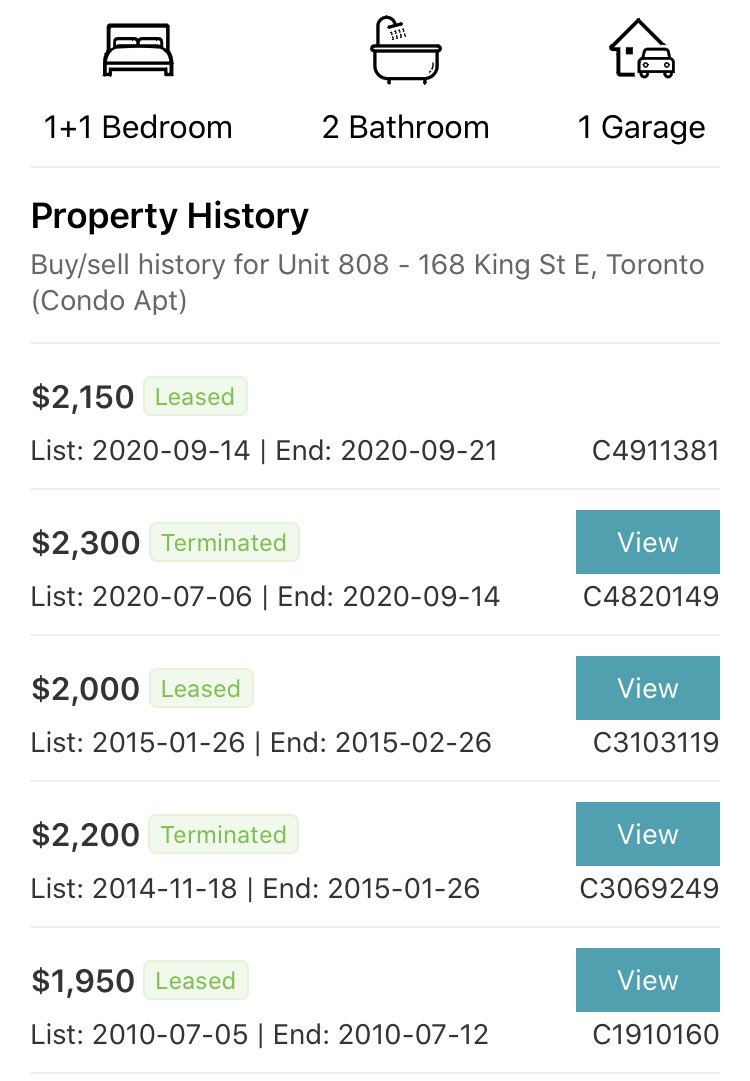

The condo is this example has essentially had neg real rent growth over a 10 yr span.

With the recent roll back in rents - think it’s safe to say majority of Toronto condos have now had negative real rent growth over last 5-7 yrs.

And this during an epic condo boom

#cdnecon

With the recent roll back in rents - think it’s safe to say majority of Toronto condos have now had negative real rent growth over last 5-7 yrs.

And this during an epic condo boom

#cdnecon

The Latest in Toronto Rents

This one is a WOW! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

This unit was just leased for slight below the 2012 rented price!!

A massive ~30% drop in revenue from the 2019 peak

This means over a decade of neg real rent growth during an epic condo boom in a world class city

#cdnecon

This one is a WOW!

This unit was just leased for slight below the 2012 rented price!!

A massive ~30% drop in revenue from the 2019 peak

This means over a decade of neg real rent growth during an epic condo boom in a world class city

#cdnecon

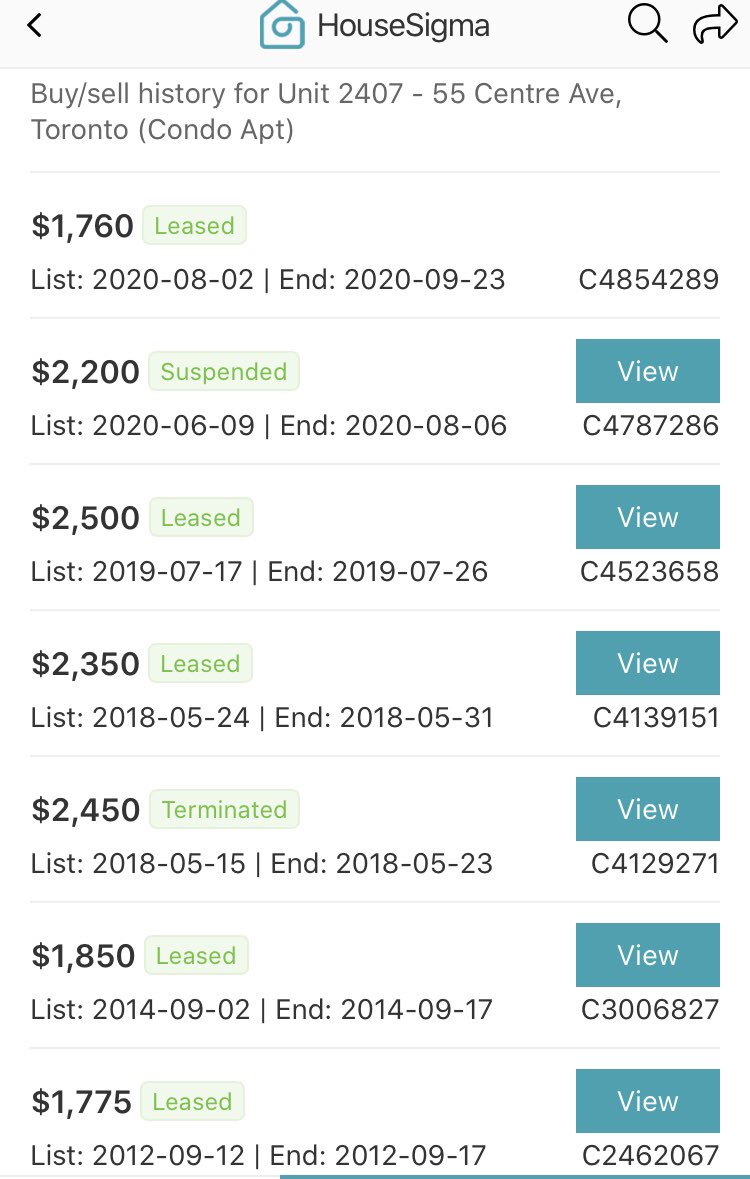

The Latest in Toronto Rents

Just another ~27% drop in revenue

What does a 20-30% drop in rents means for investors where the cap rate was already compressed to begin with.

So what if cap rates go from 2% to l%, we live in a world class city and prices going https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">

#cdnecon

Just another ~27% drop in revenue

What does a 20-30% drop in rents means for investors where the cap rate was already compressed to begin with.

So what if cap rates go from 2% to l%, we live in a world class city and prices going

#cdnecon

Current status of Toronto Rents -> Free Falling

This investor accepted the new Toronto rental reality & took a massive haircut of $1000/month or a 30% drop in revenue

Who would have thought neg cash flow may be the prick that bursts the bubble!

Low rates don’t help!

#cdnecon

This investor accepted the new Toronto rental reality & took a massive haircut of $1000/month or a 30% drop in revenue

Who would have thought neg cash flow may be the prick that bursts the bubble!

Low rates don’t help!

