@ohcapideas @foxcastlehold @frenchcmunger @chriswmayer @GWInvestors @foso_defensivo

@valueDACH @vitaliyk @LuchesiPhilippe @evantindell

@erickoop3 @smallandvalue @off_the_run

You know $BOL. Quick thread on why it has been & #39;bad,& #39; and one dead simple way to make it, uh, & #39;good.& #39;

@valueDACH @vitaliyk @LuchesiPhilippe @evantindell

@erickoop3 @smallandvalue @off_the_run

You know $BOL. Quick thread on why it has been & #39;bad,& #39; and one dead simple way to make it, uh, & #39;good.& #39;

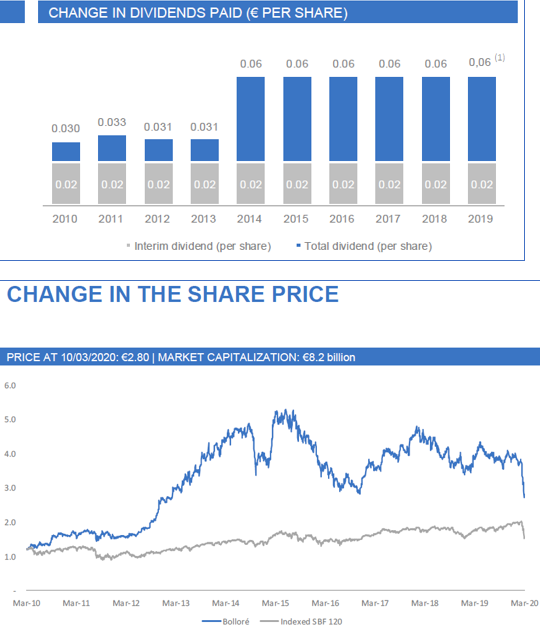

Why has $BOL been a poor stock since the (good) 2015 @muddywatersre report? Many reasons incl. but not limited to: (1) & #39;15 HAV for BOL shares destroyed >10% value, (2) some legal issues (Africa & France), (3) ongoing large BlueBiz losses, (4) Redburn drops (5) EMkts disliked..

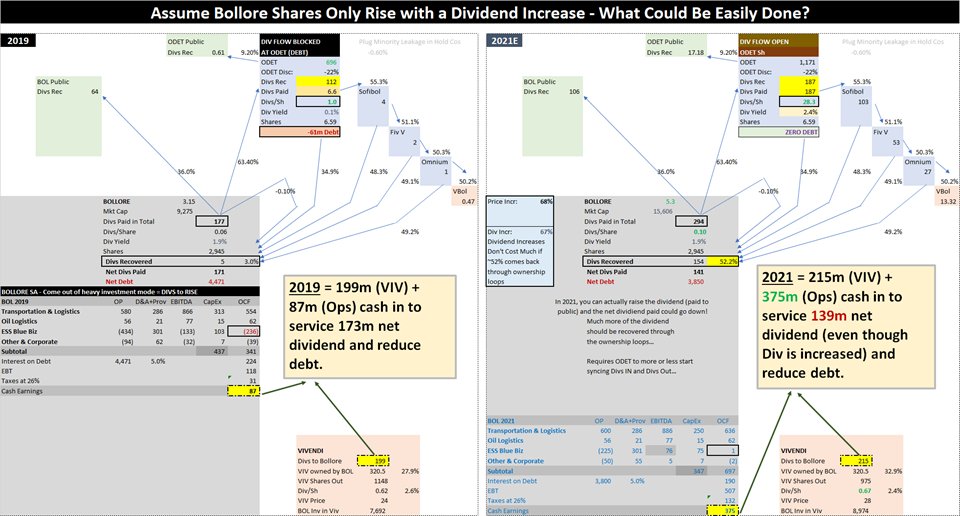

(6) VIV 25%-30% crusade & #39;okay& #39; but adds debt even when buyback better, (7) Debt recently down, boosted by sale of WiFirst/Gaumont/French Ports, etc. but almost no (recent) structural & #39;simplification.& #39; VIV consolidation actually makes & #39;appearance& #39; more complicated, which blows...

(8) Paying down the debt at $ODET with Divs received from $BOL has been & #39;good& #39; but prevents Divs from having & #39;circled.& #39;

Key: At 1H20, debt at ODET is zeroed out! Yay! Now, even without any BOL/ODET structural simplification, ODET & #39;can& #39; sync Divs OUT with Divs In & let them flow!

Key: At 1H20, debt at ODET is zeroed out! Yay! Now, even without any BOL/ODET structural simplification, ODET & #39;can& #39; sync Divs OUT with Divs In & let them flow!

Besides you guys, nobody is ever going to understand the $BOL structure. But... they don& #39;t need to. BOL shares ran up on a doubling of the 2014 Div, which has been stubbornly flat for 5 years. If Div flow is opened beyond the ODET gate, BOL can easily 2x the dividend again.

Below, I show that $BOL could (probably) raise the gross dividend by ~67% to €0.10 in 2021, but the net dividend could still fall ~18% to €141m, as 52% of Divs could be returned through the main ownership loops (up from just ~3% returned in 2019). See below. Make sense?

#Endgame structural simplification (BOL/ODET, etc.) would be really nice... but in the meantime, why not just go for something super simple that will not (really) cost much: Raise The Dividend!

Read on Twitter

Read on Twitter