1/25

In April I wrote a thread on the economic theory on how ETH2.0 will drive prices.

Some maximalists & arm-chair economists complained that wasn& #39;t clear correlation.

Thanks to the work from $YFI& #39;s yETH vaults, we now have a snapshot of behavior of what we can expect:

In April I wrote a thread on the economic theory on how ETH2.0 will drive prices.

Some maximalists & arm-chair economists complained that wasn& #39;t clear correlation.

Thanks to the work from $YFI& #39;s yETH vaults, we now have a snapshot of behavior of what we can expect:

2/25

In just two short days yETH vaults have more than 347,000 ETH ($150M USD) locked in the vault.

The yETH vault is a place for users to park their Ethereum and have it generate a return from an investing strategy (that uses $MKR & $DAI lending to generate return)

In just two short days yETH vaults have more than 347,000 ETH ($150M USD) locked in the vault.

The yETH vault is a place for users to park their Ethereum and have it generate a return from an investing strategy (that uses $MKR & $DAI lending to generate return)

3/25

Right now, this yETH vault generates a whopping 89% APY return

Validation #1: APYs start high

This proves the first important point I made about ETH2.0 - many people think that the staking returns will be low as they assume most users will lock up all their ETH right away

Right now, this yETH vault generates a whopping 89% APY return

Validation #1: APYs start high

This proves the first important point I made about ETH2.0 - many people think that the staking returns will be low as they assume most users will lock up all their ETH right away

4/25

But, yETH vaults have a non-zero risk (that is to say some unknown level of risk) there could be bugs, there could be issues with contract interactions etc.

For that reason, less risk tolerate users do not invest. Which is why 89% returns exist.

But, yETH vaults have a non-zero risk (that is to say some unknown level of risk) there could be bugs, there could be issues with contract interactions etc.

For that reason, less risk tolerate users do not invest. Which is why 89% returns exist.

5/25

That& #39;s how APY return motivators work. Their reward increases with risk until there is an equilibrium. A price point where the return as a ratio of the risk is to great to ignore.

That& #39;s how APY return motivators work. Their reward increases with risk until there is an equilibrium. A price point where the return as a ratio of the risk is to great to ignore.

6/25

Over time, as the yETH vault is more tested (and it runs up more against the MKR ETH cap) the APY will get lower, although it will still likely be some return that is considered insane for traditional markets.

Over time, as the yETH vault is more tested (and it runs up more against the MKR ETH cap) the APY will get lower, although it will still likely be some return that is considered insane for traditional markets.

7/25

If this risky loaning, debt based vault, that is in beta and being tested in production, can convince $150M worth of investments in a few days, imagine the inflow that early ETH2.0 will have?

If this risky loaning, debt based vault, that is in beta and being tested in production, can convince $150M worth of investments in a few days, imagine the inflow that early ETH2.0 will have?

8/25

That& #39;s why I suggested in "The 10k Report" that early ETH staking could easily be has high as a 17%-20% yield, when commercial services aren& #39;t yet offering staking and its new and untested. https://twitter.com/AdamScochran/status/1255332340924133376">https://twitter.com/AdamScoch...

That& #39;s why I suggested in "The 10k Report" that early ETH staking could easily be has high as a 17%-20% yield, when commercial services aren& #39;t yet offering staking and its new and untested. https://twitter.com/AdamScochran/status/1255332340924133376">https://twitter.com/AdamScoch...

9/x

A 20% yield on a base layer product that& #39;s been tested for months and developed for years, will attract a lot more investment than an 80% return on a risky test in prod product (which don& #39;t get me wrong, I love the yETH work!)

A 20% yield on a base layer product that& #39;s been tested for months and developed for years, will attract a lot more investment than an 80% return on a risky test in prod product (which don& #39;t get me wrong, I love the yETH work!)

10/25

So now the question becomes does lock up actually impact the price?

Validation #2: Lock up impacts price!

So now the question becomes does lock up actually impact the price?

Validation #2: Lock up impacts price!

11/25

This one feels like it shouldn& #39;t be a surprise, but, plenty of people disputed it.

When an asset is more scarce, it becomes more valuable as long as it is still needed/wanted.

No one wants to leave their money idle.

Idle money loses value.

