1/

Gravity Interactive $GRVY

… is a South Korean game developer, known for their game Ragnarok (MMORPG).

Idea from @ValueGARP, @89Olle, @Pappakeno1, thanks! Lots of information can be found there.

Do you like high growth, cash rich, #GARP, then have a look.

#Thread

Gravity Interactive $GRVY

… is a South Korean game developer, known for their game Ragnarok (MMORPG).

Idea from @ValueGARP, @89Olle, @Pappakeno1, thanks! Lots of information can be found there.

Do you like high growth, cash rich, #GARP, then have a look.

#Thread

2/

Ragnarok Online was released in 2002 for PC and shortly thereafter also in EU or parts of SE Asia. According to Wikipedia, around 20M people played the game, 500k in Europe. It’s more or less free2play, and has become a known brand (which the market has totally neglected).

Ragnarok Online was released in 2002 for PC and shortly thereafter also in EU or parts of SE Asia. According to Wikipedia, around 20M people played the game, 500k in Europe. It’s more or less free2play, and has become a known brand (which the market has totally neglected).

3/

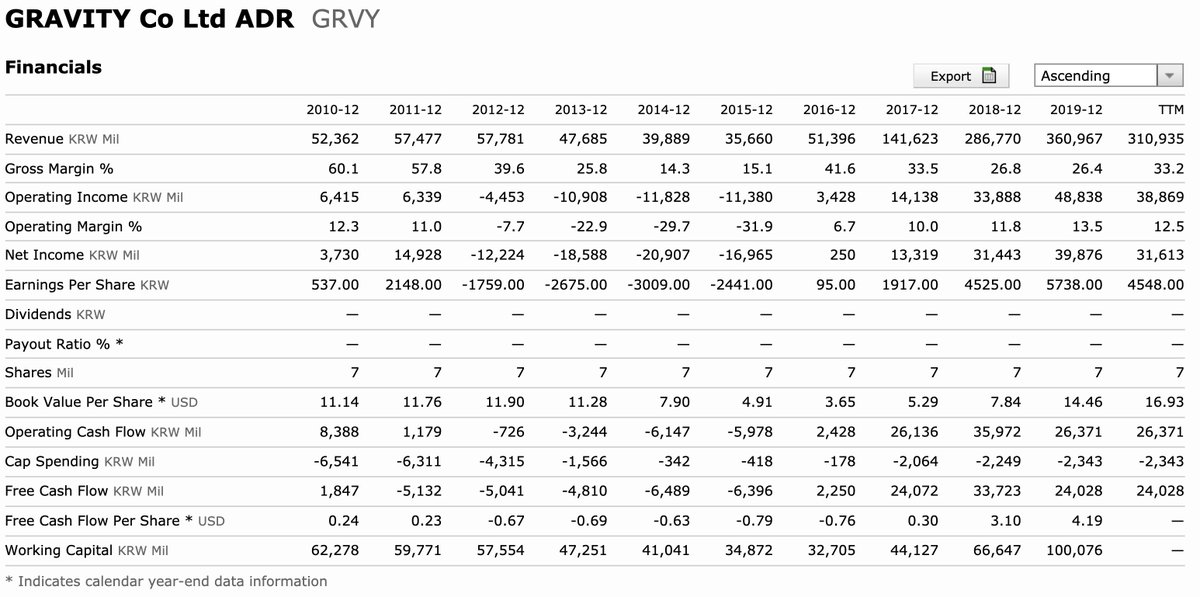

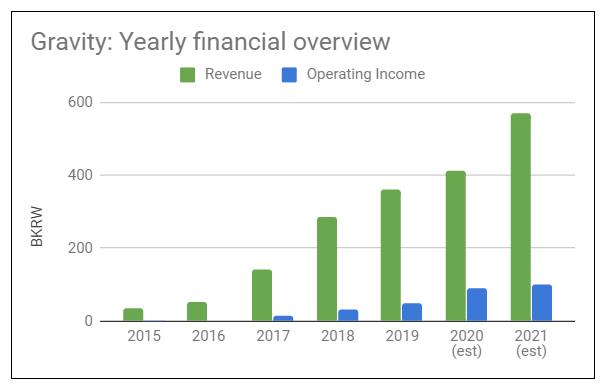

Gravity did not profit at all from their success, they barely monetized this franchise. Looking at the financials, nothing has happened from 2004 until 2015: slightly falling revenues, the income summed up is negative.