#cdnecon

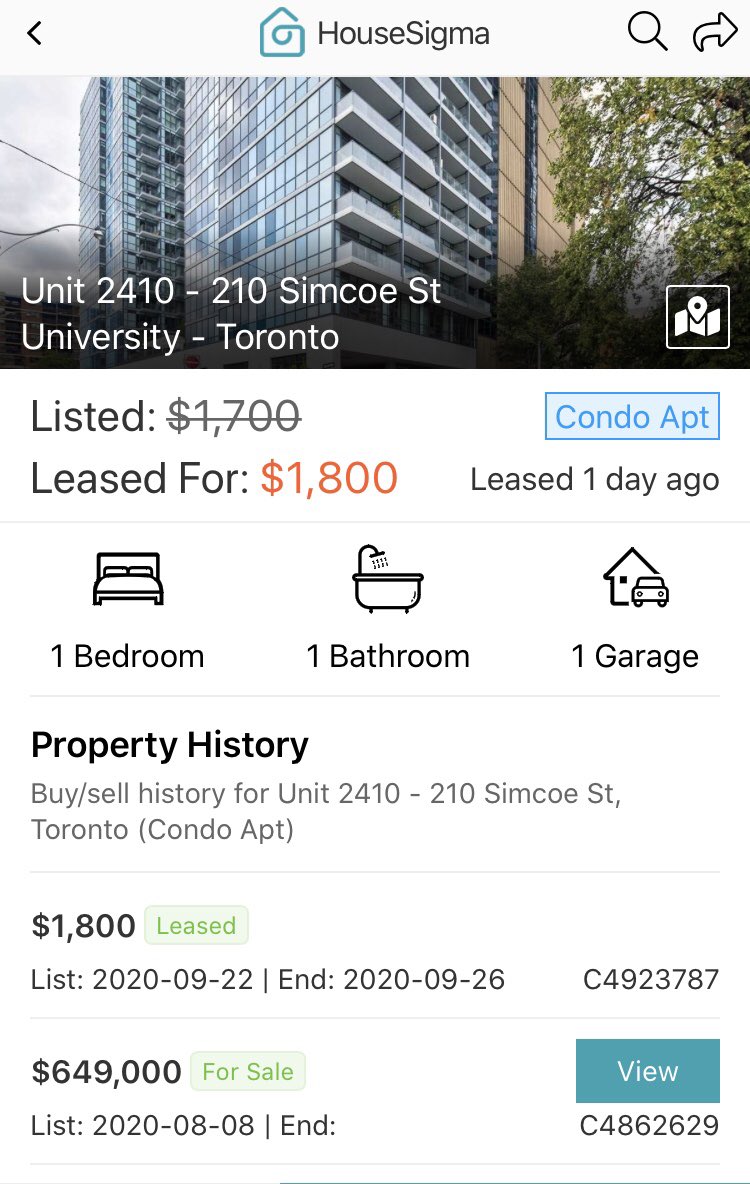

The Latest on Toronto Rents

This condo was just leased for slightly below the 2014 rented price!

A 6 yr roll back in rents.

This would mean a decade of negative real rent growth in a world class city

Not enough supply they said.

#cdnecon

This condo was just leased for slightly below the 2014 rented price!

A 6 yr roll back in rents.

This would mean a decade of negative real rent growth in a world class city

Not enough supply they said.

