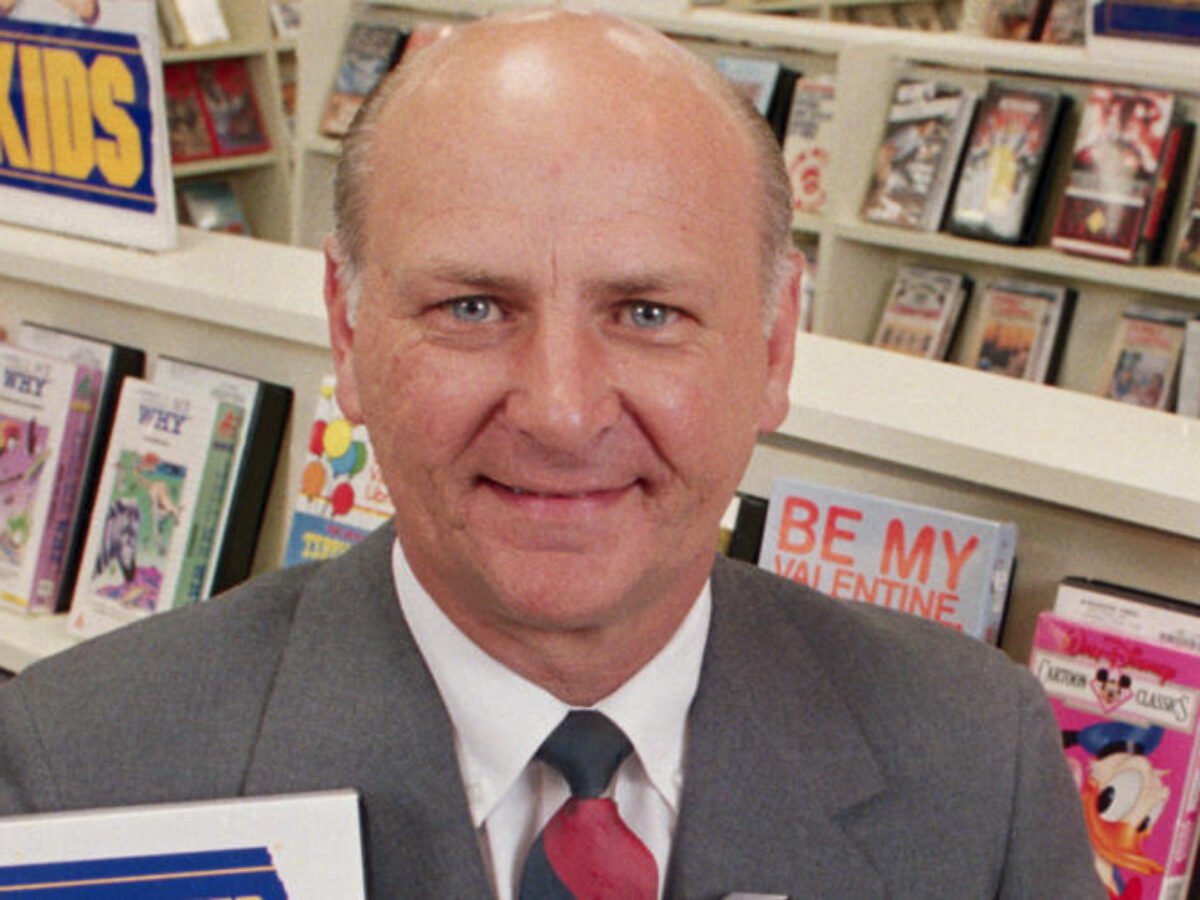

1/ Let& #39;s discuss one of the most successful, but forgotten, entrepreneurs of recent times, Wayne Huizenga.

I love learning from great entrepreneurs and being a South FL native, I don& #39;t think Huizenga gets the credit he deserves.

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

I love learning from great entrepreneurs and being a South FL native, I don& #39;t think Huizenga gets the credit he deserves.

