$DAX Situation Analysis (thread)

Important bullish movement today that must be analyzed in depth

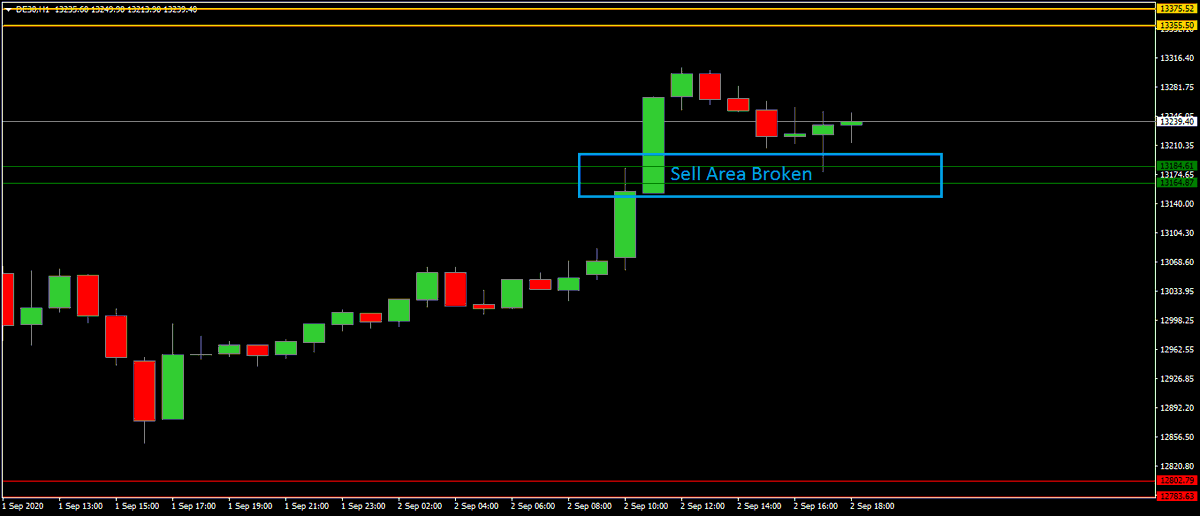

1) Intraday:

Sell Area borken this morning https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> bullish signal

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> bullish signal

But price unable to approach the next area (13355/75) https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Slight bullish weakness

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Slight bullish weakness

(Session in progress, not definitive)

Important bullish movement today that must be analyzed in depth

1) Intraday:

Sell Area borken this morning

But price unable to approach the next area (13355/75)

(Session in progress, not definitive)

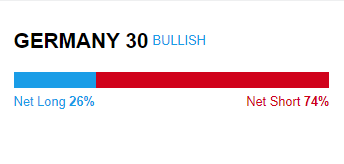

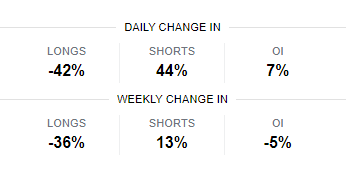

2) Contrarian Sentiment:

The bullish movement has caused a significant movement in net retail positions

Imbalance in net positions of 70% - 30%

Important percentages in intraday and weekly

Contrarian Sentiment https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Bullish signal

