1/ I just published my newest piece for Decred On-Chain, focusing on the Decred Treasury from an accountants& #39; POV

Here& #39;s the link to the article, and a TLDR twitter thread in case you just want the highlights: https://medium.com/@permabullnino/decred-on-chain-dao-treasury-accounting-afb1ed989b0a">https://medium.com/@permabul...

Here& #39;s the link to the article, and a TLDR twitter thread in case you just want the highlights: https://medium.com/@permabullnino/decred-on-chain-dao-treasury-accounting-afb1ed989b0a">https://medium.com/@permabul...

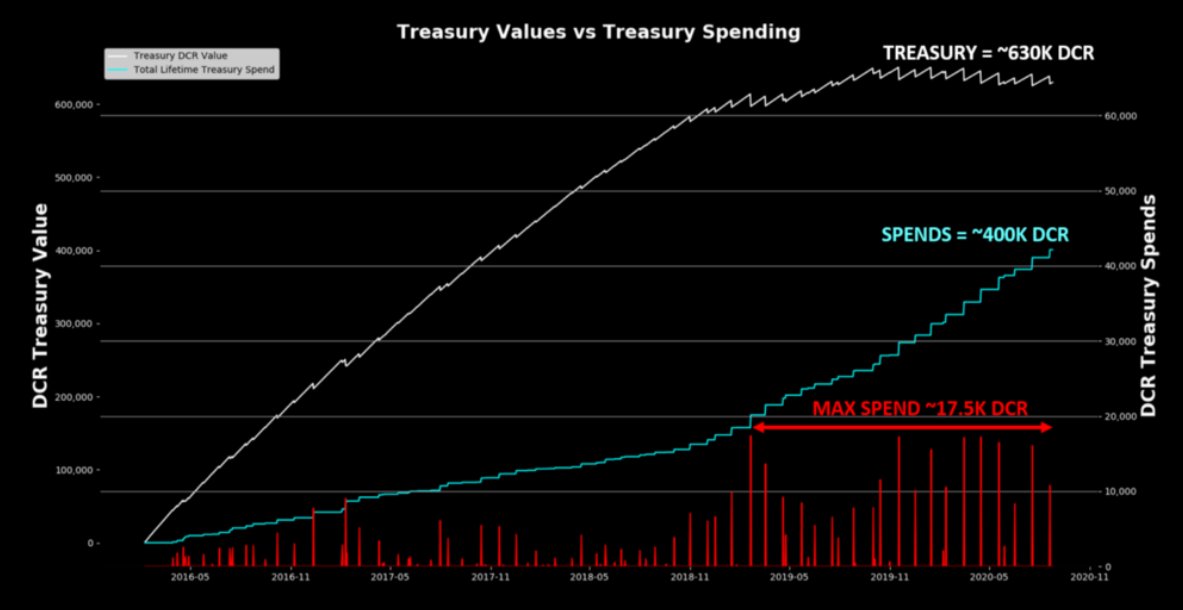

2/ Basic DCR view of the Treasury:

~630k DCR in Treasury

~400k DCR in Cumulative Spends

~17.5k DCR Max Contracting Spend for a month& #39;s worth of work for all contractors

~630k DCR in Treasury

~400k DCR in Cumulative Spends

~17.5k DCR Max Contracting Spend for a month& #39;s worth of work for all contractors

3/ Basic DCRUSD view of the Treasury:

~$10M Treasury Value as of writing

~$8-$9M Cumulative Spends

~$400k Max Contracting Spend for a month& #39;s worth of work for all contractors

- Treasury Value collided with Cumulative Spends in early 2020

~$10M Treasury Value as of writing

~$8-$9M Cumulative Spends

~$400k Max Contracting Spend for a month& #39;s worth of work for all contractors