Gravity did not profit at all from their success, they barely monetized this franchise. Looking at the financials, nothing has happened from 2004 until 2015: slightly falling revenues, the income summed up is negative.

4/

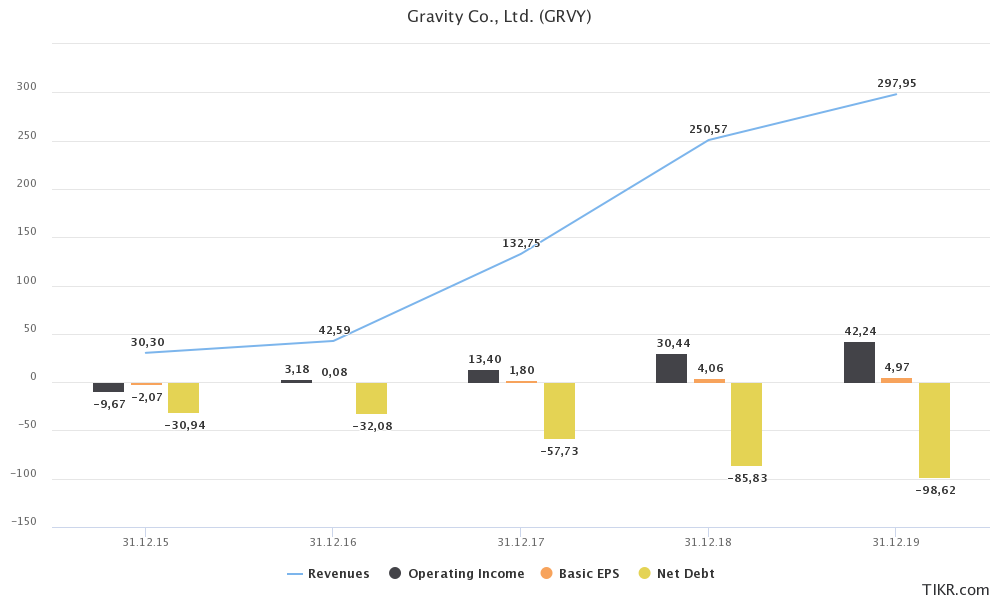

Well, that has changed: Gravity expanded monetization (subscription fees), royalties and re-released the game in parts of SE Asia. They also launched several mobile games on IOS and Android (Ragnarok Origin), which is listed high in the charts.

Well, that has changed: Gravity expanded monetization (subscription fees), royalties and re-released the game in parts of SE Asia. They also launched several mobile games on IOS and Android (Ragnarok Origin), which is listed high in the charts.

