Right. This may be the first of a number of threads on the #USS valuation document. I& #39;ll start with the Appendix A, a summary of the work of the Valuation Methodology Discussion Forum, where, true to form, #USS are engaging in wilful misrepresentation. https://www.uss.co.uk/~/media/document-libraries/uss/how-uss-is-run/2020-valuation/uss-technical-provisions-consultation-2020-valuation.pdf">https://www.uss.co.uk/~/media/d... 1/ https://twitter.com/Sam_Marsh101/status/1302880632419364864">https://twitter.com/Sam_Marsh...

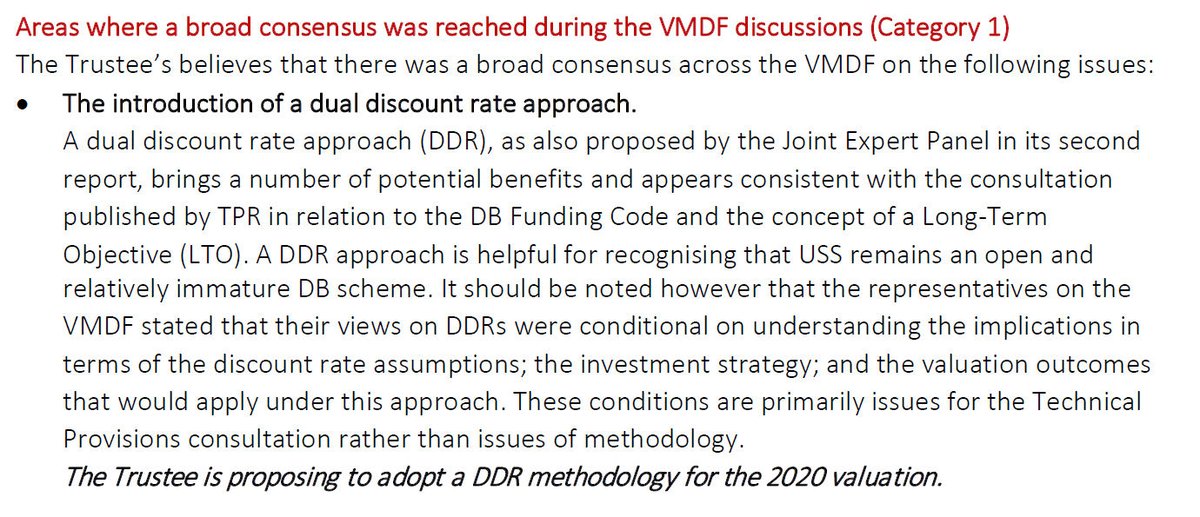

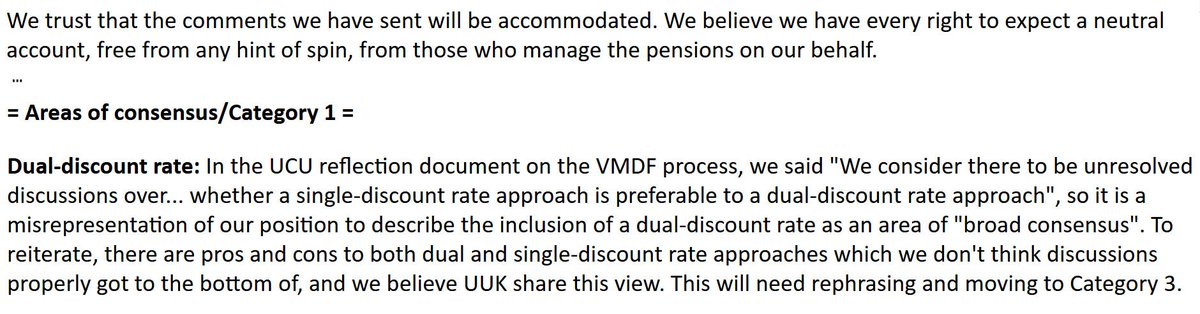

Here& #39;s #USS boldly asserting the introduction of a dual-discount rate as an area of consensus reached by the forum. Except it wasn& #39;t. And both @UCU and @UniversitiesUK representatives warned that it wasn& #39;t pre-publication when we were asked for comment. 2/

Want proof? Here& #39;s what @UCU said to #USS: & #39;it is a misrepresentation of our position to describe the inclusion of a dual-discount rate as an area of "broad consensus"... and we believe UUK share this view.& #39; 3/

The DDR certainly has its merits, but so does a single discount rate. A lack of clear like-for-like comparisons meant this was an unresolved issue, and #USS knew it. To include it in the areas of broad consensus is a political move (cf previous misrepresentation of @TPRgovUK). 4/

