There was lots of worry heading into Q2 earnings for SaaS businesses that we were in a SaaS bubble, and that the SaaSpocalypse was right around the corner. Well, turns out that wasn& #39;t the case. Multiples are now at ALL TIME HIGHS. Quick update on what we& #39;ve seen so far  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Going into earnings SaaS companies were trading at all time highs. The median NTM revenue multiple for SaaS businesses was 13x, and the median multiple for high growth SaaS businesses was 28x

We started off getting numbers for businesses with June quarter ends. To be honest, the numbers didn& #39;t impress. For the most part it seemed like Digital Transformations didn& #39;t really accelerate revenue growth - most businesses decelerated

While the deceleration wasn& #39;t significant at all, it showed that (so far) Covid hadn& #39;t accelerated SaaS spend. Now, maintaining growth rates at scale like Twilio did should be considered a win during a global pandemic, but again, there wasn& #39;t acceleration https://twitter.com/jaminball/status/1293677298382548992">https://twitter.com/jaminball...

The epitome of this for me was Datadog. It& #39;s one of my favorite SaaS businesses, I think they have massive tailwinds. HOWEVER, the deceleration in growth they saw was bigger than I imagined. And the themes / takeaways from their earnings call was consistent with others:

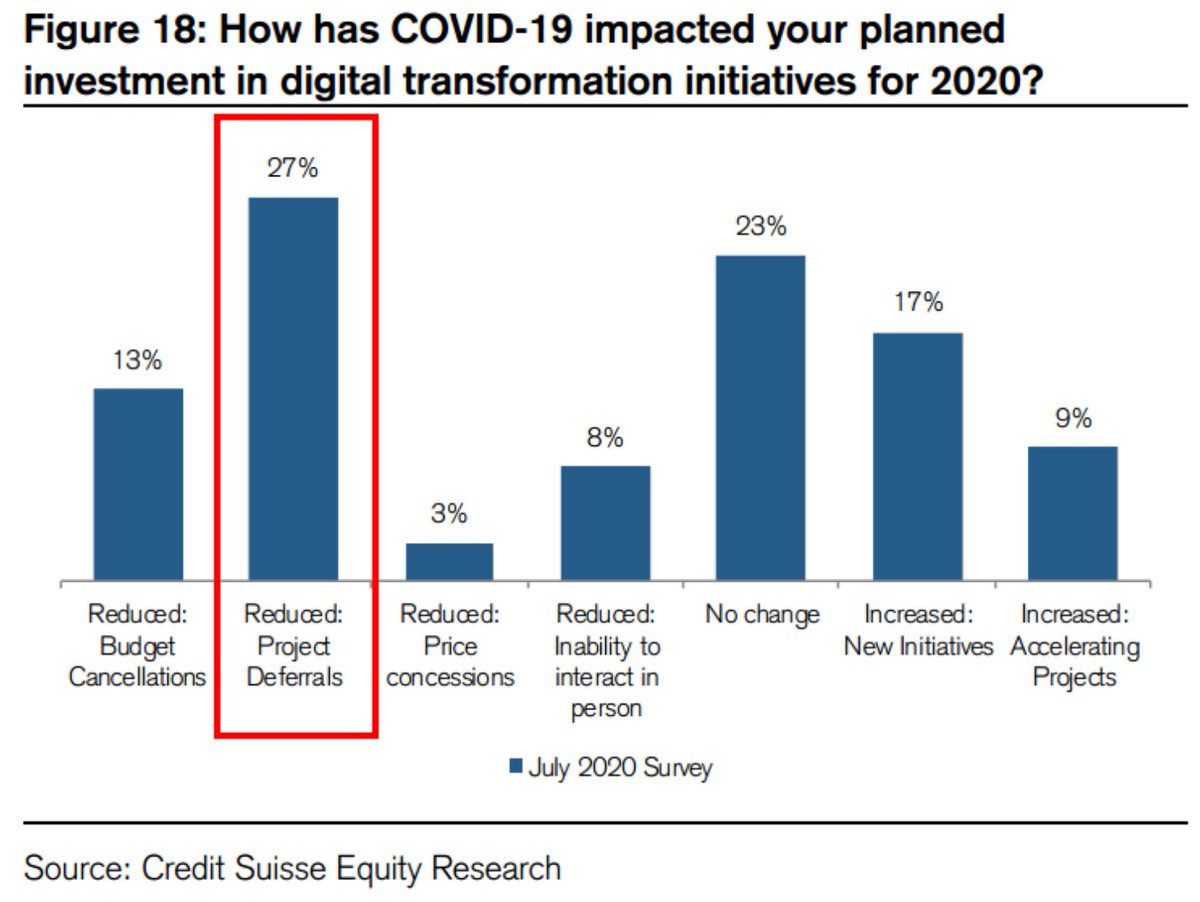

1. Procurement was being delayed / pushed. Deals they expected to close were either put through longer sales cycles, or pushed out

2. this was felt the strongest by larger enterprises. In general companies were extra cautious on ALL SPEND and looked to curb costs. Quote below:

2. this was felt the strongest by larger enterprises. In general companies were extra cautious on ALL SPEND and looked to curb costs. Quote below:

"Customers with large cloud deals from AWS, Azure or GCP look for short-term savings...we see many enterprises go through these optimization exercises on a regular basis. What was unusual this quarter was to see a large number of companies going through it at the same time."

The good news - "deferred" deals are not canceled deals. So, the big question coming was - when will these pushed deals close??

Most companies seemed to present an anecdotal light at the end of the tunnel, saying deal activity picked up towards the end of the quarter

Most companies seemed to present an anecdotal light at the end of the tunnel, saying deal activity picked up towards the end of the quarter

