So there seems to be a myth taking hold among the twitter commentariat that a lot of housing economists think that the rise in house prices in the UK is well explained by interest rates alone. This.... is not the expert consensus. Here is a thread of papers (in no partic order).

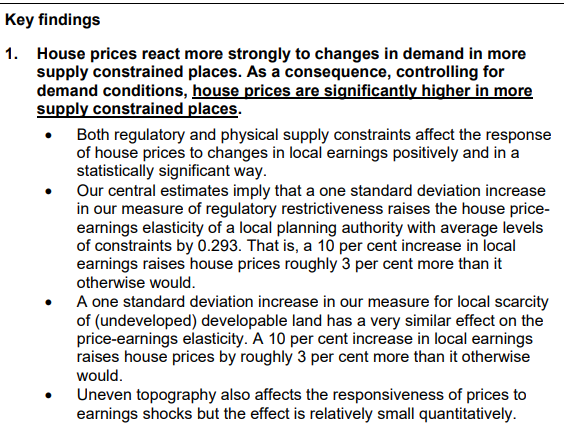

Nice recent paper using a planning dataset from the uk:

https://www.cpb.nl/sites/default/files/publicaties/download/cpb-discussion-paper-219-impact-supply-constraints-house-prices-england_0.pdf">https://www.cpb.nl/sites/def...

https://www.cpb.nl/sites/default/files/publicaties/download/cpb-discussion-paper-219-impact-supply-constraints-house-prices-england_0.pdf">https://www.cpb.nl/sites/def...

They apply their models to a counter factual and find that for the average LPA planning has increased prices by ~30%.

Note that this paper is a cross-LPA comparison, and takes advantage of differences in the planning regimes between different LPA& #39;s in effect, so it should be robust against any country-wide factor like interest rates.

Ideally we could go back to the beginning, the seminal anaylsis by Peter Hall way back in 1974 already found that planning had perverse effects on urban areas, but sadly its gated behind Jstor for me.

So lets pick another important contribution, this time Glaeser in 2003. The paper can be found online here: https://www.newyorkfed.org/medialibrary/media/research/epr/03v09n2/0306glae.pdf">https://www.newyorkfed.org/medialibr...

It finds that *in the areas where prices are high*, the majority of the costs difference is driven by restrictive zoning, conclusion here:

Bonus paper: in depth analysis of the UK planning system, showing delays are much longer than reported and planning permissions over count because developers apply for multiple permissions on the same site: http://www.reading.ac.uk/web/files/REP/housingsupply.pdf">https://www.reading.ac.uk/web/files...

Effects of supply constraints on office space in the UK: http://eprints.lse.ac.uk/4372/1/Office_space_supply_restrictions_(LSERO_version).pdf">https://eprints.lse.ac.uk/4372/1/Of... TLDR: Also the most expensive office space in the world due to different regulatory effects:

Ok so here is some research commissioned by the government and carried out by some LSE professors: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/6358/1767157.pdf">https://assets.publishing.service.gov.uk/governmen...

It starts with some nice cross country facts, TLDR: English house prices are extraordinary on any cross country comparison:

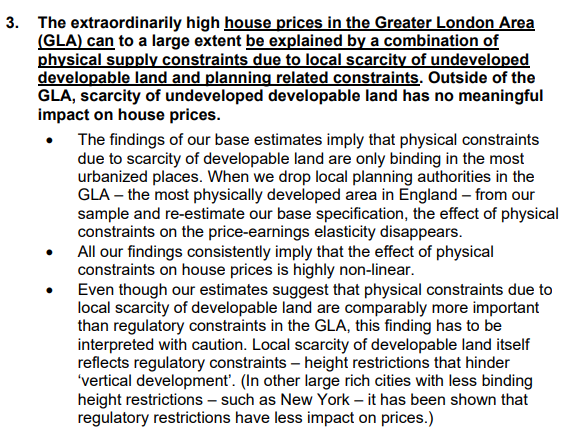

But this is the real kicker, together with 2, the planning system raises prices in england even in places where there is no shortage of develop-able land!

The academic consensus is overwhelmingly that the high house prices of the UK relative to a cross country sample is due to the planning system, and that addressing the planning constraints could bring us into line with Germany or France which implies a 15-30% fall in prices.

Read on Twitter

Read on Twitter