Holwill v. Abbvie, ND Ill refuses to dismiss 10b action alleging Abbvie failed to disclose that it marketed Humira w/ unlawful kickbacks. Usually the legal rule is that accurate reports of revenues are not misleading under 10b, but -

- it is misleading to falsely attribute success to legal factors when success was due to illegal ones. (I discuss that principle here:

https://lawprofessors.typepad.com/business_law/2020/07/rumpelstiltskin-and-the-securities-laws.html)">https://lawprofessors.typepad.com/business_...

https://lawprofessors.typepad.com/business_law/2020/07/rumpelstiltskin-and-the-securities-laws.html)">https://lawprofessors.typepad.com/business_...

In AbbVie& #39;s case, well:

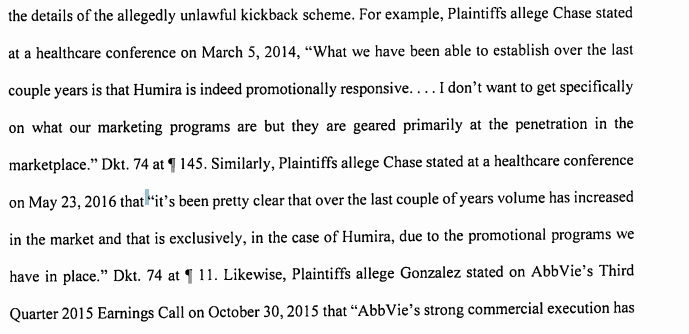

I haven& #39;t read the briefing, but what& #39;s great here is - these statements were literally true! Success was due to their marketing! Just, well, the marketing was illegal.

So the court said that& #39;s a misleading omission, demonstrating the ever-finer line drawn in this genre of case.

So the court said that& #39;s a misleading omission, demonstrating the ever-finer line drawn in this genre of case.

But - also, like, how is there any informational content conveyed in "our success is due to our marketing"? What else could it possibly be?

But you also have to ask - when an exec officer is that evasive about a "marketing" program, when should investors see red flags?

But you also have to ask - when an exec officer is that evasive about a "marketing" program, when should investors see red flags?

I& #39;ll note the opinion is remarkably pltf friendly in other ways - finds the Code of Ethics sufficiently definite to support a 10b claim, material omissions under 105 and 303. Even infers scienter from the importance of the scheme to the company ("core operations doctrine"), and -

- that defendants spoke to the issue ("I don& #39;t want to get specifically on what our marketing programs are") suggests they knew what they were talking about.

Which is a totally normal inference! But unusual in securities cases bc we don& #39;t draw normal inferences under the PSLRA.

Which is a totally normal inference! But unusual in securities cases bc we don& #39;t draw normal inferences under the PSLRA.

Anyway, to sum: (1) Make money using illegal tactics but report only the revenues earned: Truthful, no fraud.

(2) Attribute success to legal factors: Fraudulent.

(3) Attribute success to legal factors "among others": Truthful, no fraud (that& #39;s the blog post linked upthread).

(2) Attribute success to legal factors: Fraudulent.

(3) Attribute success to legal factors "among others": Truthful, no fraud (that& #39;s the blog post linked upthread).

And now - (4) Attribute success to the actual illegal conduct w/o giving enough details to reveal its illegality: Fraudulent.

All of this, mind, is to dance around that the securities laws aren& #39;t meant to punish the business model, just the disclosure.

All of this, mind, is to dance around that the securities laws aren& #39;t meant to punish the business model, just the disclosure.

To put it another way, the securities laws need to deal with 3 conflicting propositions: (1) they do not prohibit lawbreaking to improve profits; (2) they do require disclosure, and (3) no one will ever disclose lawbreaking to improve profits.

Given this, courts are navigating between always imposing liability for lawbreaking in pursuit of profits (which violates proposition 1) and never imposing it (which violates proposition 2), so the question is, how much hinting at lawbreaking is just enough to escape liability?

Read on Twitter

Read on Twitter