$BTC gameplan for the 8k to 12.1k area

Gameplan valid as long as BTC remains below 12.1k.

Thread!

1/ https://twitter.com/FangTrades/status/1288776930024726528">https://twitter.com/FangTrade...

Gameplan valid as long as BTC remains below 12.1k.

Thread!

1/ https://twitter.com/FangTrades/status/1288776930024726528">https://twitter.com/FangTrade...

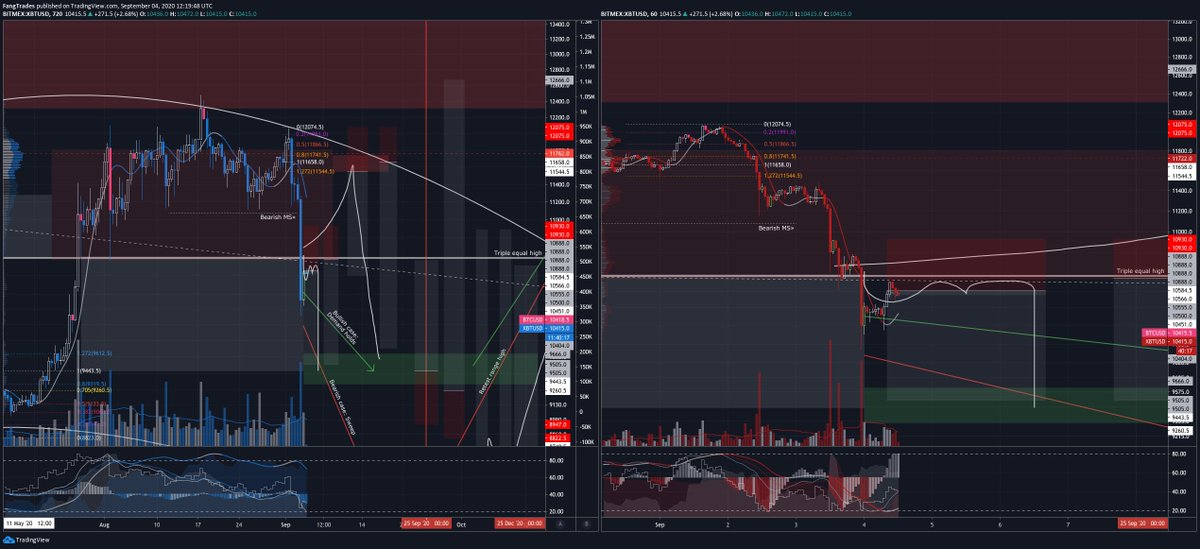

2/ $BTC 1D https://www.tradingview.com/x/kmFmyOoK/

IF">https://www.tradingview.com/x/kmFmyOo... we reclaim below range high @ 10.6k, imo tapping demand at 9.6k is imminent, and we will have a bullish and bearish case, both marked on chart:

Bullish case (green): Demand holds, bullish MS preserved, consolidate then mark up to new highs

IF">https://www.tradingview.com/x/kmFmyOo... we reclaim below range high @ 10.6k, imo tapping demand at 9.6k is imminent, and we will have a bullish and bearish case, both marked on chart:

Bullish case (green): Demand holds, bullish MS preserved, consolidate then mark up to new highs

3/ Bearish case (red): Demand doesn& #39;t hold, liquidity below swing points at 8823 & 8630 are taken, break into bearish MS. I currently believe it would be a sweep and not a stop run because 4H-12H oscillators look like they& #39;ll be oversold, and that area is concave arc support.

