1/7

With NFWG/S232 & RSA negotiations coming to a close, the uranium market is about to open the flood gates to purchasing. Unfortunately both the uranium inventory/reservoir is dropping and flow of production is at lows unseen in over a decade

With NFWG/S232 & RSA negotiations coming to a close, the uranium market is about to open the flood gates to purchasing. Unfortunately both the uranium inventory/reservoir is dropping and flow of production is at lows unseen in over a decade

2/7

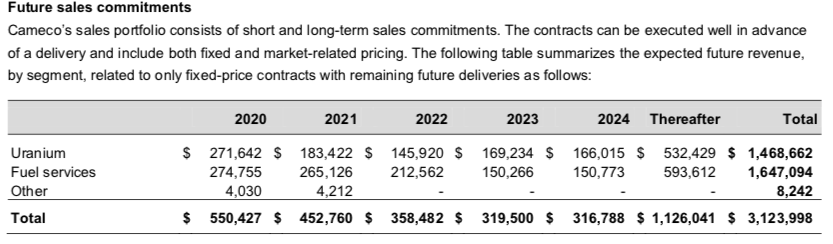

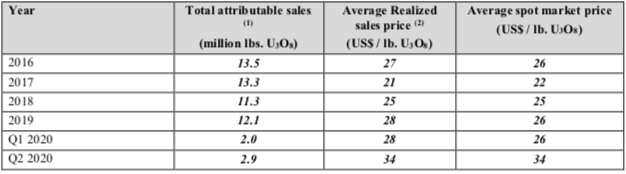

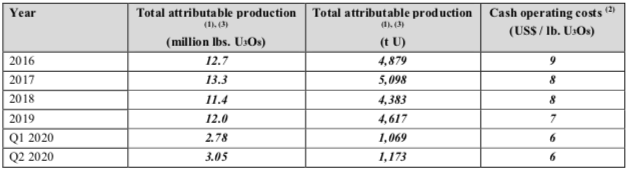

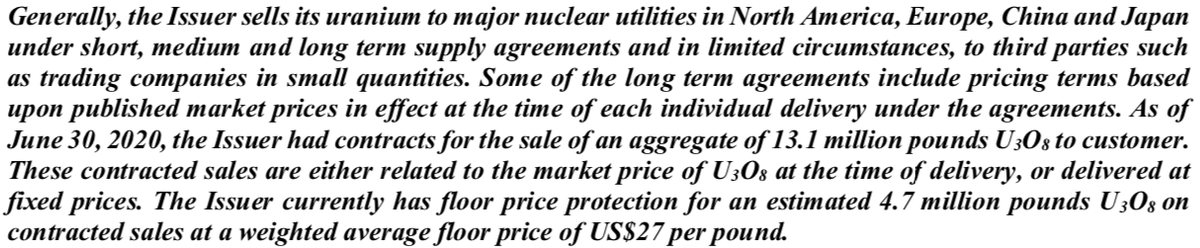

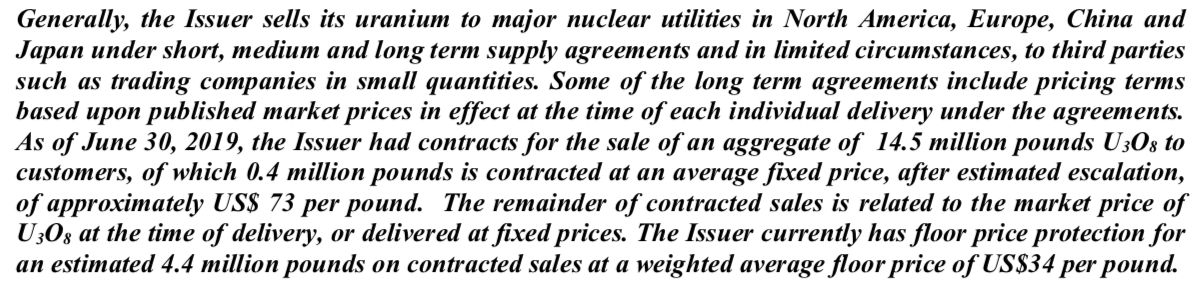

Cameco removed guidance after COVID, so looking at 2019 yearend. You can see contracts are running off with utilities waiting on the sidelines. Cigar Lake has potential for further delays next year and McA takes 1+ years to get back into production

https://s3-us-west-2.amazonaws.com/assets-us-west-2/annual/cameco-2019-annual-report.pdf">https://s3-us-west-2.amazonaws.com/assets-us...

Cameco removed guidance after COVID, so looking at 2019 yearend. You can see contracts are running off with utilities waiting on the sidelines. Cigar Lake has potential for further delays next year and McA takes 1+ years to get back into production

https://s3-us-west-2.amazonaws.com/assets-us-west-2/annual/cameco-2019-annual-report.pdf">https://s3-us-west-2.amazonaws.com/assets-us...

