Analizing BTC moves (4 moves) with Options data & On chain Analysis

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

A thread

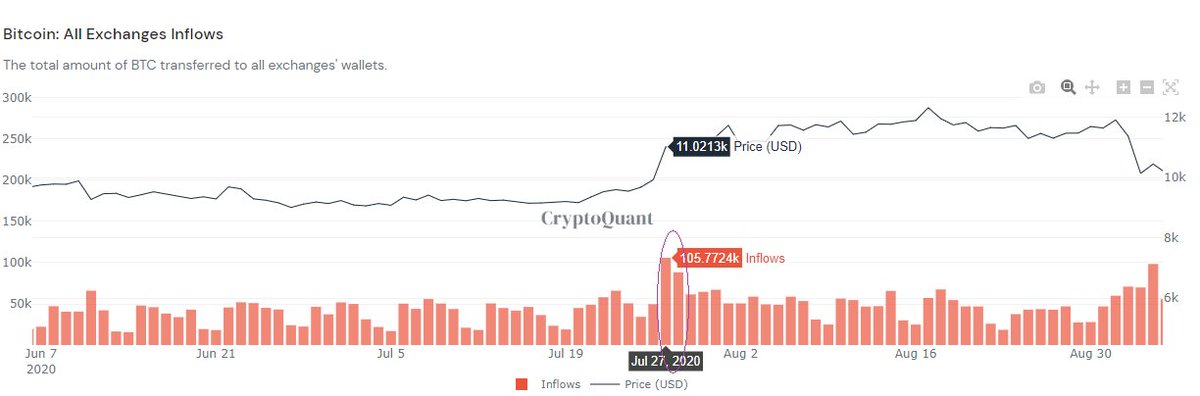

2.2) Exchange Inflows during the pump ( Jul 27/28) and 1 day after Options expiration (Jul 31)…DUMP!

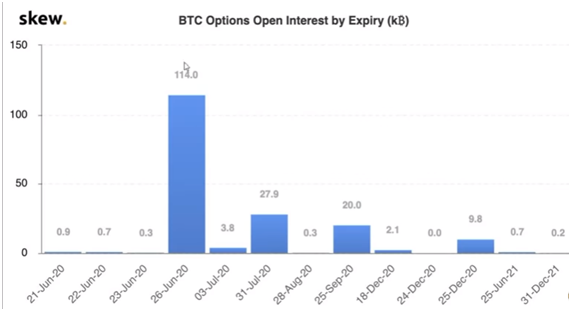

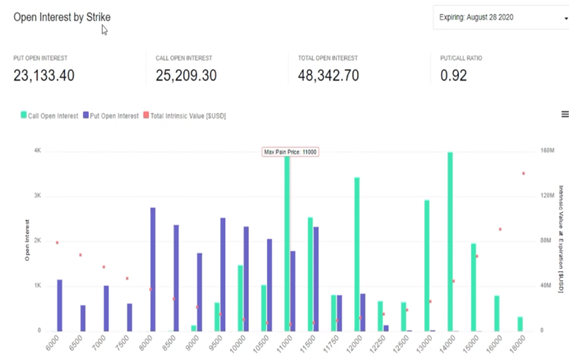

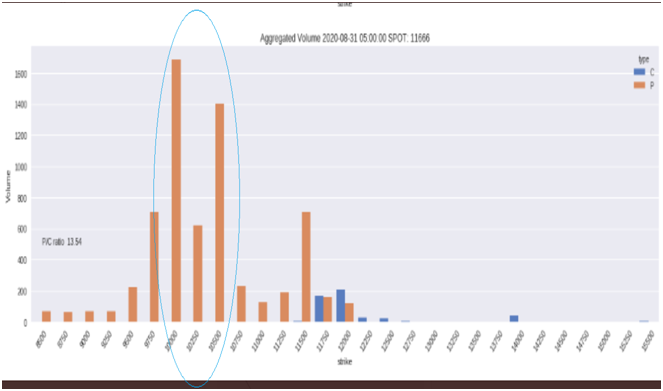

3.2) Max pain Price on Aug 28: 11000

(Max pain theory: https://clarkfinancial.com/how-to-make-money-trading-the-maximum-pain-theory/)">https://clarkfinancial.com/how-to-ma...

