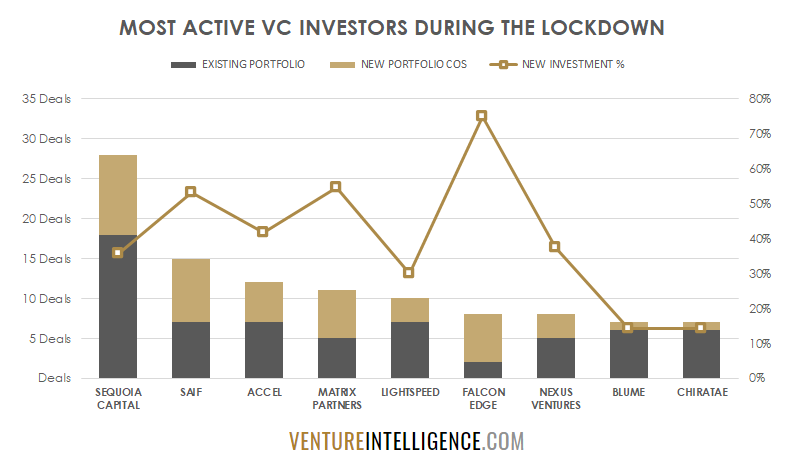

During the lockdown, VCs in India have largely focused on investing in startups founded by entrepreneurs they have known from earlier (read pre-Covid) or in backing existing portfolio companies. One of them is bucking that trend. #VentureCapital #StartupIndia #Thread

Of the 8 investments made by Falcon Edge during lock down period, 6 went into new investments. Primarily focused on #ArtificialIntelligence

SenseHawk - Series A

@availfinance - Series B

@entropiktech - Series A

@verloopio - Series A1

@nextbillionai - Series A

Setu - Series A

SenseHawk - Series A

@availfinance - Series B

@entropiktech - Series A

@verloopio - Series A1

@nextbillionai - Series A

Setu - Series A

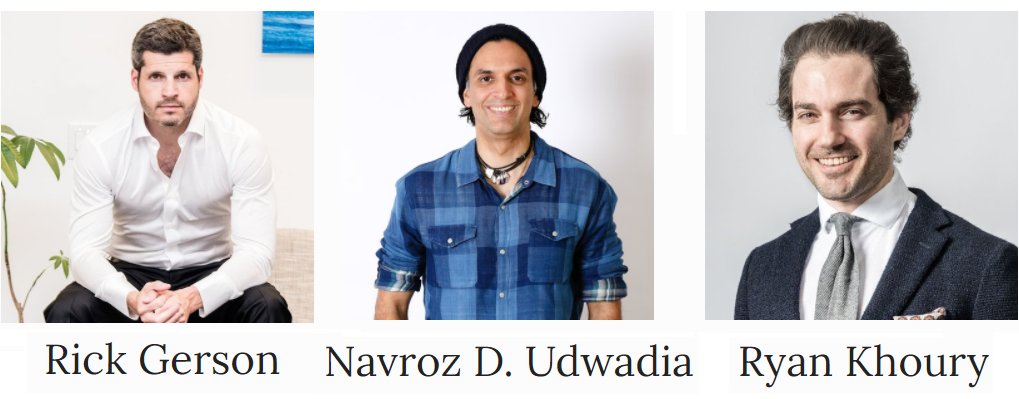

Falcon Edge is founded by second generation "Tiger Cub" Rick Gerson and former-Eton Park executives Navroz D. Udwadia and Ryan Khoury.

More Info available in this Newyork Times @dealbook article: https://dealbook.nytimes.com/2012/07/30/tiger-management-helps-next-generation-funds/">https://dealbook.nytimes.com/2012/07/3...

More Info available in this Newyork Times @dealbook article: https://dealbook.nytimes.com/2012/07/30/tiger-management-helps-next-generation-funds/">https://dealbook.nytimes.com/2012/07/3...

This @livemint article by @manicontrol2020 chronicles Falcon Edge& #39;s journey in India including

Flexible Investment strategy

First Investment in http://Housing.com"> http://Housing.com

Partnership with @matrixindiavc

Upcoming Plans

https://www.livemint.com/companies/start-ups/falcon-edge-capital-in-talks-for-250-mn-fund-focused-on-india-11581273748129.html">https://www.livemint.com/companies...

Flexible Investment strategy

First Investment in http://Housing.com"> http://Housing.com

Partnership with @matrixindiavc

Upcoming Plans

https://www.livemint.com/companies/start-ups/falcon-edge-capital-in-talks-for-250-mn-fund-focused-on-india-11581273748129.html">https://www.livemint.com/companies...

Of its 24 investments in India, Falcon Edge and @matrixindiavc have partnered in 10 of them. Common portfolio include (Source: https://www.ventureintelligence.com/pelogin.php )

https://www.ventureintelligence.com/pelogin.p... href="https://twitter.com/Olacabs">@Olacabs

Ola Money

@DailyhuntApp

@DealShareIndia

@Mswipe

@ofbusiness_com

@Quikr

Stanza Living

@availfinance

@zupeequiz

Ola Money

@DailyhuntApp

@DealShareIndia

@Mswipe

@ofbusiness_com

@Quikr

Stanza Living

@availfinance

@zupeequiz

Falcon Edge is now doubling down on India with a new Alpha Incubation Wave fund , sponsored by @Adq_Official with a focus on artificial intelligence and machine learning. @AditiS90 reported that the fund is also building its India team for the fund. https://tech.economictimes.indiatimes.com/news/startups/falcon-edge-cofounders-alpha-wave-incubation-to-set-up-india-investment-team/77893385">https://tech.economictimes.indiatimes.com/news/star...

Read on Twitter

Read on Twitter