#cdnecon

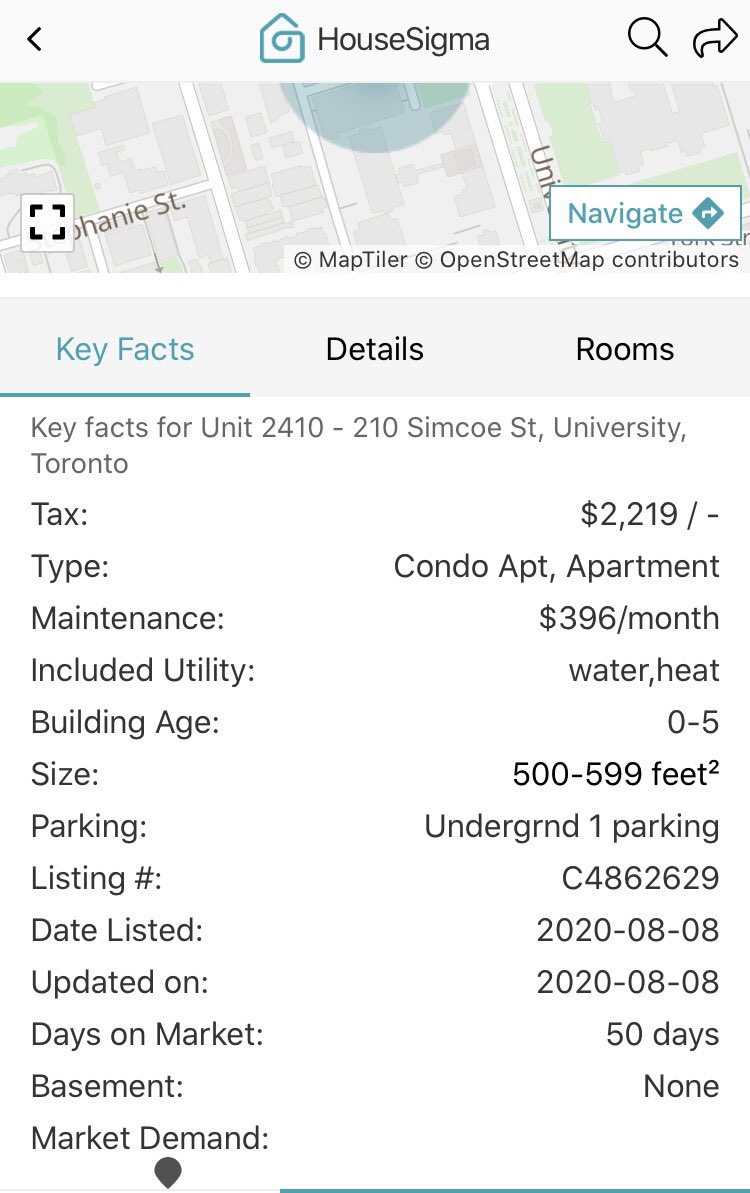

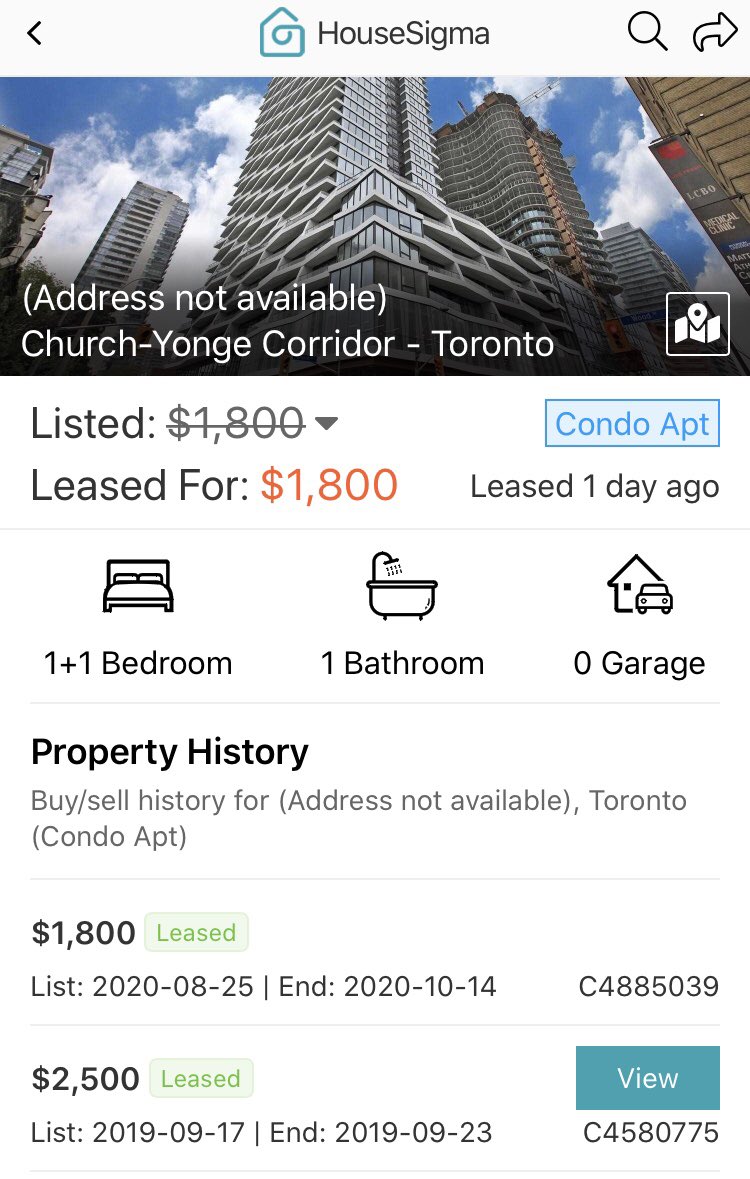

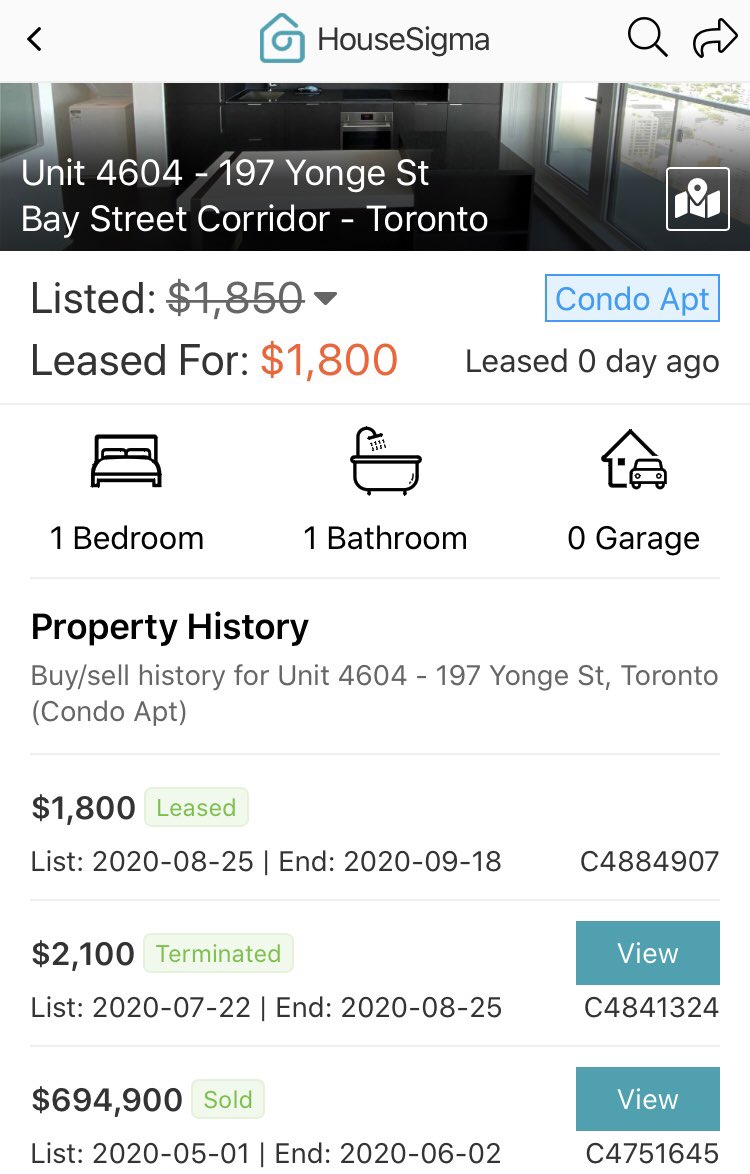

Good luck getting the #’s to work on this “investment”

