1/ Bitcoin calls into question the very basis of economic organization. No other breakthrough in history will contribute more dramatically to the evolution of monetary systems.

*Just published* w/ @coinmetrics

Bitcoin: A Novel Economic Institution https://ark-invest.com/white-papers/bitcoin-part-one/">https://ark-invest.com/white-pap...

*Just published* w/ @coinmetrics

Bitcoin: A Novel Economic Institution https://ark-invest.com/white-papers/bitcoin-part-one/">https://ark-invest.com/white-pap...

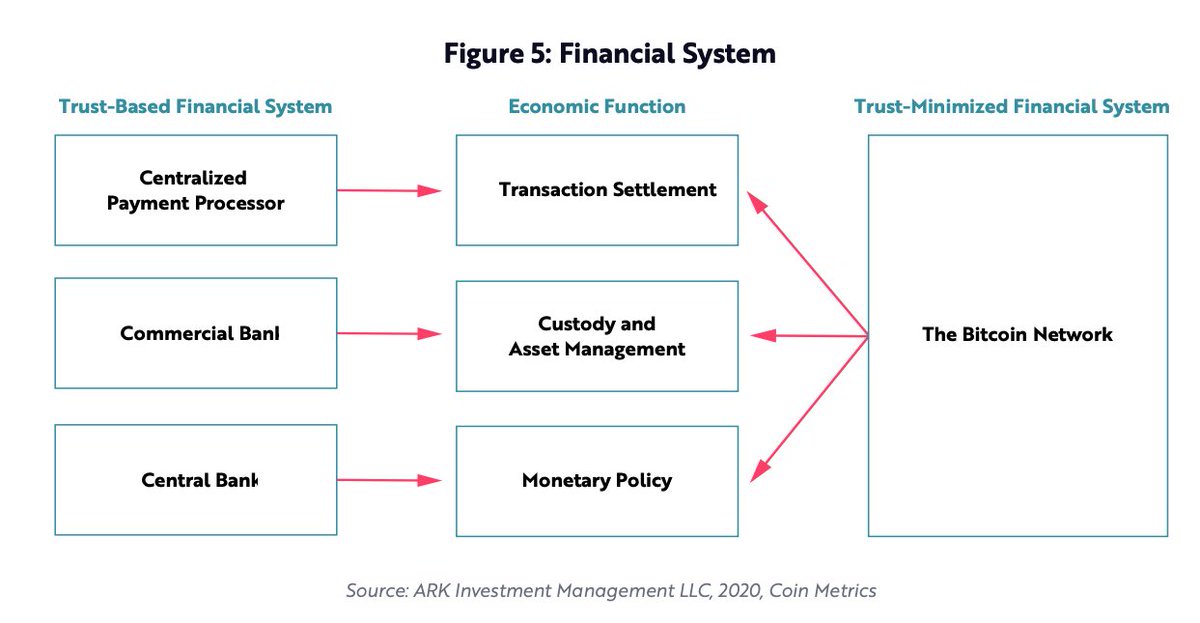

2/ The promise of Bitcoin is best understood in relation to traditional financial systems, which rely on

centrally controlled institutions that enforce the rules, record-keeping, and adjudication of the system.

centrally controlled institutions that enforce the rules, record-keeping, and adjudication of the system.

3/ These institutions were created to standardize the exchange of value, manage wealth, and facilitate

economic activity. Ex: Central banks govern monetary policy, while commercial banks custody and manage assets, and centralized payment processors mediate consumer transactions.

economic activity. Ex: Central banks govern monetary policy, while commercial banks custody and manage assets, and centralized payment processors mediate consumer transactions.

4/ Under a “trust-based” model, the integrity of an institution is a function of those controlling the

institution. Rules enforced from the top down are guaranteed if those in control are trustworthy.

institution. Rules enforced from the top down are guaranteed if those in control are trustworthy.

5/ Financial systems founded on a trust-based model fail to provide predictable economic assurances. Specifically, under a financial system:

6/ Here is why the current financial system falls short:

Assurance 1: Value should be exchanged globally and freely.

Why the trust-based model fails to meet Assurance 1: Centralized parties determine the eligibility of participants and control the flow of capital.

Assurance 1: Value should be exchanged globally and freely.

Why the trust-based model fails to meet Assurance 1: Centralized parties determine the eligibility of participants and control the flow of capital.

7/ Assurance 2: Wealth should be protected and owned wholly.

Why the trust-based model fails to meet Assurance 2: Participants rely on a local enforcer to grant property rights and protect property.

Why the trust-based model fails to meet Assurance 2: Participants rely on a local enforcer to grant property rights and protect property.

8/ Assurance 3: Rules should be enforced reliably and predictably.

Why the trust-based model fails to meet Assurance 3:

Centrally controlled institutions can enforce and change rules arbitrarily.

Why the trust-based model fails to meet Assurance 3:

Centrally controlled institutions can enforce and change rules arbitrarily.

9/ Assurance 4: Integrity of the system should be verifiable.

Why the trust-based model fails to meet Assurance 4:

Centrally controlled institutions lack transparency and auditability.

Why the trust-based model fails to meet Assurance 4:

Centrally controlled institutions lack transparency and auditability.

10/ Enter Bitcoin, a trust-minimized financial institution.

Bitcoin fundamentally shifts how a financial system distributes trust, eliminating the roles of several institutions that rely on centralized authorities and creating an ecosystem based on cryptography.

Bitcoin fundamentally shifts how a financial system distributes trust, eliminating the roles of several institutions that rely on centralized authorities and creating an ecosystem based on cryptography.

11/ Bitcoin is designed to uniquely satisfy the four economic assurances. It relies on a global network of peers to enforce rules, shifting enforcement from manual, local, and inconsistent to automated, global, and predictable.

12/ Why is Bitcoin able to satisfy these assurances?

Assurance 1: Value should be exchanged globally and freely.

Why Bitcoin Satisfies Assurance 1:

Bitcoin users can send any amount of value anytime to anyone anywhere.

Assurance 1: Value should be exchanged globally and freely.

Why Bitcoin Satisfies Assurance 1:

Bitcoin users can send any amount of value anytime to anyone anywhere.

13/ Assurance 2: Wealth should be protected and owned wholly.

Why Bitcoin Satisfies Assurance 2:

Bitcoin has an embedded independent property system.

Why Bitcoin Satisfies Assurance 2:

Bitcoin has an embedded independent property system.

14/ Assurance 3: Rules should be enforced reliably and predictably.

Why Bitcoin Satisfies Assurance 3:

Bitcoin incorporates a unique system of checks and balances to maintain integrity.

Why Bitcoin Satisfies Assurance 3:

Bitcoin incorporates a unique system of checks and balances to maintain integrity.

15/ Assurance 4: The system’s integrity should be verifiable.

Why Bitcoin Satisfies Assurance 4:

Bitcoin embeds native verification tools.

Why Bitcoin Satisfies Assurance 4:

Bitcoin embeds native verification tools.

16/ By eliminating the need for a trust-based model, Bitcoin is calling into question the current foundation of economic organizations and is paving the way for a more

predictable financial system.

predictable financial system.

17/ In doing so, Bitcoin presents an extremely unique opportunity to investors.

Stay tuned for Part 2, where @coinmetrics & I analyze bitcoin as an investment. While many investors question its merit, in our view bitcoin is the most compelling monetary asset to emerge since gold

Stay tuned for Part 2, where @coinmetrics & I analyze bitcoin as an investment. While many investors question its merit, in our view bitcoin is the most compelling monetary asset to emerge since gold

Read on Twitter

Read on Twitter