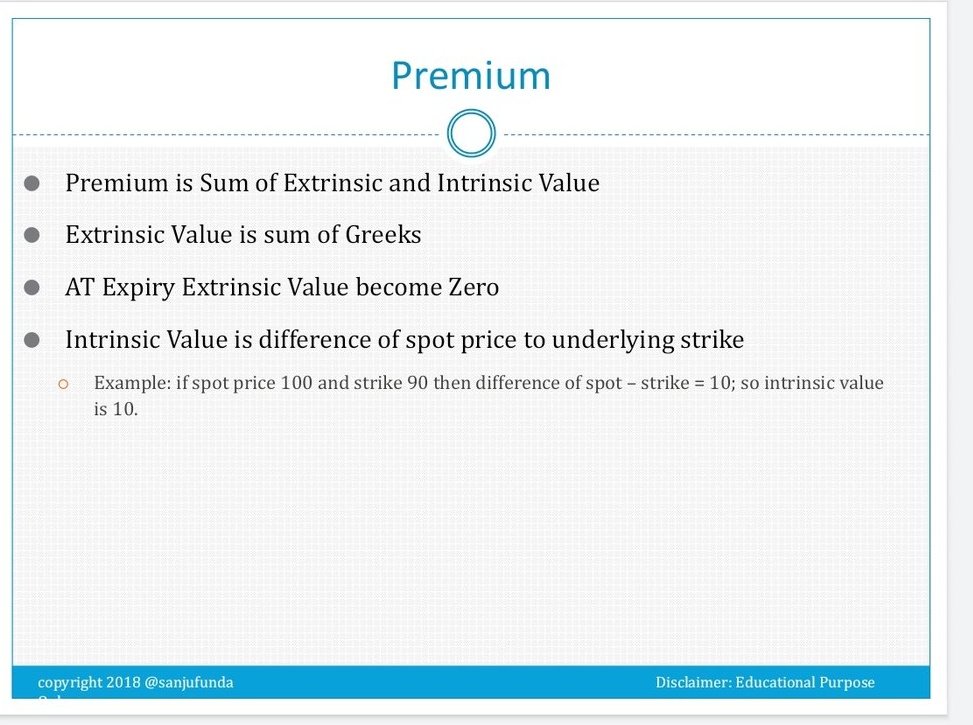

Price for stock same as for option price called as premium which basically sum of extrinsic and intrinsic value.

Given example of call option as below.

In short extrinsic value also prefer as time value.

Given example of call option as below.

In short extrinsic value also prefer as time value.