(Max pain theory: https://clarkfinancial.com/how-to-make-money-trading-the-maximum-pain-theory/)">https://clarkfinancial.com/how-to-ma...

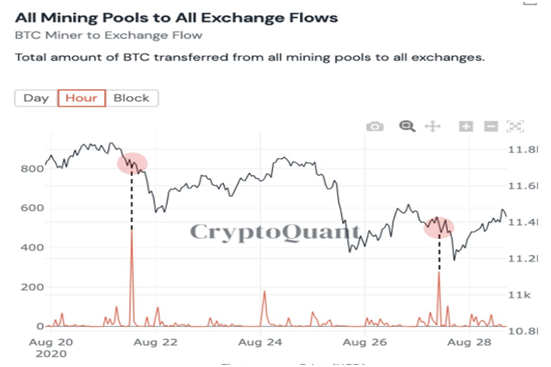

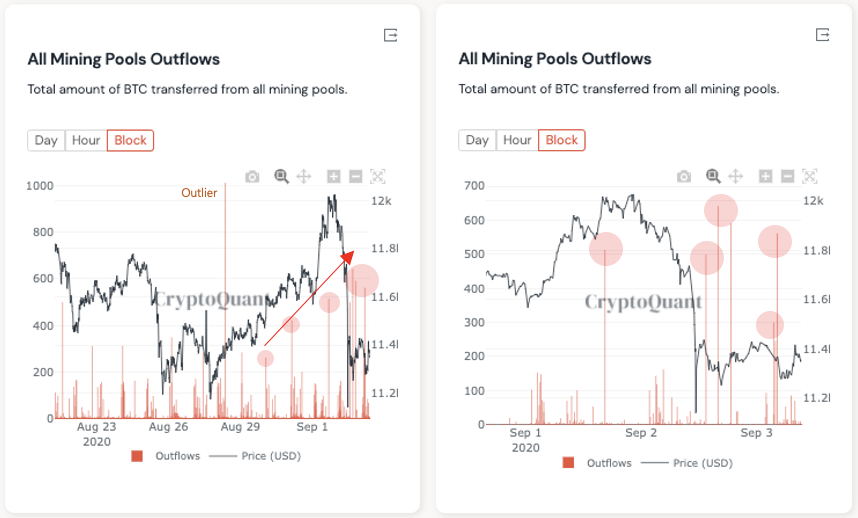

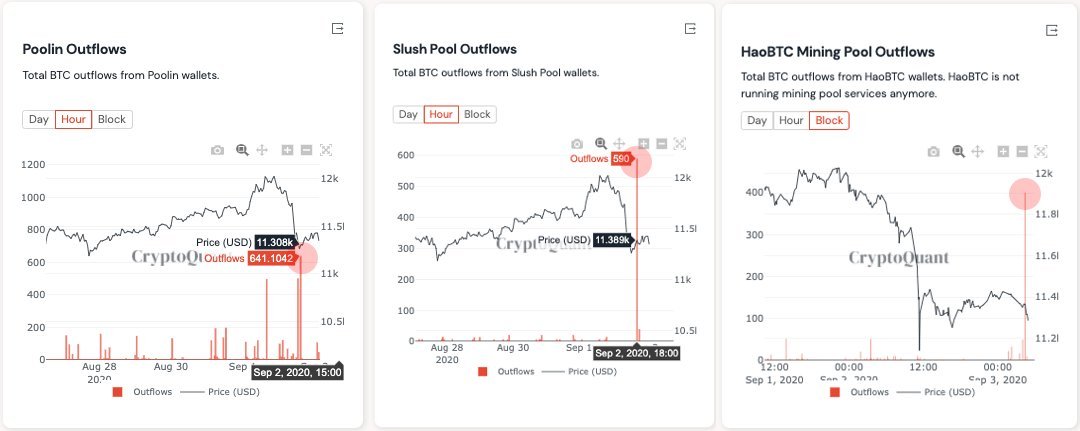

3.3) Miner outflows during the dump driving the price to the max pain price (low11ks) at expiration.