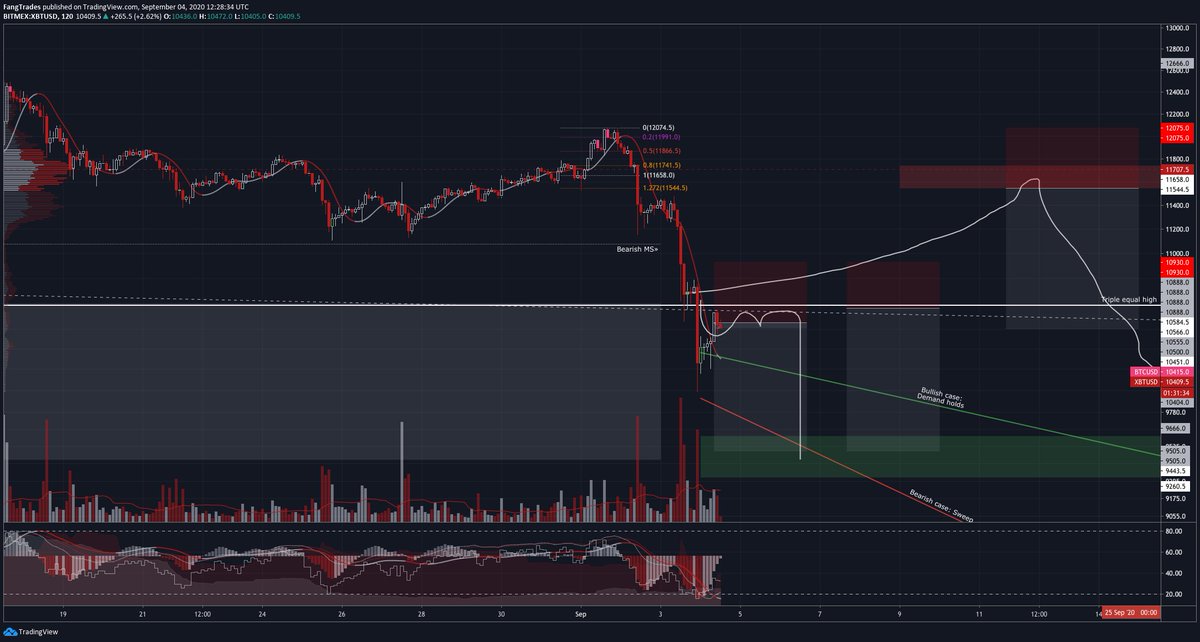

4/ $BTC 12H https://www.tradingview.com/x/5EJYDaEO/

Here& #39;s">https://www.tradingview.com/x/5EJYDaE... how I plan to play this:

#1 Short: IF we retrace upwards from here, I& #39;ll open a heavy short at supply, 11550-11750. Invalidation 12075 and targets 10400 & 9650.

Here& #39;s">https://www.tradingview.com/x/5EJYDaE... how I plan to play this:

#1 Short: IF we retrace upwards from here, I& #39;ll open a heavy short at supply, 11550-11750. Invalidation 12075 and targets 10400 & 9650.

#2 Short: If we reclaim below 10.6k, regardless of if we retraced first, I might play a range reclaim setup, targeting demand at 9600-9300, depending on how clean the PA looks at that moment.

#3 Long: IF the reclaim occurs, then I will long demand at 9450-9250 with invalidation at 8950-8800

This continues bullish MS so targeting new highs at 12666 is logical. But 10.6k will be a significant barrier since it would be a range high reclaim + retest, so 50% TP there.

This continues bullish MS so targeting new highs at 12666 is logical. But 10.6k will be a significant barrier since it would be a range high reclaim + retest, so 50% TP there.

7/ I personally hope demand breaks because the resulting bearish MS would be good news for my full 1x short. But the RRR is good here for longs, and it& #39;s a pretty pivotal area; should be able to make money either way. It& #39;s hedging my hedge I guess

#4 Long: If demand does break AND we print a clean sweep, I plan to long a reclaim of the May 25 swing low towards a test of 10.6k, stop below the wick. Since we& #39;d have bearish MS then, the range high test should hold and so I& #39;d set full TP at ~10550 (and prob flip short again)

9/ I find trading is less stressful when I plan actions in advance like this - the analysis is already done when the opportunity arrives, so it& #39;s easier to go against the crowd and not get caught up in the moment

Anyways just sharing my thoughts as usual, take what you will.

Anyways just sharing my thoughts as usual, take what you will.

