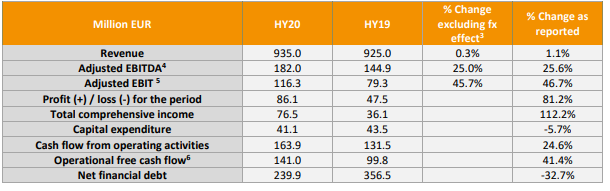

Tessenderlo $TESB.BR recently announced their stunning results for the first 6 months of 2020.

Revenue almost stable, but big jump on profitability.

Investments in Bio-Valorization finally seem to be paying off.

Some highlights & thoughts from the earnings call here:

Revenue almost stable, but big jump on profitability.

Investments in Bio-Valorization finally seem to be paying off.

Some highlights & thoughts from the earnings call here:

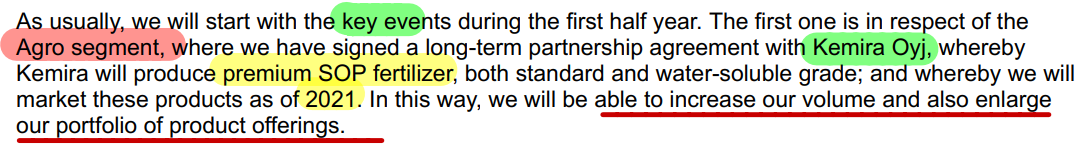

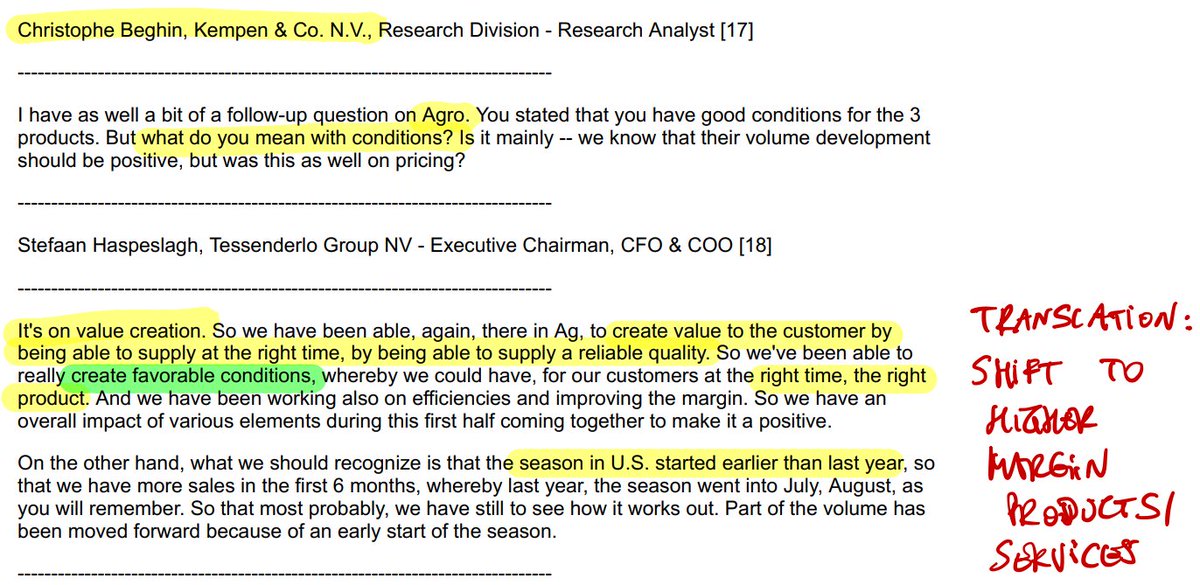

1/ AGRO

Partnership with Kemira: sounds like a capital light opportunity for extra profits, but they didn& #39;t want to give financial details.

Will increase capacity, but will have negligable impact on overall EBITDA

Partnership with Kemira: sounds like a capital light opportunity for extra profits, but they didn& #39;t want to give financial details.

