1/ Currency wars are going digital.

In this new world:

+ For the USD to remain the global settlement currency, the US govt must embrace crypto

+ For crypto to survive, the crypto community must help the US govt

@ElectricCapital article w/ LOTS of data: https://medium.com/@ElectricCapital/the-case-for-collaboration-why-the-us-government-and-crypto-ecosystem-must-work-together-4de0e97396a?sk=52e94374a2a113b0eca7e6241d097c0b">https://medium.com/@Electric...

In this new world:

+ For the USD to remain the global settlement currency, the US govt must embrace crypto

+ For crypto to survive, the crypto community must help the US govt

@ElectricCapital article w/ LOTS of data: https://medium.com/@ElectricCapital/the-case-for-collaboration-why-the-us-government-and-crypto-ecosystem-must-work-together-4de0e97396a?sk=52e94374a2a113b0eca7e6241d097c0b">https://medium.com/@Electric...

2/ A US govt and the crypto community collaboration is not about ideology -- simply game theory and self-interest.

Why? China is swiftly embraciing digital currencies and the degree to which they can influence crypto creates a common adversary for the US govt and crypto.

Why? China is swiftly embraciing digital currencies and the degree to which they can influence crypto creates a common adversary for the US govt and crypto.

3/ The Chinese govt is testing a central bank digital currency (CBDC), digital currency denominated electronic payment system (DCEP), and blockchain services network (BSN) domestically with banks and mobile apps.

It is a remarkable effort for a govt of their scale to accomplish

It is a remarkable effort for a govt of their scale to accomplish

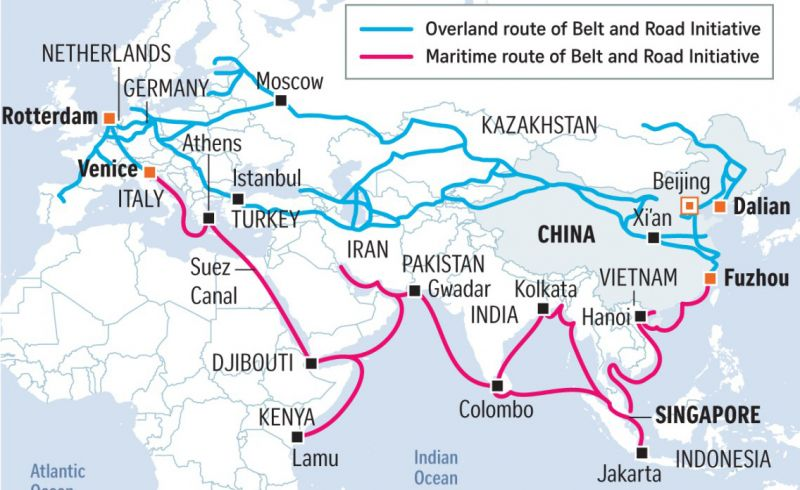

4/ Next, the renminbi denominated DCEP will roll out to Belt and Road countries.

The DCEP offers instant settlement + significant efficiency gains for financial firms, supply chains, and international trade.

All a country has to do is denominate trade in RMB rather than USD.

The DCEP offers instant settlement + significant efficiency gains for financial firms, supply chains, and international trade.

All a country has to do is denominate trade in RMB rather than USD.

5/ Think China pushing to move off the USD can& #39;t happen? Russia-China trade is no longer majority denominated in USD.

Imagine how quickly emerging markets could move off the USD if the Chinese government is investing billions to make it happen.

Imagine how quickly emerging markets could move off the USD if the Chinese government is investing billions to make it happen.

6/ If the US were to lose the USD as the primary settlement layer for global trade, there would be significant downstream consequences - would sanctions be effective? Would KYC/AML work? Could the US print money the way it does today?

