"In DSGE models ... economic system is assumed to behave like a consumer with fixed preferences over how much they wish to consume ...

This is equivalent to attempting to model the behaviour of a colony of ants by constructing a model of one large ‘average’ ant." - @JoMicheII https://twitter.com/DrCameronMurray/status/1049042739948449793">https://twitter.com/DrCameron...

This is equivalent to attempting to model the behaviour of a colony of ants by constructing a model of one large ‘average’ ant." - @JoMicheII https://twitter.com/DrCameronMurray/status/1049042739948449793">https://twitter.com/DrCameron...

Meanwhile, in fables involving ants, is there or isn& #39;t there a #savingsglut?

https://www.ft.com/content/202ed286-6832-11df-a52f-00144feab49a">https://www.ft.com/content/2... (Wolf 2010)

https://www.ft.com/content/202ed286-6832-11df-a52f-00144feab49a">https://www.ft.com/content/2... (Wolf 2010)

With follow-up article https://www.ft.com/content/6d4dd078-6db7-11df-b5c9-00144feabdc0">https://www.ft.com/content/6... (Wolf 2010b)

Great discussions mostly sparked by Klein, Matthew C., and Michael Pettis. 2020. Trade Wars Are Class Wars: How Rising Inequality Distorts the Global Economy and Threatens International Peace. Illustrated edition. New Haven: Yale University Press. https://yalebooks.yale.edu/book/9780300244175/trade-wars-are-class-wars.">https://yalebooks.yale.edu/book/9780...

Leading to that most excellent debate in mid-Aug:

Jain Institute. 2020. Geoeconomics and the Balance of Payments. https://www.youtube.com/watch?v=mayqIvr50dE&feature=youtu.be.">https://www.youtube.com/watch... https://www.youtube.com/watch...

Jain Institute. 2020. Geoeconomics and the Balance of Payments. https://www.youtube.com/watch?v=mayqIvr50dE&feature=youtu.be.">https://www.youtube.com/watch... https://www.youtube.com/watch...

@DavidBeckworth helped with:

"Jon Sindreu on Global Financial Flows and the Balance of Trade.” https://www.mercatus.org/bridge/podcasts/08032020/jon-sindreu-global-financial-flows-and-balance-trade.">https://www.mercatus.org/bridge/po...

"Jon Sindreu on Global Financial Flows and the Balance of Trade.” https://www.mercatus.org/bridge/podcasts/08032020/jon-sindreu-global-financial-flows-and-balance-trade.">https://www.mercatus.org/bridge/po...

And

“Matthew Klein on Global Trade, Inequality, and International Conflict.” Accessed August 20, 2020b. https://www.mercatus.org/bridge/podcasts/07072020/matthew-klein-global-trade-inequality-and-international-conflict.">https://www.mercatus.org/bridge/po...

“Matthew Klein on Global Trade, Inequality, and International Conflict.” Accessed August 20, 2020b. https://www.mercatus.org/bridge/podcasts/07072020/matthew-klein-global-trade-inequality-and-international-conflict.">https://www.mercatus.org/bridge/po...

Earlier this year:

Mian, Atif R, Ludwig Straub, and Amir Sufi. 2020. “The Saving Glut of the Rich and the Rise in Household Debt.” Working Paper 26941. Working Paper Series. National Bureau of Economic Research. https://doi.org/10.3386/w26941 .">https://doi.org/10.3386/w...

Mian, Atif R, Ludwig Straub, and Amir Sufi. 2020. “The Saving Glut of the Rich and the Rise in Household Debt.” Working Paper 26941. Working Paper Series. National Bureau of Economic Research. https://doi.org/10.3386/w26941 .">https://doi.org/10.3386/w...

For how this relates to endogenous $, try:

Klein, Matthew. 2020. “What Endogenous Money Means—and Doesn’t Mean—for the Balance of Payments | LinkedIn.” August 13, 2020. https://www.linkedin.com/pulse/what-endogenous-money-meansand-doesnt-meanfor-balance-matthew-klein/.">https://www.linkedin.com/pulse/wha...

Klein, Matthew. 2020. “What Endogenous Money Means—and Doesn’t Mean—for the Balance of Payments | LinkedIn.” August 13, 2020. https://www.linkedin.com/pulse/what-endogenous-money-meansand-doesnt-meanfor-balance-matthew-klein/.">https://www.linkedin.com/pulse/wha...

However, it& #39;s not a #globalsavingsglut, it& #39;s a #globalbankingglut!

Shin, Hyun Song. 2011. “Global Savings Glut or Global Banking Glut?” http://VoxEU.Org"> http://VoxEU.Org (blog). December 20, 2011. https://voxeu.org/article/global-savings-glut-or-global-banking-glut.">https://voxeu.org/article/g...