5/

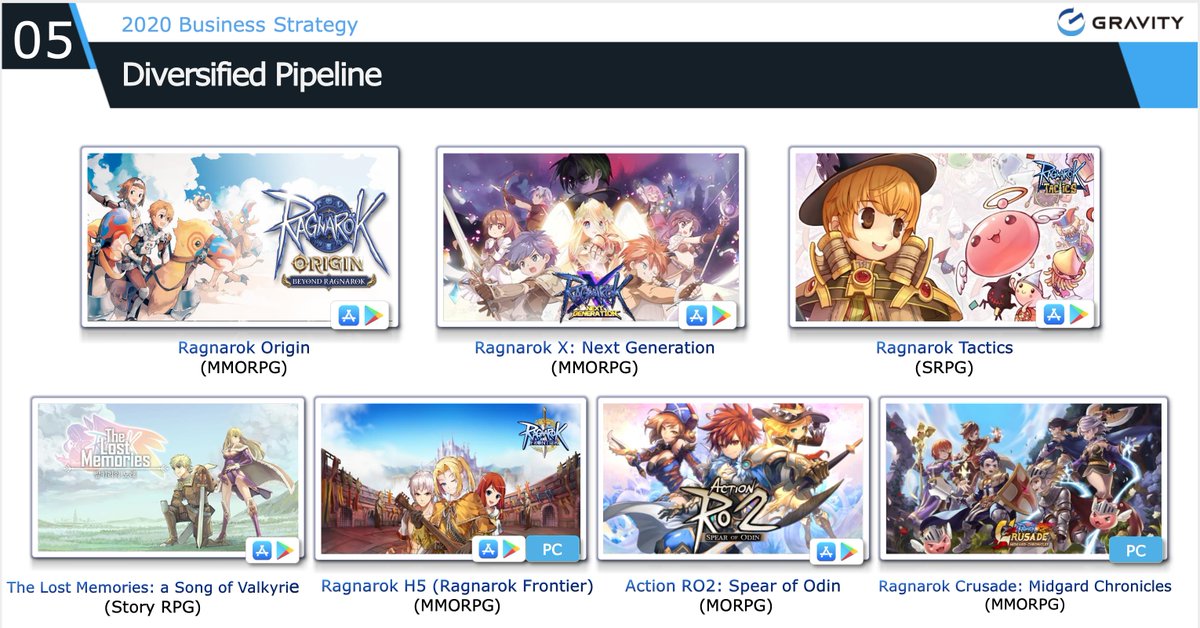

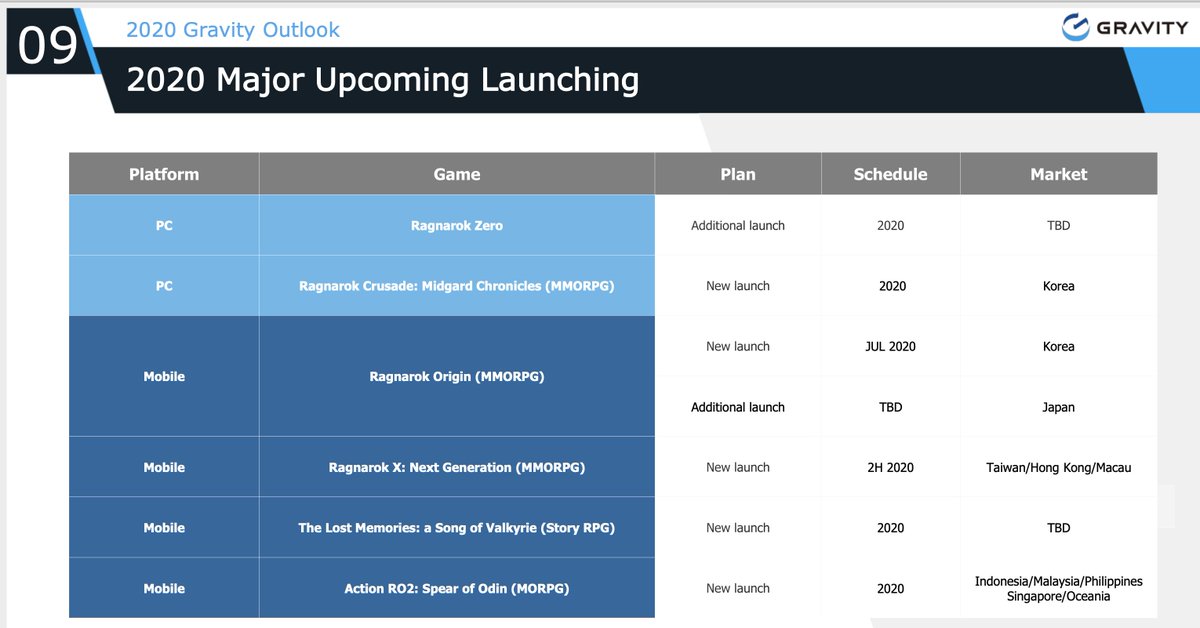

Their pipeline of upcoming releases is vast: Full of releases and full of launches in different countries.