A thread

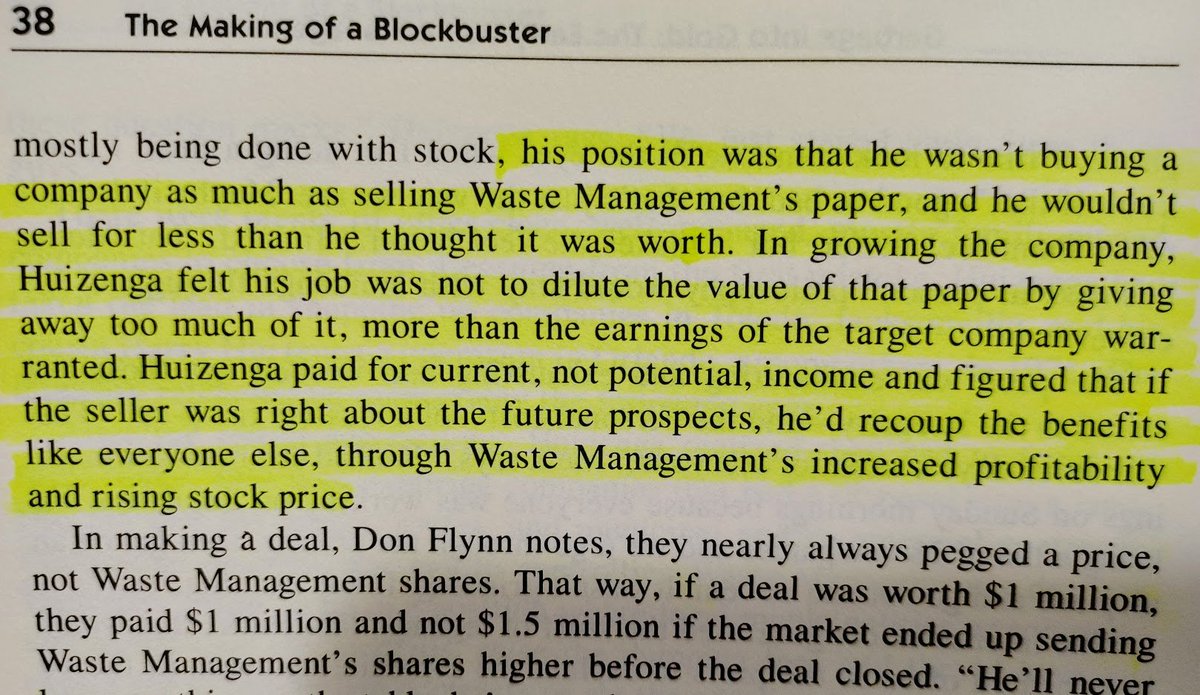

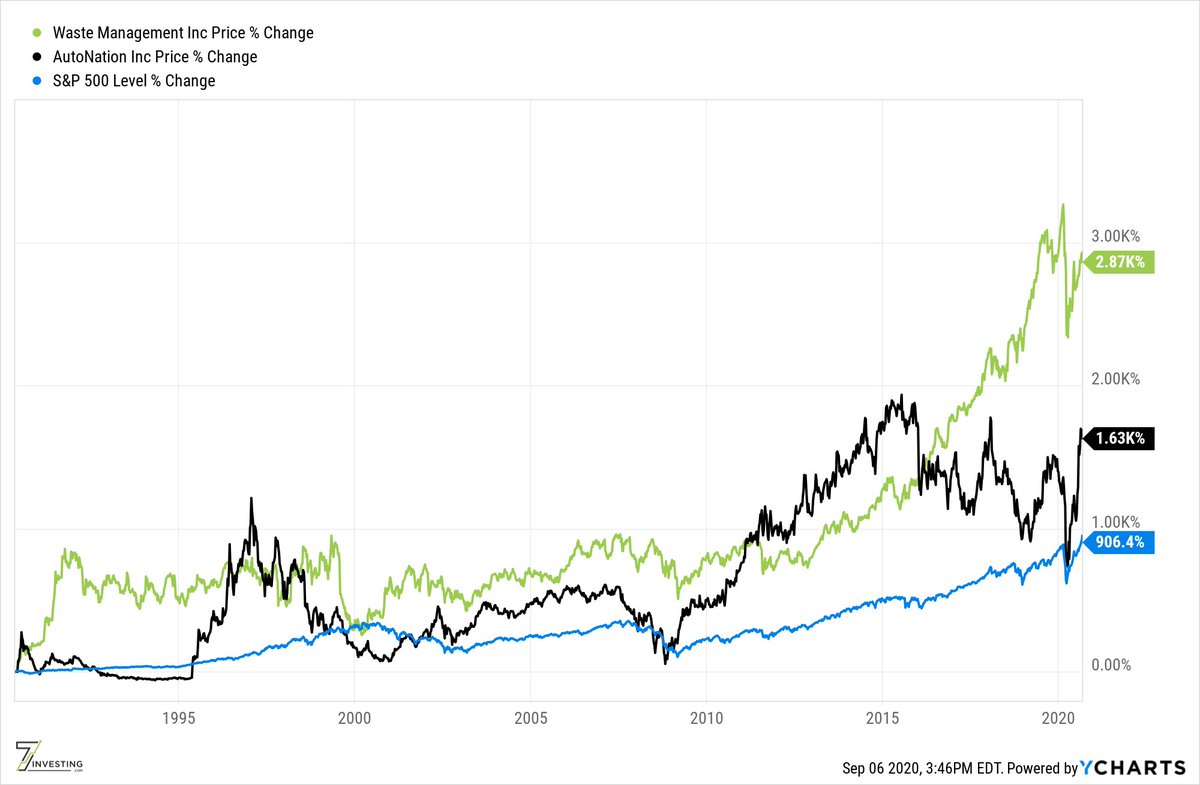

2/ Using a strategy of seeking out fragmented industries and then going on relentless acquisition sprees, Huizenga launched not 1, not 2, but 3 multi-billion dollar cos.

That includes Waste Management $WM, Blockbuster Entertainment, and AutoNation $AN.

Most of these notes from:

That includes Waste Management $WM, Blockbuster Entertainment, and AutoNation $AN.

Most of these notes from:

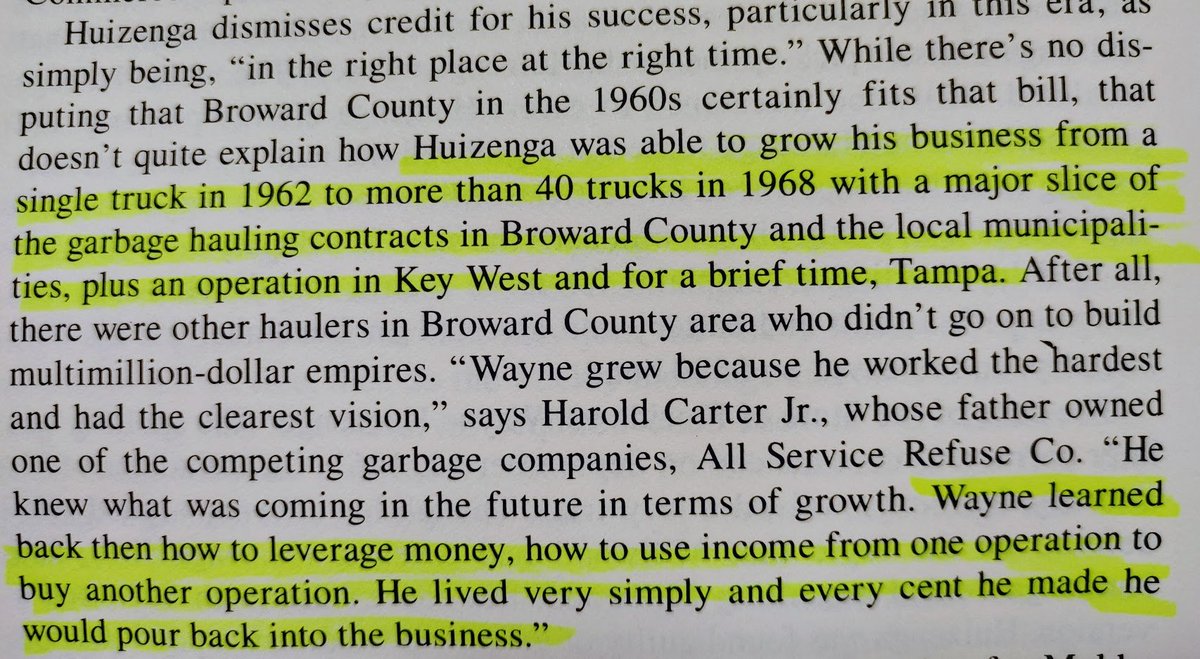

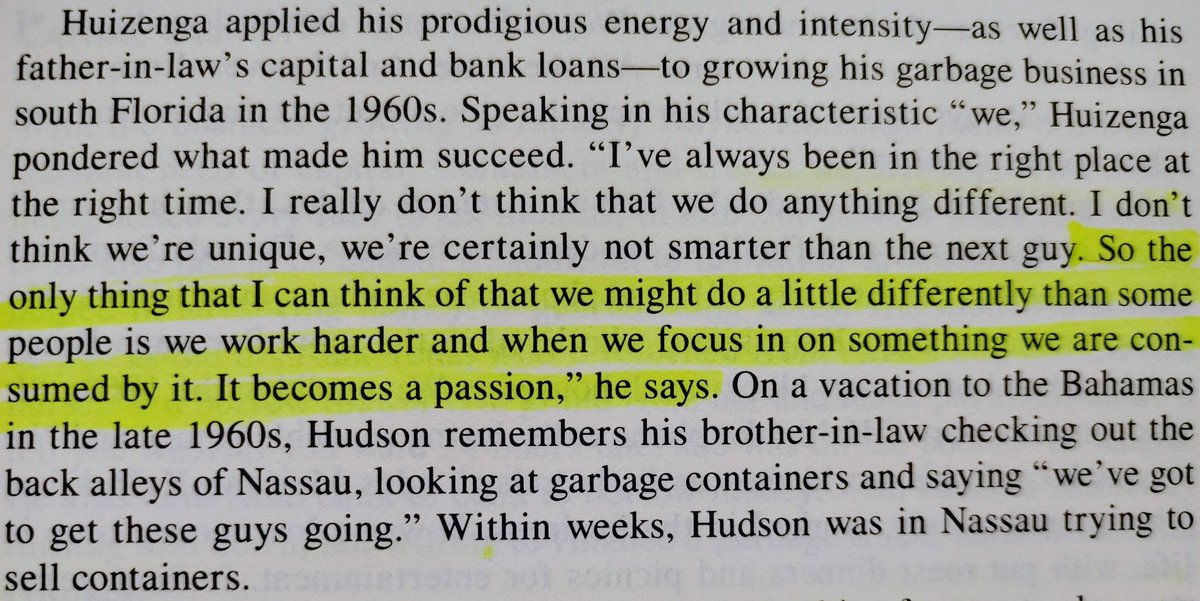

3/ Wayne Huizenga started with one garbage truck in the early 1960s in Fort Lauderdale. Within 6 yrs, he grew his operation to >40 trucks and several major garbage removal contracts across South FL.