Bought for $649K, leased for $1800

Assume 20% down & 1.89% rate

Mtg pmt + maintenance + prop tax

2237 + 396 + 185 + ins + vacancy/clean up

~$3000/mon cost to carry

$1100-1200/mon neg cash flow with no prop mgr

#cdnecon

Bought for $649K, leased for $1800

Assume 20% down & 1.89% rate

Mtg pmt + maintenance + prop tax

2237 + 396 + 185 + ins + vacancy/clean up

~$3000/mon cost to carry

$1100-1200/mon neg cash flow with no prop mgr

#cdnecon

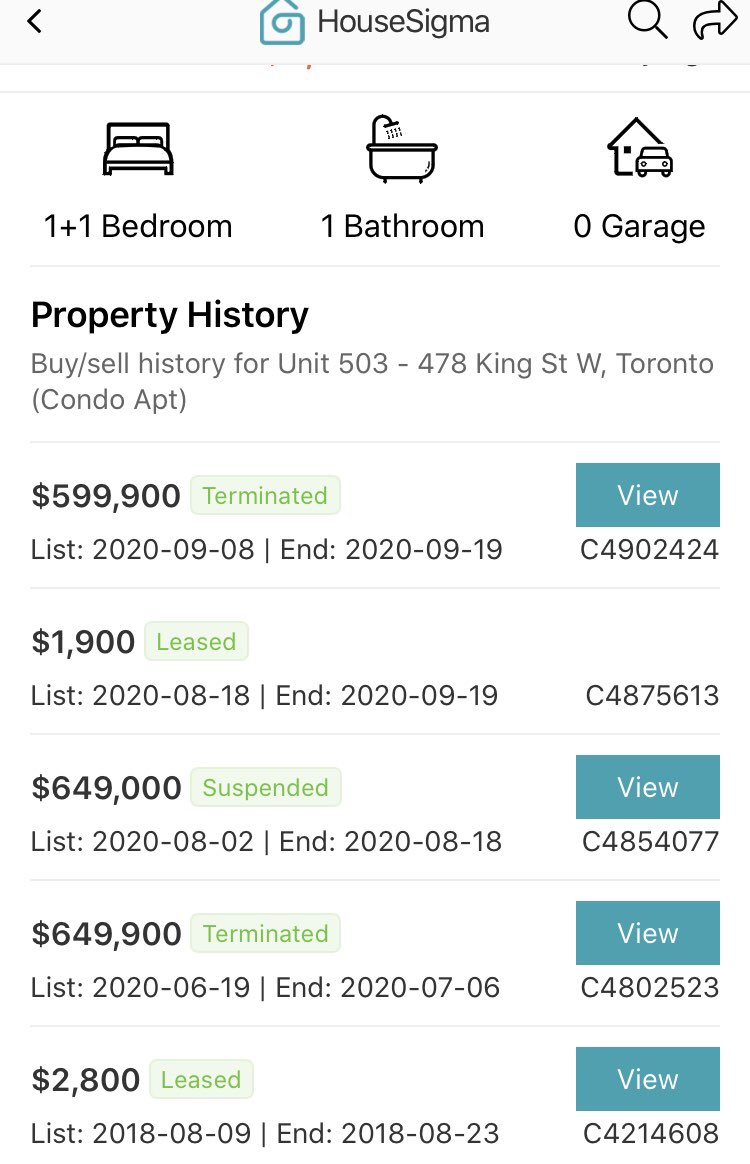

The Latest in Toronto Rents

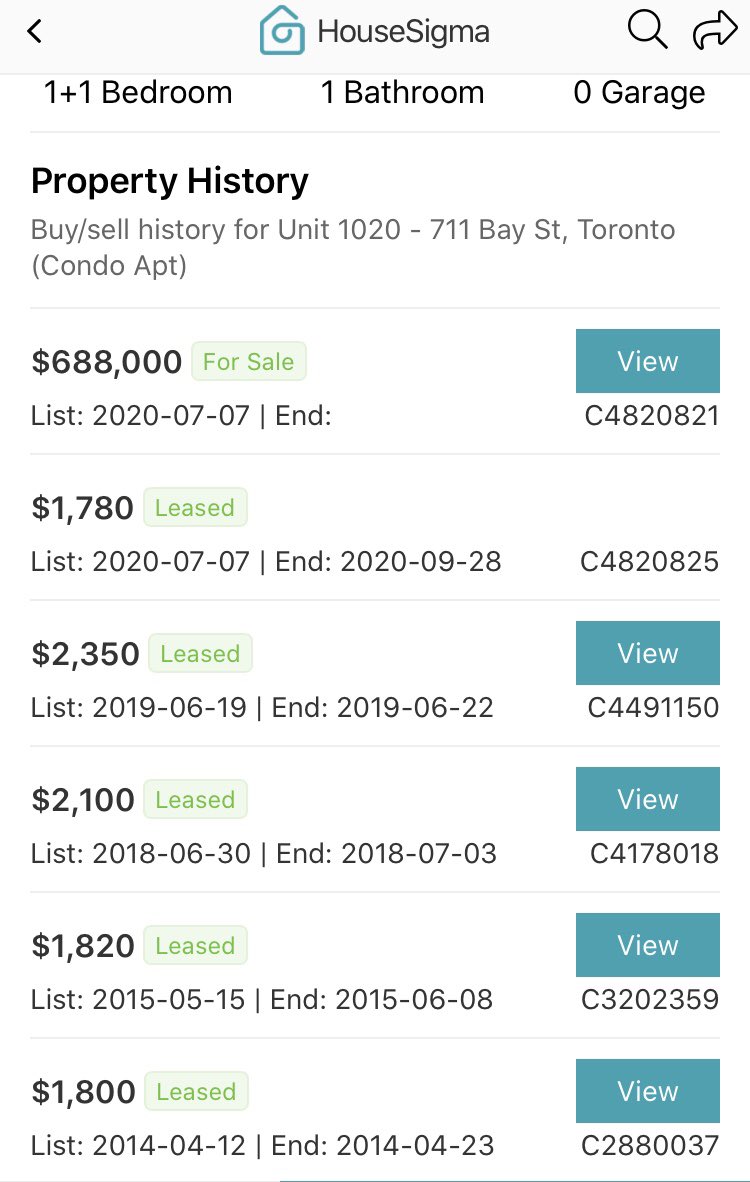

After a 3 month vacancy this 1+1 bd unit was finally leased for slightly below the 2014 price

This investor now trying to find a baggie for this $1500/month negative cash flow investment @BagholderQuotes

A 6 year roll back in rents here!

#cdnecon

After a 3 month vacancy this 1+1 bd unit was finally leased for slightly below the 2014 price

This investor now trying to find a baggie for this $1500/month negative cash flow investment @BagholderQuotes

A 6 year roll back in rents here!

#cdnecon

The Latest in Toronto Rents

Another 2 bd unit seeing a $1000/month drop in rents.

Seeing pretty consistently now investors taking 20-30% haircuts on revenue

Important to note many of these investors were already neg cash flow & had high expectations for rents rising

#cdnecon

Another 2 bd unit seeing a $1000/month drop in rents.

Seeing pretty consistently now investors taking 20-30% haircuts on revenue

Important to note many of these investors were already neg cash flow & had high expectations for rents rising

