How to track stocks/sectors:

(for the justifiably endangered retail active investor)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

(for the justifiably endangered retail active investor)

1/ To have 10 stocks in your portfolio you probably have to track a 100 companies. These include competitiors of your holdings and potential inclusions.

Every company is telling a story not just about itself, but also about its peers, its customers, its vendors - the economy.

Every company is telling a story not just about itself, but also about its peers, its customers, its vendors - the economy.

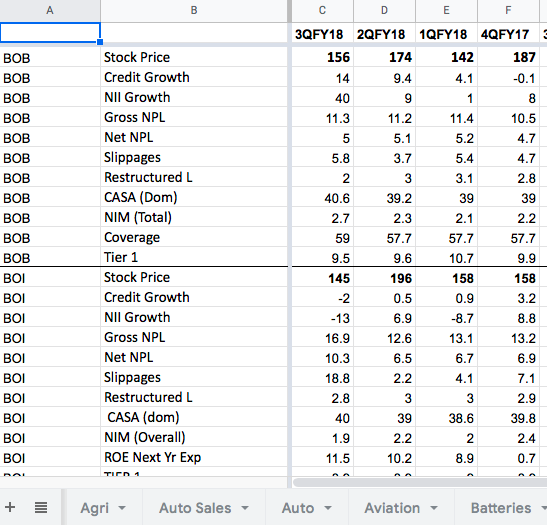

2/ Quaterly results are where you start. Maintain a sheet for each sector with important parameters (value drivers) for each stock and update it quarterly. Some website ( @Tijori1)track some of this data, but maintain your own sheet. (“Quarterly Data Sheet”).

Sample:

Sample:

3/ This rhythm of manually updating parameters forces you to think about what’s happening in the sector and assess the trends. Always buy present + history over future (many ways to misinterpret this). Knowing and understanding what is ‘currently’ happening is enough edge.

4/ Institutions can get such data from brokers but may surprisingly don’t maintain an independent database and processes around analysing it (whats working currently occupies all of the mental space). On the other hand there are few who have elaborate applications/softwares.

5/ Attend as many concalls as you can. Here you get once biased views (maangement) while in broker reports you get it twice biased (management + analyst) which probably makes it 4 times more baised. Read transcripts if you can’t get in the call.

6/ Before buying a company you should have gone through at least last 3 years of concalls and annual reports. Preferably of the competitors as well.

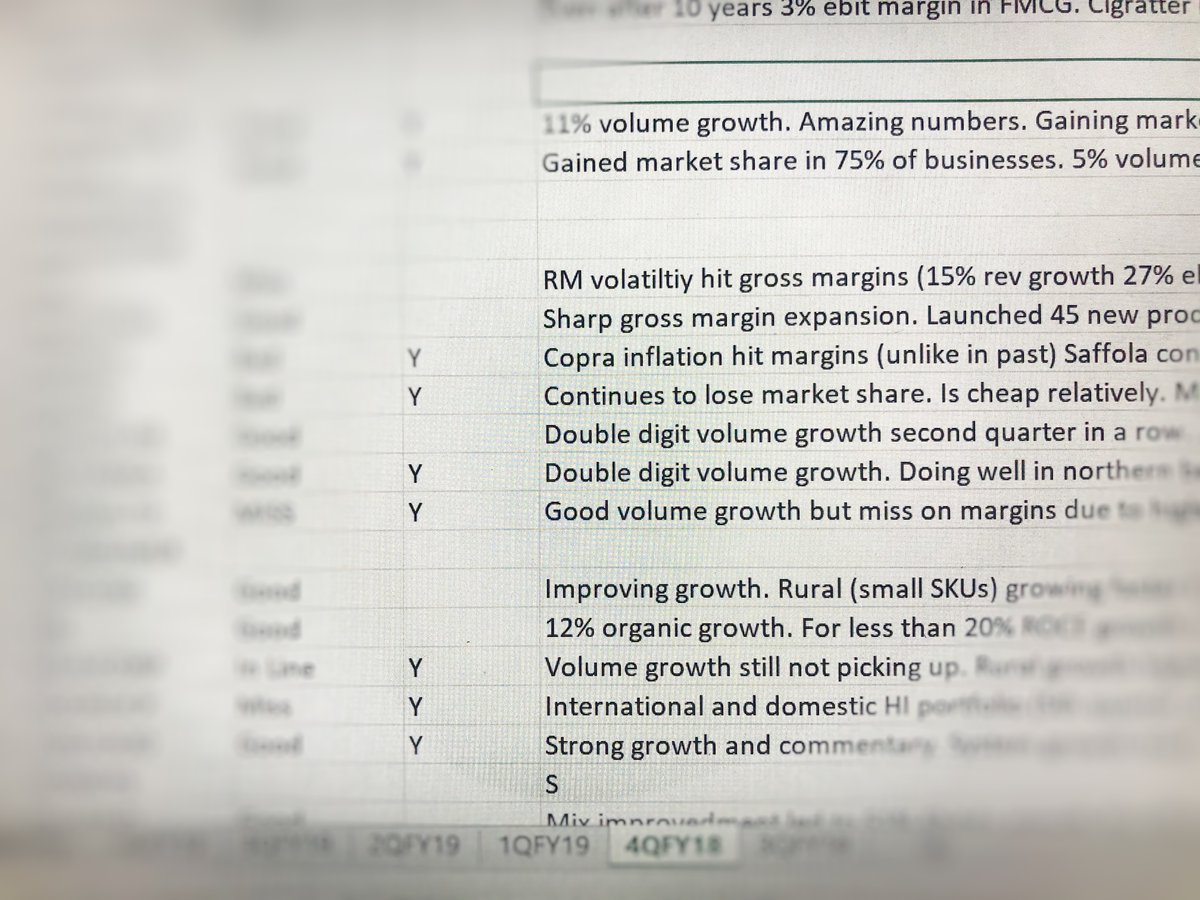

7/ Maintain a one line summary for results + concall for every quarter in one sheet for the all companies. This is surprisingly difficult as it makes you condense the result and commentary to its core (“what exactly happened here”). Forces you to think. (“Result Summaary Sheet”).

8/ Maintain a “Thought Timeline” sheet where you write down why you like or don’t like a particular idea. We have a habit of rewriting histories. This exercise will help you assess your analysis objectively and help you improve it.

9/ The default question should be “why should I buy this” not “why shouldn’t I buy this”. Always try to reject ideas. Vehemently. Occasionally you will come across something that you can’t reject.

10/ This is lot of work and if you don’t enjoy the process you stand no chance. (Buffett deliberately reads annual reports slowly, he wants it to last). Don& #39;t fool yourself. This is what investing is. Profit is incidental.

11/11 Lastly, Indexing is a great option. Keep assessing it. You could be doing something else that you enjoy more instead of doing all this even if you are able to beat the Index by a little.

Read on Twitter

Read on Twitter