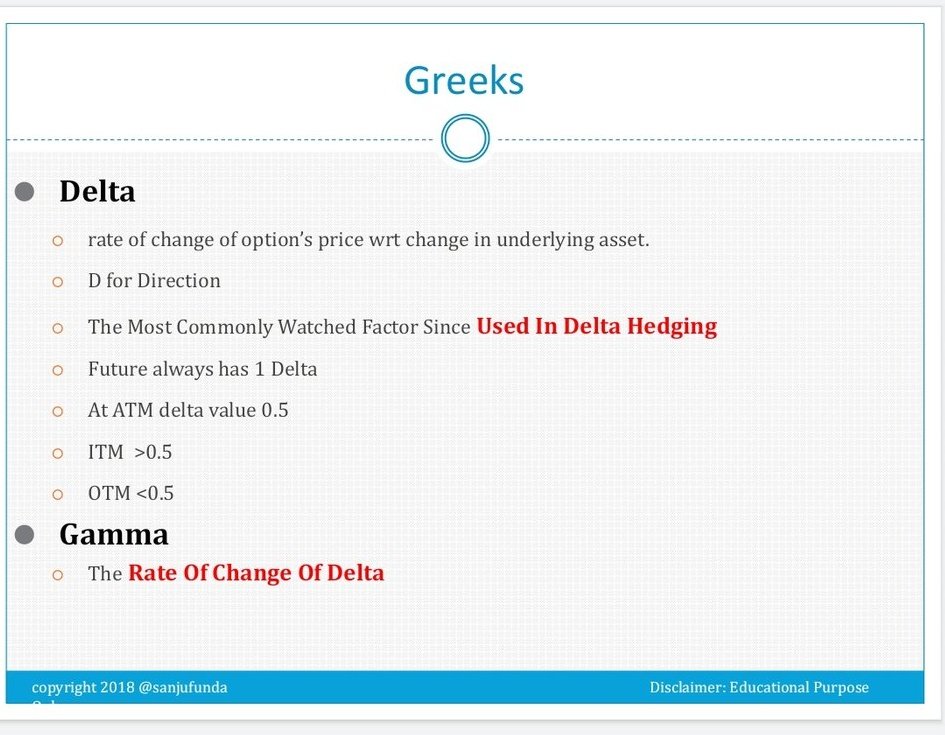

Before starting greek, let me very clear its not much useful for simple strategies, mostly helpful in custom position and greek based entry and adjustment.

There r 2 types of greek - static and dynamic.

Mostly we see static greek but as price move dynamic useful whatif condition.

There r 2 types of greek - static and dynamic.

Mostly we see static greek but as price move dynamic useful whatif condition.

I think enough written in pic already, Gamma mostly come in picture near to expiry and rapid move sometimes create panic to option seller. Thats why mostly i avoid weekly for positional and monthly to reduce gamma risk. Low dte gud for intra Trade. more info search gamma scalping

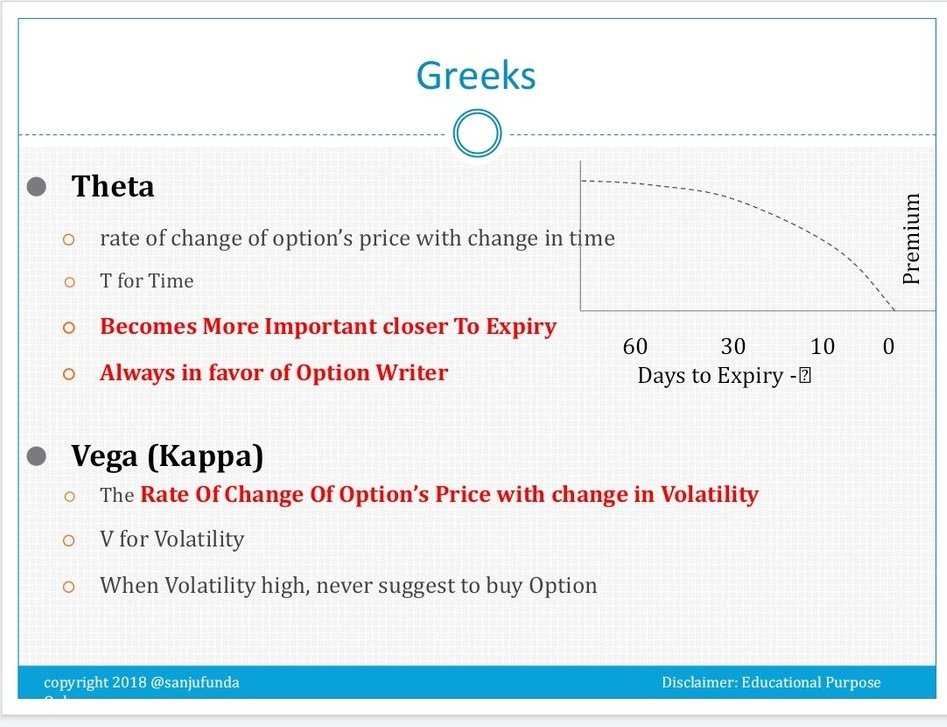

Mostly Option writer motive to eat theta sometimes vega gainer too. Theta hv exponential decay with time as per graph.

Whenever uncertainty increasing vega shift higher which we mostly read as ivp (implied volatility percentage) vary from script to script.

Whenever uncertainty increasing vega shift higher which we mostly read as ivp (implied volatility percentage) vary from script to script.

Mostly positional strategies prefer as theta positive and vega negative strategy. In some case vega positive also gud before any uncertainty coming in expectation of big move/news flow.