#cdnecon

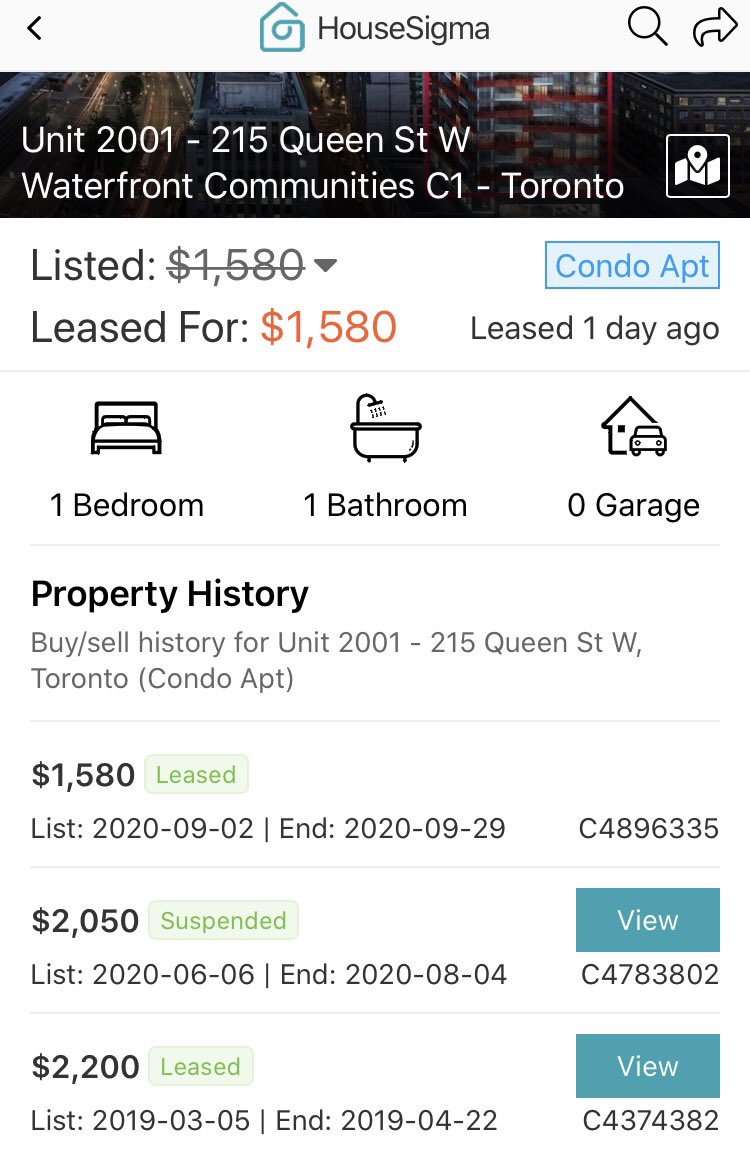

The Latest in Toronto Rents

This 1 bd condo saw it’s rent drop from $2200, all the way down to $1580

A 28% drop in revenue for this investor

#cdnecon

This 1 bd condo saw it’s rent drop from $2200, all the way down to $1580

A 28% drop in revenue for this investor

#cdnecon

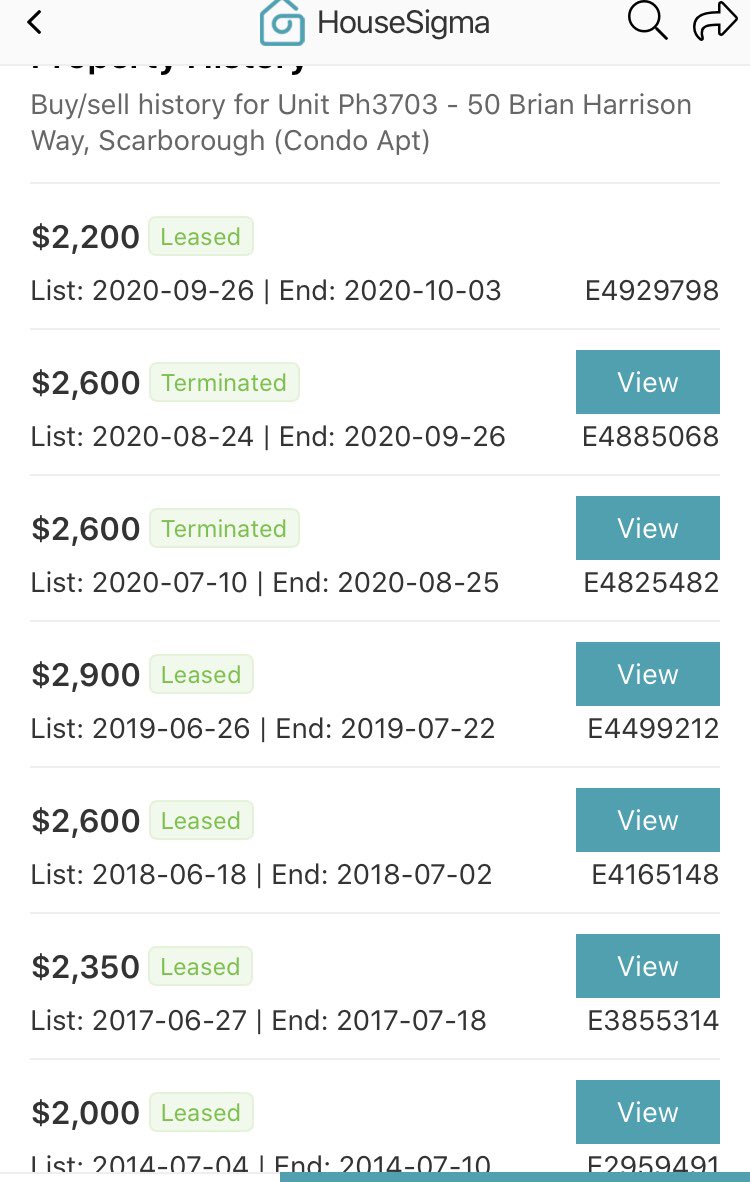

The Latest in Toronto Rents

This 2+1 condo was just leased at a $900 discount (24%) to the 2019 leased price, and just 10% above the 2014 rented price.

Essentially a decade of negative real rent growth coupled with expenses that will be rising much > inflation

#cdnecon

This 2+1 condo was just leased at a $900 discount (24%) to the 2019 leased price, and just 10% above the 2014 rented price.

Essentially a decade of negative real rent growth coupled with expenses that will be rising much > inflation

#cdnecon

The Latest in Toronto Rents

This investor accepted the new Toronto rental reality, after a 2 month vacancy, and leased this unit at a 23% ($650 month) discount to the 2019 rented price,also below the 2017 price

Would say this unit was rented at 2014-2015 rental rates

#cdnecon

This investor accepted the new Toronto rental reality, after a 2 month vacancy, and leased this unit at a 23% ($650 month) discount to the 2019 rented price,also below the 2017 price

Would say this unit was rented at 2014-2015 rental rates

#cdnecon

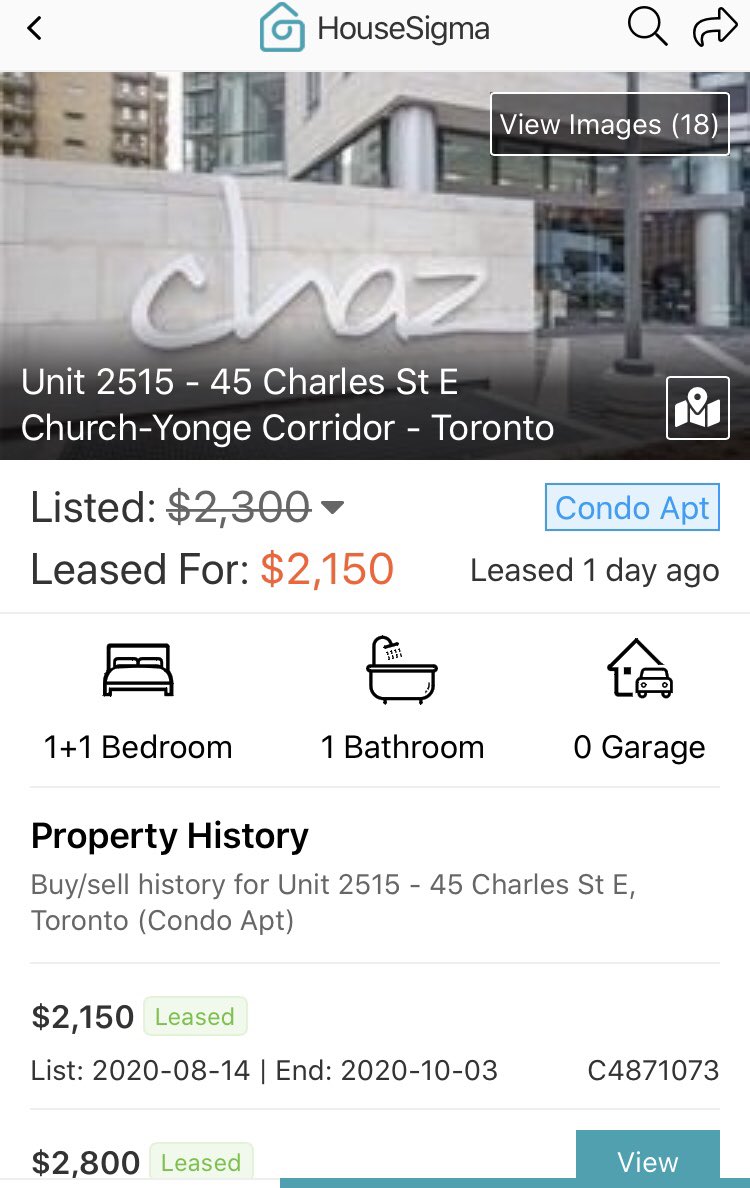

The Latest in Toronto Rents

This 1 bd condo was just leased for $1795 with parking included.