This one feels like it shouldn& #39;t be a surprise, but, plenty of people disputed it.

When an asset is more scarce, it becomes more valuable as long as it is still needed/wanted.

No one wants to leave their money idle.

Idle money loses value.

12/25

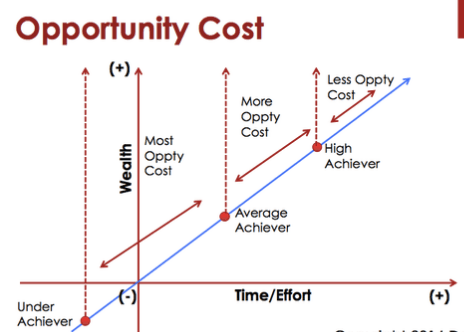

If your money just sits on an exchange, you are losing out on an opportunity cost.

Whales know that and in turn put money to work where it can generate a return that outweighs at the very least inflation, but, ideally that grows money.

If your money just sits on an exchange, you are losing out on an opportunity cost.

Whales know that and in turn put money to work where it can generate a return that outweighs at the very least inflation, but, ideally that grows money.

13/25

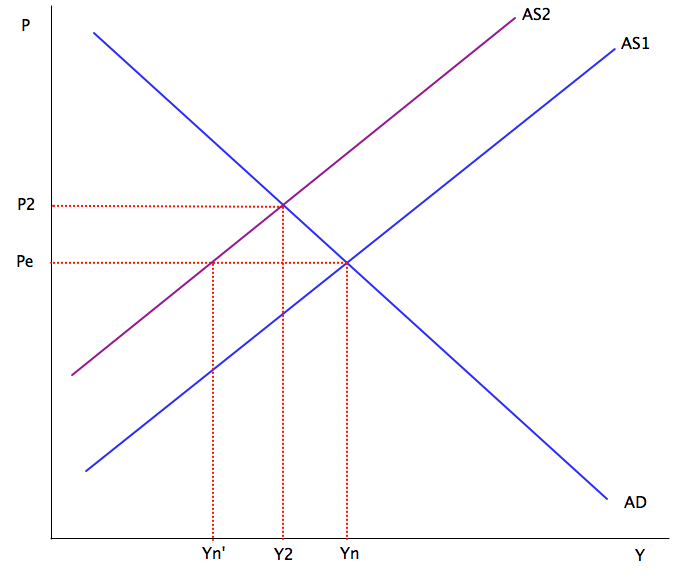

But this means we have a "supply shock" ( https://twitter.com/AdamScochran/status/1250938836307398656)">https://twitter.com/AdamScoch... where there is less liquid ETH available for sale, meanwhile we have a "demand shock" from users wanting in on the returns, whales doubling down, and people cycle buying.

But this means we have a "supply shock" ( https://twitter.com/AdamScochran/status/1250938836307398656)">https://twitter.com/AdamScoch... where there is less liquid ETH available for sale, meanwhile we have a "demand shock" from users wanting in on the returns, whales doubling down, and people cycle buying.

14/25

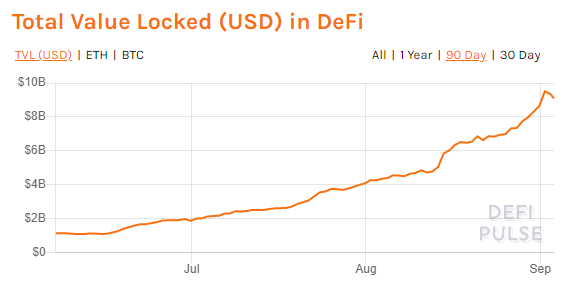

All of this drives up an asset price; and its as plain as day.

When more ETH was locked in DeFi, Uniswap, $SUSHI and yETH vaults, less ETH was on exchanges and prices rose.

(Brown line is % ETH on exchanges)

All of this drives up an asset price; and its as plain as day.

When more ETH was locked in DeFi, Uniswap, $SUSHI and yETH vaults, less ETH was on exchanges and prices rose.

(Brown line is % ETH on exchanges)

15/25

None of these lock-up opportunities have the gravity or draw that ETH2.0 will have, but most importantly they don& #39;t have the finality that ETH2.0 will have.