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Bullish signal

The bullish movement has caused a significant movement in net retail positions

Imbalance in net positions of 70% - 30%

Important percentages in intraday and weekly

Contrarian Sentiment

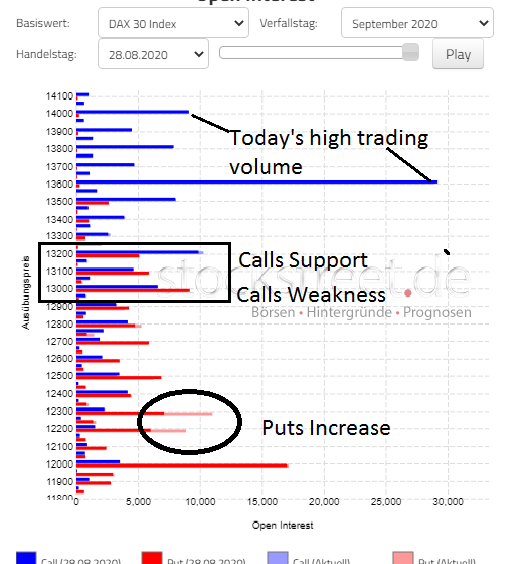

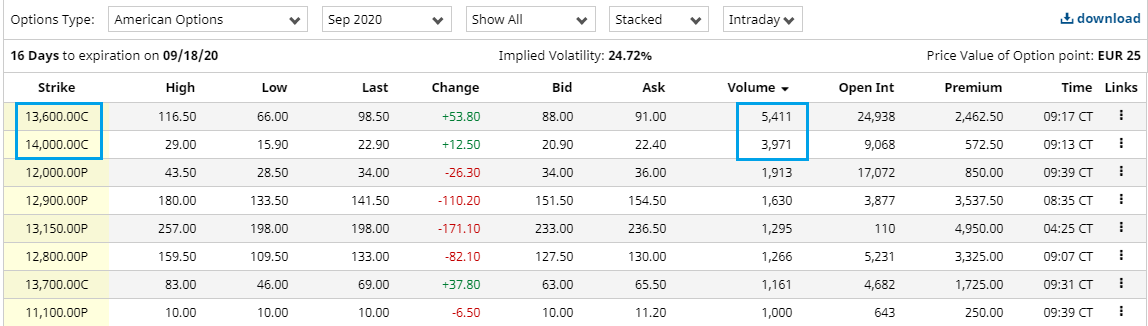

3) OPEX:

Significant Puts increase Monday and Tuesday in 12300 and 12200

Remember Sunday& #39;s options analysis

Significant trading volume today on Calls 13600 and 14000 (I can& #39;t tell right now if it& #39;s increase or decrease of open interest)

https://twitter.com/MakaveliDAX/status/1300096566544474112">https://twitter.com/MakaveliD...

Significant Puts increase Monday and Tuesday in 12300 and 12200

Remember Sunday& #39;s options analysis

Significant trading volume today on Calls 13600 and 14000 (I can& #39;t tell right now if it& #39;s increase or decrease of open interest)

https://twitter.com/MakaveliDAX/status/1300096566544474112">https://twitter.com/MakaveliD...

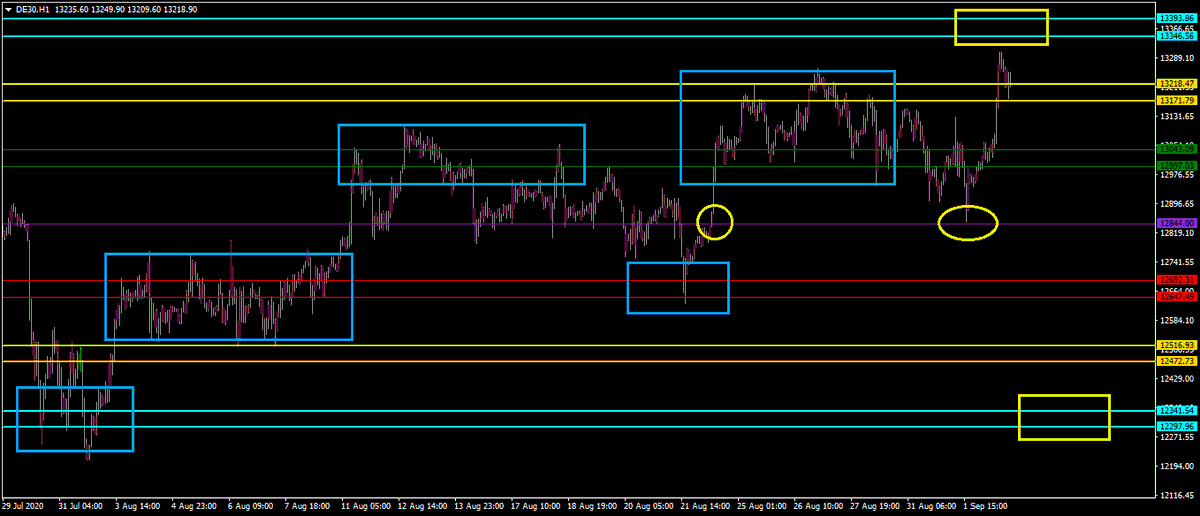

4) Million dollar Chart (Part I):

For me it& #39;s still the chart that marks the important movements in the DAX since July 30

In the chart you can see the level zones and how the price has acted with those zones

In blue, important moments

For me it& #39;s still the chart that marks the important movements in the DAX since July 30

In the chart you can see the level zones and how the price has acted with those zones

In blue, important moments

Yellow circles mark the level where it theoretically go from positive to negative (I won& #39;t explain details, sorry)