Tracking negative real rent growth since 2013 with expenses continuing to rise > inflation.

So what’s the bull thesis for condos?

#cdnecon

This 1 bd condo was just leased for $1795 with parking included.

Tracking negative real rent growth since 2013 with expenses continuing to rise > inflation.

So what’s the bull thesis for condos?

#cdnecon

The Latest in Toronto Rents

This 1+1 was just leased at the exact same price as 2014!!

Any hopes of a neg cash flow condo turning positive has not only dissipated, but investors are now doubling down on amt of neg cash flow they incur

What a tough pill to swallow!

#cdnecon

This 1+1 was just leased at the exact same price as 2014!!

Any hopes of a neg cash flow condo turning positive has not only dissipated, but investors are now doubling down on amt of neg cash flow they incur

What a tough pill to swallow!

#cdnecon

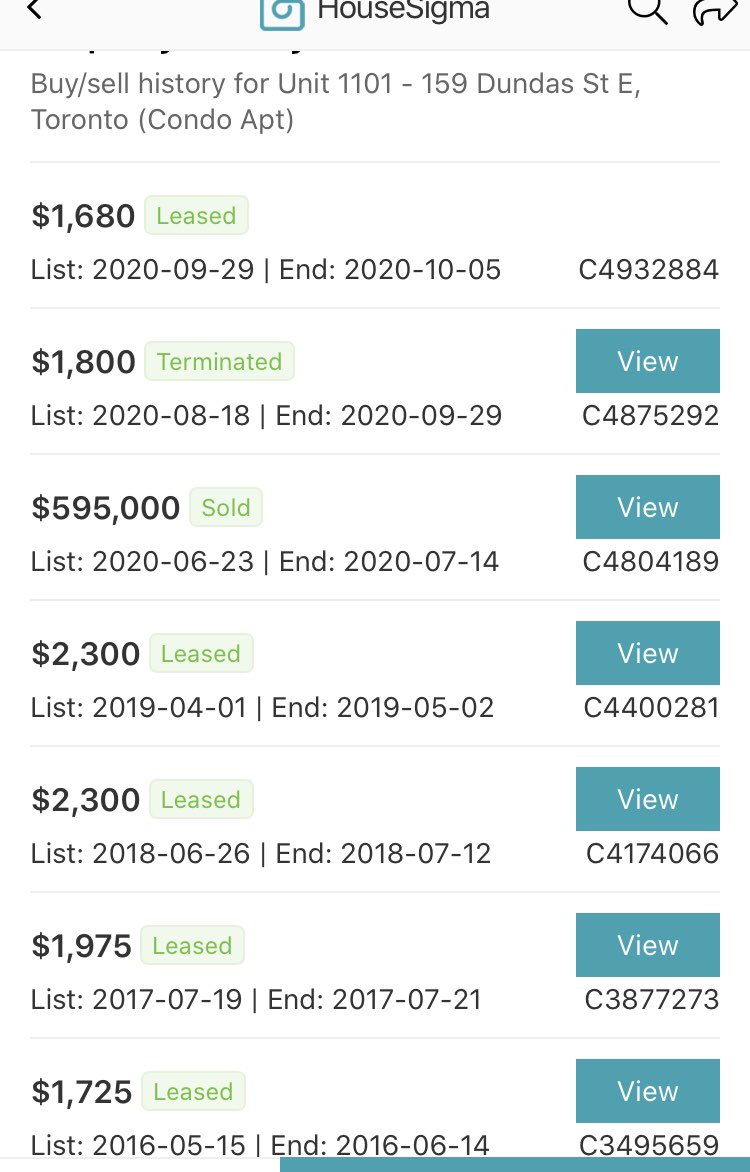

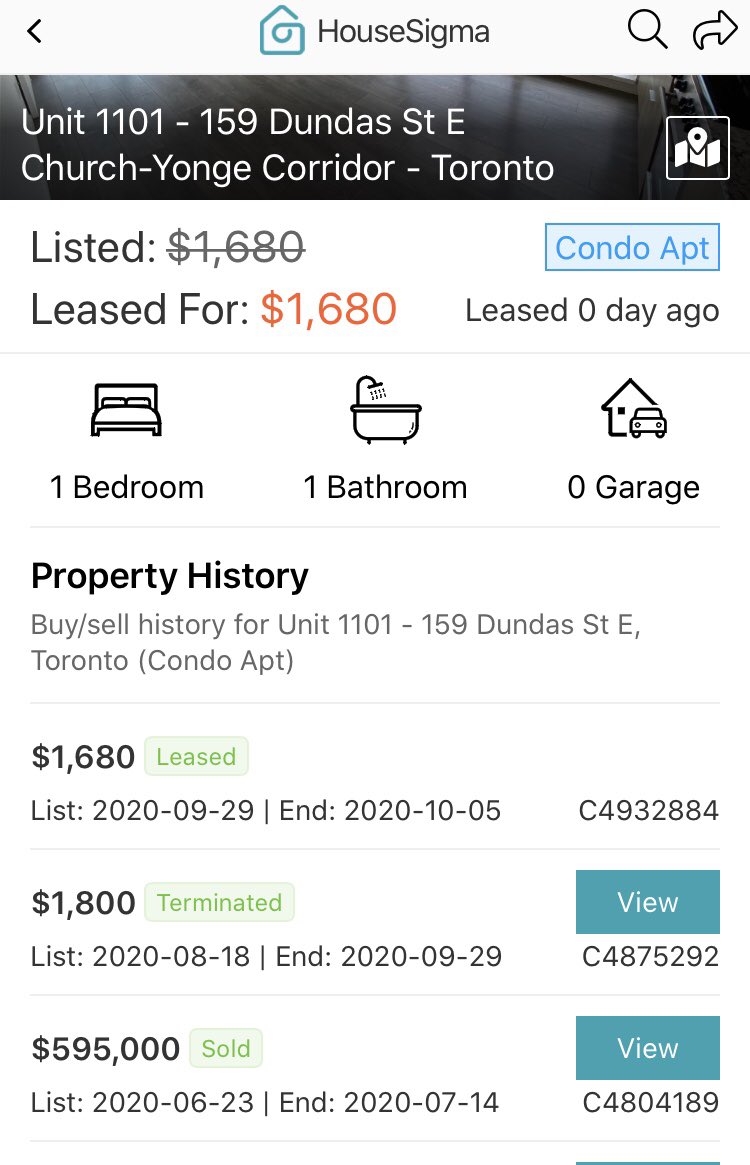

An $800/month haircut for this 2 bd condo with a 440 sq ft terrace in the heart of downtown

A corner unit too with lots of sunlight and it still took ~2 months to rent which means there’s more downside room for rents to fall further

25-30% rent drops becoming norm now

#cdnecon

A corner unit too with lots of sunlight and it still took ~2 months to rent which means there’s more downside room for rents to fall further

25-30% rent drops becoming norm now

#cdnecon

The Latest in Toronto Rents

A very well lit SW corner unit being leased at a $720 discount to the 2019 peak price & below the 2016 rented price

A whopping 31% reduction for this unit with locker & parking included

#cdnecon

A very well lit SW corner unit being leased at a $720 discount to the 2019 peak price & below the 2016 rented price

A whopping 31% reduction for this unit with locker & parking included

#cdnecon

The Latest in Toronto Rents

This luxury 2+1 bd condo was just leased at a $380 discount to the 2017 rented price, with locker & parking incl, after several botched attempts to find a baggie for $800K

Likely rolling this condo back to 2014 levels.