Shin, Hyun Song. 2011. “Global Savings Glut or Global Banking Glut?” http://VoxEU.Org"> http://VoxEU.Org (blog). December 20, 2011. https://voxeu.org/article/global-savings-glut-or-global-banking-glut.">https://voxeu.org/article/g...

@Lprochon tells me that #keynesianeconomics is back in vogue, with it, #accountingidentities. Time to read:

Taylor, Lance. 2020. “‘Savings Glut’ Fables and International Trade Theory: An Autopsy.” Institute for New Economic Thinking (blog). August 2020. https://www.ineteconomics.org/perspectives/blog/savings-glut-fables-and-international-trade-theory-an-autopsy.">https://www.ineteconomics.org/perspecti...

Taylor, Lance. 2020. “‘Savings Glut’ Fables and International Trade Theory: An Autopsy.” Institute for New Economic Thinking (blog). August 2020. https://www.ineteconomics.org/perspectives/blog/savings-glut-fables-and-international-trade-theory-an-autopsy.">https://www.ineteconomics.org/perspecti...

And:

Taylor, Lance. 2020. “Germany and China Have Savings Gluts, the USA Is a Sump: So What?” Institute for New Economic Thinking, August. https://www.ineteconomics.org/research/research-papers/germany-and-china-have-savings-gluts-the-usa-is-a-sump-so-what.">https://www.ineteconomics.org/research/...

Taylor, Lance. 2020. “Germany and China Have Savings Gluts, the USA Is a Sump: So What?” Institute for New Economic Thinking, August. https://www.ineteconomics.org/research/research-papers/germany-and-china-have-savings-gluts-the-usa-is-a-sump-so-what.">https://www.ineteconomics.org/research/...

In which we learn that Mundell-Fleming IS/LM/BP model is not #stockflowconsistent. Oops. Why should we care?

Why should we care? @michaelxpettis nails that Pettis, Michael. 2015. “Thin Air’s Money Isn’t Created Out of Thin Air.” Carnegie Endowment for International Peace (blog). October 19, 2015. https://carnegieendowment.org/chinafinancialmarkets/61679.">https://carnegieendowment.org/chinafina...

Why should we care that Mundell-Fleming IS/LM/BP model is not #stockflowconsistent? @PMehrling nails it:

Mehrling, Perry. 2012. “Maynard’s Revenge: A Review.” Institute for New Economic Thinking (blog). 2012. https://www.ineteconomics.org/perspectives/blog/maynards-revenge-a-review.">https://www.ineteconomics.org/perspecti...

Mehrling, Perry. 2012. “Maynard’s Revenge: A Review.” Institute for New Economic Thinking (blog). 2012. https://www.ineteconomics.org/perspectives/blog/maynards-revenge-a-review.">https://www.ineteconomics.org/perspecti...

As does @NathanTankus in

Tankus, Nathan. n.d. “Where Do Profits Come From?” https://nathantankus.substack.com/p/where-do-profits-come-from.">https://nathantankus.substack.com/p/where-d...

Tankus, Nathan. n.d. “Where Do Profits Come From?” https://nathantankus.substack.com/p/where-do-profits-come-from.">https://nathantankus.substack.com/p/where-d...

I& #39;m grateful to @PMehrling & his excellent course https://www.coursera.org/learn/money-banking">https://www.coursera.org/learn/mon... for introducing me to Hawtrey

Also in Mehrling, Perry. 2011. “The Inherent Instability of Credit.” Institute for New Economic Thinking (blog). March 2011. https://www.ineteconomics.org/perspectives/blog/the-inherent-instability-of-credit.">https://www.ineteconomics.org/perspecti...

Hawtrey, R. G. (Ralph George). 1919. Currency and Credit. London, New York [etc.] Longmans, Green and co. http://archive.org/details/currencycredit00hawtrich.

is">https://archive.org/details/c... chock full of wisdom: "[he] saw financial instability as the abiding tendency of credit markets" (Merhling)

is">https://archive.org/details/c... chock full of wisdom: "[he] saw financial instability as the abiding tendency of credit markets" (Merhling)

