$CRWD is my largest holding and I still believe it to be one of the best long-term secular ideas.

- Exceptional CEO who understands pain points & executes well

- Consolidating market & land grab opp

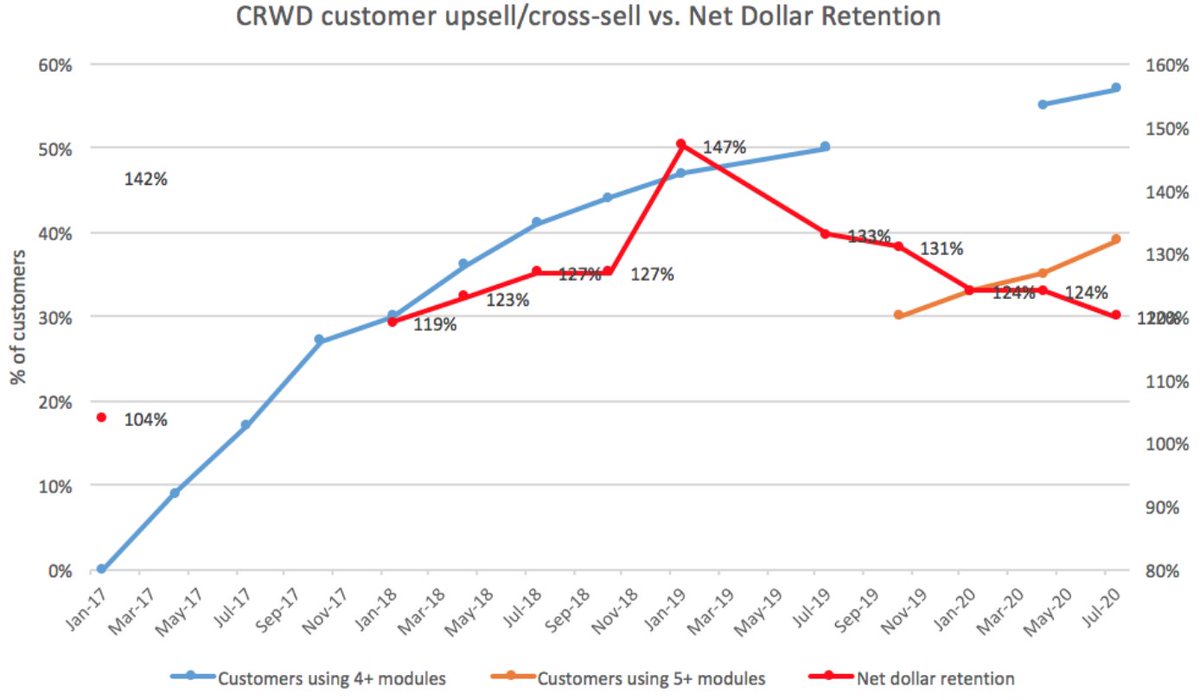

- Sticky product that wins

My thoughts on Q2 earnings: https://blog.publiccomps.com/crwdq2fy21/ ">https://blog.publiccomps.com/crwdq2fy2...

- Exceptional CEO who understands pain points & executes well

- Consolidating market & land grab opp

- Sticky product that wins

My thoughts on Q2 earnings: https://blog.publiccomps.com/crwdq2fy21/ ">https://blog.publiccomps.com/crwdq2fy2...