Let me explain.

None of these lock-up opportunities have the gravity or draw that ETH2.0 will have, but most importantly they don& #39;t have the finality that ETH2.0 will have.

Let me explain.

16/25

Most of the current locking opportunities are "soft locks" - that is to say, you can, in most cases, unlock and sell your assets with almost no waiting time or fee.

There is no penalty to unlock and leave the system.

Most of the current locking opportunities are "soft locks" - that is to say, you can, in most cases, unlock and sell your assets with almost no waiting time or fee.

There is no penalty to unlock and leave the system.

17/25

The early stages of ETH2.0 won& #39;t offer that.

At Phase0 ETH2.0 will offer attractive ETH returns on a one way transfer (ETH1 -> ETH2) and the locked ETH + ETH rewards will not be tradeable to start.

That means it will suck up ETH that can& #39;t return.

The early stages of ETH2.0 won& #39;t offer that.

At Phase0 ETH2.0 will offer attractive ETH returns on a one way transfer (ETH1 -> ETH2) and the locked ETH + ETH rewards will not be tradeable to start.

That means it will suck up ETH that can& #39;t return.

18/25

Just like we discussed with APYs, the price of an asset is a sliding scale motivator. It keeps getting higher until people decide its worth it to them to sell.

When something is hard locked, or locked with a penalty, they can& #39;t make that decision.

Just like we discussed with APYs, the price of an asset is a sliding scale motivator. It keeps getting higher until people decide its worth it to them to sell.

When something is hard locked, or locked with a penalty, they can& #39;t make that decision.

19/25

With less users able to make the decision to sell, the price rises. The more rapid that rise the longer it lasts (speed creates momentum) because we get FOMO.

More users want in because of the rising price action, even if they aren& #39;t going to stake.

With less users able to make the decision to sell, the price rises. The more rapid that rise the longer it lasts (speed creates momentum) because we get FOMO.

More users want in because of the rising price action, even if they aren& #39;t going to stake.

20/25

Until now the only test was yield farming on super high-risk assets, and liquidity providing with imper loss and low LP fees.

yETH by http://yearn.finance"> http://yearn.finance was the first example of an ETH based moderate risk (for crypto) opportunity that offered

Until now the only test was yield farming on super high-risk assets, and liquidity providing with imper loss and low LP fees.

yETH by http://yearn.finance"> http://yearn.finance was the first example of an ETH based moderate risk (for crypto) opportunity that offered

21/25

returns, penalty locks, no imper loss, and still having underlying ETH exposure.

That& #39;s what makes it the closest example we have to the impact ETH2.0 will have on price.

returns, penalty locks, no imper loss, and still having underlying ETH exposure.

That& #39;s what makes it the closest example we have to the impact ETH2.0 will have on price.

22/25

Despite being smaller and riskier, yETH has done something remarkable.

Driving the lock-up of $150M of an asset at this scale.

Despite being smaller and riskier, yETH has done something remarkable.

Driving the lock-up of $150M of an asset at this scale.

23/25

At that scale if you sold on a darkbook (book where trades aren& #39;t seen or broadcast to help prevent market price changes) you& #39;d still manage to move the entire $45B market by a 2% price change.

At that scale if you sold on a darkbook (book where trades aren& #39;t seen or broadcast to help prevent market price changes) you& #39;d still manage to move the entire $45B market by a 2% price change.

24/25

When I wrote the Economics of ETH2.0 and 10K Report back in April, when ETH was $115~ people thought I was too optimistic about what the summer held for the price of Ethereum.

Some even suggested I was crazy (which may be slightly accurate!)

When I wrote the Economics of ETH2.0 and 10K Report back in April, when ETH was $115~ people thought I was too optimistic about what the summer held for the price of Ethereum.

Some even suggested I was crazy (which may be slightly accurate!)

25/25

But, if memecoins and risky vaults can move the price 5x - just imagine what ETH2.0 will achieve.

I& #39;m more optimistic than ever about that trajectory of our little blue diamond.

But, if memecoins and risky vaults can move the price 5x - just imagine what ETH2.0 will achieve.

I& #39;m more optimistic than ever about that trajectory of our little blue diamond.

Read on Twitter

Read on Twitter