1/ Jungfraubahn Holding AG – an interesting company with a 100+ year storied history and listed on the SIX Swiss Exchange – offers a unique opportunity to own a piece of the Swiss Alps! $JFN.SW

2/ The company began in late 1893 when a Swiss industrialist applied for a concession to build a cogwheel railway from the Kleine Scheidegg mountain pass to the summit of the Jungfrau, via a long tunnel through the Eiger and Mönch mountain.

3/ Construction of the Jungfrau Railway began in 1896 and was complete by 1912 with the opening of the final section to the Jungfraujoch, 3,454 metres above sea level. The Jungfrau Railway, more than 100 years after its launch, still runs today on the same stretch!

4/ Having started as a rail transportation firm, Jungfraubahn is now an integrated leisure company that operates excursion railways, offers winter sports and sightseeing tours, operates F&B and retail outlets along the tracks, etc.

5/ Jungfraujoch - Top of Europe is the most important asset, contributing 70%+ of transportation revenue; it is a world-famous destination, attracting tourists from all over the world to enjoy the breathtaking views of the Alps.

6/ Jungfraujoch is a prime, differentiated tourist destination in Switzerland; it is unique and impossible to replicate. The company is somewhat insulated from the traditional tourism cycle as it is not strictly a winter destination and caters to Asian tourists throughout the yr

7/ Jungfraubahn is in the final months of a historic CHF 300m+ three-year growth capex project (“V-Cableway”). This will significantly enhance the customer experience and prepare the company for its next leg of growth, increasing capacity and journey efficiency

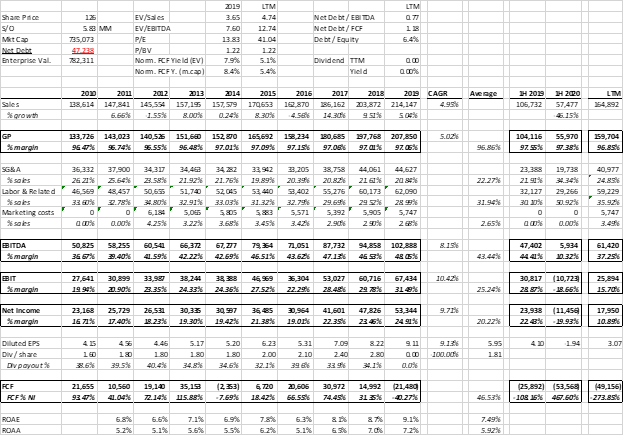

8/ Jungfraubahn has a strong balance sheet, solid margins and consistently increasing returns on capital. Revenue and net income have grown a compounded 5% and 10%, respectively, over the past 10 years. Market cap is CHF 735mm $JFN.SW

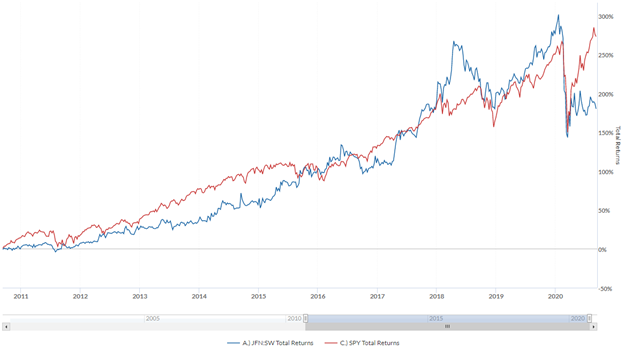

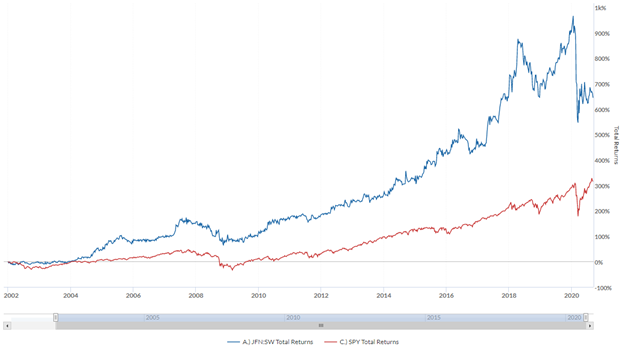

9/ Over the past 10 years, Jungfraubahn compounded shareholder returns slightly above the S&P 500 (thru YE 2019) but the shares took a hit this year due to COVID. Since 2002, the company has easily beat the S&P 500, delivering 660% total returns vs. 318% for the S&P

10/ I& #39;ve been knee-deep in this small off-the-beaten path company and thoroughly enjoyed researching it over the past week! The recent share weakness provides an opp. to evaluate the company at a time when tourism and other consumer discretionary stocks are dismissed by investors

Read on Twitter

Read on Twitter