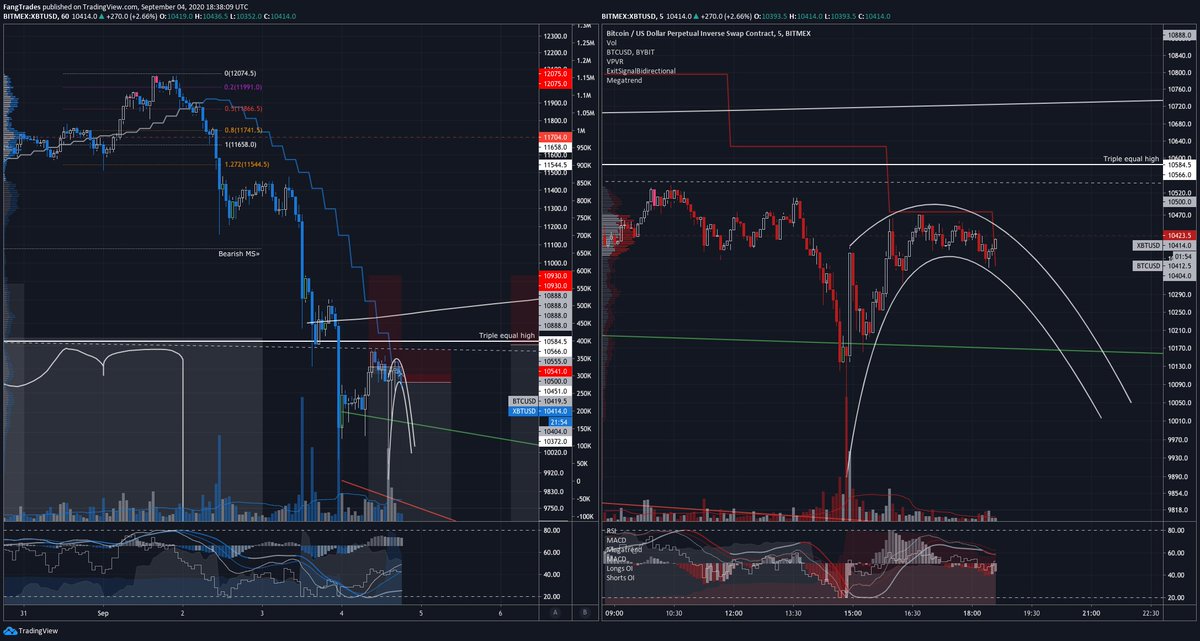

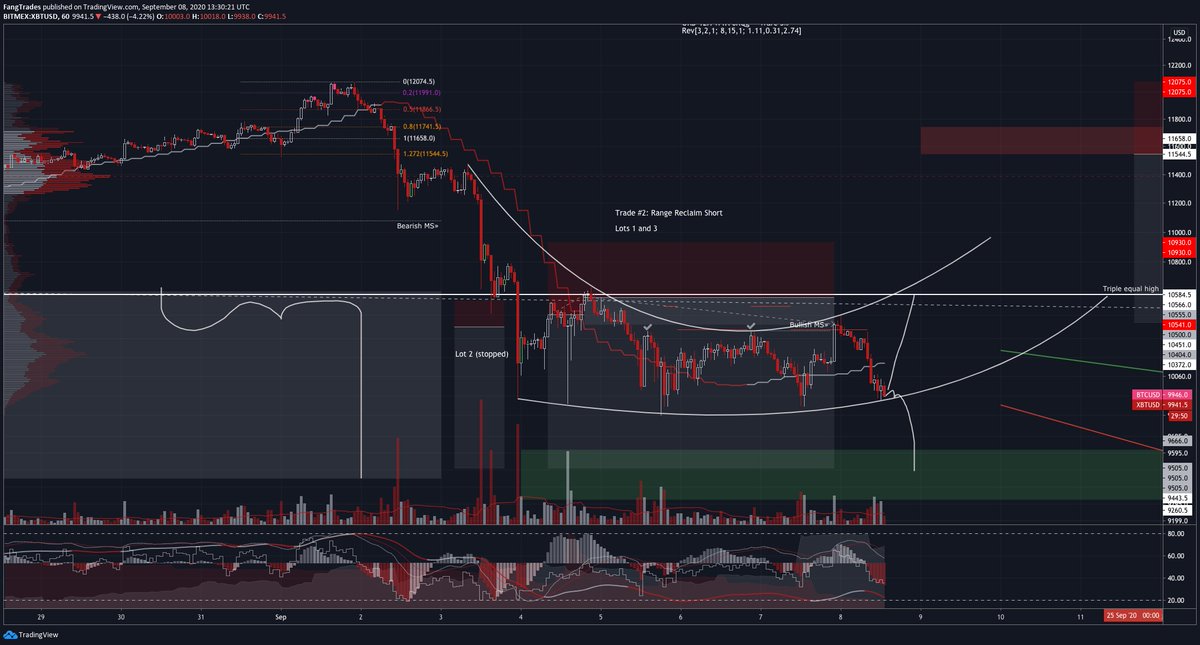

10/ $BTC 12H&1H /x/REAiYUOA/

Daily closed within the range - that& #39;s enough for me to take trade #1, the range reclaim short. Avg entry 10451, inval 10930, target 9500.

Some more asks at 10566 in case we wick higher.

Daily closed within the range - that& #39;s enough for me to take trade #1, the range reclaim short. Avg entry 10451, inval 10930, target 9500.

Some more asks at 10566 in case we wick higher.