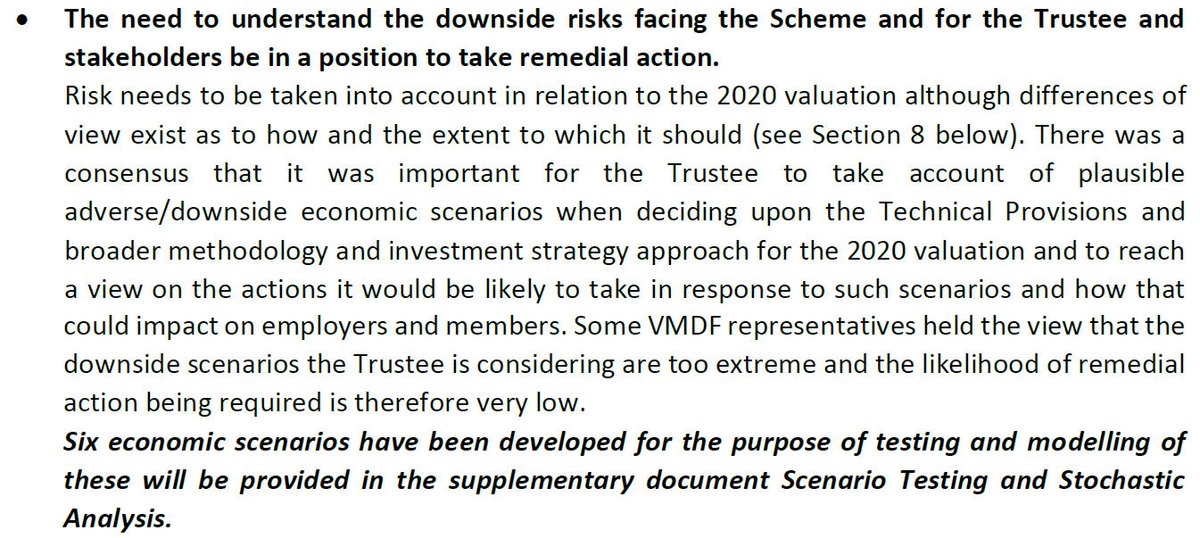

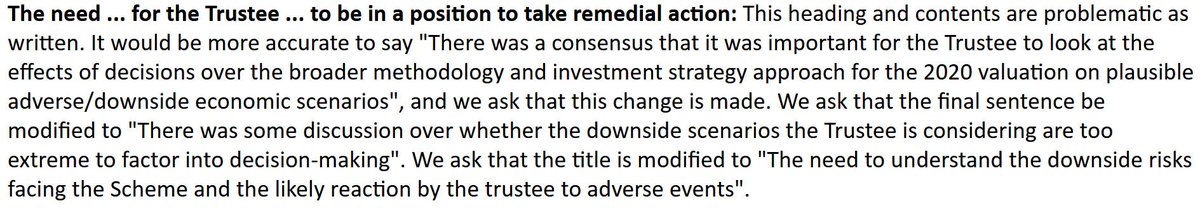

Next, a claim over consensus on "the need ... for the Trustee ... to be in a position to take remedial action", and more misrepresentation, though more subtle this time. Here& #39;s what #USS say. 5/

Here are @UCU& #39;s ciews on the original draft of that paragraph. No change to the title or to the framing of the first part by #USS because they want to manipulate the narrative, as they always do. 6/

Thankfully, the section on areas of disagreement - of which @UCU said "This section suffers from a significant problem throughout... As such, it will need a significant redraft" - has had a redraft which makes it clearer when the trustee is asserting its opinion. 7/

Onto the question of whether a contribution rate of 26% is enough to fund the benefits over a 20-year period, and #USS admit the analysis shows that yes it is "in the majority of scenarios". I& #39;ll let people judge for themselves whether the trustee& #39;s case against is convincing. 7/

Onto cashflow analysis, and its nice to see an accurate reflection of our views here. That said, it required a strong push-back from both @UCU and @UniversitiesUK on an initial draft that tried to paint the position as advocating for a "pay as you go" approach. 8/

Onto the "Fundamental Building Blocks" approach that #USS uses for its investment forecasting, and an accurate description of UCU and UUK& #39;s views. It should be, because its our re-write of what was there initially, which was an over-simplified travesty. 9/

And now a crucial question: what evidence that de-risking helps the scheme? The analysis discussed at the VMDF suggested it didn& #39;t. But don& #39;t worry: the very same #USS that put all its faith in model-driven de-risking now explains why its best to treat models with caution! 10/

This point is particularly galling given #USS used the very same models to make a case *for* de-risking in which the uncertainty hadn& #39;t been accounted for, a point that Jane Hutton raised concerns about shortly before being suspended. https://twitter.com/Sam_Marsh101/status/1183675600495677440">https://twitter.com/Sam_Marsh... 11/

Read on Twitter

Read on Twitter