A thread on George Armoyan, chairman of Clarke Inc $CKI.TO, an investor and executive not enough people know about.

George moved from Syria to Boston to live with an uncle for high school. His family could afford for George to go to a US university, but a family friend convinced him to go to Dalhousie.

That friend had been a Lebanese refugee in Syria when Armoyan& #39;s father helped him.

That friend had been a Lebanese refugee in Syria when Armoyan& #39;s father helped him.

Against his family& #39;s desires, George took civil engineering in school. It suited his mathematical mind, he couldn& #39;t stomach physiology classes (his parents wanted him to be a doctor), and he liked that classes weren& #39;t too early (he was a commuter and a partyer).

While in school he worked as the property manager for some apartments his parents had invested in.

He credits this job for teaching him finances, the importance of hard work and delayed gratification, and how to deal with people

He credits this job for teaching him finances, the importance of hard work and delayed gratification, and how to deal with people

Interest rates were 20+% when he graduated, and he found a lot of ways to make a buck.

His first big deal was buying 80 washer-dryer sets after a laundromat went bankrupt. He cleaned them up, took out ads in the paper, and delivered them himself with his brother and friends.

His first big deal was buying 80 washer-dryer sets after a laundromat went bankrupt. He cleaned them up, took out ads in the paper, and delivered them himself with his brother and friends.

Another of his deals at the time was buying a bankrupt, 3 location camping goods retail chain, and liquidating the assets.

Within a few weeks he had finished selling off the parts and had the funds to start his real estate career.

Within a few weeks he had finished selling off the parts and had the funds to start his real estate career.

He bought a 20 home subdivision when the first developer died and the heirs couldn& #39;t keep it up. He sold 25% of it to have enough for the down payment, and started selling lots just as interest rates were coming down and home builders could buy.

He kept reinvesting profits into developments, and Armco has been a very notable Eastern Canada developer ever since.

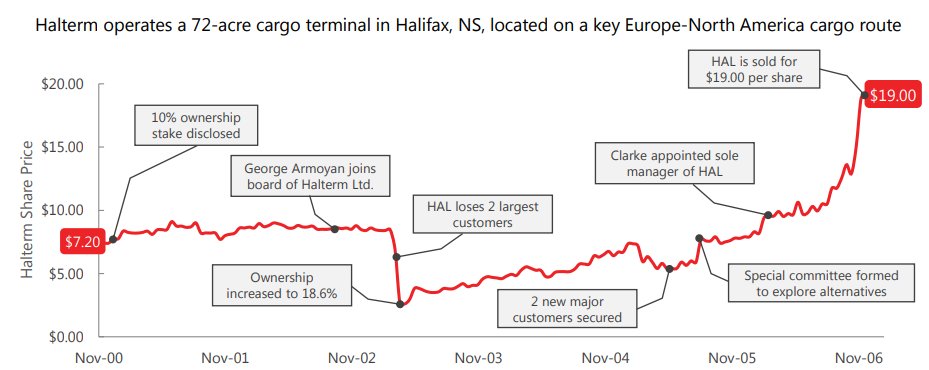

In late 2000 he began earning the his reputation as an activist by buying 10% of Halterm Income Fund, which operated a terminal in Halifax.

In late 2000 he began earning the his reputation as an activist by buying 10% of Halterm Income Fund, which operated a terminal in Halifax.

Halterm had a management contract with Clarke Inc, and Clarke& #39;s CEO and COO were on Halterm& #39;s board.

Armoyan tried to get Halterm out of the contract by buying it back from Clarke, but CEO Roy Rideout wouldn& #39;t make a deal.

“The guy really pissed me off. He wouldn’t sell me the contract at any price.” – George Armoyan

“The guy really pissed me off. He wouldn’t sell me the contract at any price.” – George Armoyan

