A quick  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

In the past few months, I& #39;ve helped probably half a dozen or so founders craft pitch decks for their first rounds of funding.

It& #39;s really hard to get right at the earliest stages, but here& #39;s how I think about telling your story:

In the past few months, I& #39;ve helped probably half a dozen or so founders craft pitch decks for their first rounds of funding.

It& #39;s really hard to get right at the earliest stages, but here& #39;s how I think about telling your story:

I like to start with a one-line, high-level overview of your business. If this was the only slide an investor read, what would you want them to know about what you& #39;re building?

A little hard to read but here& #39;s a great example from @collinmathilde at Front

A little hard to read but here& #39;s a great example from @collinmathilde at Front

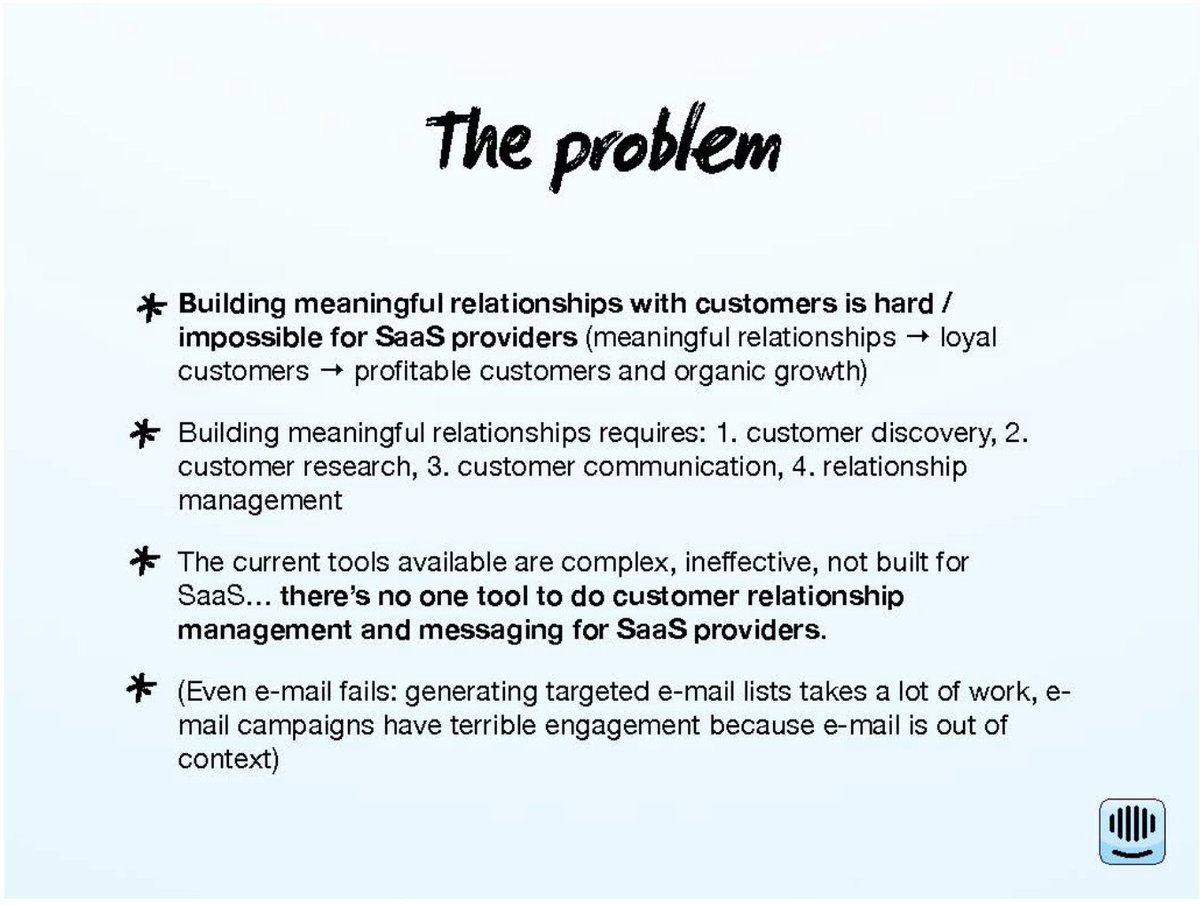

Then dive right into the big, hairy problem that you& #39;re tackling. The problem sets the foundation for the rest of your story. Investors will noodle if the problem is real and if so, how big it is.