6) Summarizing,things to keep in mind:

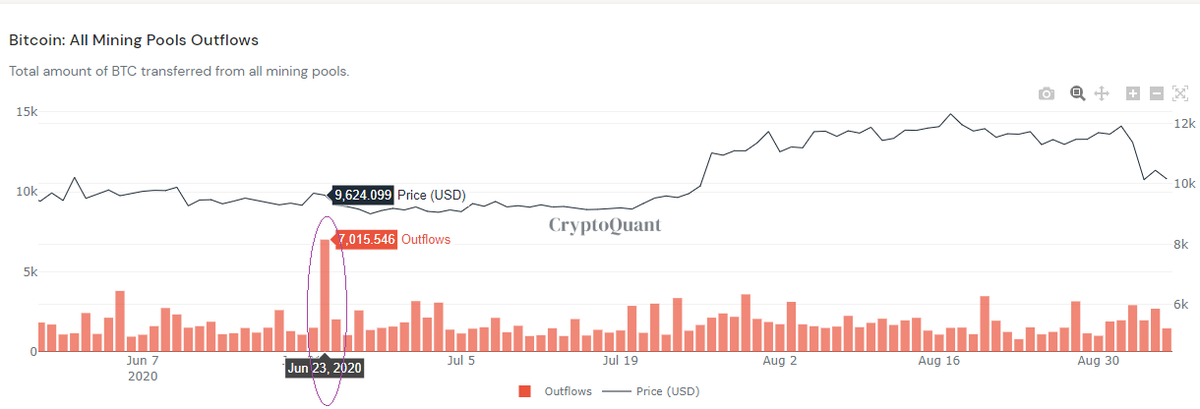

a)The Miner Outflows and Exchange Inflows @cryptoquant_com @ki_young_ju

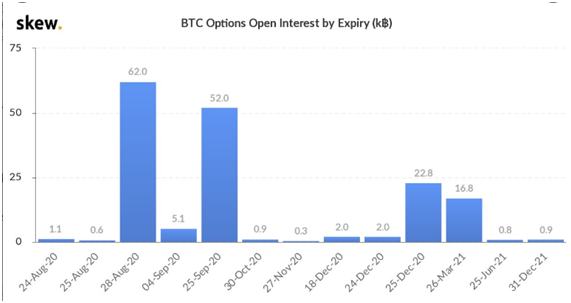

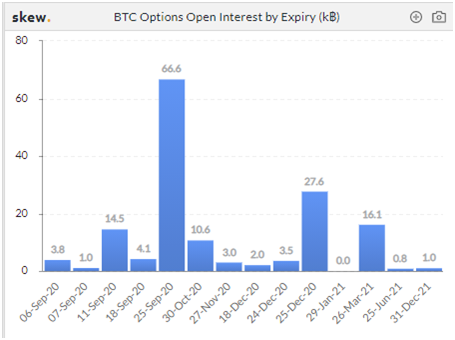

b)Expiration date of Large BTC options and the strike price (max pain price) on that date. @skewdotcom @optionstrack

c) Large puts or calls options bought.

a)The Miner Outflows and Exchange Inflows @cryptoquant_com @ki_young_ju

b)Expiration date of Large BTC options and the strike price (max pain price) on that date. @skewdotcom @optionstrack

c) Large puts or calls options bought.

Hope this help!

unroll @threadreaderapp

Read on Twitter

Read on Twitter