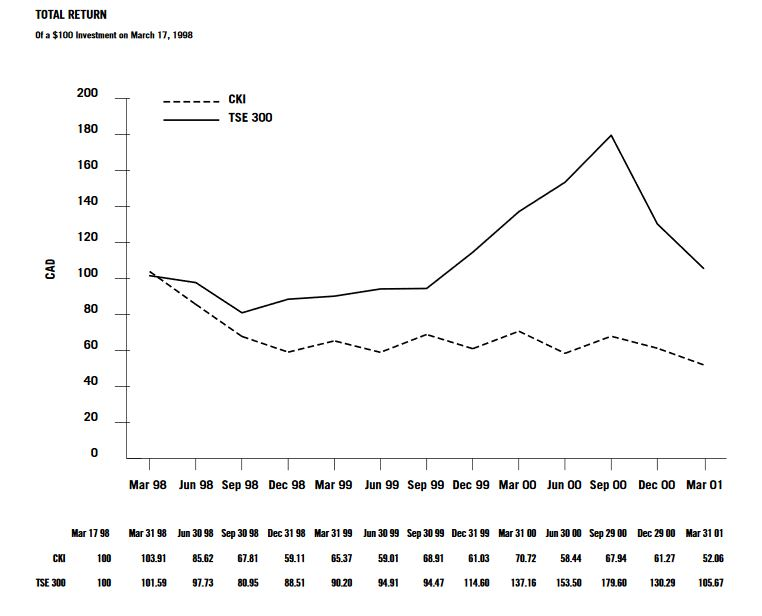

Armoyan then began buying shares of Clarke, which had been a terrible company since going public. By September 2001 he owned 16.6% of Clarke and got a seat on the board.

Rideout tried to adopt a poison pill to stop Armoyan, but George got it voted down at the AGM (Aug 2002) and then bought another 9% of the company.

By April 2003 the CEO and COO were out and Armoyan was CEO.

By April 2003 the CEO and COO were out and Armoyan was CEO.

He began his turnaround - he sold a trucking division, he cut overhead by 34%, he bought out the exorbitant pensions of the old execs, and he decided to turn Clarke into a holding company with "“a focus on asset-based operations, efficiency, profitability and accretive growth”

“I like ‘stuff’. I like to feel and touch.”

“I prefer seeing stuff with bricks and mortar, inventory, things I touch. We really put zero value on goodwill.”

“I prefer seeing stuff with bricks and mortar, inventory, things I touch. We really put zero value on goodwill.”

He really focused on failed income trusts.

Income trusts were all the rage in Canada in the mid-00& #39;s. When an income trust would cut its distribution, its unit price would crater and Armoyan would swoop in.

Income trusts were all the rage in Canada in the mid-00& #39;s. When an income trust would cut its distribution, its unit price would crater and Armoyan would swoop in.

Once he bought his stake, he& #39;d get on the board and start his activism. He made money with several methods (he acquired Granby, he took Sure-Gro private with a partner) but usually he would with the fund to sell, as he did with Halterm, Advanced Fiber Technologies, EOne, etc

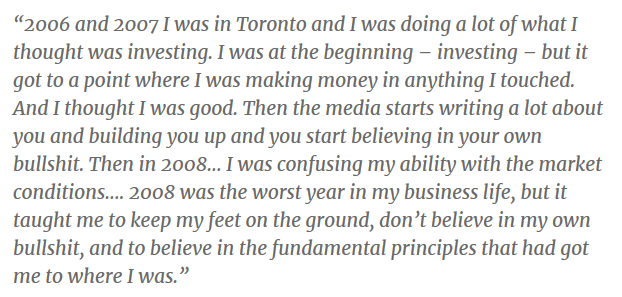

He levered up in 2006, issuing $185 million of debentures at 6%. “If I can’t make 6% on the cash that I have, I’m in the wrong place.”

You know where this is going....

You know where this is going....

He refined his process after that.

“We’ve decided to focus on less companies but bigger ones. We realized that one of our biggest challenges is human capital. Whether you’re working with a small company or a large company, it takes the same effort and time.”

“We’ve decided to focus on less companies but bigger ones. We realized that one of our biggest challenges is human capital. Whether you’re working with a small company or a large company, it takes the same effort and time.”