Will increase capacity, but will have negligable impact on overall EBITDA

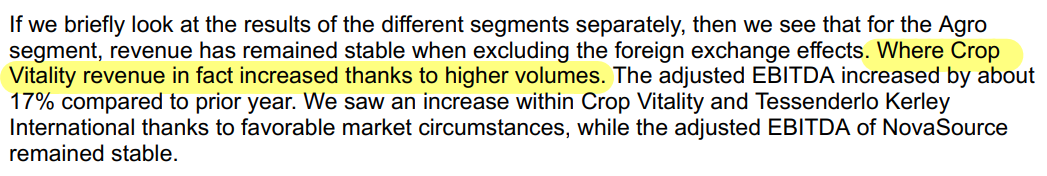

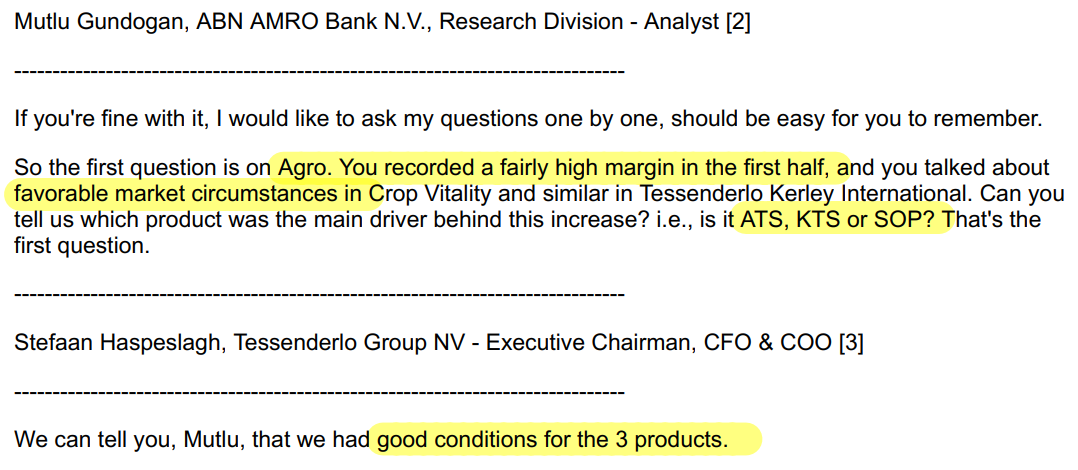

2/ Results:

Revenue slight increase, but +17% EBITDA thanks to higher volumes & favorable market circumstances.

Good results for all products

Revenue slight increase, but +17% EBITDA thanks to higher volumes & favorable market circumstances.