Yellow boxes mark two extreme price targets as long as the chart is still valid

Yellow boxes mark two extreme price targets as long as the chart is still valid

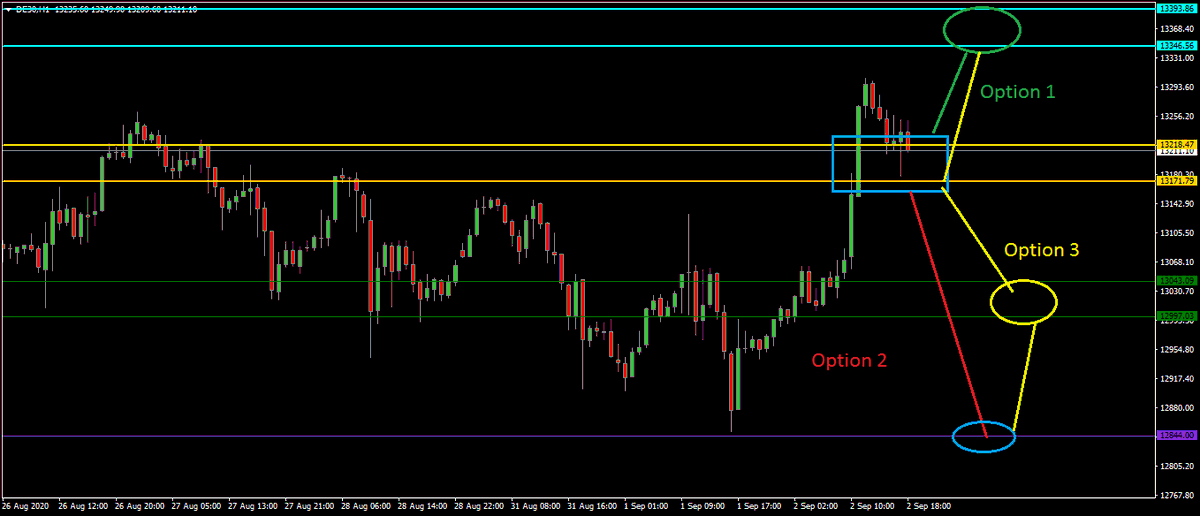

5) Million Dollar Chart (Part II):

Today the price has finally managed to get above the zone 13218/171, and most importantly, stay above

With all this information I see 3 options:

Today the price has finally managed to get above the zone 13218/171, and most importantly, stay above

With all this information I see 3 options:

Maintaining the 13218/171 zone and taking advantage of the imbalance in the retail positions go this week to 13346/13393 zone

If a certain movement doesn& #39;t occur that would end this chart (details are not necessary), it would be the end of the bullish movement

Break under zone 13218/171 between today and tomorrow

In that case it could be a definitive rejection to the area and the price should go to the important level of 12844 already commented

First reach that area of 13346/93

Then when the retail sentiment starts to change to bullish and the majority sees that the price goes to the famous gap at 13500 (sorry I don& #39;t believe in gap theories, I respect them but I don& #39;t believe in them) ...

... a bearish movement starts

Zone by zone, first to 13218/171, then to 13043/12997 zone

Turning point at 12844 and acceleration of movement below the zone 12692/647

And finally target in 12341/12297

Zone by zone, first to 13218/171, then to 13043/12997 zone

Turning point at 12844 and acceleration of movement below the zone 12692/647

And finally target in 12341/12297

Option 3 is my favorite option if this Million Dollar Chart is still valid the next days

Right now it looks like science fiction... but we& #39;ll see https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">

Right now it looks like science fiction... but we& #39;ll see

Read on Twitter

Read on Twitter bullish signalBut price unable to approach the next area (13355/75)https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Slight bullish weakness(Session in progress, not definitive)" title=" $DAX Situation Analysis (thread)Important bullish movement today that must be analyzed in depth1) Intraday:Sell Area borken this morning https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> bullish signalBut price unable to approach the next area (13355/75)https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Slight bullish weakness(Session in progress, not definitive)" class="img-responsive" style="max-width:100%;"/>

bullish signalBut price unable to approach the next area (13355/75)https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Slight bullish weakness(Session in progress, not definitive)" title=" $DAX Situation Analysis (thread)Important bullish movement today that must be analyzed in depth1) Intraday:Sell Area borken this morning https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> bullish signalBut price unable to approach the next area (13355/75)https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Slight bullish weakness(Session in progress, not definitive)" class="img-responsive" style="max-width:100%;"/>

Bullish signal" title="2) Contrarian Sentiment:The bullish movement has caused a significant movement in net retail positionsImbalance in net positions of 70% - 30%Important percentages in intraday and weeklyContrarian Sentiment https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Bullish signal">

Bullish signal" title="2) Contrarian Sentiment:The bullish movement has caused a significant movement in net retail positionsImbalance in net positions of 70% - 30%Important percentages in intraday and weeklyContrarian Sentiment https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Bullish signal">

Bullish signal" title="2) Contrarian Sentiment:The bullish movement has caused a significant movement in net retail positionsImbalance in net positions of 70% - 30%Important percentages in intraday and weeklyContrarian Sentiment https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Bullish signal">

Bullish signal" title="2) Contrarian Sentiment:The bullish movement has caused a significant movement in net retail positionsImbalance in net positions of 70% - 30%Important percentages in intraday and weeklyContrarian Sentiment https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Bullish signal">