But mostly vega increase for short time duration which is notional loss after some time it will back normal.

High ivp is best time for Option seller anyone can see biggest profitable month came in march,20 even after big trend.

Small vega gain offset by theta.

High ivp is best time for Option seller anyone can see biggest profitable month came in march,20 even after big trend.

Small vega gain offset by theta.

Only few days vega effect higher than theta. Choose strategy accordingly situation and technical/data analysis.

Time spread mostly vega positive trades if position size same for short and long.

Time spread mostly vega positive trades if position size same for short and long.

Time spread biggest issues iv dropped bcoz its vega positive trade.

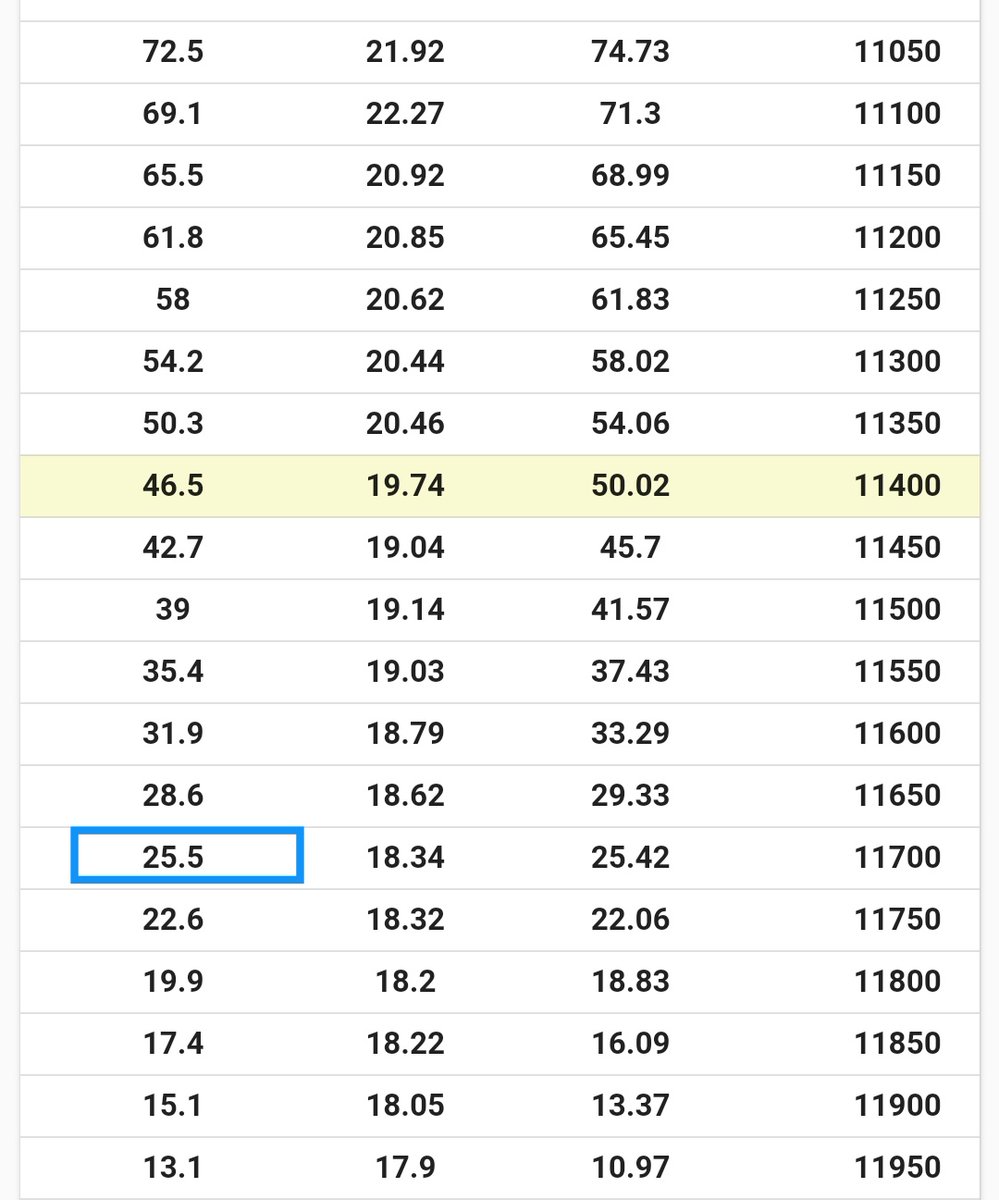

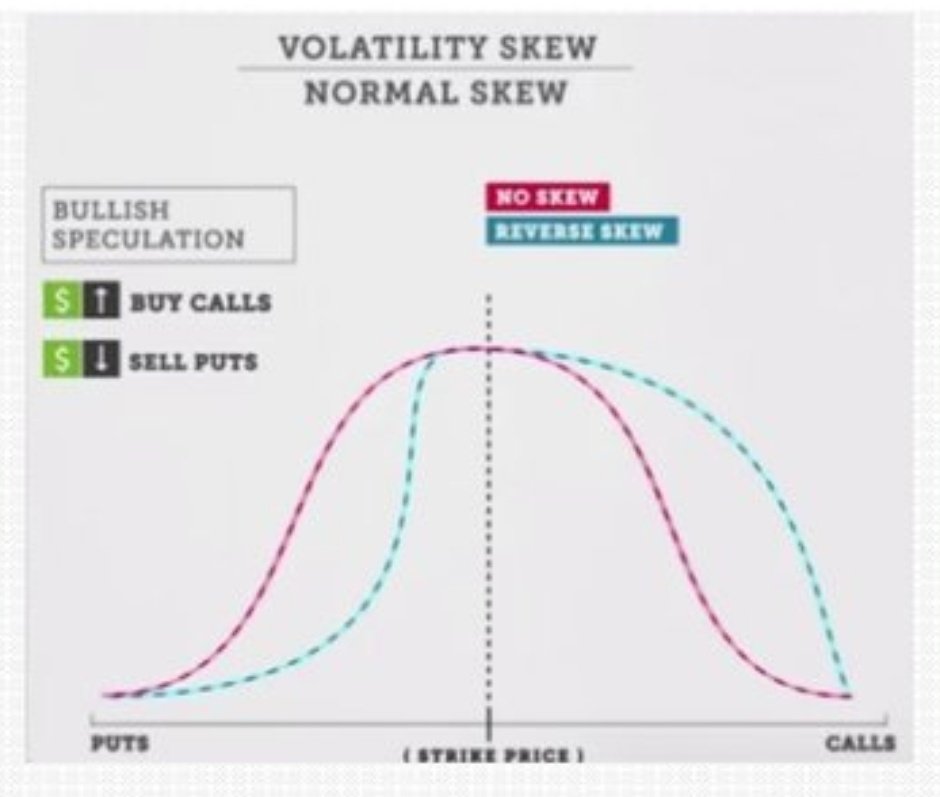

Mostly due to uncertainty Option price skew always to the put side, u can see in form of put side more premium.

Any queries please comment, if i can help i will answer.

Mostly due to uncertainty Option price skew always to the put side, u can see in form of put side more premium.

Any queries please comment, if i can help i will answer.

Mostly probably of profit is inverse of delta. If u short 25 delta then pop near 75% and if delta 10 then pop near 90%. For complex position do it via any payoff diagram.

People hv so many misconceptions like same premium hv same delta but its not bcoz of skew which already told about put side normally more premium.

Call more sensitive to price movement than put thats why sometimes people tell call double but put stay almost same.

Call more sensitive to price movement than put thats why sometimes people tell call double but put stay almost same.

Few refer to vomma and itm hv more intrinsic value less extrinsic and less vega effect but its static when we see dynamic and itm become atm then vega effect most and dynamic of strategy payoff changed who sell itm time spread most often.

I think its enough to understand about greek. Still management varies strategy to strategy.

Thanks again, slow but sure!

Thanks again, slow but sure!

Read on Twitter

Read on Twitter