#cdnecon

This luxury 2+1 bd condo was just leased at a $380 discount to the 2017 rented price, with locker & parking incl, after several botched attempts to find a baggie for $800K

Likely rolling this condo back to 2014 levels.

#cdnecon

The Latest in Toronto Rents

This 1 bd condo (parking included) was just leased at a $600/month (26%) discount from the 2018 rented price, which means likely a $30% drop from peak.

25-30% drop in rents becoming a lot more common place.

#cdnecon

This 1 bd condo (parking included) was just leased at a $600/month (26%) discount from the 2018 rented price, which means likely a $30% drop from peak.

25-30% drop in rents becoming a lot more common place.

#cdnecon

The Latest in Toronto Rents

This 2 bd condo was just leased at the same rate as 2015

A 5 year roll back in rents here.

5 yrs of 0% rent growth while expenses rise much > inflation

#cdnecon

This 2 bd condo was just leased at the same rate as 2015

A 5 year roll back in rents here.

5 yrs of 0% rent growth while expenses rise much > inflation

#cdnecon

The Latest in Toronto rents

This 2 bd condo was also just leased for $2000/month

A $700/month (26%) drop in rents from 2019

Rents being rolled all the way back

#cdnecon

This 2 bd condo was also just leased for $2000/month

A $700/month (26%) drop in rents from 2019

Rents being rolled all the way back

#cdnecon

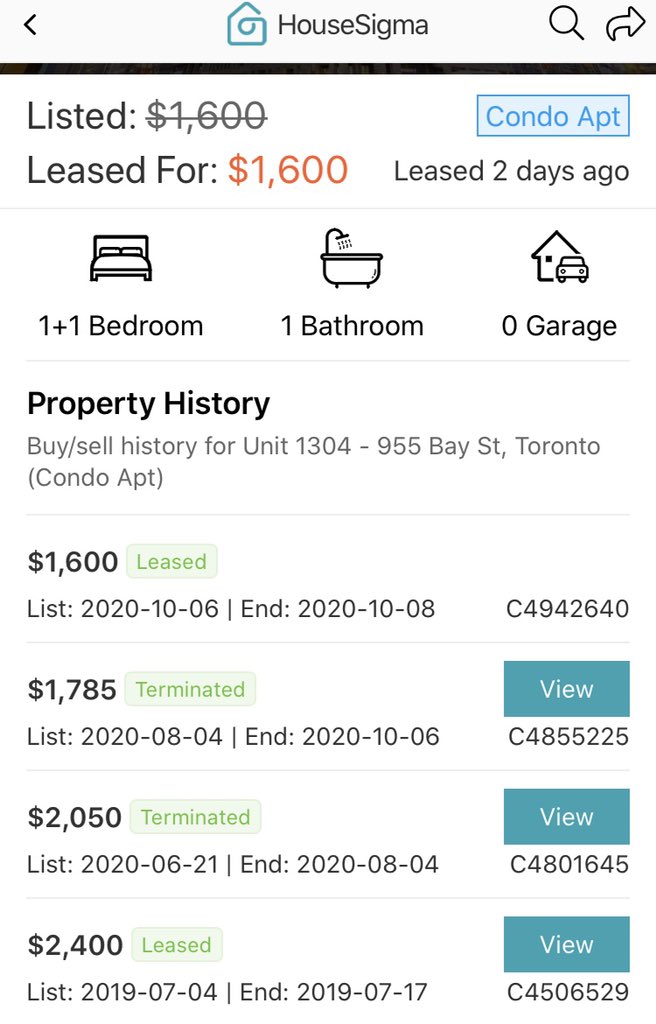

The Latest in Toronto Rents

This one is quite the drop!

A massive $800/month (33%) from the 2019 leased price.

A 1+1 bd up to 599 sq ft for $1600 in the heart of downtown!

It says den can be used as 2nd bd

Note no parking but wasn’t avail in prev listing either

#cdnecon

This one is quite the drop!

A massive $800/month (33%) from the 2019 leased price.

A 1+1 bd up to 599 sq ft for $1600 in the heart of downtown!

It says den can be used as 2nd bd

Note no parking but wasn’t avail in prev listing either

#cdnecon

The Latest in Toronto Rents

This 2 bd 830/sqft condo was just leased for $100/month below the 2016 rented price!

Rent is $2.77/sqft - parking & locker included

A ~5 yr rollback in rents

25-30% drops in rents from peak no longer outliers & becoming much more frequent

#cdnecon

This 2 bd 830/sqft condo was just leased for $100/month below the 2016 rented price!

Rent is $2.77/sqft - parking & locker included

A ~5 yr rollback in rents

25-30% drops in rents from peak no longer outliers & becoming much more frequent

#cdnecon

The Latest in Toronto Rents

Just another 25% drop from 2018 levels.

Ask yourself this

If I’m easily able to find on a daily basis condos that have been leased at 25-30% drop from peak, is it an outlier any longer?

#cdnecon

Just another 25% drop from 2018 levels.

Ask yourself this

If I’m easily able to find on a daily basis condos that have been leased at 25-30% drop from peak, is it an outlier any longer?

#cdnecon

The Latest in Toronto Rents

A $600/month (25.5%) drop in rents for the 1+1 condo.

The 25%+ drops are pretty standard right now.

#cdnecon

A $600/month (25.5%) drop in rents for the 1+1 condo.

The 25%+ drops are pretty standard right now.