3/7

Unlike Cameco, Uranium One will sell to traders. Their book has a mix of long/medium/short term contracts and has also slowly run off. As U1& #39;s share of production declines over the next ~12 months, U1 should sell less in the open market to guarantee their contracts are filled

Unlike Cameco, Uranium One will sell to traders. Their book has a mix of long/medium/short term contracts and has also slowly run off. As U1& #39;s share of production declines over the next ~12 months, U1 should sell less in the open market to guarantee their contracts are filled

4/7

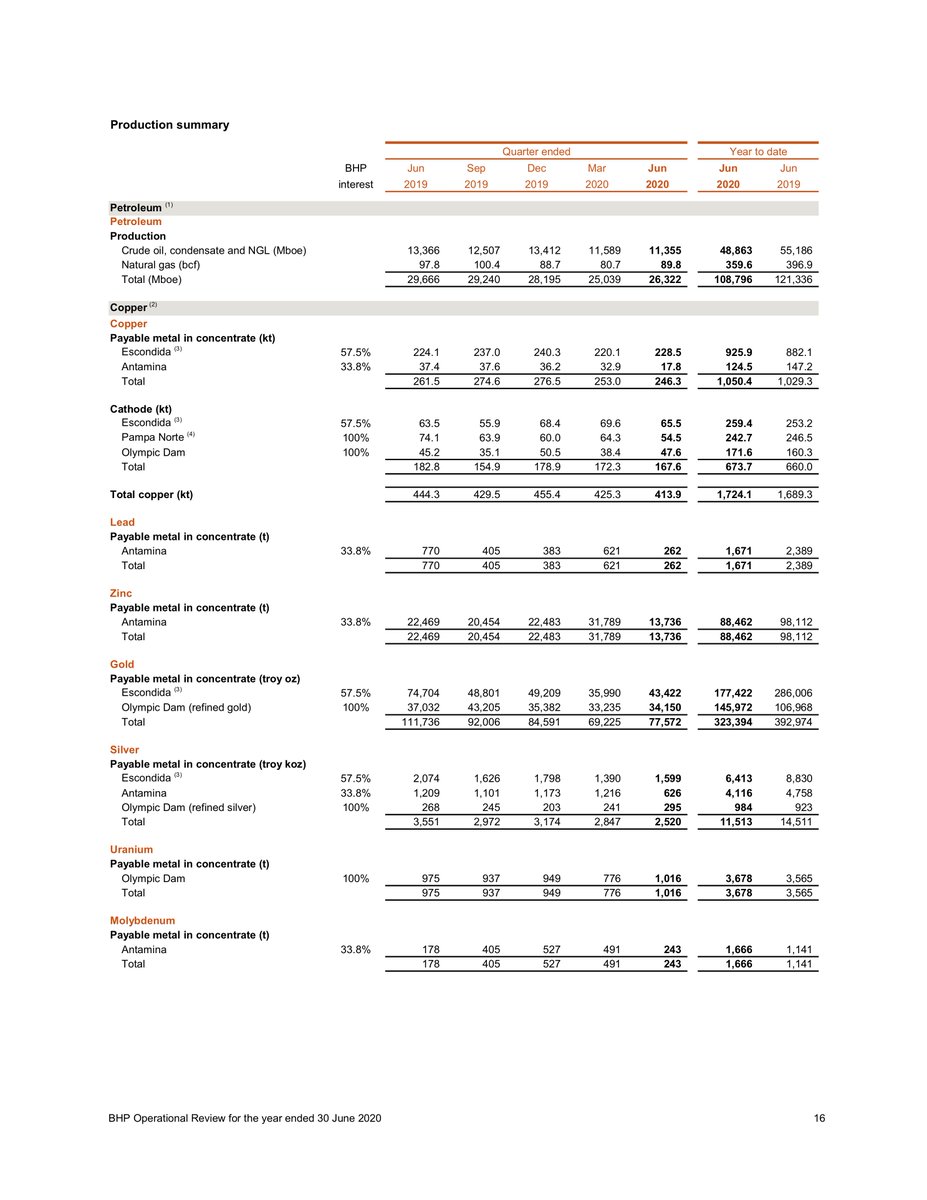

BHP / Olympic Dam

Have you seen the move in the price of gold??? BHP is going to target zones with higher gold concentration. Uranium will continue to be a byproduct and not specifically targeted

BHP / Olympic Dam

Have you seen the move in the price of gold??? BHP is going to target zones with higher gold concentration. Uranium will continue to be a byproduct and not specifically targeted

5/7

Yellowcake and Uranium Participation have been in the open market selling uranium. It& #39;s a few hundred thousand lbs to fund their share buybacks, to fix the discount to NAV issue. A reversal into buying will start when the market becomes hungry for U, exponentiating the buying

Yellowcake and Uranium Participation have been in the open market selling uranium. It& #39;s a few hundred thousand lbs to fund their share buybacks, to fix the discount to NAV issue. A reversal into buying will start when the market becomes hungry for U, exponentiating the buying