I love this from @intercom (and they hinted at their solution with bold font)

I love this from @intercom (and they hinted at their solution with bold font)

After the problem, explain your solution. No other details. I often see founders add more context to the problem and I don& #39;t think this is the right place.

A format I like is "startup is [description of solution]" with a few bullet points that nail why your way is the future.

A format I like is "startup is [description of solution]" with a few bullet points that nail why your way is the future.

Now you can do 1 of 2 things.

Either 1) add some https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> product screenshots and explain "how it works" for your end-user (consumer or business or both)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> product screenshots and explain "how it works" for your end-user (consumer or business or both)

or 2) Hop straight into your vision

Either 1) add some

or 2) Hop straight into your vision

For 2) if your solution is clear enough that it doesn& #39;t need some extra screenshots, I& #39;ve always found this to be a good time to go from "simple thing we& #39;re building today" to "massive thing we can be in the future".

If not, the vision slide can always come later in the deck.

If not, the vision slide can always come later in the deck.

After the solution, I think it& #39;s good to talk about traction/growth/how you& #39;ve validated and de-risked your thesis.

This can be a slide like "where we& #39;re at today" followed by a couple of slides backing this up with data (churn rate, engagement, CAC, etc, etc).

This can be a slide like "where we& #39;re at today" followed by a couple of slides backing this up with data (churn rate, engagement, CAC, etc, etc).

You want to create a sense of momentum. If you& #39;re raising early this can be an MVP with some loyal paying users (or even a huge waitlist but lol)

For later stage, this could be up and to the right growth/usage numbers. Love this tweet from Leo https://twitter.com/lpolovets/status/1303854425690128385">https://twitter.com/lpolovets...

For later stage, this could be up and to the right growth/usage numbers. Love this tweet from Leo https://twitter.com/lpolovets/status/1303854425690128385">https://twitter.com/lpolovets...

The traction slide can also come after the next slide (market opp) but it all comes down to how you want to tell your story. What _feels_ right in context?