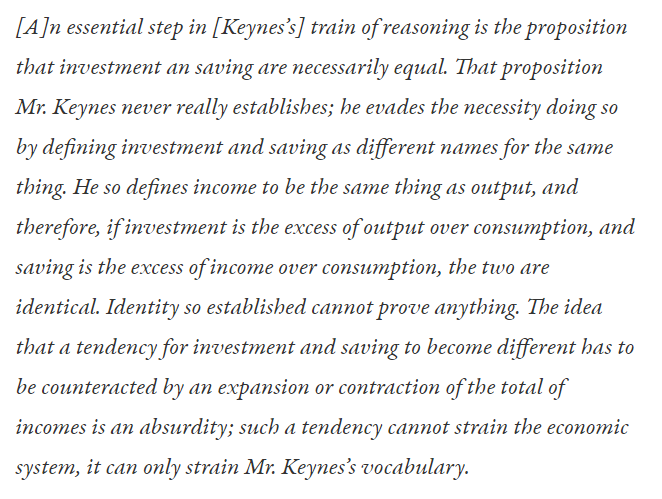

"Hawtrey was again sharply critical of Keynes’s tendency to argue from definitions rather than from causal relationships."

Glasner, David. 2013. “Keynes and Hawtrey: The General Theory.” Uneasy Money (blog). March 19, 2013. https://uneasymoney.com/2013/03/18/keynes-and-hawtrey-the-general-theory/.">https://uneasymoney.com/2013/03/1...

Glasner, David. 2013. “Keynes and Hawtrey: The General Theory.” Uneasy Money (blog). March 19, 2013. https://uneasymoney.com/2013/03/18/keynes-and-hawtrey-the-general-theory/.">https://uneasymoney.com/2013/03/1...

Echoed by Pettis https://carnegieendowment.org/chinafinancialmarkets/61679">https://carnegieendowment.org/chinafina...

But did Keynes use #accountingidentities to refute the neoclassical proposition that it is the rate of interest which equilibrates savings and investment?

Glasner, David. 2015. “Keynes and Accounting Identities.” Uneasy Money (blog). October 21, 2015. https://uneasymoney.com/2015/10/20/keynes-and-accounting-identities/.">https://uneasymoney.com/2015/10/2...

Glasner, David. 2015. “Keynes and Accounting Identities.” Uneasy Money (blog). October 21, 2015. https://uneasymoney.com/2015/10/20/keynes-and-accounting-identities/.">https://uneasymoney.com/2015/10/2...

Back to #globalfinancialflows & the #balanceoftrade / #balanceofpayments, is it true that:

Pettis, Michael. 2019. “Washington Should Tax Capital Inflows.” Carnegie Endowment for International Peace (blog). August 6, 2019. https://carnegieendowment.org/chinafinancialmarkets/79641?">https://carnegieendowment.org/chinafina...

Pettis, Michael. 2019. “Washington Should Tax Capital Inflows.” Carnegie Endowment for International Peace (blog). August 6, 2019. https://carnegieendowment.org/chinafinancialmarkets/79641?">https://carnegieendowment.org/chinafina...

BIS asks: did global current account imbalances contribute to the GFC?

Borio, Claudio, and Piti Disyatat. 2011. “Global Imbalances and the Financial Crisis: Link or No Link?,” May. https://www.bis.org/publ/work346.htm.">https://www.bis.org/publ/work...

Borio, Claudio, and Piti Disyatat. 2011. “Global Imbalances and the Financial Crisis: Link or No Link?,” May. https://www.bis.org/publ/work346.htm.">https://www.bis.org/publ/work...

Wrong excess?

"We conjecture that the main contributing factor to the financial crisis was not "excess saving" but the "excess elasticity" of the international monetary and financial system"

"We conjecture that the main contributing factor to the financial crisis was not "excess saving" but the "excess elasticity" of the international monetary and financial system"

Also:

Borio,& Disyatat 2015. “Capital Flows and the Current Account: Taking Financing (More) Seriously” https://www.bis.org/publ/work525.htm.

questions">https://www.bis.org/publ/work... the appropriateness of analytical frameworks that focus on CAs or net capital flows for assessing the pattern of cross-border capital flows

Borio,& Disyatat 2015. “Capital Flows and the Current Account: Taking Financing (More) Seriously” https://www.bis.org/publ/work525.htm.

questions">https://www.bis.org/publ/work... the appropriateness of analytical frameworks that focus on CAs or net capital flows for assessing the pattern of cross-border capital flows

Coming full circle, back to @UWEBristol:

Sissoko, Carolyn 2020. “The Savings Glut or the Death of Schumpeterian Growth.” Synthetic Assets (blog). August 14, 2020. ( @csissoko) https://syntheticassets.wordpress.com/2020/08/14/the-savings-glut-or-the-death-of-schumpeterian-growth/.">https://syntheticassets.wordpress.com/2020/08/1...

Sissoko, Carolyn 2020. “The Savings Glut or the Death of Schumpeterian Growth.” Synthetic Assets (blog). August 14, 2020. ( @csissoko) https://syntheticassets.wordpress.com/2020/08/14/the-savings-glut-or-the-death-of-schumpeterian-growth/.">https://syntheticassets.wordpress.com/2020/08/1...

