There are few things less important for the future of America right now than the stock market. But the disconnect between rising stocks and everything else is still interesting. So a few notes 1/

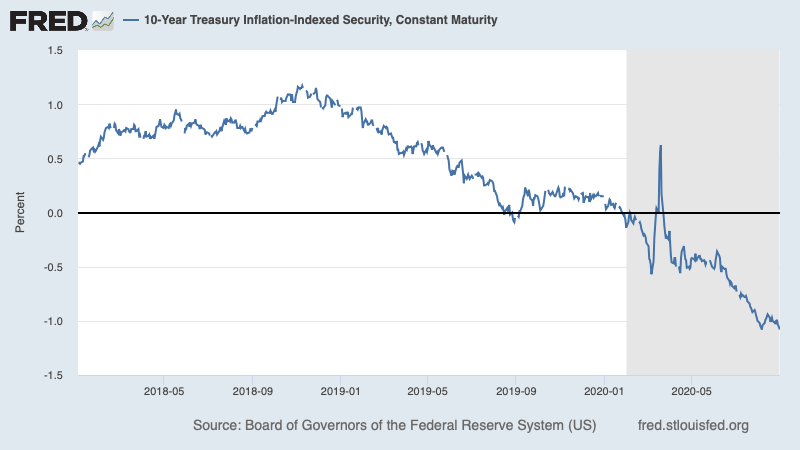

One key point for making (some) sense of stocks is the question, where else are you going to put your money? Interest rates, especially on inflation-protected bonds, have plunged 2/

This interest plunge, incidentally, basically reflects long-term economic pessimism. So in a perverse way strong stocks may in part result from *bad* economic prospects 3/

Now, traditionally we would expect the effect of low alternative yields on stock valuations to be dampened. Why? Tobin& #39;s q, which has nothing to do either with conspiracy theories or with this guy 4/

Instead, the argument is that higher valuations relative to the replacement cost of capital will induce investment, which drives returns down over time. And markets will supposedly take those future effects into account, limiting the initial rise 5/

Read on Twitter

Read on Twitter