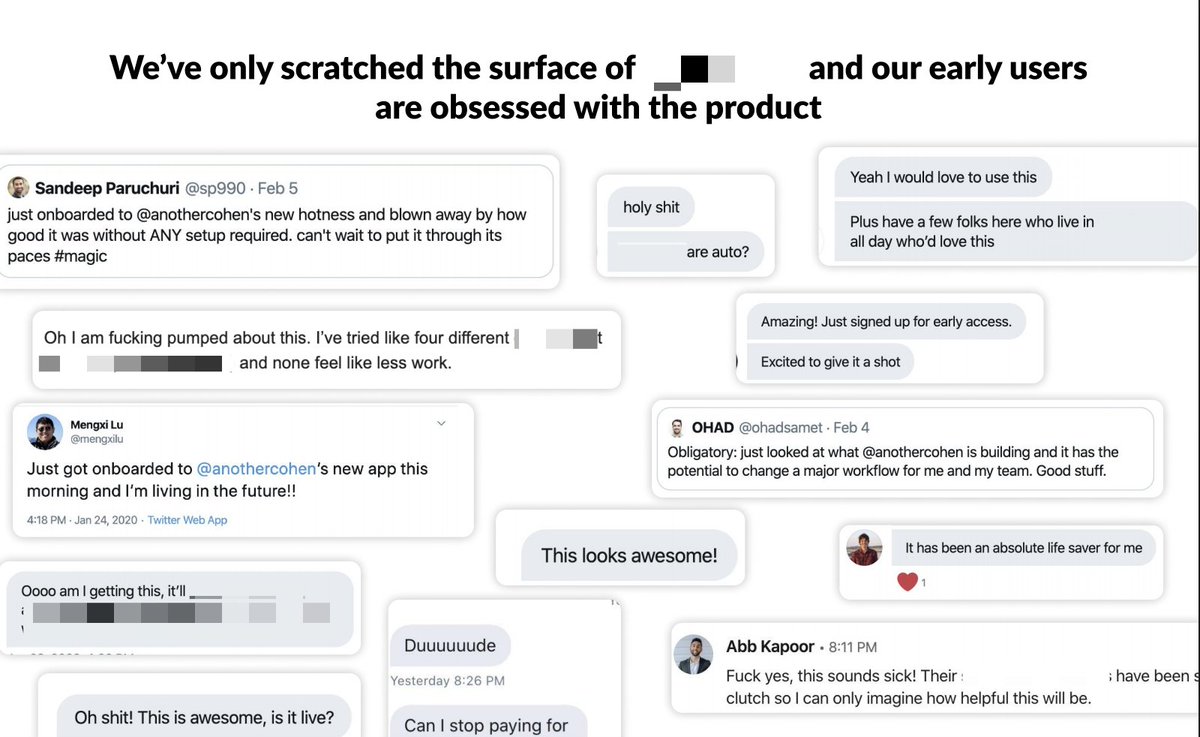

Another great thing to add is testimonials - for our pre-seed deck, I had a whole slide with tweets from our MVP users

Another great thing to add is testimonials - for our pre-seed deck, I had a whole slide with tweets from our MVP users

Then, once you& #39;ve sold your reader on your early ability to actually execute and get it in the hands of real people, tell them on how big the market is (they probably don& #39;t actually know).

This is the one place in your deck that& #39;s going to convince an investor the problem you& #39;re working on is of venture backable scale

My fav market slide I& #39;ve ever seen is from one of Atlassian& #39;s presentation mapping the expansion of JIRA (and I copied the format for our deck https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">)

My fav market slide I& #39;ve ever seen is from one of Atlassian& #39;s presentation mapping the expansion of JIRA (and I copied the format for our deck

Next, "where we& #39;re going from here"

Talk about your 10-year vision - what future are you going to build if everything goes according to plan?

Talk about your 10-year vision - what future are you going to build if everything goes according to plan?