Good results for all products

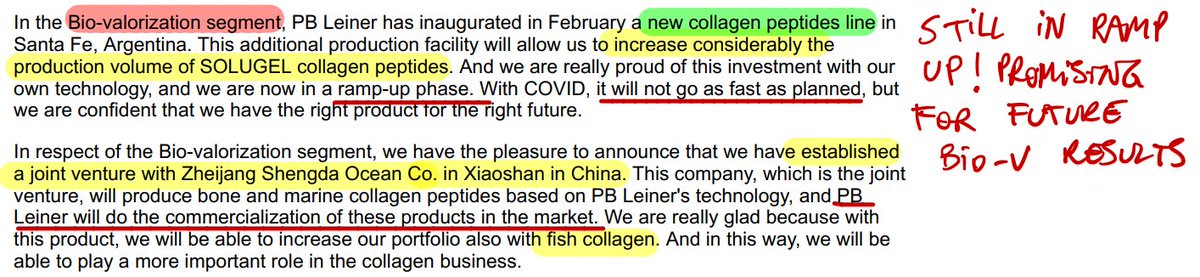

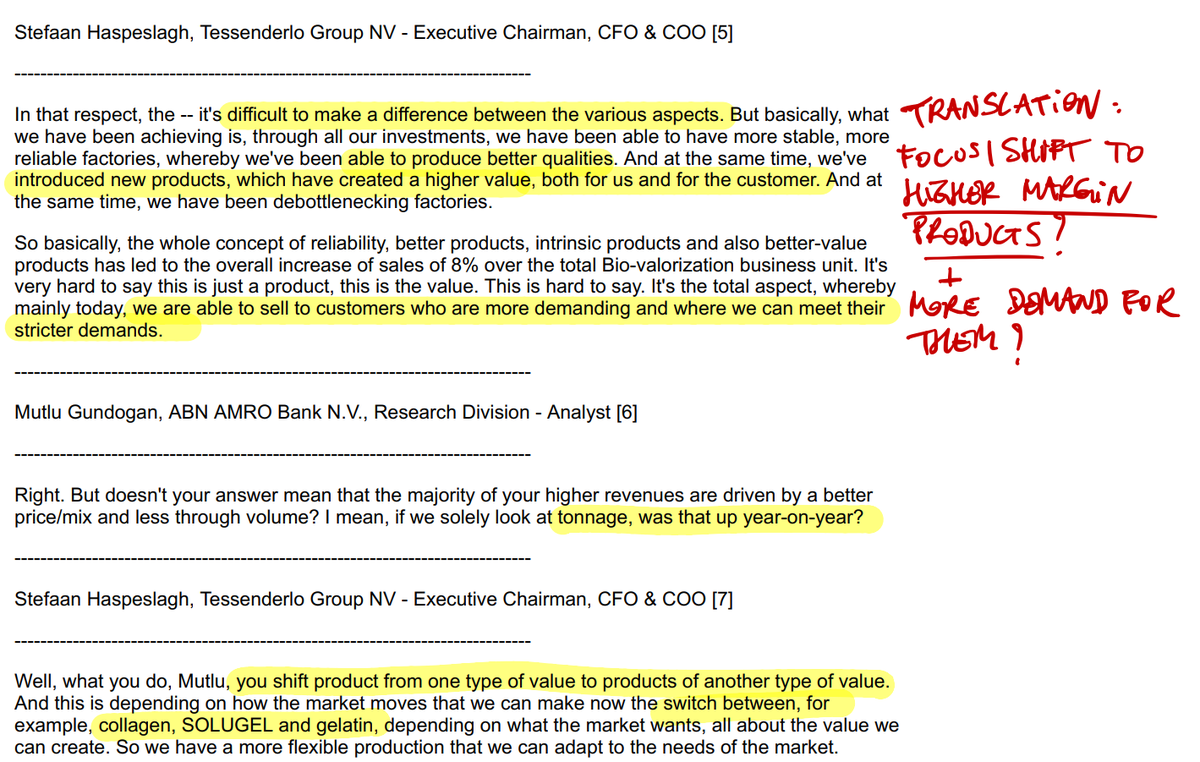

3/ BIO-Valorization:

This has been historically neglected, but the focus of recent investments last couple of years.

New collagen peptide line active in Sante Fe (still in ramp-up!). New JV in China announced.

