The world& #39;s biggest mining company @bhp also has one of the world& #39;s biggest corporate carbon footprints.

If it wants to address that it& #39;s going to have to play its part in changing how steel is made.

Thread on my column today: https://www.bloomberg.com/opinion/articles/2020-09-03/bhp-s-road-to-reduced-emissions-should-be-electric-powered?utm_medium=social&utm_source=twitter&utm_content=view&utm_campaign=socialflow-organic&cmpid%3D=socialflow-twitter-view&sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

If it wants to address that it& #39;s going to have to play its part in changing how steel is made.

Thread on my column today: https://www.bloomberg.com/opinion/articles/2020-09-03/bhp-s-road-to-reduced-emissions-should-be-electric-powered?utm_medium=social&utm_source=twitter&utm_content=view&utm_campaign=socialflow-organic&cmpid%3D=socialflow-twitter-view&sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

It& #39;s quite remarkable to me that mining companies have so far avoided most of the pressure oil companies have been feeling in relation to carbon emissions.

By their own disclosures, BHP, Rio Tinto and Vale are on a par with the biggest independent oil companies.

By their own disclosures, BHP, Rio Tinto and Vale are on a par with the biggest independent oil companies.

Pretty much every western-listed oil company has laid out a path to emissions reduction this year, but the mining companies have so far avoided this. BHP will be the first, with an announcement due next week. https://twitter.com/KetanJ0/status/1260129288411664384?s=20">https://twitter.com/KetanJ0/s...

I would expect something along the lines of "reducing emissions intensity" -- ie. going ahead with potash/more copper so that the "average emissions" from BHP products go down without reducing the total.

Needless to say, the climate doesn& #39;t care about averages, only the total.

Needless to say, the climate doesn& #39;t care about averages, only the total.

But I think there& #39;s a bolder path that BHP is well-positioned to take advantage of -- pushing into (rather than away from) the way that the way we make steel is changing.

I wrote about that a little here: https://www.bloomberg.com/opinion/articles/2019-03-12/mining-s-green-turn-undermined-by-steel-pollution?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

I wrote about that a little here: https://www.bloomberg.com/opinion/articles/2019-03-12/mining-s-green-turn-undermined-by-steel-pollution?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

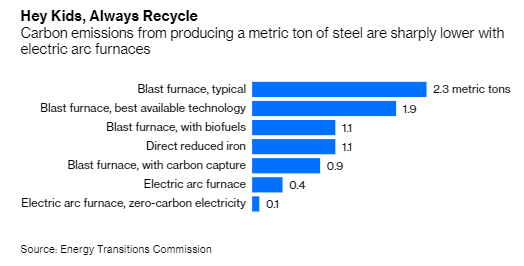

The key thing to remember is that producing a metric ton of steel produces roughly the same emissions as burning a metric ton of coal for energy.

But as with coal-fired power, there& #39;s a lower-carbon technology that could disrupt this:

But as with coal-fired power, there& #39;s a lower-carbon technology that could disrupt this:

To explain this, we need a quick detour into how steel is made.

You have two products, primary steel (made from iron ore) and secondary steel (recycled from scrap).

Traditionally:

Primary steel https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔧" title="Schraubenschlüssel" aria-label="Emoji: Schraubenschlüssel">is made in a blast furnace

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔧" title="Schraubenschlüssel" aria-label="Emoji: Schraubenschlüssel">is made in a blast furnace

Secondary steel https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔩" title="Mutter und Schraube" aria-label="Emoji: Mutter und Schraube"> is made in an electric arc furnace

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔩" title="Mutter und Schraube" aria-label="Emoji: Mutter und Schraube"> is made in an electric arc furnace

You have two products, primary steel (made from iron ore) and secondary steel (recycled from scrap).

Traditionally:

Primary steel

Secondary steel

Blast furnaces have much higher emissions because they use coal as the fuel to break apart iron and oxygen atoms.

All steel contains carbon, but it& #39;s on the scale of 0.6%-2%, with the majority of steel having below 1%.

All steel contains carbon, but it& #39;s on the scale of 0.6%-2%, with the majority of steel having below 1%.

Historically and at present blast furnaces make the majority of the world& #39;s steel, about 70% now.

Why?

1. Traditionally it& #39;s the only way to make primary steel. You can& #39;t put iron ore in an electric furnace

2. Scrap is more scarce/expensive than iron ore and coal

Why?

1. Traditionally it& #39;s the only way to make primary steel. You can& #39;t put iron ore in an electric furnace

2. Scrap is more scarce/expensive than iron ore and coal

However, electic furnaces (EAFs) have some advantages too. You can switch them on and off at will, whereas you have to run a blast furnace-basic oxygen furnace (BF-BOF) for 15 years non-stop, which means you risk selling at a loss whenever demand gets weak.

This process has already played out in the American steel industry.