- Treasury Value collided with Cumulative Spends in early 2020

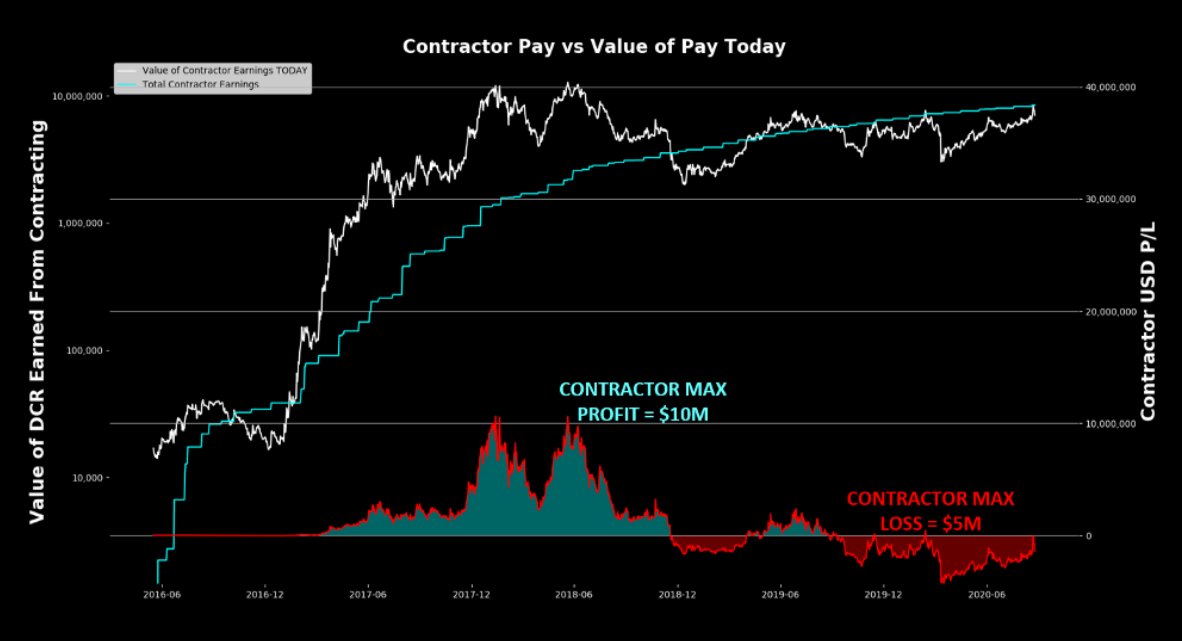

4/ Now for a contracting USD POV:

- Cumulative contracting payments at bull peak were ~$10M in profit versus the value contractors received on paydays

- At bear market lows, contractors were cumulatively ~$5M underwater on payments

- Cumulative contracting payments at bull peak were ~$10M in profit versus the value contractors received on paydays

- At bear market lows, contractors were cumulatively ~$5M underwater on payments

5/ Contracting % POV shows:

- Value of contractor coins TODAY versus when they received them at bull peak were 12.5x more valuable

- Value of contractor coins TODAY have historically bottomed at a ~40% loss

- USD value of contractor coins are only a 2x from the ATH at $13M

- Value of contractor coins TODAY versus when they received them at bull peak were 12.5x more valuable

- Value of contractor coins TODAY have historically bottomed at a ~40% loss

- USD value of contractor coins are only a 2x from the ATH at $13M

6/ Basic view of Treasury flows:

- Accumulating 40k - 50k DCR every 90 days for most of the project& #39;s history

- These flows flipped negative around November 2019, recovery still pending as DCRUSD price hasn& #39;t moved off the lows

- Accumulating 40k - 50k DCR every 90 days for most of the project& #39;s history

- These flows flipped negative around November 2019, recovery still pending as DCRUSD price hasn& #39;t moved off the lows

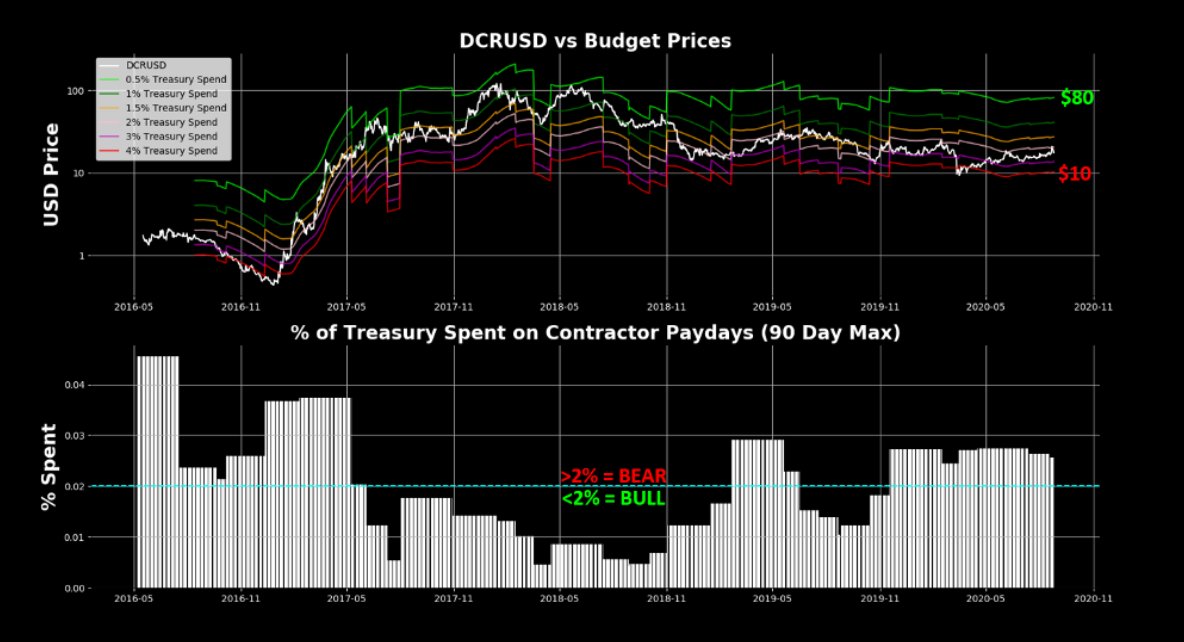

7/ A look at Treasury Budgeting:

- By taking the maximum contracting payment over 90-day rolling period, we can build budget prices to determine what price DCRUSD needs to be at to only spend a certain % of the Treasury on paydays

- $80 DCURSD: 0.5% draw

- $10 DCRUSD:: 4% draw

- By taking the maximum contracting payment over 90-day rolling period, we can build budget prices to determine what price DCRUSD needs to be at to only spend a certain % of the Treasury on paydays

- $80 DCURSD: 0.5% draw

- $10 DCRUSD:: 4% draw

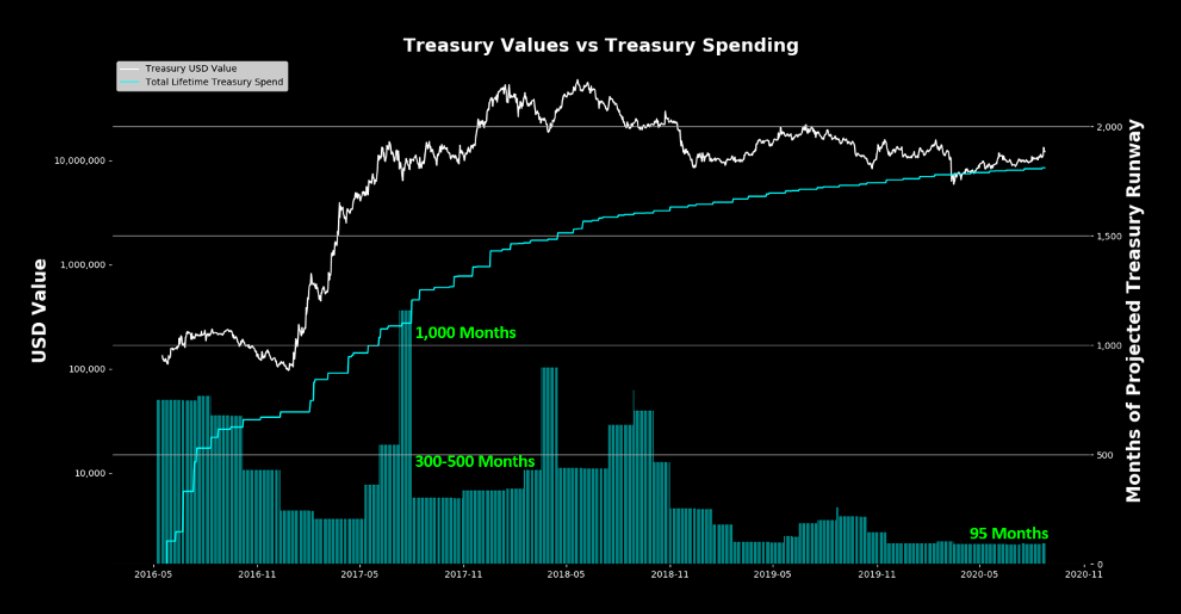

8/ Treasury sustainability:

- We can take available balance, remaining issuance, and contracting pay data to estimate how many months of runway the Treasury has before running out

- Bull peak: 1,000 months

- Bull normal: 300-500 months

- Current: 95 months

- We can take available balance, remaining issuance, and contracting pay data to estimate how many months of runway the Treasury has before running out

- Bull peak: 1,000 months

- Bull normal: 300-500 months

- Current: 95 months

9/ Treasury returns:

- By comparing the current Treasury value versus cumulative USD spends, we can gauge ROI on contracting work paid for

- Bull peak: Treasury 60x greater than spends

- If multiple returns to 10x - 20x range, that would imply a $135M Treasury valuation

- By comparing the current Treasury value versus cumulative USD spends, we can gauge ROI on contracting work paid for

- Bull peak: Treasury 60x greater than spends

- If multiple returns to 10x - 20x range, that would imply a $135M Treasury valuation

10/ As an accountant by training, I found this dive infinitely interesting. If you want my two cents, the ability to build accounting tools for DAOs completely flips the idea of "public accounting" on its head, and we& #39;re just getting started. Hope yall enjoy the read!

Read on Twitter

Read on Twitter