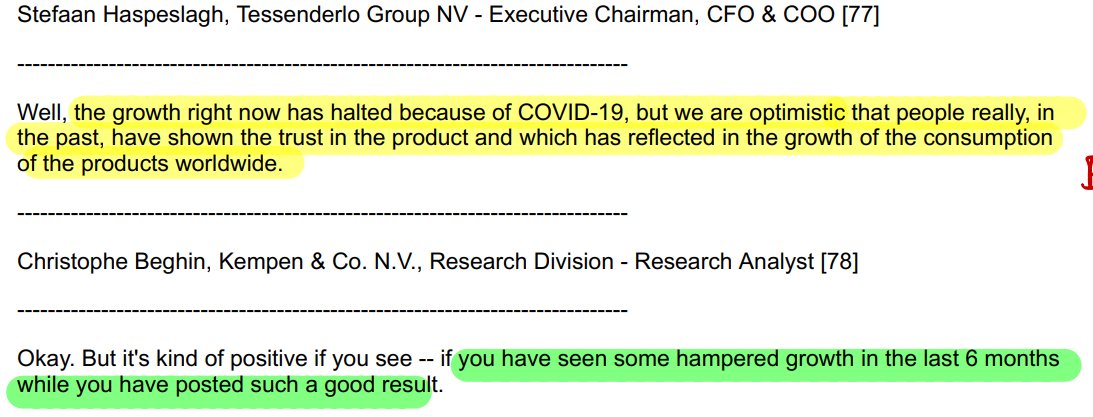

They seem very bullish on collagen peptides

This has been historically neglected, but the focus of recent investments last couple of years.

New collagen peptide line active in Sante Fe (still in ramp-up!). New JV in China announced.

They seem very bullish on collagen peptides

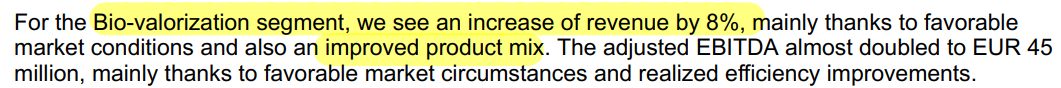

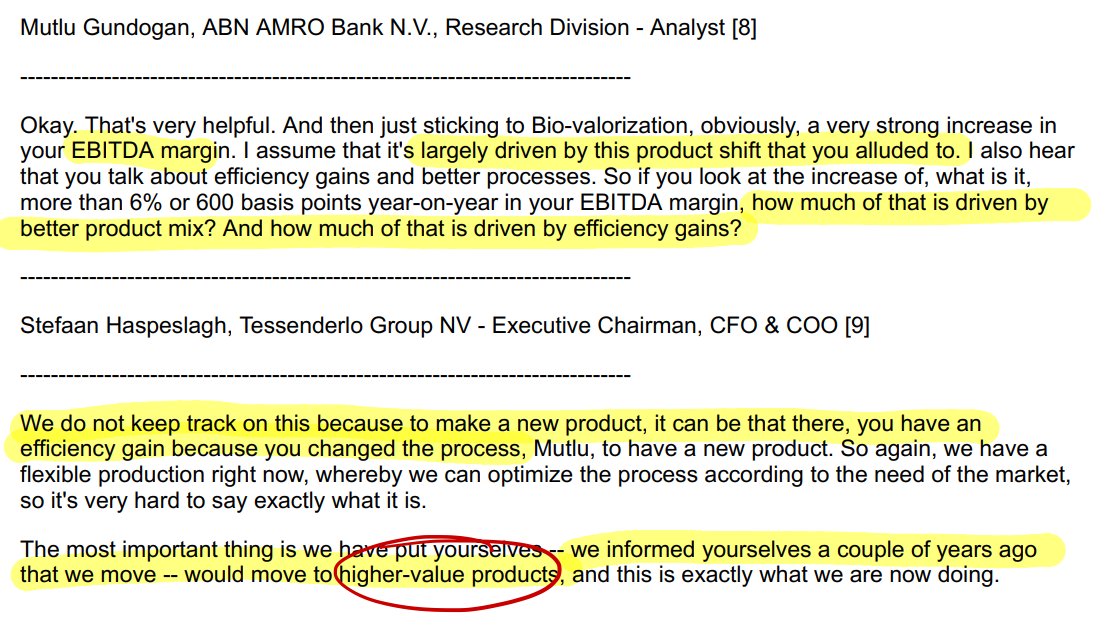

4/ Results:

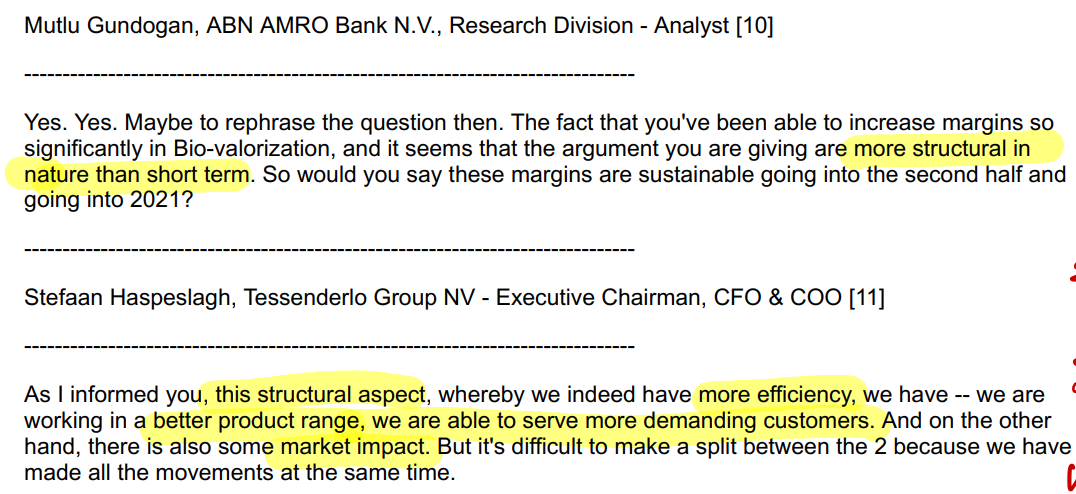

Revenue +8%, EBITDA from 25 to 45m, EBIT from 8 to 28m !

Thanks to: product mix, market conditions & realized efficiency improvements

Revenue +8%, EBITDA from 25 to 45m, EBIT from 8 to 28m !

Thanks to: product mix, market conditions & realized efficiency improvements

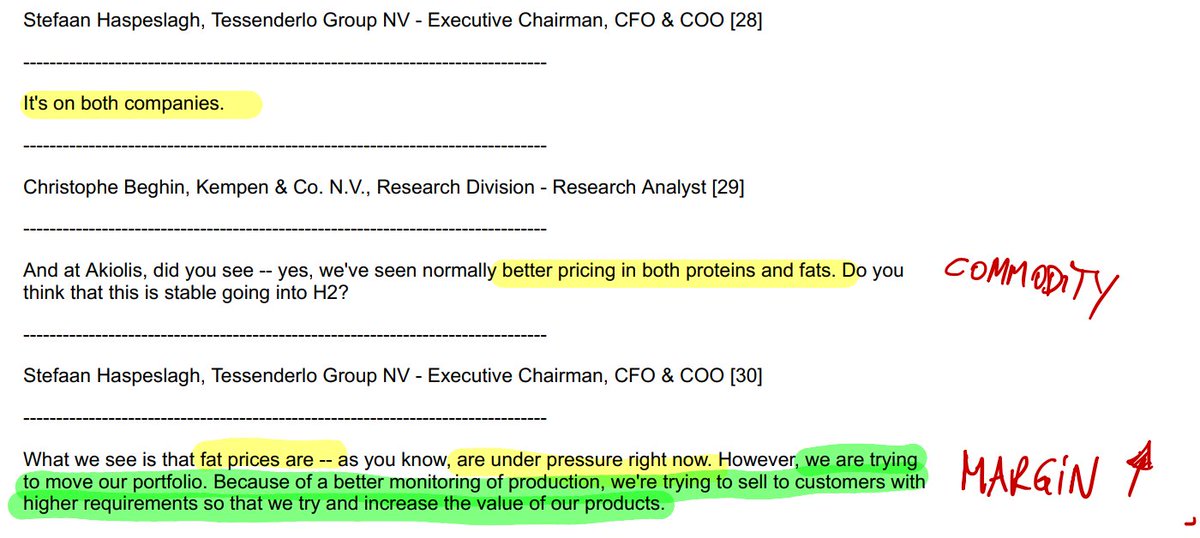

11/ Industrial Solutions:

Nothing too interesting happened here. Revenue -8%, EBITDA stable thanks to cost savings.

