This weekend& #39;s tracker feedback lesson is all about risk management. Risk management is all that really matters when it comes to Day Trading.

#DayTrading #Daytrader https://twitter.com/DayTraderWayne/status/1301478622054756352">https://twitter.com/DayTrader...

#DayTrading #Daytrader https://twitter.com/DayTraderWayne/status/1301478622054756352">https://twitter.com/DayTrader...

We often say one must first learn how to lose, if they are ever going to become, let alone STAY, consistently profitable. It’s the FIRST thing we always look at when reviewing someone’s tracker.

This can be worded many different ways. The most annoying is the end of the old cliché: “Let your winners run and keep your losses small”. No  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">. Easy says hard does. But it’s true. Keeping your losses small is THE key to being successful.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">. Easy says hard does. But it’s true. Keeping your losses small is THE key to being successful.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

We see traders all the time undo a day, a week or even a month’s worth a great trading by throwing the risk management out the window on a single trade. And I’m not talking about the occasional and inevitable rug pull and/or halt that blows past your mental or hard stop.

I’m talking about when you ignore your stop. For whatever reason, YOU decide to give it a little bit more room to the downside. I’ll just give it another $.10… I’ll just give it to the 20ema… VWAP will hold... This rarely ends well. ALWAYS honor your freakin’ stop!

One of the ways we measure this is taking a look at a trader’s realized average loss versus what they were actually risking. The realized loss should be less than (often far less) what they were risking. One MUST have the right mindset and execution when it comes to risk.

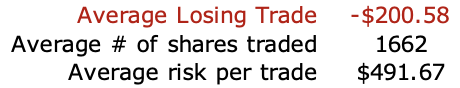

Here’s a trader doing a GREAT JOB. What they realize on average is WAY LESS than what they actually risk. They are WILDLY profitable because of it.

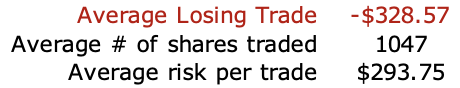

Now, a few examples of newer traders who aren’t. Note, it’s rarely about the “size” and/or “amount” of risk. It’s all about what you’re realizing in comparison.

And let’s be frank. If they don’t figure out this ONE aspect of their trading, they will NEVER become let alone STAY consistently profitable. THIS is all that matters to them right now. FINDING THE DISCIPLINE. LEARNING HOW TO LOSE THE RIGHT WAY. EMBRACING THE SMALL LOSSES.

It doesn’t matter how good their win rate is… How well they scale out… How well they stick to the A+ Setups… Without proper risk management, NONE of your other data points matter.

Do you know how to lose? Remember, your stop is your “worst-case” scenario and often you should hit out long before it’s hit. I wrote a blog about this here: https://www.daytraderwayne.com/post/2016/10/16/first-learn-how-to-lose">https://www.daytraderwayne.com/post/2016...

We also did a webinar on Hold & Hope:

http://bit.ly/HoldANDHope

Thanks">https://bit.ly/HoldANDHo... for reading the thread and have a great long weekend everyone. Remember, life is too short so enjoy the time away from the screens!

http://bit.ly/HoldANDHope

Thanks">https://bit.ly/HoldANDHo... for reading the thread and have a great long weekend everyone. Remember, life is too short so enjoy the time away from the screens!

Read on Twitter

Read on Twitter