#cdnecon

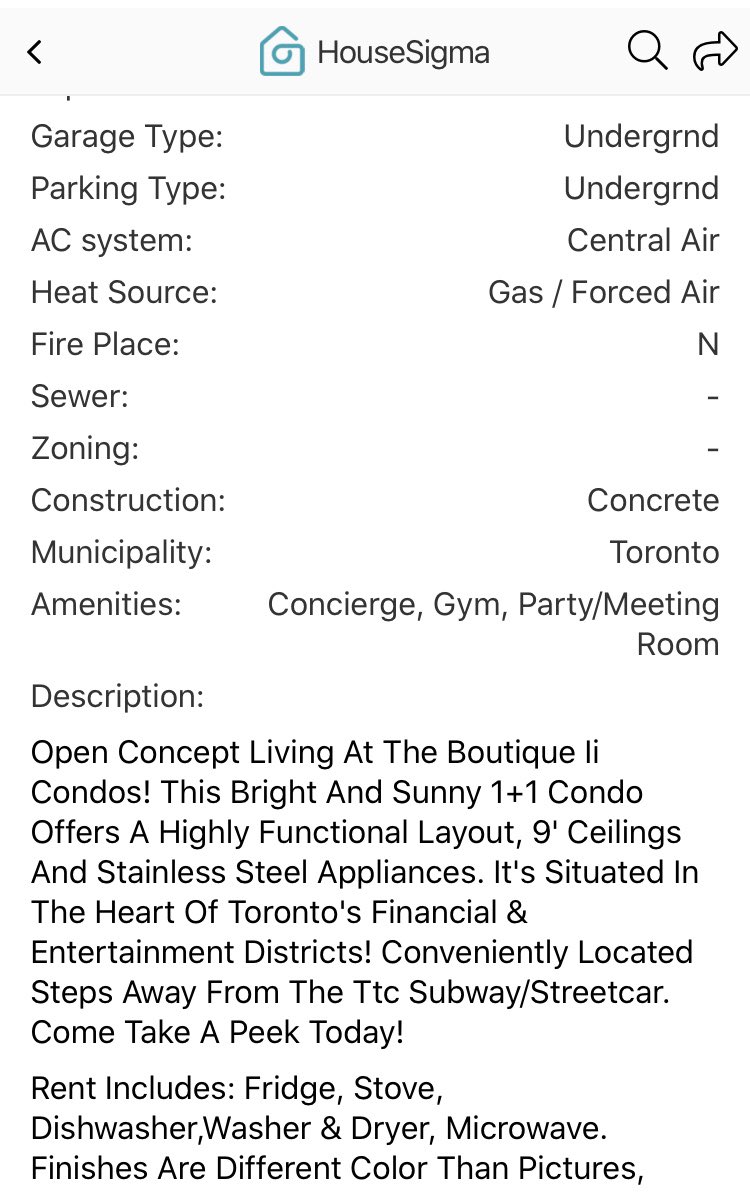

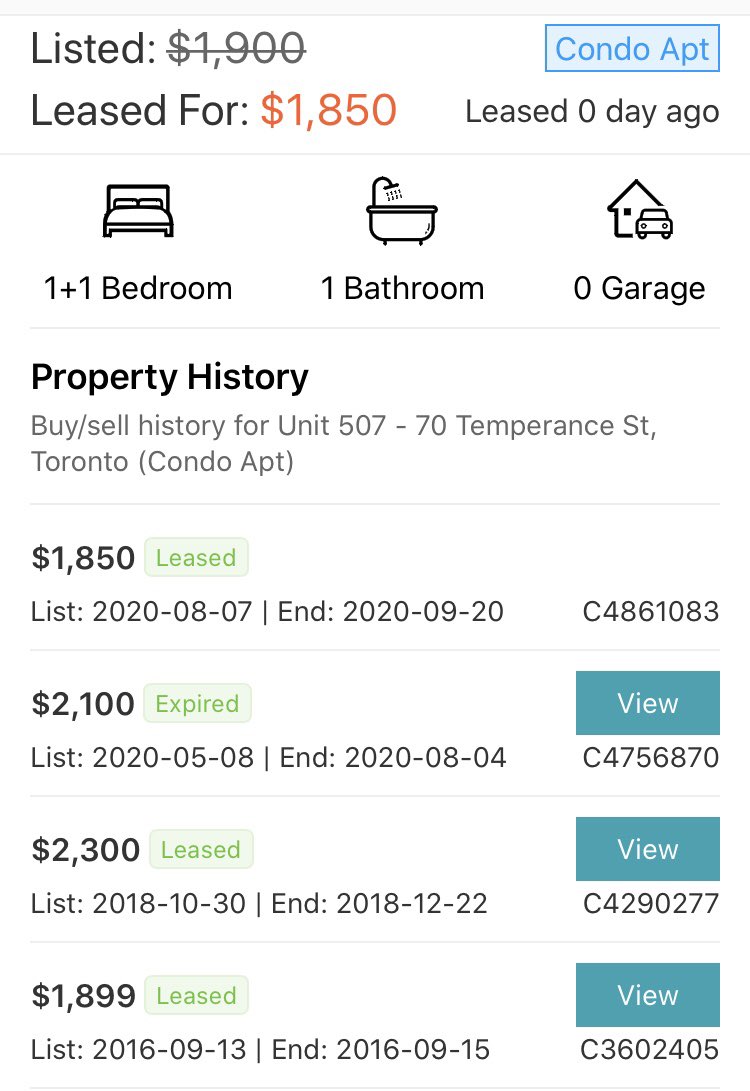

Check out this 1+1 Toronto Condo is the heart of the financial district that was just leased for $1850, which is only $50 above 2014 leased price & 23% ($550) below 2019

In REAL terms, this condo is much cheaper to rent today vs 2014!!

While expenses rise > inflation

#cdnecon

In REAL terms, this condo is much cheaper to rent today vs 2014!!

While expenses rise > inflation

#cdnecon

The Latest in Toronto Rents

This one is a gigantic WOW!

The condo was just leased at the same rented price as 2012!!!

Parking included and you can have furnished if you like lol

What a complete disaster for rents!

#cdnecon

This one is a gigantic WOW!

The condo was just leased at the same rented price as 2012!!!

Parking included and you can have furnished if you like lol

What a complete disaster for rents!

#cdnecon

28% down and $700/month less in rent for this 1+1 condo in the heart of downtown Toronto

25-30% drops in rents becoming much more common now.

#cdnecon

25-30% drops in rents becoming much more common now.

#cdnecon

Read on Twitter

Read on Twitter

from all the neg cash flow ( > $1000/month neg cash flow assume 20% down & 1.99%) #cdnecon" title="This condo was just rented for $600 (23%) below 2019 price & ~17% below the 2018 rented priceAfter purchasing this condo for $650K in 2019, this investors pocket will literally be on https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> from all the neg cash flow ( > $1000/month neg cash flow assume 20% down & 1.99%) #cdnecon" class="img-responsive" style="max-width:100%;"/>

from all the neg cash flow ( > $1000/month neg cash flow assume 20% down & 1.99%) #cdnecon" title="This condo was just rented for $600 (23%) below 2019 price & ~17% below the 2018 rented priceAfter purchasing this condo for $650K in 2019, this investors pocket will literally be on https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> from all the neg cash flow ( > $1000/month neg cash flow assume 20% down & 1.99%) #cdnecon" class="img-responsive" style="max-width:100%;"/>

This unit was just leased for slight below the 2012 rented price!!A massive ~30% drop in revenue from the 2019 peakThis means over a decade of neg real rent growth during an epic condo boom in a world class city #cdnecon" title="The Latest in Toronto RentsThis one is a WOW! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> This unit was just leased for slight below the 2012 rented price!!A massive ~30% drop in revenue from the 2019 peakThis means over a decade of neg real rent growth during an epic condo boom in a world class city #cdnecon" class="img-responsive" style="max-width:100%;"/>

This unit was just leased for slight below the 2012 rented price!!A massive ~30% drop in revenue from the 2019 peakThis means over a decade of neg real rent growth during an epic condo boom in a world class city #cdnecon" title="The Latest in Toronto RentsThis one is a WOW! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> This unit was just leased for slight below the 2012 rented price!!A massive ~30% drop in revenue from the 2019 peakThis means over a decade of neg real rent growth during an epic condo boom in a world class city #cdnecon" class="img-responsive" style="max-width:100%;"/>

#cdnecon" title="The Latest in Toronto RentsJust another ~27% drop in revenue What does a 20-30% drop in rents means for investors where the cap rate was already compressed to begin with.So what if cap rates go from 2% to l%, we live in a world class city and prices going https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben"> #cdnecon" class="img-responsive" style="max-width:100%;"/>

#cdnecon" title="The Latest in Toronto RentsJust another ~27% drop in revenue What does a 20-30% drop in rents means for investors where the cap rate was already compressed to begin with.So what if cap rates go from 2% to l%, we live in a world class city and prices going https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben"> #cdnecon" class="img-responsive" style="max-width:100%;"/>