However, after all of the talk around Digital Transformations accelerating SaaS revenue I was skeptical. The real proof would be in the Q2 numbers for companies with July quarter ends - ones that had one more month of business than the companies, like Datadog, with June Q ends

And what& #39;s happened so far during earnings for companies with July quarter ends? We& #39;ve seen a whole lot of strength. It does appear that more deals started to close. The talk of "deal activity picking up" by the companies with June quarter ends appeared to be true

Companies like Okta noted in their earnings call: "We...continue to experience strength with customer upsells, particularly with our enterprise customers." Enterprise buyers were picking up their buying activity again! They also added $70M of net new ARR this Q vs $62M last Q

Salesforce reported incredibly numbers, growing nearly 30% YoY (some bump from Tableau acquisition).

Zoom grew customers w/ACV >$100k by 112%!

We& #39;re not seeing everyone accelerate revenue growth. However, the tone on earnings calls is more positive, and the numbers back it up

Zoom grew customers w/ACV >$100k by 112%!

We& #39;re not seeing everyone accelerate revenue growth. However, the tone on earnings calls is more positive, and the numbers back it up

I still think we& #39;ll see a bigger gap (that will widen over the next year) between the Tier 1 SaaS names and everyone else - I believe they& #39;ll benefit disproportionately from cloud acceleration.

Ultimately, based on what I& #39;ve seen so far, it feels like we& #39;ve made it out of the worst period of Covid where buyers were putting all spend on pause and pushing deals. Normal buying behavior is picking back up, and we may be just starting to see the real "Covid Acceleration"

And I think the market feels this too. Right now the median SaaS businesses is trading at 16x NTM revenue (up from 13x pre Q2 earnings), and high growth SaaS businesses are trading at 37x ntm revenue (up from 28x pre Q2 earnings)

Crowdstrike will be a great case study tomorrow! Stock is up almost 20% today on anticipations of a phenomenal quarter. We& #39;ll see what happens!

These multiples are very high. The expectation is locked in that high growth will continue. Unfortunately I think it could lead to rocky roads ahead for some, but the Tier 1 names are primed

Can& #39;t really look ahead yet, but I& #39;m thinking Q3 earnings will be very interesting!

Can& #39;t really look ahead yet, but I& #39;m thinking Q3 earnings will be very interesting!

Read on Twitter

Read on Twitter