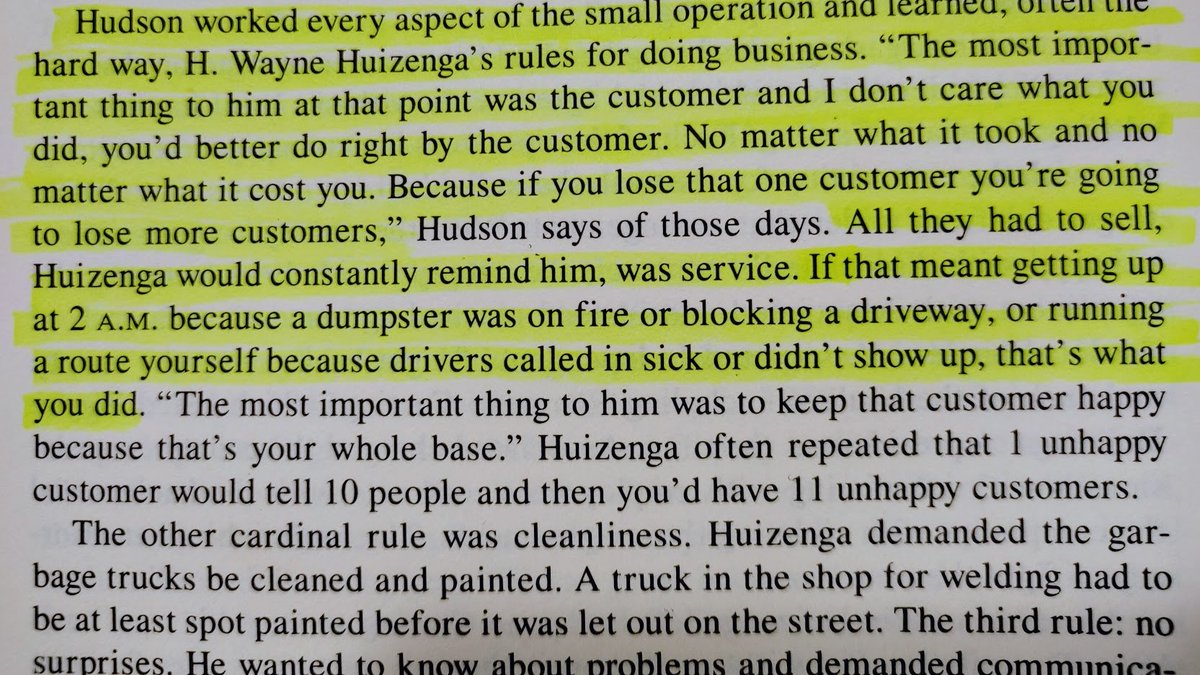

4/ Huizenga would become much more of an empire-builder than operator, loving the challenge of building a company up from almost nothing to an industry behemoth before moving on. Still the man knew what was important.

His #1 priority as an owner? Treat the customer right.

His #1 priority as an owner? Treat the customer right.

5/ In a service industry, like picking up trash, or when selling a commodity, like a video or car, there& #39;s little that can separate you from the competition except maybe better service. Sometimes there aren& #39;t short cuts to success.

6/ He also lived frugally when starting out, living in a modest home and driving a modest car. Love the Cadillac line at the bottom of this passage. His living style definitely inflated over time, but he knew he had to start out modestly.

7/ Any company following the acquisition strategy, needs to understand the real drivers of the profitability in the industry. For waste management, this was finding companies who owned the landfills, not just a fleet of trucks and route contracts.

8/ Huizenga also learned that they weren& #39;t just gaining companies, balance sheets, and assets, but people. If these people weren& #39;t going to make a good fit, the acquisition wouldn& #39;t be successful.

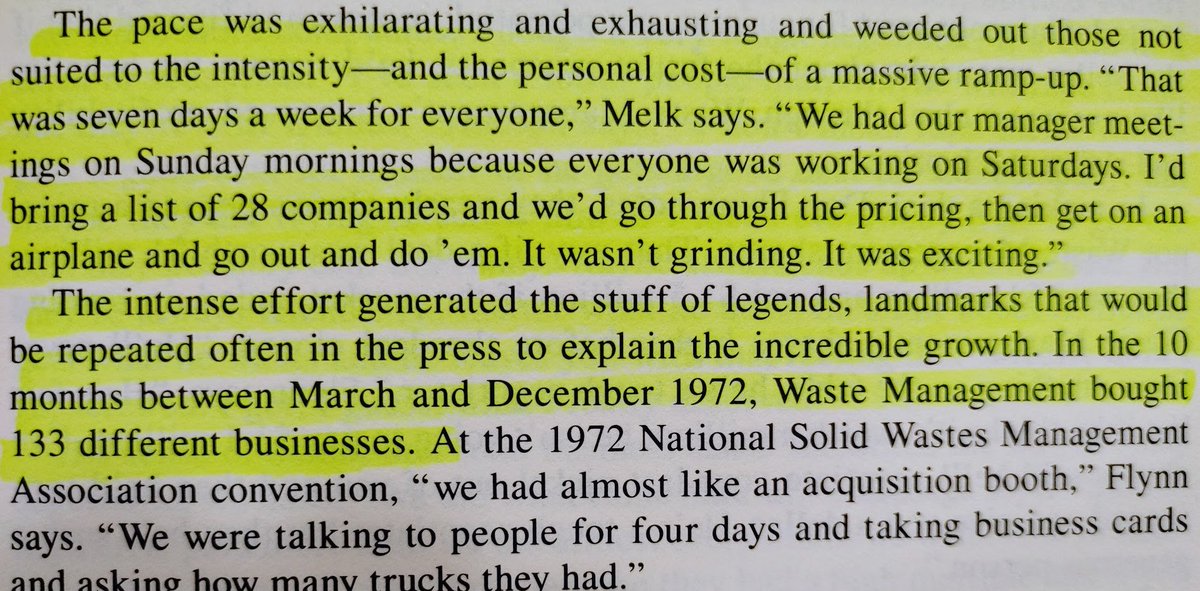

9/ At a certain point, all of Huizenga& #39;s companies reached escape velocity, and slew of deals followed.

In 1972, $WM bought 133 different companies.