Most important is their big and long-awaited sequel Ragnarok X, which has just been launched and is their big driver going forward.

Their pipeline of upcoming releases is vast: Full of releases and full of launches in different countries.

Most important is their big and long-awaited sequel Ragnarok X, which has just been launched and is their big driver going forward.

6/

Even without Ragnarok X, the valuation is compelling.u2028Gravity has shown, that they have a strong brand and people are willing to pay for content. Kids from the older days are now grown up, earning money and are still playing the game. GRVY speaks of the "2nd golden days".

Even without Ragnarok X, the valuation is compelling.u2028Gravity has shown, that they have a strong brand and people are willing to pay for content. Kids from the older days are now grown up, earning money and are still playing the game. GRVY speaks of the "2nd golden days".

7/

The valuation right now (TTM) is:

Price 88$ for ADR

MCap 611M

Net Cash around 110M

PB 5.18

PCF 27.40

PS 2.32

PE 22.88

EV 500M

EBITDA 39.5M

EV/EBITDA 12,66

One-time costs included in TTM, going forward we should get 15M+ EBITDA per quarter

Insider ownership 59.3% GungHo

The valuation right now (TTM) is:

Price 88$ for ADR

MCap 611M

Net Cash around 110M

PB 5.18

PCF 27.40

PS 2.32

PE 22.88

EV 500M

EBITDA 39.5M

EV/EBITDA 12,66

One-time costs included in TTM, going forward we should get 15M+ EBITDA per quarter

Insider ownership 59.3% GungHo

8/

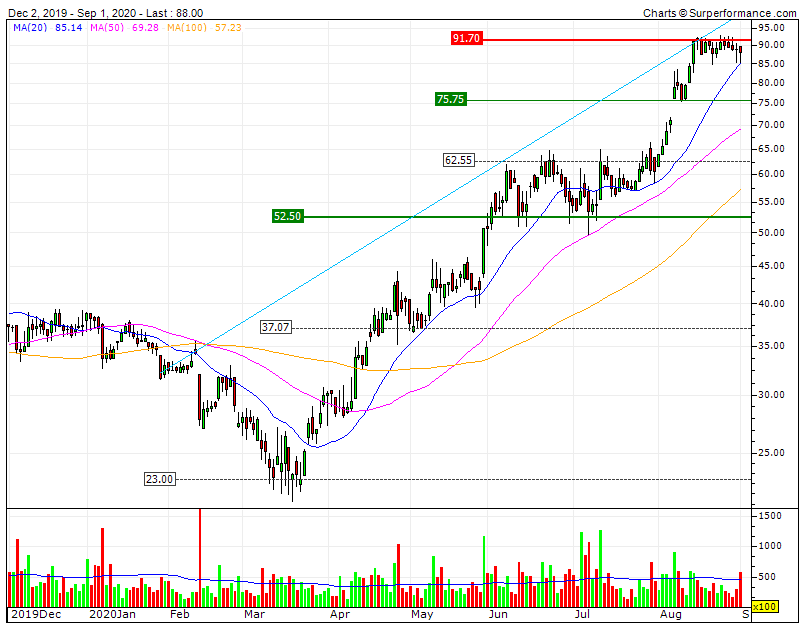

We have a high growth stock with net-cash.

$GRVY has a very strong brand and has lots of new releases in the next quarters. Development has already been done, costs should now be static.

The stock has almost tripled in 2020, but I still see lots of upside, ST as well as LT.

We have a high growth stock with net-cash.

$GRVY has a very strong brand and has lots of new releases in the next quarters. Development has already been done, costs should now be static.

The stock has almost tripled in 2020, but I still see lots of upside, ST as well as LT.

Read on Twitter

Read on Twitter