The decline of U.S. Steel (the world& #39;s first billion-dollar company) and rise of Nucor in recent decades is essentially the story of EAFs triumphing over BOFs where the demand picture and scrap supply works.

The decline of U.S. Steel (the world& #39;s first billion-dollar company) and rise of Nucor in recent decades is essentially the story of EAFs triumphing over BOFs where the demand picture and scrap supply works.

But both aspects of this are changing.

For one thing, scrap availability is about to boom in an unprecedented way. https://www.worldsteel.org/media-centre/blog/2018/future-of-global-scrap-availability.html">https://www.worldsteel.org/media-cen...

For one thing, scrap availability is about to boom in an unprecedented way. https://www.worldsteel.org/media-centre/blog/2018/future-of-global-scrap-availability.html">https://www.worldsteel.org/media-cen...

The miners& #39; current fortunes are based on the way that China has consumed steel on a scale far greater than any country in history.

The flip side of this is that ~10 years after steel is made and used, it becomes scrap and is available as raw materials for EAF steelmaking.

The flip side of this is that ~10 years after steel is made and used, it becomes scrap and is available as raw materials for EAF steelmaking.

China& #39;s mountain of this obsolete scrap is set to surge over the coming decade.

Unlike iron ore and coking coal, which it must import from trade partners it doesn& #39;t entirely trust, this is a domestic resource:

Unlike iron ore and coking coal, which it must import from trade partners it doesn& #39;t entirely trust, this is a domestic resource:

The other problem is making primary steel without blast furnaces.

It& #39;s not quite right to say that it& #39;s *impossible* to do this. India and Iran make quite a lot of primary steel with so-called direct reduced iron or DRI, which can be put straight into an electric furnace.

It& #39;s not quite right to say that it& #39;s *impossible* to do this. India and Iran make quite a lot of primary steel with so-called direct reduced iron or DRI, which can be put straight into an electric furnace.

The trouble with DRI is you still need a lot of energy to tear apart iron oxide molecules, and traditionally that means natural gas -- a product that the big steel-demand countries of China and India are pretty short of.

That may be changing, though. This week a coalition of Scandinavian industrial companies started up a radical test project using hydrogen-based DRI to make fossil fuel-free steel: https://twitter.com/MGornerup/status/1300312927338143745?s=20">https://twitter.com/MGornerup...

DRI is also hard to transport. It has a tendency to spontaneously combust!

But, you can process it into blocks of more or less pure metal, called hot briquetted iron. BHP used to make this stuff 20 years ago, although the project wasn& #39;t a success back then.

But, you can process it into blocks of more or less pure metal, called hot briquetted iron. BHP used to make this stuff 20 years ago, although the project wasn& #39;t a success back then.

This sells for typically about three times the price of high-grade iron ore. To make it, of course, you need an abundant, cheap energy source -- either natural gas or hydrogen.

As it happens, BHP is well-placed to provide this. It& #39;s one of the biggest players in natural gas fields offshore the Pilbara region, where about half the world& #39;s seaborne trade in iron ore is mined.

The gas is exported just a few miles up the coast from the iron ore port.

The gas is exported just a few miles up the coast from the iron ore port.

Mining companies could help reduce emissions while earning more $$ *and* more exports and jobs for their home countries if they dedicated a growing share of their output to HBI.

They have the market power to do this. The big 5 companies have ~3/4 of the seaborne iron ore market.

They have the market power to do this. The big 5 companies have ~3/4 of the seaborne iron ore market.

Obviously natural gas-reduced DRI won& #39;t get you to near-zero emissions because natural gas is a hydrocarbon. But immediately a DRI-EAF route gets you roughly a 50% reduction over the BF-BOF route to make steel:

The next stage of the process is to replace natural gas with first "blue hydrogen" (made from gas, with carbon capture and storage) and eventually "green hydrogen" (made via electrolysis from water with renewable power).

No mining company is set up at present to provide green hydrogen. But BHP right now has a source of natural gas right next to the Pilbara iron-ore region, plus oil reservoirs which are the only places where to date carbon capture and storage has ever been successfully achieved.

I& #39;m pretty sceptical on carbon capture and storage generally, but if the industry is *remotely* serious about it, it& #39;s places like the Pilbara/North West Shelf where it& #39;s going to happen. In fact one of the largest operating projects is at Chevron& #39;s nearby Gorgon LNG plant.

This would unquestionably be a radical change for the steel industry. China& #39;s fleet of blast furnaces is young, so may well keep running past 2050: https://www.bloomberg.com/opinion/articles/2020-08-18/bhp-earnings-optimism-on-coking-coal-may-be-misplaced?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

But you still have to shut down a blast furnace every 15 years or so to replace the firebricks. That can cost hundreds of millions. If a carbon price/policy support/cheap electricity is in place, steelmakers may take the opportunity to switch to the EAF route instead.