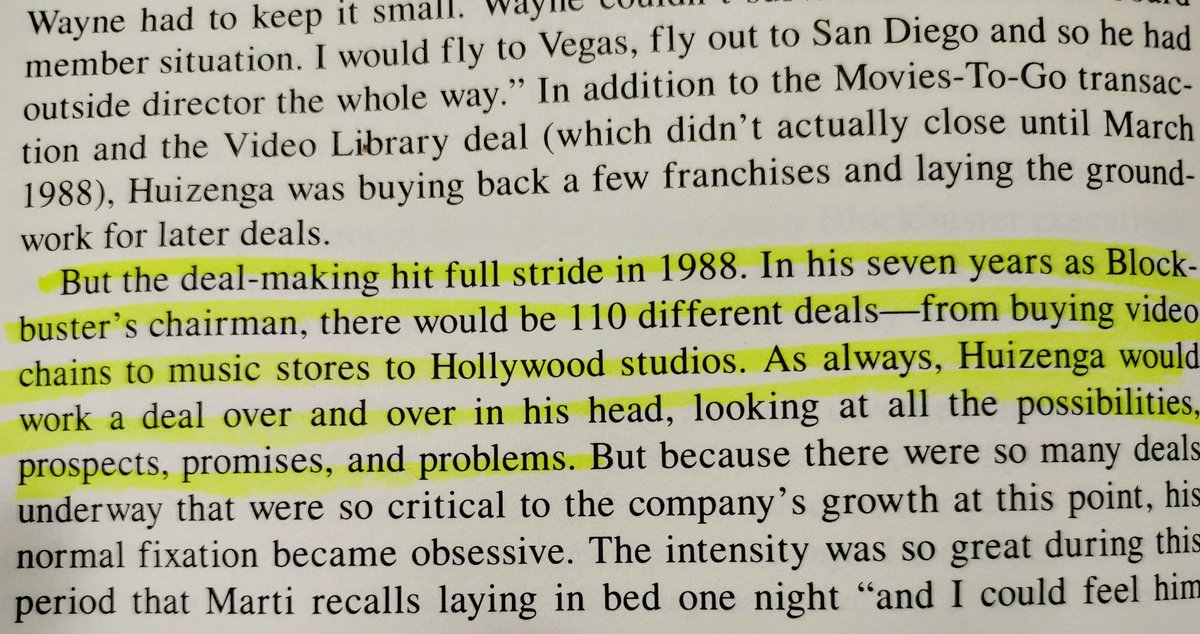

In his 7 yrs at Blockbuster, Huizenga made 110 different deals.

In 1972, $WM bought 133 different companies.

In his 7 yrs at Blockbuster, Huizenga made 110 different deals.

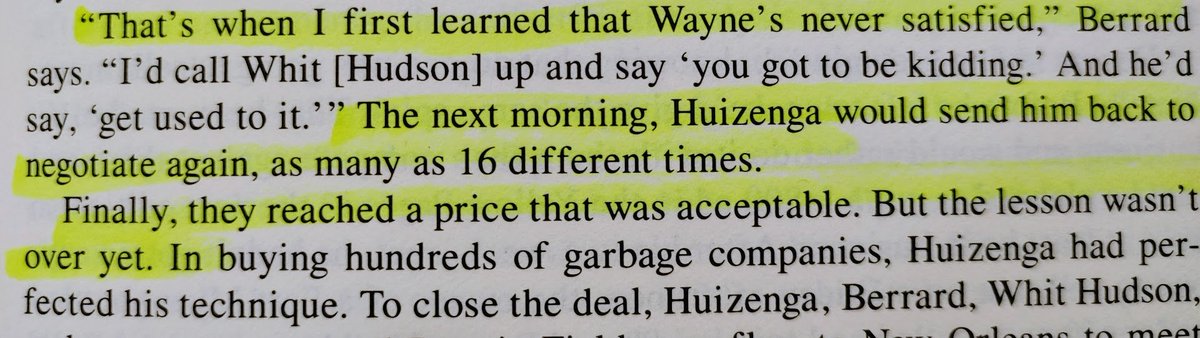

10/ What were the secrets to Wayne& #39;s deal-making skills?