Or, back to @martinwolf_ on the role of globalization in the GFC:

Wolf, Martin. 2014. The Shifts and the Shocks: What We’ve Learned – and Have Still to Learn – from the Financial Crisis. Penguin. https://www.penguinrandomhouse.com/books/313193/the-shifts-and-the-shocks-by-martin-wolf/.">https://www.penguinrandomhouse.com/books/313...

Wolf, Martin. 2014. The Shifts and the Shocks: What We’ve Learned – and Have Still to Learn – from the Financial Crisis. Penguin. https://www.penguinrandomhouse.com/books/313193/the-shifts-and-the-shocks-by-martin-wolf/.">https://www.penguinrandomhouse.com/books/313...

Sissoko, Carolyn. 2014. “On ‘How the World Economy Shifted.’” Synthetic Assets 2014. https://syntheticassets.wordpress.com/2014/11/05/on-how-the-world-economy-shifted/.

"EM">https://syntheticassets.wordpress.com/2014/11/0... countries undervalue their currencies and make it easy for them to run CA surpluses & the uncharacteristic movement of the U.S. business sector into surplus.."

"EM">https://syntheticassets.wordpress.com/2014/11/0... countries undervalue their currencies and make it easy for them to run CA surpluses & the uncharacteristic movement of the U.S. business sector into surplus.."

Also at @UWEBristol the #criticalmacrofinance project @DanielaGabor, @JoMicheII @YannisDafermos et al explain that globalised finance is the dominant force in modern capitalism

@DanielaGabor explains to @DavidBeckworth & us:

Beckworth, David. n.d. “Macro Musings: Daniela Gabor on Financial Globalization, Capital Controls, and the Critical Macrofinance Framework.” https://macromusings.libsyn.com/daniela-gabor-on-financial-globalization-capital-controls-and-the-critical-macrofinance-framework.">https://macromusings.libsyn.com/daniela-g...

Beckworth, David. n.d. “Macro Musings: Daniela Gabor on Financial Globalization, Capital Controls, and the Critical Macrofinance Framework.” https://macromusings.libsyn.com/daniela-gabor-on-financial-globalization-capital-controls-and-the-critical-macrofinance-framework.">https://macromusings.libsyn.com/daniela-g...

Wrong glut? https://twitter.com/DanielaGabor/status/1294164565899587584">https://twitter.com/DanielaGa...

And yet @martinwolf_ suggests https://www.ft.com/content/f3ee37e0-b086-11ea-a4b6-31f1eedf762e...">https://www.ft.com/content/f...

... that to understand global conflicts owe more to divisions within countries than between them (Pettis & Klein& #39;s perspective) goes back to:

https://en.wikipedia.org/wiki/Imperialism_(Hobson)">https://en.wikipedia.org/wiki/Impe...

https://en.wikipedia.org/wiki/Imperialism_(Hobson)">https://en.wikipedia.org/wiki/Impe...

So much to read!

We have not succeeded in answering all our problems. The answers we have found only serve to raise a whole set of new questions. In some ways we feel we are as confused as ever, but we believe we are confused on a higher level and about more important things

/end

We have not succeeded in answering all our problems. The answers we have found only serve to raise a whole set of new questions. In some ways we feel we are as confused as ever, but we believe we are confused on a higher level and about more important things

/end

For the excellent discussion of international trade and financial flows back in Aug, thanks to

@JWMason1

@MonaAli_NY_US

@DanielaGabor

@izakaminska

@M_C_Klein

@michaelxpettis

@Brad_Setser

@jonsindreu

@colbyLsmith

@NathanTankus

@adam_tooze.

Happy Labour Day weekend.

@JWMason1

@MonaAli_NY_US

@DanielaGabor

@izakaminska

@M_C_Klein

@michaelxpettis

@Brad_Setser

@jonsindreu

@colbyLsmith

@NathanTankus

@adam_tooze.

Happy Labour Day weekend.

Read on Twitter

Read on Twitter

![Hawtrey, R. G. (Ralph George). 1919. Currency and Credit. London, New York [etc.] Longmans, Green and co. https://archive.org/details/c... chock full of wisdom: "[he] saw financial instability as the abiding tendency of credit markets" (Merhling) Hawtrey, R. G. (Ralph George). 1919. Currency and Credit. London, New York [etc.] Longmans, Green and co. https://archive.org/details/c... chock full of wisdom: "[he] saw financial instability as the abiding tendency of credit markets" (Merhling)](https://pbs.twimg.com/media/EhKjgbNXgAE841c.png)