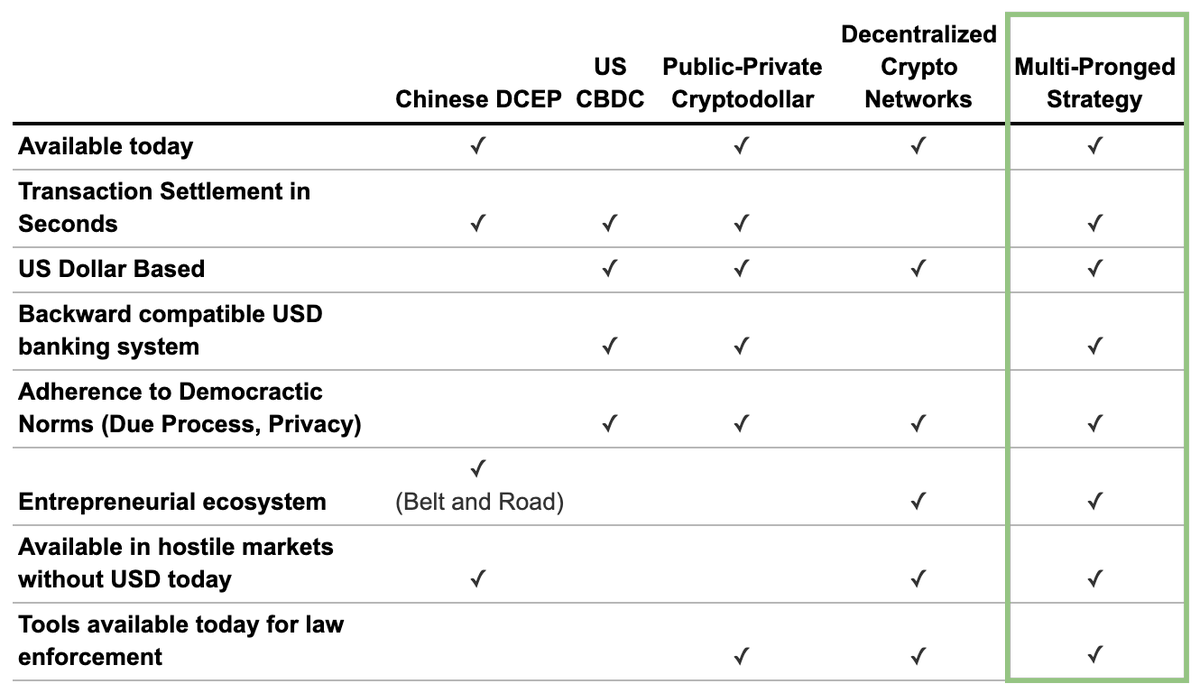

7/ The US can only outcompete the Chinese DCEP if it gets a digital currency to market quickly and offers an alternative via benefits the Chinese government cannot: freedom of speech, privacy, due process, and protection from unreasonable seizure.

8/ The Chinese govt simultaneously seeks to influence crypto, as it does all tech ecosystems.

They smartly let mining supply chains and capacity concentrate in China, allow just enough capital flow in to the space to have influence, and control fiat on/off ramps in to crypto.

They smartly let mining supply chains and capacity concentrate in China, allow just enough capital flow in to the space to have influence, and control fiat on/off ramps in to crypto.

9/ A world that runs on the Chinese DCEP is one where the Chinese govt could shut off those that most need cryptocurrencies - the underbanked, journalists, political refugees, etc.

The crypto community is unlikely to outcompete the DCEP on adoption without the US Govt& #39;s help.

The crypto community is unlikely to outcompete the DCEP on adoption without the US Govt& #39;s help.

10/ Against a common challenger, the US Govt and crypto community must collaborate to offer:

i. a USD based settlement platform alternative to the DCEP

ii. cryptodollars by mid-2021

iii. regulatory clarity to unlock crypto as an offensive tool that offers benefits the DCEP cannot

i. a USD based settlement platform alternative to the DCEP

ii. cryptodollars by mid-2021

iii. regulatory clarity to unlock crypto as an offensive tool that offers benefits the DCEP cannot

11/ i. A USD settlement layer enabled by a USD CBDC and modern Fedwire could bootstrap a global USD DCEP.

The expertise to design and build this system is in the crypto community and we should help the Govt build it properly.

Unfortunately this will take years to get to market

The expertise to design and build this system is in the crypto community and we should help the Govt build it properly.

Unfortunately this will take years to get to market

12/ ii. To get to market quickly, the US Govt must unblock cryptodollars via @Libra, @Celo, @Avantibank, @USDC & other programmable platforms

Cryptodollars backed by USD sitting in US banks could in 12 months get to 1 billion users, many of them who may be new users of USD

Cryptodollars backed by USD sitting in US banks could in 12 months get to 1 billion users, many of them who may be new users of USD

13/ Cryptodollars are programmable dollars. They can reach underserved people in developed and emerging markets via mobile.

Cryptodollars can also onboard people to decentralized ecosystems with benefits such as privacy, microloans, and new job opportunities.

Cryptodollars can also onboard people to decentralized ecosystems with benefits such as privacy, microloans, and new job opportunities.

14/ iii - Regulatory clarity would unlock innovation in the crypto ecosystem and capital inflows to the US.

Having the biggest companies in crypto hq-ed in the US and the majority of capital inflows going to a US ETF, the US Govt could have as much influence as the Chinese govt.

Having the biggest companies in crypto hq-ed in the US and the majority of capital inflows going to a US ETF, the US Govt could have as much influence as the Chinese govt.

15/ For some in the crypto community, collaborating with the US Govt is heresy.

But the reality is that bad regulation in the US is a very likely outcome if the crypto community does not engage. And a Chinese DCEP changes the game theory of crypto-US govt collaboration.

But the reality is that bad regulation in the US is a very likely outcome if the crypto community does not engage. And a Chinese DCEP changes the game theory of crypto-US govt collaboration.

16/ Read about the Case for Collaboration (a modified version of our Q3 letter to @ElectricCapital investors): https://medium.com/@ElectricCapital/the-case-for-collaboration-why-the-us-government-and-crypto-ecosystem-must-work-together-4de0e97396a?sk=52e94374a2a113b0eca7e6241d097c0b">https://medium.com/@Electric...

17/ Thank you to @Alicesqhan, @JaredCohen, @jubos, @leanthebean, @MariaShen, @mattysino, @puntium, @wheatpond, @zooko and other friends who read drafts and contributed on this.

Read on Twitter

Read on Twitter