12/ $BTC 1H&5m /x/S9ltGdKC/

Added another lot of shorts here with a tight stop just above the minor 10540 high - around 5R theoretical. We got a LL on the 5m; I think price is going to curve down again along this arc

Added another lot of shorts here with a tight stop just above the minor 10540 high - around 5R theoretical. We got a LL on the 5m; I think price is going to curve down again along this arc

13/ $BTC 12H&1H /x/46GiUeoh/ , 5m /x/vJ6Zla3M/

The LTF arc broke up and the tight second lot was stopped. Asks above were hit though; third lot opened

We& #39;re right at range high so I& #39;m expecting a rejection here

(Also I mistyped earlier - this reclaim short is trade #2, not #1)

The LTF arc broke up and the tight second lot was stopped. Asks above were hit though; third lot opened

We& #39;re right at range high so I& #39;m expecting a rejection here

(Also I mistyped earlier - this reclaim short is trade #2, not #1)

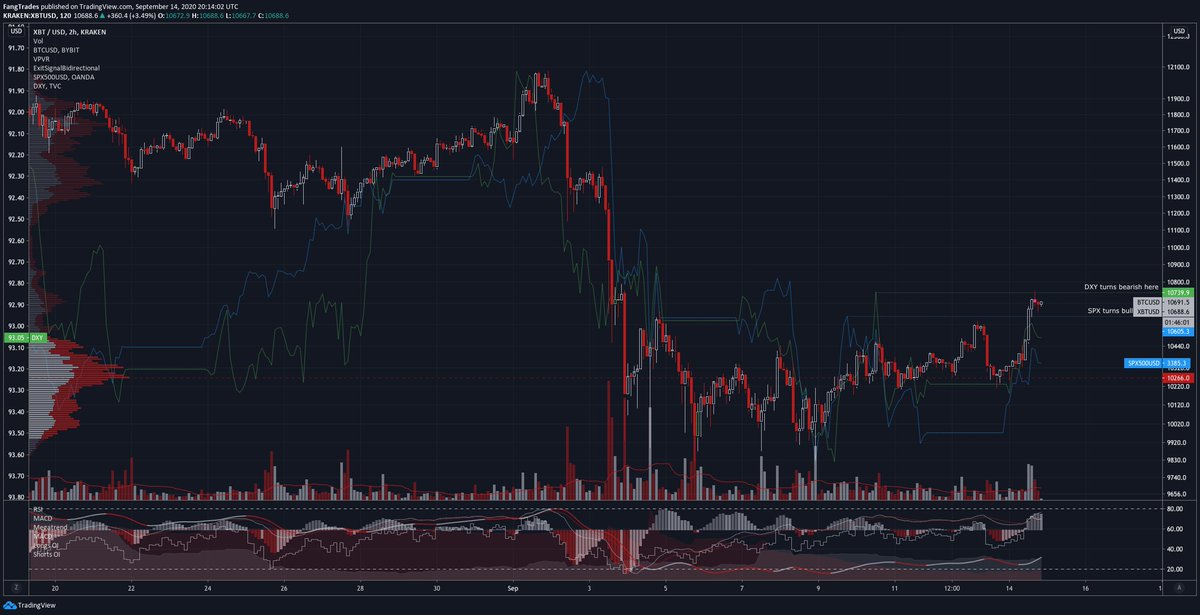

Thinking aloud here... Stops below 10.6 were taken, then the people who bought those stops got stopped with the deep SFP today

That& #39;s a double liquidation, which usually is bullish. The LTF PA does look bullish.

That& #39;s a double liquidation, which usually is bullish. The LTF PA does look bullish.

The problem is it& #39;s right into range high resistance, where MM& #39;s who longed above 10.6 are probably looking to limit out around breakeven - that& #39;s why we usually retest a range from within shortly after reclaiming it. This sell pressure usually results in the range retest holding

The double liq + SFP implies there are other big players who were looking to load up here, possibly to mark up to the 11900 area to unload. The MM& #39;s wouldn& #39;t try to get *more* long exposure if their goal is to distribute

So it& #39;s MM& #39;s vs bullwhales; I& #39;m betting with the MM& #39;s.

So it& #39;s MM& #39;s vs bullwhales; I& #39;m betting with the MM& #39;s.

OTOH, here& #39;s some valuable bull items from around CT, first three are short term only:

1) Unfilled price inefficiency up above, aka gap or liquidity void (from @ChonkyFX)

https://twitter.com/ChonkyFX/status/1302013363363348480?s=19

2)">https://twitter.com/ChonkyFX/... Missing test of H&S baseline (from @edwardmorra_btc) https://twitter.com/edwardmorra_btc/status/1301865405686964226?s=19">https://twitter.com/edwardmor...