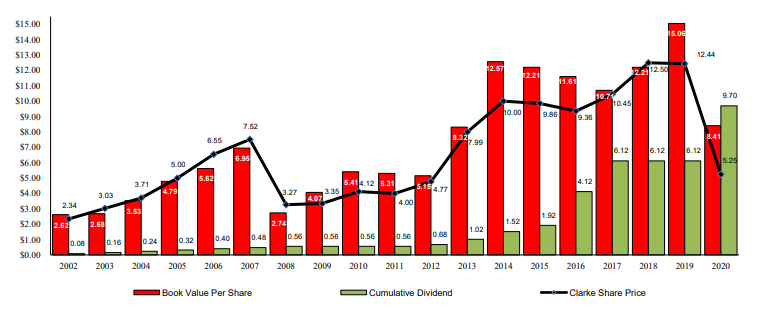

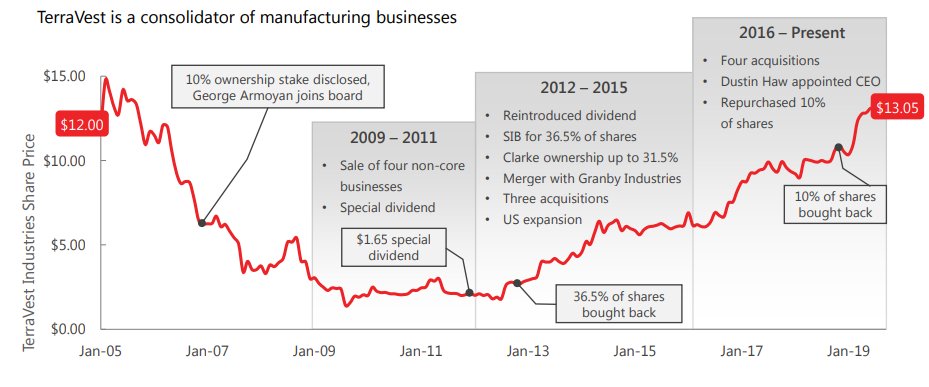

He did some interesting things after 08 including a highly publicized fight against Sherritt (where directors were making 5x the avg Canadian& #39;s income for 7 meetings/yr), but a chart tells the rest of the story well

From the time Armoyan got there, book value growth + dividends paid out has been ~12.5% CAGR. That compares to ~6.1% for the S&P 500 (without reinvesting dividends for either).

How did he do it?

1) He& #39;d buy whatever was out of favour (failed income trusts in the 00& #39;s, a lot of O&G in the 10& #39;s, etc), get a board seat, then work to improve or sell it.

2) Even though he was an activist, he invested for the long term.

1) He& #39;d buy whatever was out of favour (failed income trusts in the 00& #39;s, a lot of O&G in the 10& #39;s, etc), get a board seat, then work to improve or sell it.

2) Even though he was an activist, he invested for the long term.

It took him 6 years to sell Halterm, and Clarke held Terravest $TVK.TO for ~14 years before the spinoff this year.

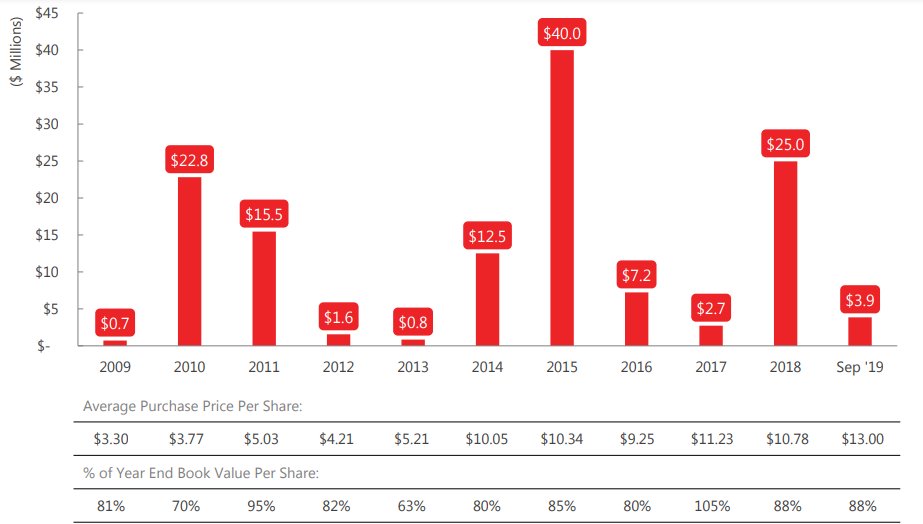

3) He bought back shares when they were undervalued, and he would pay out large special dividends when he had no good places to put the cash (seen on the performance chart above).

George Armoyan went to the US knowing no English, couldn& #39;t afford schooling there so went to Canada (Nova Scotia of all places), and became a (likely) billionaire mostly through public equity investments. His story should be better known.

Read on Twitter

Read on Twitter