An interesting example of technology making things better in underserved markets: check cashing via cell phone. Ingo Money appears to be one of the leaders in it.

("Check cashing" in this usage is slightly different than depositing a check, and is mostly used by unbanked people)

("Check cashing" in this usage is slightly different than depositing a check, and is mostly used by unbanked people)

You& #39;ve probably seen retail check cashing outlets if you& #39;ve been in a large US city for a while. They& #39;re alternative finance providers (= alternative to banks) and generally have a number of products, but check cashing (for payroll and benefits checks) is a big one and "feeder."

The fundamental offering is "Instead of depositing that check into your bank account and getting 100% of it N days later, you sign that check over to us, we deposit it and get 100% of it N days later *if the check is good*, you get cash *now*, and you pay a fee."

The typical user of check cashing establishments is extremely cash constrained much of the time.

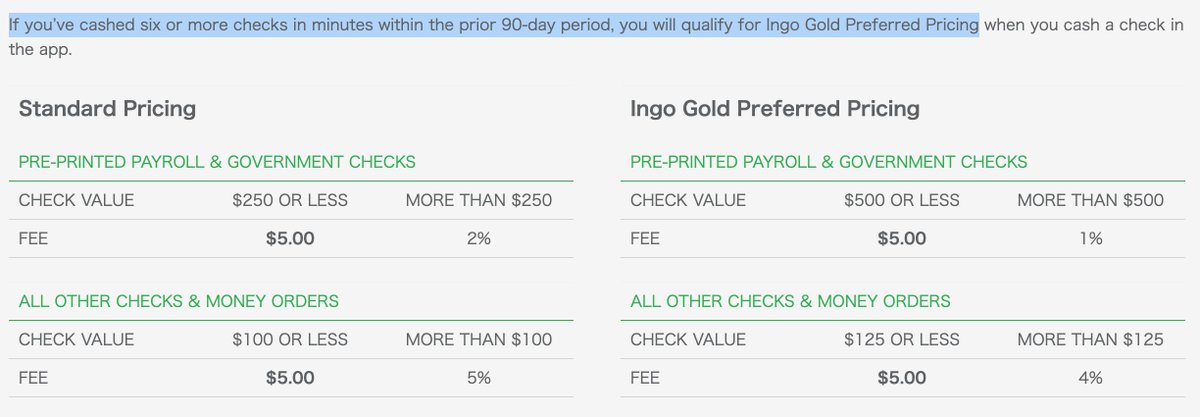

The fees are generally on the order of $5 for small checks and 5% for larger checks. This pays for the retail establishment and the not-insubstantial fraud/credit risk.

The fees are generally on the order of $5 for small checks and 5% for larger checks. This pays for the retail establishment and the not-insubstantial fraud/credit risk.

Advocates for people in financial precarity are generally extremely skeptical of alternative finance because it is as expensive as heck, and the expense falls on people who do not have a lot of extra dollars to pay for financial services.

Sociology work on it is interesting.

Sociology work on it is interesting.

A recurring theme of that sociology work (I don& #39;t have a link handy but Federal Reserve in St. Louis has a number of good pieces) is that the consumer base feels themselves much more trusted and less judged by their local check casher than by a bank.

e.g. The person behind counter at a check casher is likely someone in circumstances not too different from the customer, there tends to be an ongoing "And how are the kids?" sort of sticky relationship, the check casher structurally never charges an ill-timed surprise fee, etc.

And so simply telling the customer base "If you just had more financial education, you& #39;d deposit that check at a bank and not spend extra money" does not move them into the banking system.

(There are many other factors here but I& #39;ve got less than a day to tweetstorm.)

(There are many other factors here but I& #39;ve got less than a day to tweetstorm.)

(Banks, for their parts, are less than enthusiastic about doing the panoply of things they& #39;d need to do to capture this business.

For one it means siting expensive branches in neighborhoods which are rough to do banking business in.)

For one it means siting expensive branches in neighborhoods which are rough to do banking business in.)

(For another the business of banks is charging money for financial services and it is very difficult to appease an advocate for people in financial precarity who comes from a perspective that charging people in financial precarity for financial services is ipso facto abusive.)

Alright that digression out of the way: check cashing apps!

Same fundamental experience as a check casher *but*:

* no retail establishment

* persistent, legible-to-the-business identities

* graduated upgrades to more formal financial system

Same fundamental experience as a check casher *but*:

* no retail establishment

* persistent, legible-to-the-business identities

* graduated upgrades to more formal financial system

No retail establishment is pretty straightforward. The core expenses of a check casher are a) the storefront and b) a close-to-minimum-wage employee who is constantly in the storefront. This drives much of the price of the service.

Eliminate that; split difference with consumer.

Eliminate that; split difference with consumer.

Persistent, legible identities:

One of the reasons many un- or underbanked people cannot access the formal financial system is inability or unwillingness to demonstrate formal identity to the financial system. Check cashing apps can bootstrap identity where banks can& #39;t (by law).

One of the reasons many un- or underbanked people cannot access the formal financial system is inability or unwillingness to demonstrate formal identity to the financial system. Check cashing apps can bootstrap identity where banks can& #39;t (by law).

Aside from the legal requirement, one reason identity matters is because cashing a check is *fundamentally an extension of credit* (the check can go bad *after* you& #39;ve handed over money) and because a history of depositing/cashing good checks suggests that the Nth check is good.

Some of the check cashing apps operationalize this (and try to capture additional customer loyalty) by dropping their fees after N successive good checks in a period.

One of Ingo& #39;s (many) ways to access it will ~halve the cost for common checks.

One of Ingo& #39;s (many) ways to access it will ~halve the cost for common checks.

Graduated upgrades to the formal financial system:

Check cashing places are, like most small-dollar retail establishments, built on recurring custom. They have very little incentive to tell you "Psst Chase would happily do business with you. Let me introduce you."

Check cashing places are, like most small-dollar retail establishments, built on recurring custom. They have very little incentive to tell you "Psst Chase would happily do business with you. Let me introduce you."

Due to the capability of Ingo to bizdev and the increasing interconnectedness of app-based financial ecosystems, Ingo (or fintechs building on top of them, a common deployment topology) can give people the ~instant money they want *today* while setting them up with better options

e.g. "Sure we can do instant cash checking into a bank account of your choice, like perhaps the no-bullshit-NSF-fee-ever-we-promise options like $FINTECH $FINTECH or $FINTECH. Want that account? Takes like a minute to set up [and they will pay us $20+ to do this]."

And finally they make some decisions which check cashers just don& #39;t, like an effectively free option.

(Again, this is a strictly worse offering than you& #39;d get if you were banked but there are crunchy reasons people remain un- or underbanked.)

(Again, this is a strictly worse offering than you& #39;d get if you were banked but there are crunchy reasons people remain un- or underbanked.)

Anyhow: retail financial services, particularly for people in precarity, are nuanced and complicated. The increasing fintechization of them is broadly a good thing.

There are a surprising number of players involved in even "simple" transactions, and many marketing brands.

There are a surprising number of players involved in even "simple" transactions, and many marketing brands.

Read on Twitter

Read on Twitter