6/7

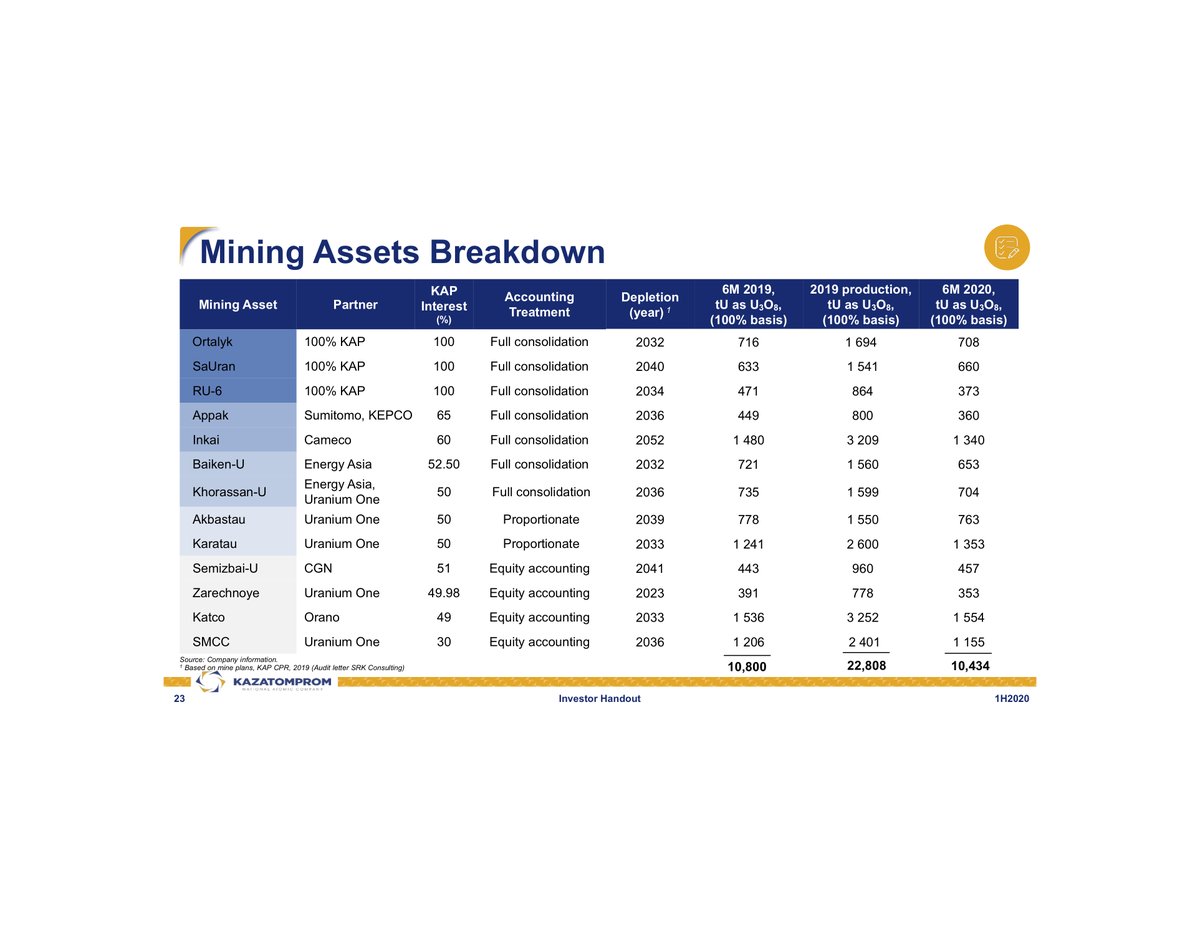

Kazatomprom

Over the next ~12 months KAP will see an unavoidable decrease in production volume, due to COVID well production delays. Contracts should be unaffected, but partners& #39; share of supply will significantly decrease (U1, Cameco, CGN, Orano, Etc)

https://www.kazatomprom.kz/storage/73/kap_investor_handout_1h20.pdf">https://www.kazatomprom.kz/storage/7...

Kazatomprom

Over the next ~12 months KAP will see an unavoidable decrease in production volume, due to COVID well production delays. Contracts should be unaffected, but partners& #39; share of supply will significantly decrease (U1, Cameco, CGN, Orano, Etc)

https://www.kazatomprom.kz/storage/73/kap_investor_handout_1h20.pdf">https://www.kazatomprom.kz/storage/7...

7/7

Contracted supply appears fairly secure, but is decreasing in favor for uncontracted material. Open market sales will hit dangerously low levels as suppliers move to guarantee the fufillment of their book. Risk to utilities is increasing

Contracted supply appears fairly secure, but is decreasing in favor for uncontracted material. Open market sales will hit dangerously low levels as suppliers move to guarantee the fufillment of their book. Risk to utilities is increasing

Read on Twitter

Read on Twitter