Nothing too interesting happened here. Revenue -8%, EBITDA stable thanks to cost savings.

12/ T-Power

Tendering for a second gas-fired power station, but still early to be to excited about that.

Tendering for a second gas-fired power station, but still early to be to excited about that.

13/ Outstanding results here: EBITDA +12.5%, EBIT +50% thanks to continued cost optimization. These changes are structural.

(They acquired Naes last year for the plant maintenance. Read more here: http://panly.blogspot.com/2020/08/nice-deal.html)">https://panly.blogspot.com/2020/08/n...

(They acquired Naes last year for the plant maintenance. Read more here: http://panly.blogspot.com/2020/08/nice-deal.html)">https://panly.blogspot.com/2020/08/n...

14/ Overall COVID impact has been limited:

Most factories stayed open as they are considered essential.

But some customers & suppliers can be affected in the future, so their could still be an impact at some point.

Most factories stayed open as they are considered essential.

But some customers & suppliers can be affected in the future, so their could still be an impact at some point.

16/ Outlook for FY 2020 an increase of +10-20% in EBITDA.

But first 6 months were so outstanding that +10% would imply a YoY drop for the second HY.

You have to remember that they basically always underpromise, so I think we can expect a result at the top end of the guidance

But first 6 months were so outstanding that +10% would imply a YoY drop for the second HY.

You have to remember that they basically always underpromise, so I think we can expect a result at the top end of the guidance

17/ Balance Sheet

$TESB has been producing lots of cash, which has been reinvested & used to deleverage rapidly.

The typical conservative approach of an owner-operator

$TESB has been producing lots of cash, which has been reinvested & used to deleverage rapidly.