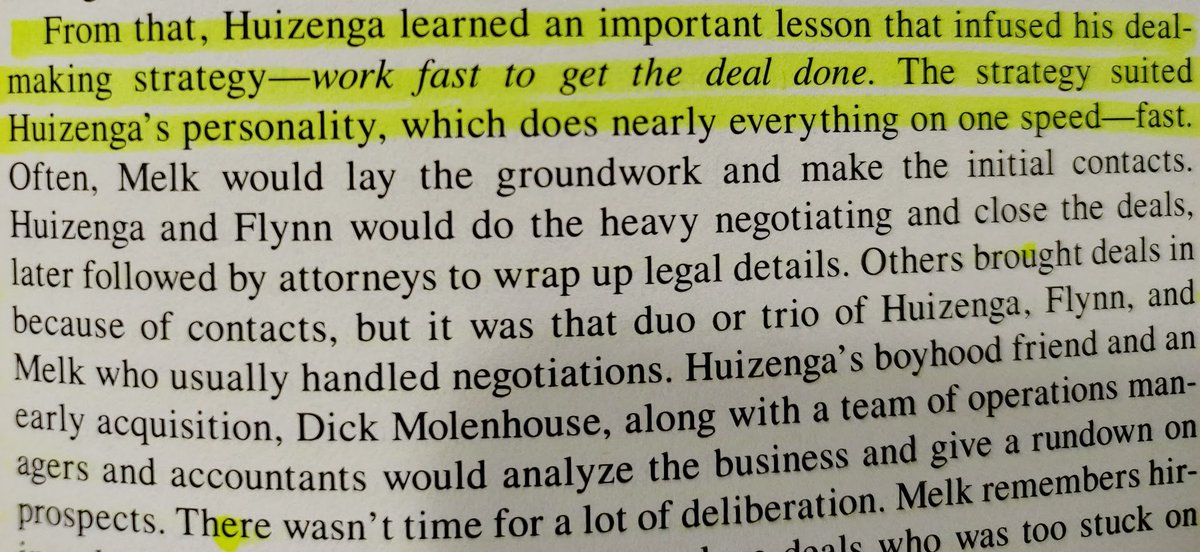

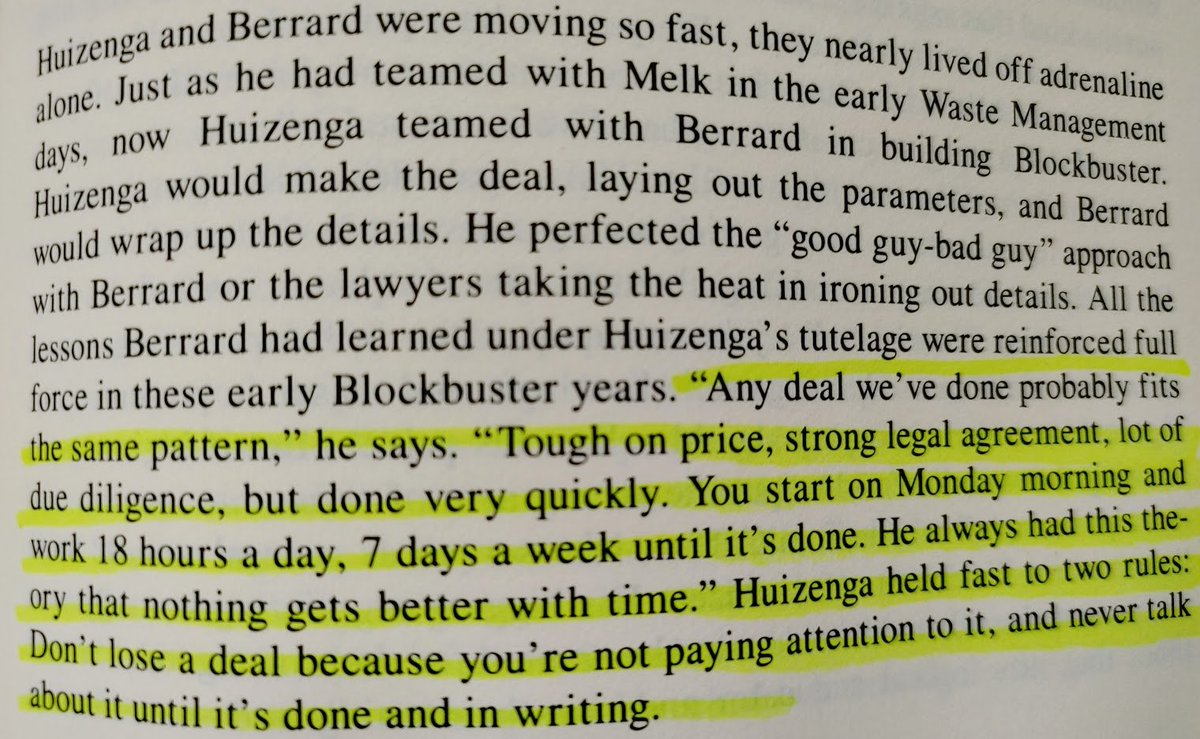

Rule #1: Move fast, close fast. If you& #39;re close on terms, if you have a deal in principle, work fast to close it.

Rule #1: Move fast, close fast. If you& #39;re close on terms, if you have a deal in principle, work fast to close it.

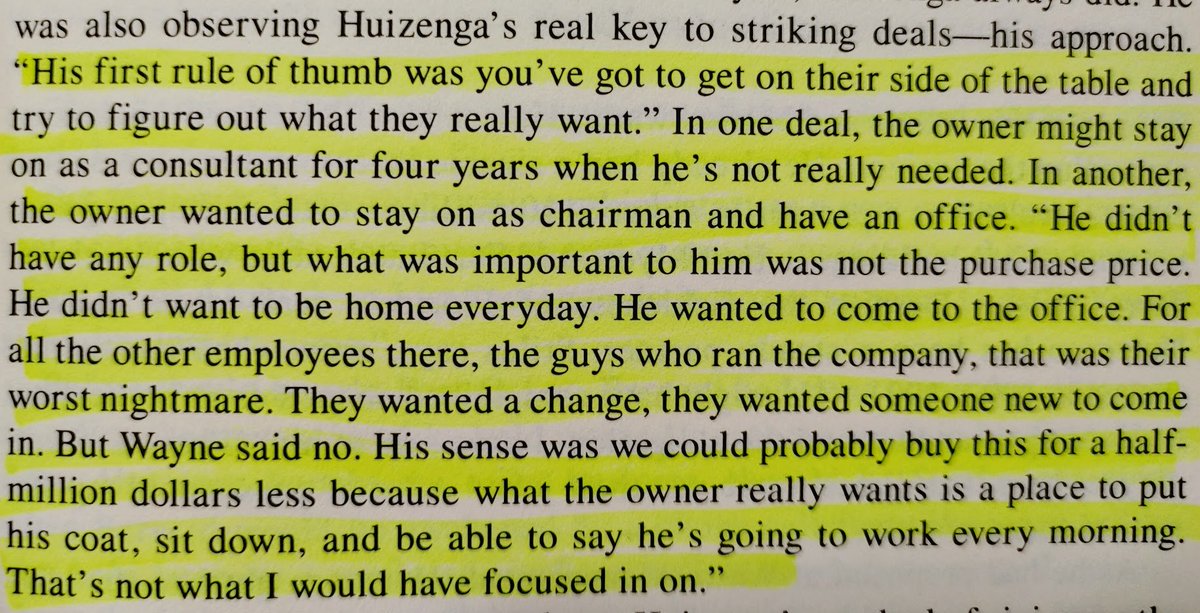

11/ Rule #2: Understand what the person sitting across from you really wants. It& #39;s not always just more money. Sometimes they still want a job, a role to play. Sometimes that& #39;s their worst nightmare.