This isn& #39;t the way the industry is trending at the moment -- but even BHP reckons we& #39;ll go from blast furnaces having a 70% share of steel production now to 45%-50% by 2050.

More importantly, we have to tackle this if we& #39;re to tackle climate change.

Steel accounts for about 7%-8% of global emissions -- 2.8bn tons, vs. 10.1bn tons for thermal coal.

This is a major, major emitter.

Steel accounts for about 7%-8% of global emissions -- 2.8bn tons, vs. 10.1bn tons for thermal coal.

This is a major, major emitter.

Here& #39;s some of my previous columns on the subject.

On why the mining industry needs to deal with steel emissions: https://www.bloomberg.com/opinion/articles/2019-03-12/mining-s-green-turn-undermined-by-steel-pollution?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

On why the mining industry needs to deal with steel emissions: https://www.bloomberg.com/opinion/articles/2019-03-12/mining-s-green-turn-undermined-by-steel-pollution?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

On why Fortescue& #39;s founder, billionaire Andrew Forrest, should live up to his ambitions of leadership and work to reduce a personal carbon footprint the size of Bangladesh:

https://www.bloomberg.com/opinion/articles/2020-02-19/fortescue-earnings-it-s-possible-to-make-steel-cleaner?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

https://www.bloomberg.com/opinion/articles/2020-02-19/fortescue-earnings-it-s-possible-to-make-steel-cleaner?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

On why BHP& #39;s optimism on the outlook for its coking coal business may be as misplaced as its previous optimism about thermal coal: https://www.bloomberg.com/opinion/articles/2020-08-18/bhp-earnings-optimism-on-coking-coal-may-be-misplaced?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

And today, arguing that BHP is the company best-positioned to take the lead on pushing a switch in the steelmaking industry: https://www.bloomberg.com/opinion/articles/2020-09-03/bhp-s-road-to-reduced-emissions-should-be-electric-powered?utm_medium=social&utm_source=twitter&utm_content=view&utm_campaign=socialflow-organic&cmpid%3D=socialflow-twitter-view&sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

Thanks for reading! (ends)

A small postscript.

I realize this isn& #39;t a mainstream vision of where the steel industry is headed. But IMO it& #39;s quite plausible.

A study for @hybrit_project reckoned it only needs €40-€60 euros a tonne carbon price to outcompete blast furnaces.

CO2 costs €29/tonne now!

I realize this isn& #39;t a mainstream vision of where the steel industry is headed. But IMO it& #39;s quite plausible.

A study for @hybrit_project reckoned it only needs €40-€60 euros a tonne carbon price to outcompete blast furnaces.

CO2 costs €29/tonne now!

Rhetorically, a thing you hear a lot from the steel and mining industry is essentially "there is no alternative" to blast furnace-based steelmaking.

But there is an alternative. It comprises 30% of the current steel industry. And it offers a plausible path to decarbonization.

But there is an alternative. It comprises 30% of the current steel industry. And it offers a plausible path to decarbonization.

That "there is no alternative" line reminds me of nothing so much as the line you heard from people about thermal coal a decade ago. That turned out to be very, very wrong. https://www.bloomberg.com/opinion/articles/2019-10-23/coal-is-in-retreat-worldwide-as-renewable-energy-costs-drop?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

It& #39;s easy to forget that the groundbreaking 2006 @lordstern1 report on climate change economics assumed that renewables wouldn& #39;t be competitive in power generation till the 2030s.

That assumption seemed almost incontestible back then. But it was wrong. https://www.bloomberg.com/opinion/articles/2020-01-02/power-sector-shows-world-the-way-on-carbon-emissions?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

That assumption seemed almost incontestible back then. But it was wrong. https://www.bloomberg.com/opinion/articles/2020-01-02/power-sector-shows-world-the-way-on-carbon-emissions?sref=5JzLFdzD">https://www.bloomberg.com/opinion/a...

I may be wrong on decarbonizing steel. I don& #39;t have the expertise of the big miners and steelmakers. But I also don& #39;t have the vested interest in the status quo. I think we need to broaden this conversation and think more about the range of what& #39;s possible.

(ends, really)

(ends, really)

Oh, one last thing. The renewable resource in northwest Australia near the Pilbara is really, really good. Here& #39;s wind:

(from here: https://globalsolaratlas.info/map?c=-11.953349,73.476563,3)

This">https://globalsolaratlas.info/map... is some of the best renewable resources in the world, but it& #39;s remote from population centres so it needs some viable industry to consume its electrons.

A green hydrogen-DRI-HBI iron upgrading industry would fit the bill very nicely.

This">https://globalsolaratlas.info/map... is some of the best renewable resources in the world, but it& #39;s remote from population centres so it needs some viable industry to consume its electrons.

A green hydrogen-DRI-HBI iron upgrading industry would fit the bill very nicely.

Read on Twitter

Read on Twitter