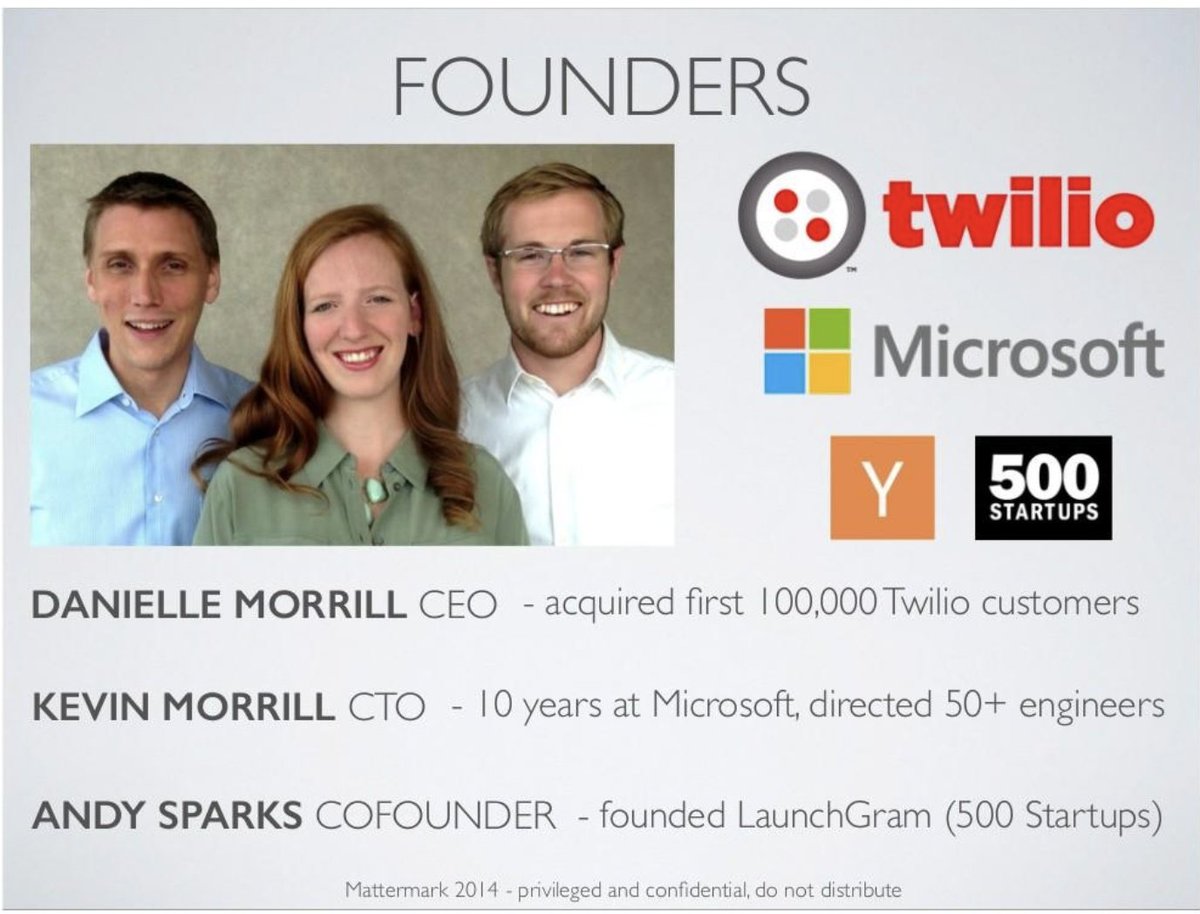

The team - who are the brains behind the company? If the founders have an interesting backstory, you can include a blurb.

I like this team slide from @DanielleMorrill @SparksZilla @MisterMorrill when they were raising their seed round!

I like this team slide from @DanielleMorrill @SparksZilla @MisterMorrill when they were raising their seed round!

For the team slide, you can add logos, past titles, or summaries of your past roles, but I think the most important thing to remember is that your job is to convince an investor who likely doesn& #39;t know you that well why you& #39;re the person who can build this company

The ask slide (optional, I prefer to save this for convos vs in writing to be shared all over) - how much are you raising, what big milestones does that get you, what are you going to validate to raise leading up to the next round?

Here& #39;s another slide from Intercom& #39;s seed deck

Here& #39;s another slide from Intercom& #39;s seed deck

And of course, to wrap it up, a thank you slide with your email or phone number!

Gotta close it out with something. Most of what I see is a simple "thank you" or "come join us" but do whatever makes your heart content

Gotta close it out with something. Most of what I see is a simple "thank you" or "come join us" but do whatever makes your heart content

A few quick notes - I left out some slides for the core deck but you can definitely include an appendix with several optional slides:

Revenue model - some businesses are complex and this could be a dedicated slide. My POV is to either weave it into the market opportunity slide or let it be a point that comes up in a conversation (a deck just gets you the meeting anyway)

Competitors - I think most competitor slides are cheesy but hey, if you want to make some quadrant chart with your company being all alone in the top right quadrant, go for it?

Financials - at the stage company if an investor asks for financial projections, probably a good sign to  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏃♂️" title="Läufer" aria-label="Emoji: Läufer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏃♂️" title="Läufer" aria-label="Emoji: Läufer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏃♂️" title="Läufer" aria-label="Emoji: Läufer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏃♂️" title="Läufer" aria-label="Emoji: Läufer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏃♂️" title="Läufer" aria-label="Emoji: Läufer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏃♂️" title="Läufer" aria-label="Emoji: Läufer">

And lastly, the whole point of the deck is to get the meeting.

Don& #39;t give everything away in the deck. Save some of the exciting and more complex stuff when you get a chance to meet with someone 1-1, it& #39;s more fun that way

Don& #39;t give everything away in the deck. Save some of the exciting and more complex stuff when you get a chance to meet with someone 1-1, it& #39;s more fun that way

Here& #39;s a good summary https://twitter.com/JaredHenriques/status/1304161220954648576?s=20">https://twitter.com/JaredHenr...

Read on Twitter

Read on Twitter

)" title="This is the one place in your deck that& #39;s going to convince an investor the problem you& #39;re working on is of venture backable scaleMy fav market slide I& #39;ve ever seen is from one of Atlassian& #39;s presentation mapping the expansion of JIRA (and I copied the format for our deck https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">)" class="img-responsive" style="max-width:100%;"/>

)" title="This is the one place in your deck that& #39;s going to convince an investor the problem you& #39;re working on is of venture backable scaleMy fav market slide I& #39;ve ever seen is from one of Atlassian& #39;s presentation mapping the expansion of JIRA (and I copied the format for our deck https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">)" class="img-responsive" style="max-width:100%;"/>