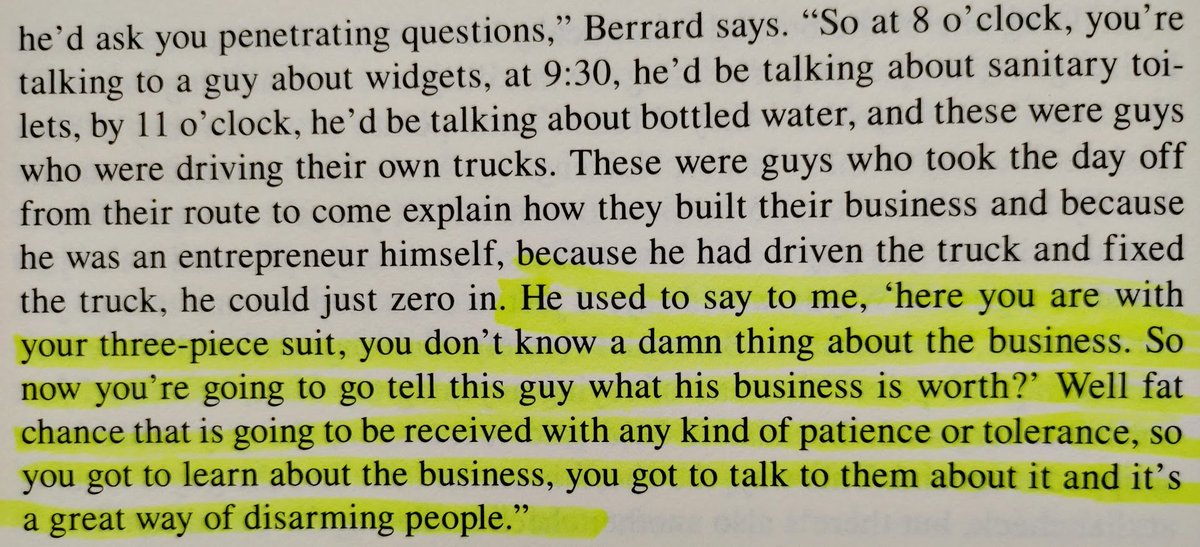

12/ Rule #3: Know about the business you& #39;re buying. If you don& #39;t know anything about what you& #39;re buying, you won& #39;t be able to negotiate terms as successfully.

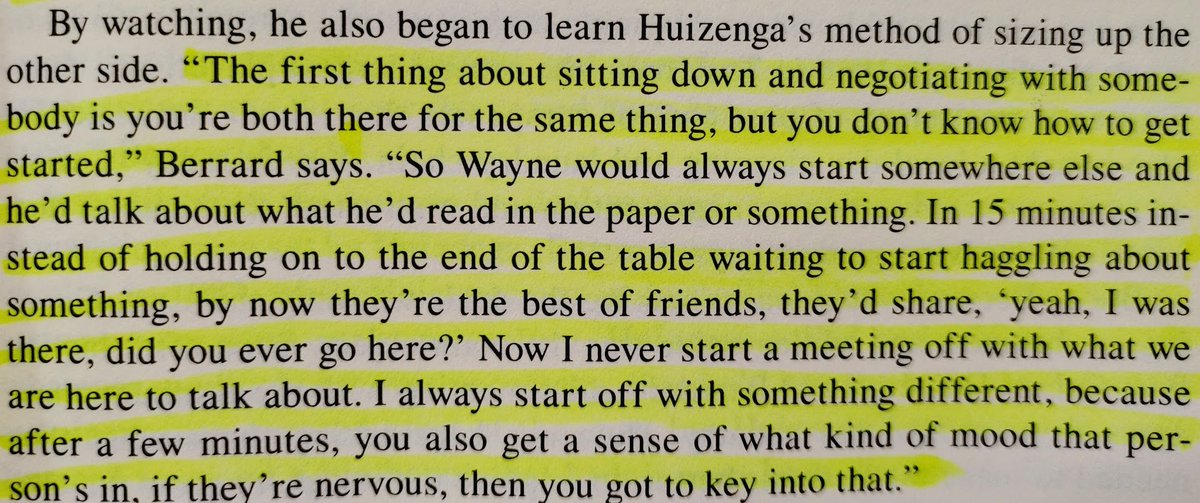

13/ Rule #4: Start negotiations off with small talk. Get to know the other person. Become their friend.

