2020 has been a great yr for many individual investors in innovative & growth Co& #39;s. Congratulations! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">

cc: @saxena_puru @richard_chu97 @BrianFeroldi @FromValue @TMFJMo @7Innovator @BluegrassCap

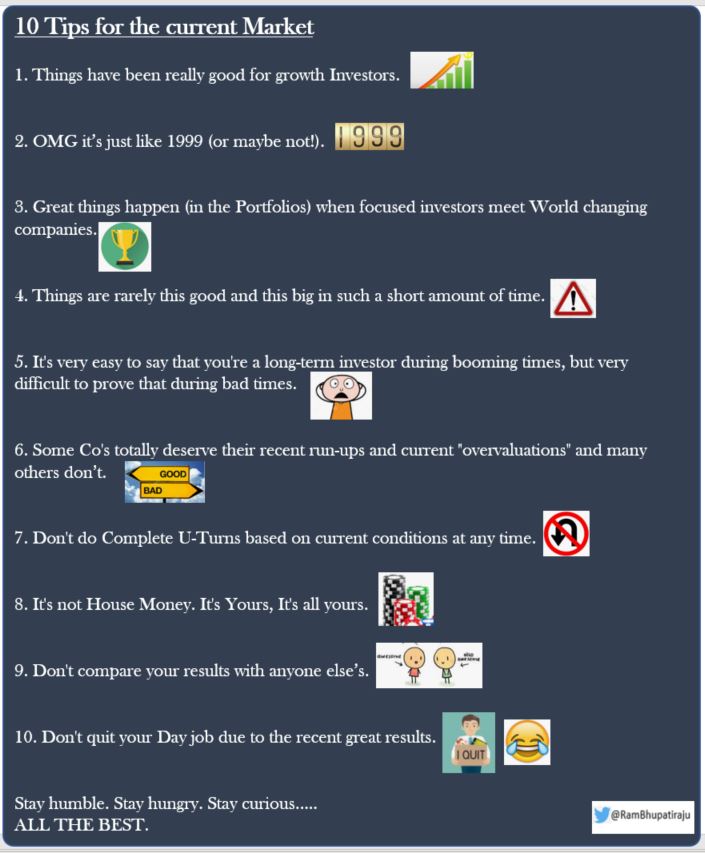

10 Tips with compliments, caution & everything in between, for anyone interested.

cc: @saxena_puru @richard_chu97 @BrianFeroldi @FromValue @TMFJMo @7Innovator @BluegrassCap

10 Tips with compliments, caution & everything in between, for anyone interested.

1. Things have been really good for growth Investors : especially in Tech/SaaS/Fintech/E-Commerce/Gaming and few other smaller sectors... which had many stocks that appreciated by hundreds of percent from the March levels.

If you held on to these from before, or correctly identified the good ones and bought them during the Feb/Mar/Apr lows, Congratulations! You deserve all the recent success! Maybe attribute a little bit of success to Luck also (maybe, just a little).

2. OMG it& #39;s 1999 (not!): This comparison is often made due to the spectacular rise in NASDAQ & many Tech sub-sectors. It& #39;s easy to make quick conclusions & references to TMT bubble charts, but a lot more subtlety is needed, & even then no one can accurately predict the future.

On the Business side, the biz models for many Co& #39;s are much better, the consumer/enterprise acceptance of innovative Tech solutions is more widely accepted, and Tech is much more ingrained in daily life now, Interest rates are very low, and the Fed very accommodating ...

On the Investor side : Yes there are definitely trends like WFH, Robinhood/Trading mentality, $0 Commissions,& rising stock prices contributing to the recent enthusiasm. With that said, the major moves are caused by the big institutions & not by retail investors day trading.

It& #39;s up to you to decide if it& #39;s like 1999, if you want to do anything about it, or just ignore the topic and focus on your goals/process and Portfolio co& #39;s.

3. Great things happen (in the Portfolios) when focused long-term investors meet World changing companies :

The access to reliable information (Co& #39;s Financial docs) and quality of investment services/blogs now is much higher than 20 years ago.

The access to reliable information (Co& #39;s Financial docs) and quality of investment services/blogs now is much higher than 20 years ago.

So for an investor who knows what he wants to research/own and can focus on them while avoiding the constant noise and distractions, this is a golden time.

For the Co& #39;s that obsessively focus on solving their Customer problems, create or align with the mega-trends, know how...

For the Co& #39;s that obsessively focus on solving their Customer problems, create or align with the mega-trends, know how...

..to harness the power of data (while building Network effects/switching costs) and think long-term, this is also a golden time.

When both of these meet, magic can happen in Portfolios over the long-term.

When both of these meet, magic can happen in Portfolios over the long-term.

4. Things are rarely this good and this big in such a short amount of time : Quality and growth are always preferable, but there are many years where even good growth stocks go no where, testing investor patience.

Even a Company like $AAPL lingered for many yrs between P/FCF between 8 to 15 (yes, even when investors knew the power of the recurring Services revenue off the huge installed base).

In the short and medium term, a decent amount of the multiple expansion or contraction in any Stock depends a lot on the investor sentiment (towards Market and certain sectors) and huge inflows/outflows into the Market..