The typical conservative approach of an owner-operator

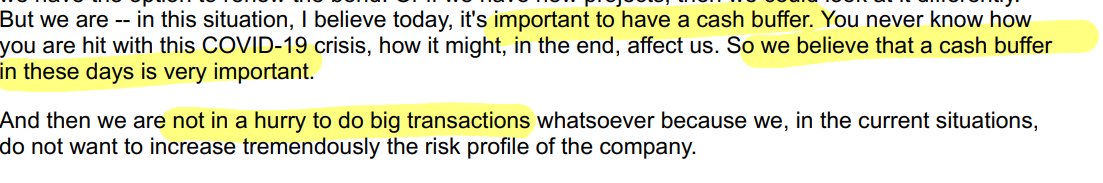

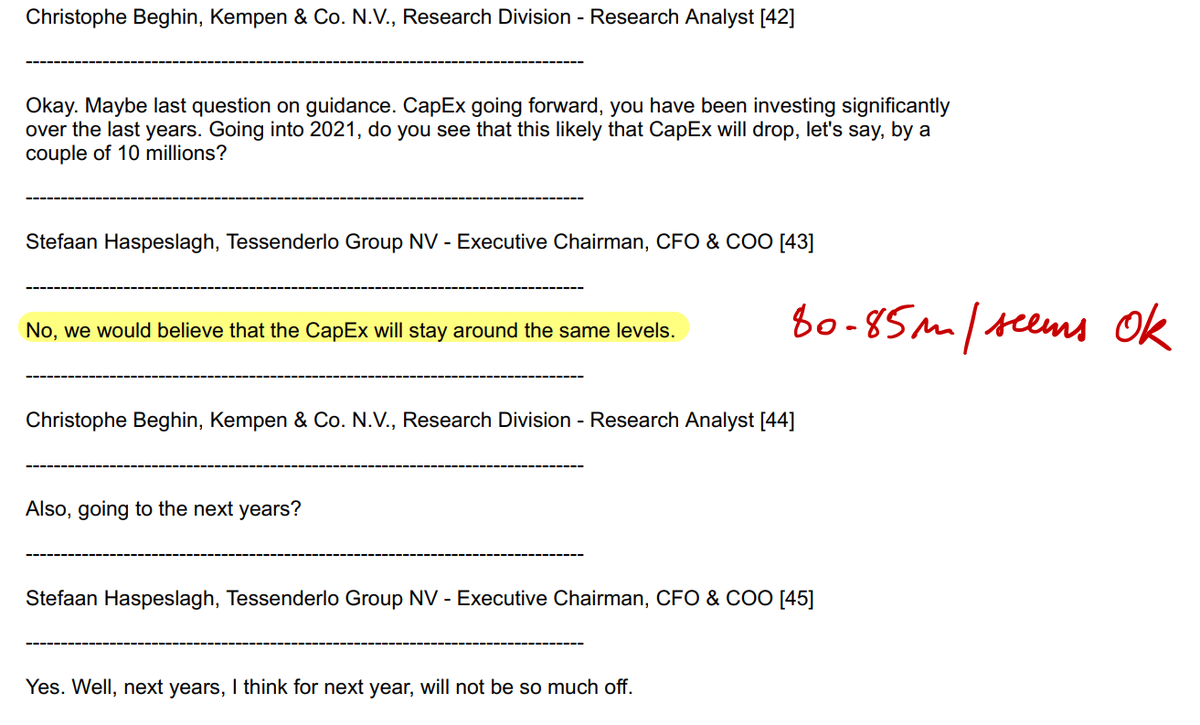

18/ CAPEX?

TESB keeps investing in growth. It& #39;s nice when you have a good CEO who says plenty of opportunities to reinvest the generated cash.

TESB keeps investing in growth. It& #39;s nice when you have a good CEO who says plenty of opportunities to reinvest the generated cash.

19/ Biggest takeaways for me:

Their emphasis on "higher value products": $TESB very consciously goes for a better product mix. Shifting to more differentiated, less commoditized, higher margin products.

Either with a higher quality product or by providing better service

Their emphasis on "higher value products": $TESB very consciously goes for a better product mix. Shifting to more differentiated, less commoditized, higher margin products.

Either with a higher quality product or by providing better service

20/ This makes me very confident in the future of Tessenderlo.

If they would be more promotional and clearly lay out this strategy of a shift in product mix, the stock would already be worth more imo.

If they would be more promotional and clearly lay out this strategy of a shift in product mix, the stock would already be worth more imo.

21/ Which brings us to valuation.

With an EV of about 1400m + 240m = 1640m

and a 2020 EBITDA of 300-330m, we& #39;re looking at an undemanding EV/EBITDA of 5-5,5 on 2020 numbers

With an EV of about 1400m + 240m = 1640m

and a 2020 EBITDA of 300-330m, we& #39;re looking at an undemanding EV/EBITDA of 5-5,5 on 2020 numbers

22/ Never easy with a cyclical company that& #39;s continuously investing in growth to come up with a average "throughout the cycle" normalized earnings number.

But these results and mgmt commentary leaves me pretty bullish about the future of $TESB.

But these results and mgmt commentary leaves me pretty bullish about the future of $TESB.

23/ So can& #39;t really say what it *should* be worth, but easy to see it& #39;s very cheap right now.

I realize focus on EBITDA can result in tears, but for $TESB it& #39;s goes hand in hand with plenty of cash generated.

I realize focus on EBITDA can result in tears, but for $TESB it& #39;s goes hand in hand with plenty of cash generated.

24/ Tagging some people who might be interested:

@Panly89485488 @FoxCastlehold @EricKoop3

I would highly appreciate any extra comments & thoughts!

@Panly89485488 @FoxCastlehold @EricKoop3

I would highly appreciate any extra comments & thoughts!

https://assets.tessenderlo.com/press/Documents/PR%2027082020/2020%20Interim%20report%20Tessenderlo%20Group%20HY20%20English.pdf">https://assets.tessenderlo.com/press/Doc...

Read on Twitter

Read on Twitter