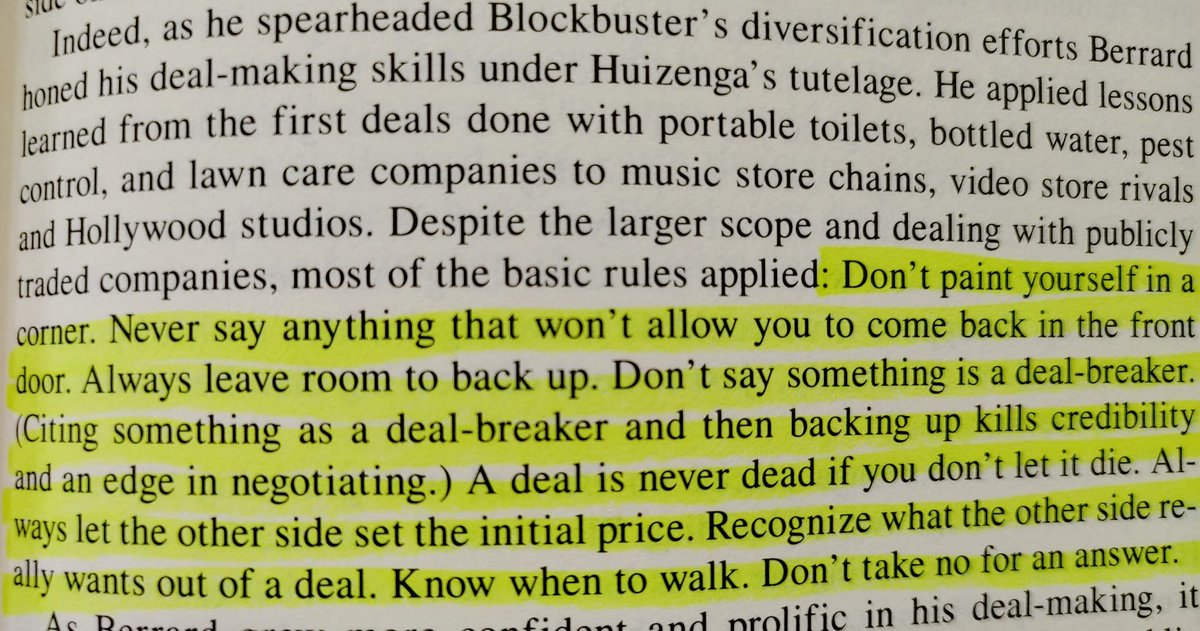

15/ Rule #6: Don& #39;t say anything you& #39;ll regret, leave room for negotiation. (e.g. If you say something is a deal-breaker and then back off, you& #39;ve killed credibility). If you do this, a deal is never dead until you say it is.

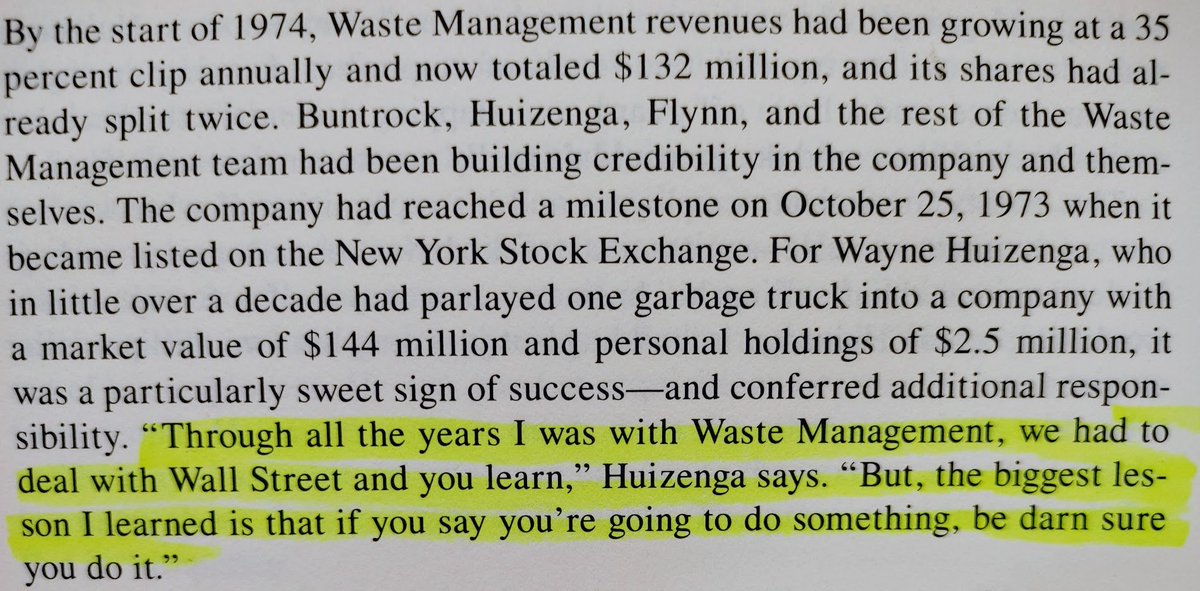

16/ After taking 3 companies public, what was Huizenga& #39;s biggest lesson he learned for dealing w/ Wall Street? If you say you& #39;re going to do something, you better make sure you do it!

17/ Shareholders in Huizenga& #39;s companies fared extremely well while he was building these companies up. Blockbuster was a $7M, 19-store video rental chain when he bought the company. $VIAC bought it in 1994 for $8.4B. https://www.latimes.com/archives/la-xpm-1994-01-08-mn-9710-story.html">https://www.latimes.com/archives/...

Read on Twitter

Read on Twitter " title="1/ Let& #39;s discuss one of the most successful, but forgotten, entrepreneurs of recent times, Wayne Huizenga.I love learning from great entrepreneurs and being a South FL native, I don& #39;t think Huizenga gets the credit he deserves.A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="1/ Let& #39;s discuss one of the most successful, but forgotten, entrepreneurs of recent times, Wayne Huizenga.I love learning from great entrepreneurs and being a South FL native, I don& #39;t think Huizenga gets the credit he deserves.A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>