...by the Pros and institutions, not necessarily in complete alignment with how good or bad the actual underlying company is doing. So enjoy the good times, but don& #39;t count on the investor enthusiasm (&multiple expansion) to be always this high, wide and deep.

5. It& #39;s very easy to say that we& #39;re long-term investors during booming times but very difficult to prove that during bad times

-When your huge accumulated gains melt down 30-50% or more

-When Quality/Growth falls along with the rest

-When your huge accumulated gains melt down 30-50% or more

-When Quality/Growth falls along with the rest

-When Prices can& #39;t stop going down

-When noise and uncertainty are at fever pitch

-When it looks like things are not going to improve and your Portfolio is never going to reach it& #39;s previous peak

-When noise and uncertainty are at fever pitch

-When it looks like things are not going to improve and your Portfolio is never going to reach it& #39;s previous peak

...that& #39;s when you still have to stick to long-term thinking, process and continue holding or even buying more of the great Co& #39;s. It& #39;s not fun thinking about bad times when things are going great, but think about it a little.

6. Some Co& #39;s totally deserve their recent run-ups and current "overvaluations" : They will grow into them and much more. There& #39;ll also be many Co& #39;s that will fail to live up to their current sky high expectations due to Competition...

...Mgmt/Execution mis-steps, Trend changes and other reasons. It& #39;s your responsibility to think more about this bifurcation and plan on what you intend to do when the thesis fails on certain Co& #39;s.

7. Don& #39;t do Complete U-Turns based on current conditions at any time : Getting over-excited during booming times and committing too much capital to recent Winners (w/o much personal research) or selling completely out of Stocks during crashes...

...and waiting for certainty before buying back in. Neither of these strategies do great over time. It& #39;s better to stay in the middle (based on your long-term goals) and adjust your edges based on the conditions.

8. It& #39;s not House Money. It& #39;s Yours, It& #39;s all yours : Every $ of accumulated gains in your Account is yours (not talking about Margins, complicated options...). You earned it by allocating time, capital, effort (and some luck).

So it& #39;s your responsibility to treat it so and commit/protect it. Don& #39;t get carried away by hype and throw it into risky/aggressive positions thinking someone gave it to you for free.

9. Don& #39;t Compare : Do not compare your YTD or Lifetime results with anyone else& #39;s. Their Financial position, goals, strategies, risk tolerance, competencies, luck & timing could be totally different to yours.

See if there& #39;s anything there to improve your overall process based on your goals, but comparing the actual results will only give grief (as there& #39;s always someone doing much better). If someone& #39;s doing great, wholeheartedly wish them continued success!

10. Don& #39;t quit your Day job due to the recent great results : Yes, some of these daily gains could be greater than monthly salaries, but don& #39;t extrapolate the recent good times & take more risk or believe that you could make a living off this (especially if you& #39;re new to this).

Yes, 2020 has been great for many of us (despite the complexities in the real world due to COVID) but remember to

Stay humble

Stay hungry

Stay curious...

Here& #39;s to all the individual long-term investors & innovative Co& #39;s trying to prove themselves!

Wishing you more success! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

Stay humble

Stay hungry

Stay curious...

Here& #39;s to all the individual long-term investors & innovative Co& #39;s trying to prove themselves!

Wishing you more success!

Read on Twitter

Read on Twitter cc: @saxena_puru @richard_chu97 @BrianFeroldi @FromValue @TMFJMo @7Innovator @BluegrassCap10 Tips with compliments, caution & everything in between, for anyone interested." title="2020 has been a great yr for many individual investors in innovative & growth Co& #39;s. Congratulations!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">cc: @saxena_puru @richard_chu97 @BrianFeroldi @FromValue @TMFJMo @7Innovator @BluegrassCap10 Tips with compliments, caution & everything in between, for anyone interested." class="img-responsive" style="max-width:100%;"/>

cc: @saxena_puru @richard_chu97 @BrianFeroldi @FromValue @TMFJMo @7Innovator @BluegrassCap10 Tips with compliments, caution & everything in between, for anyone interested." title="2020 has been a great yr for many individual investors in innovative & growth Co& #39;s. Congratulations!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">cc: @saxena_puru @richard_chu97 @BrianFeroldi @FromValue @TMFJMo @7Innovator @BluegrassCap10 Tips with compliments, caution & everything in between, for anyone interested." class="img-responsive" style="max-width:100%;"/>

" title="Yes, 2020 has been great for many of us (despite the complexities in the real world due to COVID) but remember to Stay humble Stay hungry Stay curious...Here& #39;s to all the individual long-term investors & innovative Co& #39;s trying to prove themselves!Wishing you more success!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">" class="img-responsive" style="max-width:100%;"/>

" title="Yes, 2020 has been great for many of us (despite the complexities in the real world due to COVID) but remember to Stay humble Stay hungry Stay curious...Here& #39;s to all the individual long-term investors & innovative Co& #39;s trying to prove themselves!Wishing you more success!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">" class="img-responsive" style="max-width:100%;"/>