1) Unfilled price inefficiency up above, aka gap or liquidity void (from @ChonkyFX)

https://twitter.com/ChonkyFX/status/1302013363363348480?s=19

2)">https://twitter.com/ChonkyFX/... Missing test of H&S baseline (from @edwardmorra_btc) https://twitter.com/edwardmorra_btc/status/1301865405686964226?s=19">https://twitter.com/edwardmor...

3) Shorts are currently overextended (from @BTC_y_tho)

https://twitter.com/BTC_y_tho/status/1302007034402009092?s=19">https://twitter.com/BTC_y_tho...

4) Weekly hasn& #39;t closed below 10.5k, still a break + retest (from @IRaptorI):

https://twitter.com/IRaptorI/status/1301918095389454345?s=19

First">https://twitter.com/IRaptorI/... three are LTF tho, so less weight vs the 10.6k level that& #39;s almost a year old. We& #39;ll see!

https://twitter.com/BTC_y_tho/status/1302007034402009092?s=19">https://twitter.com/BTC_y_tho...

4) Weekly hasn& #39;t closed below 10.5k, still a break + retest (from @IRaptorI):

https://twitter.com/IRaptorI/status/1301918095389454345?s=19

First">https://twitter.com/IRaptorI/... three are LTF tho, so less weight vs the 10.6k level that& #39;s almost a year old. We& #39;ll see!

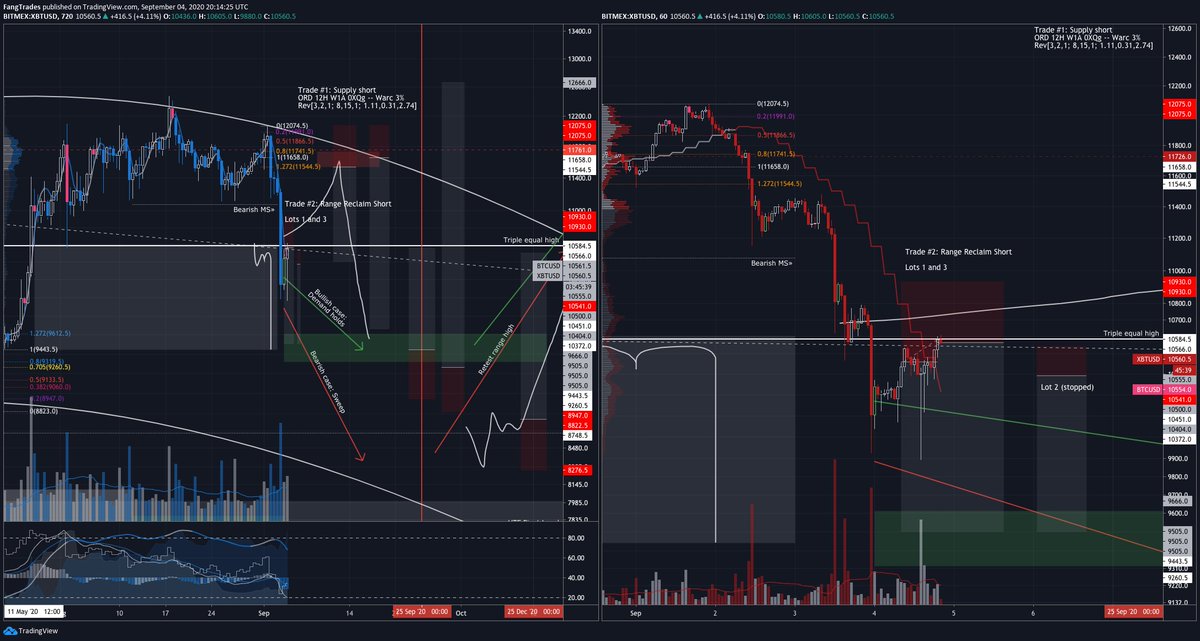

19/ $BTC 1H /x/ANpsJUr9/

Trailed my stop too close and my short got stopped out: +0.13R and +0.51R on lots 1 and 3. Oh well

Anyways, Bitcoin looks pivotal at the moment - we got 1H bullish MS and have now retraced to convex arc support. Bounce here otherwise 9.5k soon imo.

Trailed my stop too close and my short got stopped out: +0.13R and +0.51R on lots 1 and 3. Oh well

Anyways, Bitcoin looks pivotal at the moment - we got 1H bullish MS and have now retraced to convex arc support. Bounce here otherwise 9.5k soon imo.

Read on Twitter

Read on Twitter