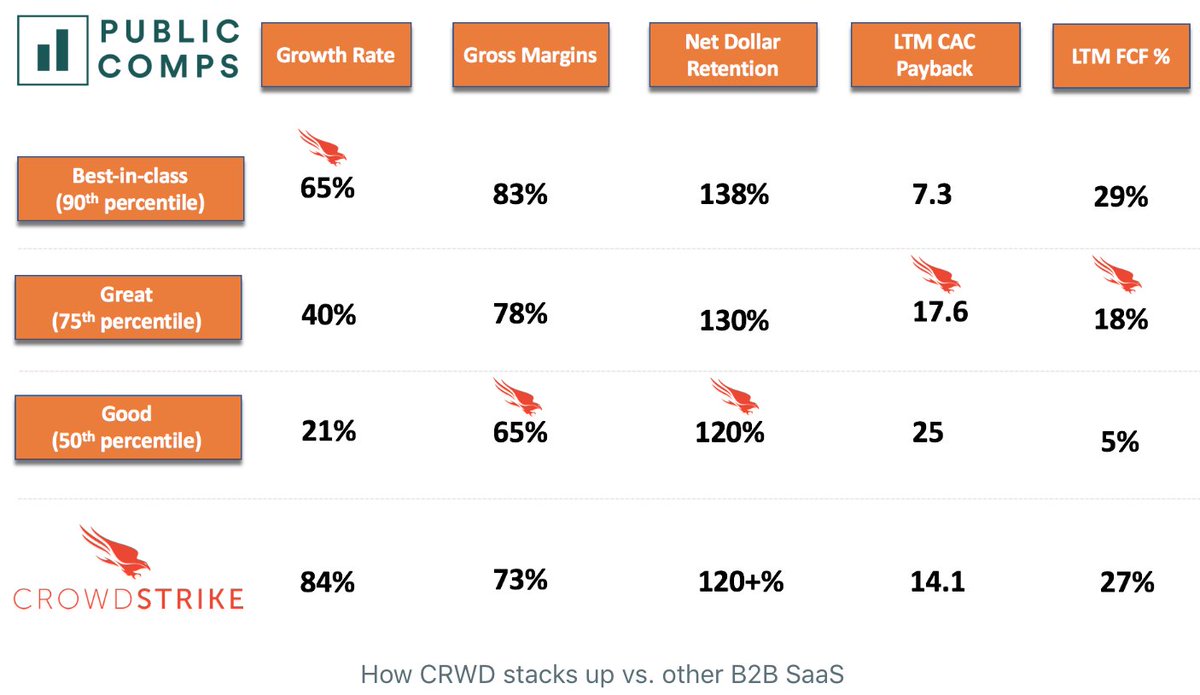

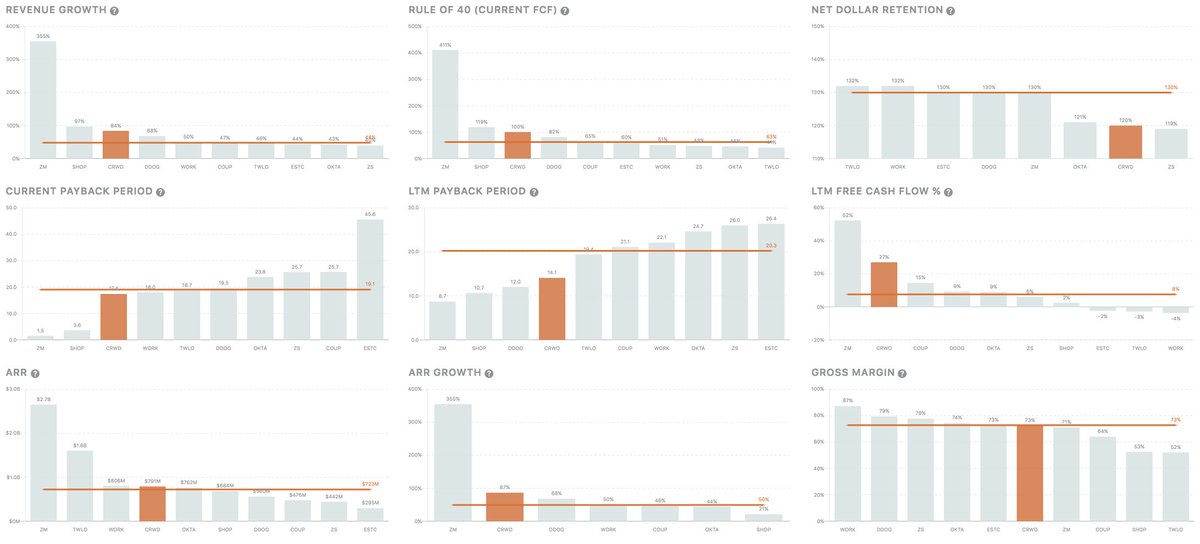

CRWD is the 2nd fastest growing B2B SaaS behind $ZM, even at $790M in ARR, it continues to grow exceptionally fast because of the shift to cloud & and customers hardly churn.

The market has historically been fragmented, but CRWD is benefitting disproportionate from having better unit economics. Category leaders are grabbing more market share than they used to, and $CRWD& #39;s breadth of offerings is consolidating the market and displacing legacy on-prem.

For a company with ACVs of $109k, they execute exceptionally fast, this is due to 1) superior product that converts from free trial; 2) frictionless & self-service model; 3) Management that prides themselves on sales efficiency and uses magic number as a KPI

Read on Twitter

Read on Twitter